Public Finance Investment Banking: Pathway to Politics, or Bottom-Tier Bonus Bullpen?

One of the more controversial industry groups is public finance investment banking.

The controversy starts with the name: Is public finance “really” investment banking?

Can you compare M&A advisory on multi-billion-dollar corporate deals to underwriting municipal bond issuances from state and local governments?

You could argue this either way, but the short answer is yes, public finance still counts as investment banking.

It is a more specialized group with certain disadvantages vs. other industry groups and product groups (e.g., more limited exit opportunities).

But if that’s your rationale for claiming that it’s “not banking,” then you might as well argue that ECM and DCM are also not banking.

We previously covered public finance in a 2-part interview series, but those articles glossed over some nuances and did not get all the explanations correct.

Also, there are still misconceptions about the financial modeling in the group, the hours, the exit opportunities, and other topics, so this updated article will address all of those:

Definitions: What is Public Finance Investment Banking?

Public Finance Investment Banking Definition: In public finance, bankers advise tax-exempt entities such as state/local governments, publicly-owned infrastructure/utility companies, and non-profits on debt issuances and occasionally other deal types, depending on the vertical.

When most people think of “public finance,” they assume that it means the underwriting of municipal securities, such as the debt issued by governments to build assets like airports, bridges, and railroads.

Municipal bond underwriting is one area within public finance, but there are others:

- Project Finance: This is similar to normal Project Finance, but now you’re working on public projects rather than private ones.

- Utilities & Infrastructure: This vertical is closer to a traditional investment banking industry group because many companies in this space could also issue equity or complete M&A deals.

- Healthcare: Many non-profit hospitals operate similarly to corporations, so you could also gain exposure to more than debt issuances in this vertical.

In addition, some normal corporations may be able to issue tax-exempt securities, depending on their legal structure and ownership (certain banks also advise public-private partnerships).

Many banks put public finance within “Capital Markets,” along with ECM and DCM, but the classification varies. For example:

- Goldman Sachs – Includes “Public Sector and Infrastructure” as an industry group within investment banking.

- Morgan Stanley – Includes public finance within fixed income.

- Jefferies – Includes public finance in investment banking and fixed income (“Municipal and Not-for-Profit”).

The experience you get varies widely – which is why it’s difficult to generalize the work, lifestyle/hours, and exit opportunities.

Public Finance vs. Project Finance vs. Debt Capital Markets (DCM) vs. Leveraged Finance vs. Power & Utilities vs. Infrastructure vs. Healthcare

All these groups are related based on industry sector or product (debt).

The difference lies in the typical clients: mostly governments, non-profits, and other tax-exempt entities rather than for-profit corporations.

But let’s go through the list one by one:

- Project Finance – The main difference here is the client base; you also tend to do more granular, cash-flow-level modeling in Project Finance and rely less on automated reports and output for parts of the financial analysis.

- Debt Capital Markets (DCM) – There is some overlap here because DCM could also advise governments on investment-grade bond issuances. However, DCM does mostly sovereign-level issuances rather than state and local ones, and DCM bankers advise primarily corporations rather than tax-exempt entities.

- Leveraged Finance – LevFin typically advises for-profit corporations on the debt required to fund transactions such as leveraged buyouts and mergers & acquisitions, so it’s probably the most different of all these.

- Power & Utilities, Infrastructure, and Healthcare – There is some overlap with these groups, but in each one, you’ll be advising mostly for-profit corporations, and you’ll be doing so for more than debt issuances.

What Do You Do as an Analyst or Associate in Public Finance Investment Banking?

Let’s state the most important point first: you still do financial modeling in public finance, but it’s different from the 3-statement, DCF, and M&A/LBO modeling used in other groups, and it’s sometimes closer to structured finance.

In public finance, bankers use an industry-standard program called DBC to size and structure municipal bond issuances; it can also calculate debt service ratios and analyze refinancing scenarios.

You input the required data, and the program produces the reports and key output.

However, similar to ARGUS in real estate, DBC alone is insufficient for everything.

It might work for the most vanilla deals, but for anything more complex, professionals use Excel add-ins/macros or optimization techniques to structure issuances.

Also, many municipal bond issuers have large derivatives portfolios, adding to the complexity and explaining why public finance is sometimes grouped within fixed income trading.

This DBC program saves you time and makes it easier to run simulations and scenarios, but it’s not a magical solution for everything.

An average day in the life of an Analyst or Associate will consist of:

- Reviewing Bond Documents: You spend a lot of time reviewing an issuer’s existing bonds, the terms and structuring used, and how that influences the securities they can issue in the future. This sounds easy, but these documents are often long and confusing.

- Drafting Presentations for Clients and Potential Clients: You’ll also prepare monthly updates and new proposals for clients and potential clients, similar to traditional pitch books.

- Responding to Requests for Proposals (RFPs): In competitive deals, issuers send RFPs to many banks to solicit different deal terms and fees and get the best pricing. You spend time gathering the required data and drafting responses to these RFPs, which could be simple or time-consuming depending on the firm, group, issuer, and relationships.

- Modeling Different Transaction Structures: In proposals, pitches, and RFP responses, you almost always present different deal structures, some of which may involve features used in structured finance, like subordination and credit enhancements.

The experience also differs based on the types of securities your group focuses on.

The two big categories are general obligation (GO) bonds and revenue bonds.

GO bonds are backed by the “full faith and credit” of the issuer and can be serviced via all revenue sources, while a revenue bond is linked to a specific asset, such as a toll highway or airport.

Revenue bonds are perceived to be more interesting than GO bonds, and more analytical work may be required to analyze them and propose deal structures that use them.

Public Finance Investment Banking: Lifestyle and Hours

Similar to ECM and DCM, it’s fair to say that the hours are generally better in public finance investment banking.

At the bulge bracket banks, you might expect 60-70 hours per week, which sounds like a lot until you compare it to the longer hours in other groups.

I wrote “generally” above because some groups work closer to normal IB hours, and last-minute emergencies and calls do come up.

So, it’s not unusual to see emails written at 2-3 AM from someone in the group, but it’s far less common than in the M&A group.

The hours tend to be better because:

- Fees and Compensation Are Lower – Governments and non-profits simply pay lower fees, which means a lower bonus pool, making it more difficult to expect 90-hour workweeks.

- Clients Are Less Demanding – The Finance Director of Arlington, Texas, will not email you at 3 AM with an urgent request and expect an immediate response.

Industry Trends, Drivers, and Updates

Many people claim that public finance investment banking is one of the most “stable” areas in finance because governments always need to raise funds and spend money.

And if a state or local government runs into financial troubles, it might be more inclined to issue municipal bonds to cover its funding shortfall.

Public finance is “more stable” than a group like industrials or technology, but it does change over time as well.

Key drivers include:

- Government Tax Policy – How are tax rates changing? Have certain items become deductible or non-deductible, affecting government revenues? Are cash inflows from taxes up or down?

- Government Spending – Is the state or local government making a big infrastructure push? Did the federal government just pass an infrastructure package in which states receive fixed dollar amounts? Do local utilities, airports, or other transportation need maintenance or upgrades?

- Demographic Trends – Is the population in this state, province, or city growing or shrinking? Is it getting older or younger, and are average incomes rising or falling? What about family sizes and the demand for utilities and transportation they create?

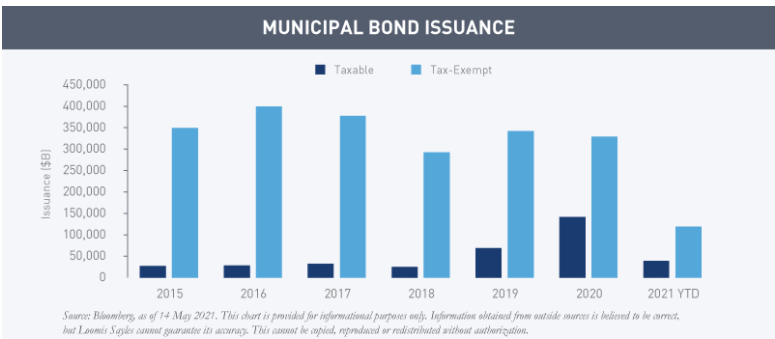

As an example of how this industry can change over time, consider the Tax Cuts and Jobs Act (TCJA) passed in the U.S. in 2017.

It eliminated “advanced refunding” (i.e., refinancing) of tax-exempt debt with additional tax-exempt issuances, causing taxable issuances to increase by 4x:

And since it limited state-and-local tax (SALT) deductions, it led to increased demand for municipal bonds from investors in high-tax states.

If you’re in the public finance team, you need to follow this type of legislation and other government initiatives to stay abreast of all the trends.

Public Finance Investment Banking Documents

Normally, we present dozens of pitch books and deal documents from real banks in this section.

Unfortunately, that’s not possible here because banks in the U.S. disclose presentations, Fairness Opinions, etc., only when advising publicly-traded, for-profit corporations.

The good news is that you can easily find municipal bond issuances by cities and states as well as budget information:

General Obligation (GO) Bonds:

Revenue Bonds:

- Teachers College (New York State)

- Portland International Airport – Customer Facility Charge Revenue Bonds

- Summary of West St. Paul Utility Revenue Bonds

City/State Budgets:

- Austin City Budget for the Electric Utility Commission

- Tucson Adopted Budget

- City of San Jose – Proposed Capital Budget and Debt Service Analysis

Public Finance Salaries and Bonuses

Traditionally, public finance investment banking has paid significantly less than other groups for several reasons:

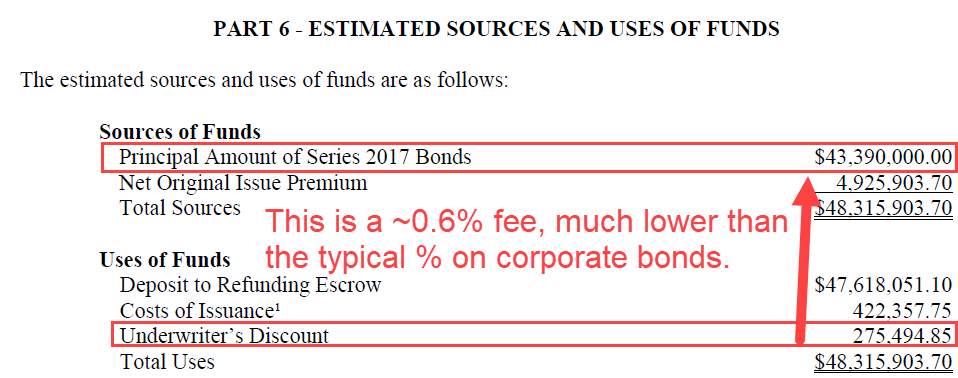

- Lower Fees – A bank might be able to charge a 2-3% fee on a corporate debt deal, but these percentages are much lower in public finance. Municipal bonds are much less risky than corporate bonds, and the issuance process tends to be simpler, so banks are compensated based on this reduced risk and complexity:

- Top-Heavy Deal Flow – Since the top few firms dominate deal flow in public finance, there have been huge bonus disparities between bulge bracket and middle market banks (much more so than in other groups).

- Public Perception – Since all fees are disclosed publicly, governments don’t want to be perceived as “paying bankers too much” to fund projects like roads and power/water utilities.

- Bundling of Other Services – In many cases, large banks “bundle” other services with the underwriting (e.g., commercial banking or derivative/liquidity products) that generate higher fees than the underwriting spread alone.

These factors translate into total compensation that is typically 20-30% lower.

Usually, that means that base salaries are about the same, with much lower bonuses (e.g., 50% of base salary rather than 100%).

However, this varies based on the firm and market, and smaller firms might pay even lower bonuses.

Also, note that public finance teams are often slow to raise base salaries to match other IB groups.

Everything above means that VPs in public finance might earn closer to Associate compensation, Directors might earn closer to VP compensation, and MDs might earn closer to Director compensation.

It’s still possible to earn over $1 million at the MD level, but it’s not necessarily “the norm,” as it is in other industry groups.

The Top Firms for Public Finance Investment Banking

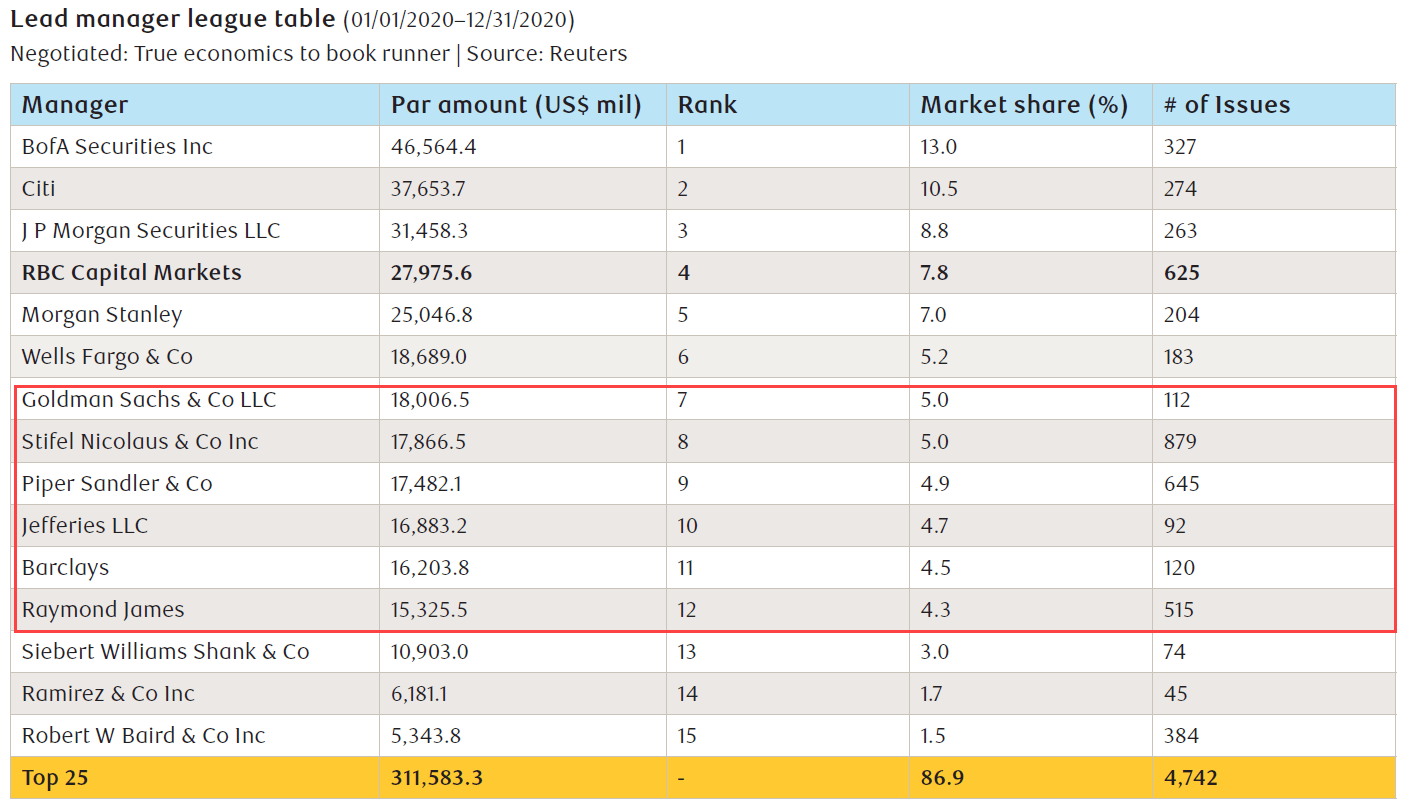

“Ranking the banks” depends on the league table you use: Long-term municipal bonds? Short-term? Negotiated? Competitive? Lead-managed deals, co-managed deals, or both together?

To simplify a bit, Bank of America Merrill Lynch, JP Morgan, and Citi are usually in the top 3 positions or very close to them.

Next, you’ll see firms like RBC, Morgan Stanley, Wells Fargo, Goldman Sachs, and Barclays.

Interestingly, middle market banks like Stifel Nicolaus, Piper Sandler, Jefferies, and Raymond James also perform well, often with market share close to much larger banks:

Aside from Barclays and a bit of activity from UBS, the European banks barely participate in this market – probably because municipal bonds are extremely U.S.-centric.

The elite boutique banks have almost no presence in this market, but there are plenty of industry-specific and regional boutiques: Siebert Williams Shank & Co, Ramirez & Co, Loop Capital Markets, Cabrera Capital, HJ Sims, Ziegler, and Davenport are a few examples.

One final note is that public finance investment banking teams tend to be more geographically distributed than other groups because each regional office focuses on specific states and cities.

So, even if you’re outside of a major financial center, you could still get a good experience and plenty of deal flow because of the localized nature of clients.

Recruiting and Interview Questions

The recruiting process for public finance investment banking is similar to the one for any other group: network beforehand, apply online, complete a HireVue interview, and if you pass, go through live or in-person interviews.

The main issue is that you need to determine how each bank classifies public finance before applying to anything.

Some banks have dedicated applications (BAML, MS, Barclays), while others put it within investment banking, so you need to open the IB app and select public finance for your group preference (JPM, GS).

There isn’t much to say about your resume; it’s the same template as always, but try to insert something that shows an interest in public policy, government, or politics.

The main queries we get about interview questions are:

- How technical will they get? Do you need to know DBC or Monte Carlo simulations or other, more advanced topics? What about bond math? The Greeks?

- Should you expect a modeling test or case study?

In general, public finance interview questions are not super-technical, but bankers expect you to know something about the market and the main products offered (in addition to all the standard IB interview questions).

Modeling tests and case studies are uncommon unless you’re interviewing for a lateral position as an experienced hire.

For entry-level roles, you don’t need to know DBC or advanced Excel/simulations/optimizations, but it helps to know why PF groups use these tools.

Here are some sample interview questions you might receive:

Q: Why public finance?

A: You should say that you enjoy both finance and public policy, government, or politics, and you like the tangible nature of projects in public finance.

If you work on M&A or equity/debt deals for companies, you rarely “see” the results of your work because these deals usually represent existing assets or companies.

But in public finance, your work might result in new infrastructure or education/healthcare facilities, so the impact is more visible (on a long enough time frame…).

Q: A 5% coupon bond with a 10-year maturity trades at 5% discount to par value. What is its approximate Yield to Maturity (YTM)?

A: See our tutorial on approximating the YTM.

The 5% coupon rate corresponds to a 5% YTM, and the 5% discount / 10 years adds ~0.5% per year.

So, the approximate YTM is ~5.5% (it’s 5.7% in Excel using the YIELD function).

Q: What does the “tax-equivalent yield” mean?

A: It’s the return that a taxable bond would need to equal the yield on a comparable tax-exempt bond. It equals the tax-free bond yield / (1 – tax rate).

So, if a tax-free bond yields 5%, and the tax rate is 25%, a taxable bond would need to yield 5% / (1 – 25%) = 6.7% to be equivalent.

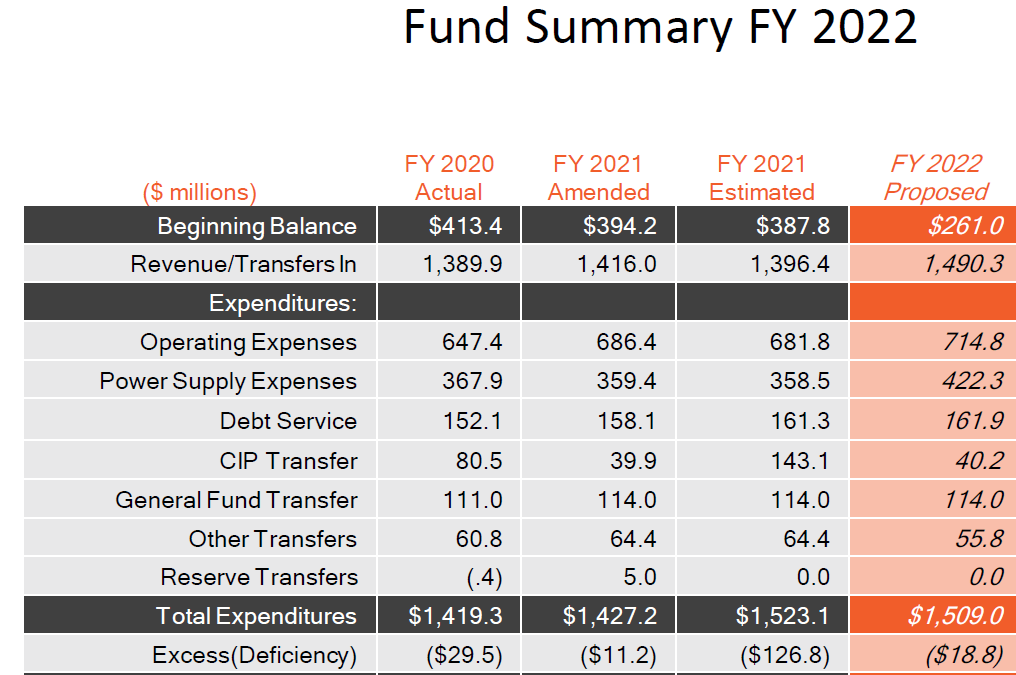

Q: How does fund accounting for non-profits and cities/states differ from standard accrual accounting?

A: The main difference is that the goal is to make revenue match expenditures as closely as possible.

A city or state might have several funds for different purposes, with separate financial statements for each one.

The statements look similar to standard ones for corporations, but there’s an operating surplus / (deficit) on the Income Statement, and there are entries for transferring capital in and out of separate funds.

The final line is the net surplus / (deficit), which is similar to the net income / (loss) line for companies:

The Balance Sheet is similar, but the “fund balance” is the final line item, and it changes based on the net surplus / (deficit).

Tax-exempt entities don’t necessarily view a surplus as a positive; it might be a sign they got the tax rates or spending wrong.

Q: How would an issuer decide on a taxable vs. tax-exempt issuance?

A: From an issuer’s perspective, it’s mostly about the cost of funding, which means that tax-exempt debt is usually the best option.

However, that’s not always the case because taxable debt might also have more favorable terms, such as options for earlier calls (repayment) or different structures (subordination, credit enhancement, etc.) due to different investor bases.

If these different terms allow a city or state to fund a specific project or refinance debt more easily, the issuer might opt for a taxable issuance even if the cost of funding is slightly higher.

Q: How do competitive vs. negotiated deals differ?

A: In a competitive deal, an issuer describes the financing it wants and sends RFPs to banks to solicit competitive bids and get the package with the best terms and lowest fees. The issuer picks a winner, and the winning bank purchases the bonds and resells them to investors.

In a negotiated deal, the issuer selects one bank to purchase the bonds, and that bank sells the bonds to investors, with the terms of the bonds tailored to meet the desires of the investors and the issuer. There’s also a “pre-sale” process in which the underwriter bank seeks indications of interest in the issuance before setting the pricing.

Competitive deals tend to result in lower funding costs and fees for issuers, but they’re best for “plain vanilla” deals.

The more unusual the deal or issuer profile, the more it makes sense to do a negotiated deal to boost investor interest in the offering.

Q: How do revenue bonds and general obligation (GO) bonds differ? Which one would you use to fund a park vs. an airport?

A: Revenue bonds are supported by the cash flows of a specific asset, such as a toll road, hospital, or electric utility, while GO bonds are backed by all the issuer’s revenue sources.

A revenue bond makes the most sense for an airport because it has specific revenue streams (usage fees and taxes) that can cover the interest payments.

If this park does not have a consistent/predictable revenue stream attached, a GO bond is the best option, but if it does generate specific fees, a revenue bond could work.

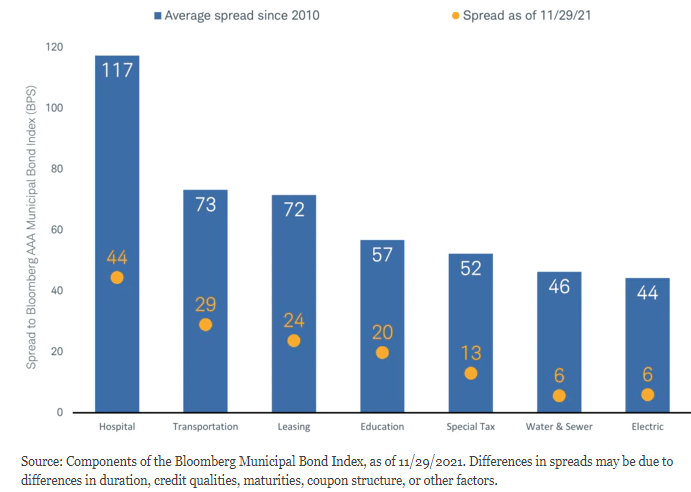

Q: Which types of revenue bonds tend to be riskier and less risky?

A: Revenue bonds backed by “essential services,” such as water, sewer, and electric utilities, are less risky because no matter what happens in the broader economy, people still need electricity, water, and toilets.

Transportation revenue bonds, such as ones backed by buses, subways, toll roads, and airports, are riskier because not all transportation is “essential,” and demand fluctuates based on economic conditions.

Hospital and healthcare revenue bonds are even riskier because most revenue comes from insurance reimbursements, Medicare/Medicaid in the U.S., or self-pay from patients without insurance, and a sizable percentage of total municipal bond defaults occur here.

This data from Schwab and Bloomberg sums it up quite well:

Q: Tell me about the municipal bond market at a high level – what’s the approximate issuance volume, and which banks are strong in which areas? What about other types of debt besides revenue bonds and GO bonds?

A: See the previous comments about the top firms and search for recent municipal league tables (Bloomberg publishes a quarterly update).

For the second question, this “Types of Municipal Debt” page is very helpful.

Public Finance Investment Banking Exit Opportunities

The good news is that it’s fairly easy to move around within a large bank since public finance is connected to so many other areas: traditional investment banking, sales & trading, direct lending, derivatives, project finance, and more.

Also, if you’re working in a vertical that does standard IB-like assignments, such as healthcare, you could even move to a for-profit healthcare company in a corporate finance or corporate development role.

The bad news is that traditional private equity and hedge fund exits are not very common.

Yes, in theory, the skill set might seem relevant for infrastructure private equity, power/utilities/energy private equity, or credit-focused hedge funds…

…but in reality, you will be at a disadvantage because:

- You don’t get much practice with traditional financial statement modeling, valuation, or LBO modeling.

- DBC does a chunk of the modeling/reporting work (yes, you often go beyond this, but recruiters don’t necessarily understand that).

- There’s less negotiation/process work required, as many PF deals come down to the rates and fees your bank charges.

- There’s some stigma around public finance, and similar to groups like FIG, recruiters rarely take the time to understand the nuances of your experience.

The exits vary based on your vertical, and you have a higher chance of the traditional ones if you’re in an area like infrastructure/project finance, healthcare, or utilities.

If you do want to leave, the most common options include:

- Government positions, such as the Finance Director in a mid-sized city’s budget office.

- Other teams at your bank, such as DCM or related industry groups.

- Desks within fixed income trading on the S&T side.

- Business school.

- Roles at for-profit corporations with some relationship to municipal bonds and government spending.

Recommended Resources

If you want to learn more about the sector, here are some recommended resources:

- The Bond Buyer – Good place to review data, read news of recent deals, and more.

- Municipal Securities Rulemaking Board – You can look up “official statements” (similar to offering memos) for bonds that have already been issued here.

- SIFMA’s Fundamentals of Municipal Bonds – Considered “The Bible” in this space.

- Refinitiv Municipal Bond Dashboard – Very helpful for finding recent market activity.

- Raymond James: Municipal Bond Investor Weekly – You can use this to find news summaries about yields, markets, and recent issuances.

Public Finance Investment Banking: Pros and Cons

Here’s how I would summarize the group:

Pros:

- Improved Hours and Lifestyle – You’ll work less than in most other IB industry and product groups (but still far more than a 9-to-5 job).

- Stability – While the market does change over time, public finance rarely, if ever, “crashes” in the same way that a group like technology or industrials can.

- Potential for Unique Modeling Experience and Skill Set – If you’re in the right group, you might get exposure to topics like structuring, optimization, and simulations that go beyond standard Excel-based corporate finance models.

- Internal Mobility – You can use public finance experience to move to other credit-related groups in IB and S&T.

- It’s Very Nice at the Top – The MDs in this group probably have the best work/life balance anywhere. Yes, they earn less than other coverage or product group bankers, but they also work close to “normal hours.”

Cons:

- The Work Can Be Tedious / Boring – At smaller firms, you might spend a lot of time responding to RFPs and doing other data-gathering tasks. Yes, many deals go beyond DBC, but that doesn’t mean that you, personally, will always do intellectually engaging work for each deal.

- Compensation is Significantly Lower – Fees on issuances are much lower than in other areas, which leads to a smaller bonus pool and, potentially, lower base salaries that tend to lag behind other groups.

- Exit Opportunities Are Limited – You can move around at your bank and go to related government and corporate roles, but private equity and hedge funds are not likely exits (though not impossible).

- You Will Get Pigeonholed If You Stay Too Long – Similar to other specialized groups, such as FIG, real estate, and oil & gas, the longer you stay, the more difficult it gets to move elsewhere.

Public finance is great for career bankers who want a good work/life balance, moderately interesting work, and high-but-not-top-tier pay.

It’s less great if you’re new to the industry and you’re not sure about your long-term goals.

That doesn’t make public finance a “bad” option, but I wouldn’t pick it over other industry or product groups unless you’re incredibly fascinated by public policy and the role of government.

That’s the most politically correct way to frame this group, though I’m sure it will still generate controversy.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

Hi Brian, thanks for your detailed article! I have an offer from a big 4 for a Deal Advisory role (FDD) and an offer from a Bank for IB PF. What are some of your thoughts on which one I should take.

It depends on your goals and where you want to end up (and the specific bank where you received the IB PF offer). You could potentially use either one to move into more of a “real” IB group if that is your goal, but I think you’d probably have an advantage doing so coming from PF within a large bank – just because you’re already at the large bank (assuming you make the move quickly). The Big 4 offer might win if it were not in FDD but in the actual internal investment bank at the firm instead.