Healthcare Investment Banking: The Best Group to Check Into When Human Civilization is Collapsing?

- Investment Banking Industry Groups: Healthcare

- Recruiting: Who Gets Into Healthcare Investment Banking?

- What Do You Do as an Analyst or Associate in Healthcare Investment Banking?

- Healthcare Trends and Drivers

- Healthcare Sector Overview

- Healthcare Valuation and Financial Modeling

- Healthcare IB League Tables: The Top Banks

- Exit Opportunities

- Is Healthcare Investment Banking Truly “Recession-Resistant?”

- For Further Reading

- Pros and Cons of Healthcare Investment Banking

Along with an uptick in questions about restructuring investment banking and distressed private equity, we’ve also seen more interest in healthcare investment banking lately.

It makes sense: when there’s a recession, pandemic, or market crash, everyone wants to run to the “safe group.”

The only problem is that healthcare has not been so “recession-resistant” this time around.

It’s still a solid industry group, but it may not deliver on everything it promises.

We’ll cover that as well as the following points in this industry overview:

- The main sectors within healthcare, including drivers and operating and valuation metrics.

- Sample investor presentations, valuations, and Fairness Opinions.

- Recruiting and what to expect as an Analyst or Associate.

- The top banks in the sector and exit opportunities.

- Pros and cons of the group and why the “recession-resistant” label is a simplification.

Investment Banking Industry Groups: Healthcare

Healthcare Investment Banking Definition: In healthcare IB, bankers advise companies in the biotech, pharmaceutical, medical device, healthcare service/facility, and healthcare IT markets on mergers, acquisitions, and debt and equity capital issuances.

Most banks divide their teams into industry groups and product groups, and healthcare is the perfect example of an industry group.

The healthcare team executes all types of transactions (M&A, debt, equity, and more), but only within a single industry.

Most healthcare companies fall into one of two broad categories:

- Pharmaceuticals, Biotechnology, and Life Sciences – This category includes companies that make both branded (patented) and generic drugs, either derived from living organisms (biotech) or chemicals (pharmaceuticals). It also includes companies that make tools to support these activities (“Life Sciences”).

- Healthcare Equipment & Services – This category includes hospitals, assisted living and nursing facilities, labs, managed care, and medical device companies.

Many healthcare companies provide “essential services” whose demand is relatively inelastic – even if there’s a recession, someone with a broken leg still needs to go to the hospital.

The entire sector is heavily regulated, and government involvement is high even in countries that lack “universal healthcare,” such as the U.S.

There are a few dozen huge, public companies that account for much of the deal and financing activity in the sector, and then hundreds or thousands of small-cap companies and startups that are potential acquisition targets.

U.S.-based firms also account for an unusually high percentage of the total market cap worldwide.

Healthcare Information Technology (HCIT) is sometimes grouped in the “Equipment & Services” category, but it could be separate or even part of the Technology group.

Similarly, health insurance companies could be here, or in the Financial Institutions Group (FIG), or both; we’re not going to cover them here, so please refer to the FIG article.

The same applies to healthcare REITs, so refer to our REIT coverage.

Recruiting: Who Gets Into Healthcare Investment Banking?

Unlike groups such as biotech equity research and life science venture capital, you do not need an advanced degree in medicine, biology, or chemistry to get into this group.

Healthcare groups hire many undergrads from unrelated majors; medical knowledge can be helpful, but more so in specific verticals.

Knowledge of healthcare business models is much more important because that affects everything you do.

A background with some exposure to healthcare always helps so you can tell your story more effectively, but it’s not a strict requirement.

The recruitment process is similar to the one in any other group: attend a top undergrad or MBA program, earn high grades, get relevant internships/work experience, and do a good amount of networking and preparation.

What Do You Do as an Analyst or Associate in Healthcare Investment Banking?

As always, you’ll work on a combination of pitch books, deals, and “random tasks.”

Your experience as an Analyst or Associate depends on the specific vertical you focus on within healthcare. There are three points worth noting here:

- In Healthcare Equipment & Services, you’ll tend to work with bigger companies that use more debt. Leveraged buyouts are common, and so are standard M&A deals. You’ll learn more about finance and less about the market and the science behind different drugs.

- In Pharmaceuticals, Biotechnology, and Life Sciences, you’ll work with the huge companies and much smaller companies, so you’ll gain more market/product knowledge, but you’ll spend less time working on LBOs and high-yield debt financings.

- You may get exposure to more unusual deal types, such as joint ventures, royalty arrangements, asset swaps, and spin-offs because managers at the Big Pharma companies often control “collections of assets,” and they may prefer to partner with other firms rather than outright acquiring them.

Healthcare Trends and Drivers

A few drivers that apply to all sectors within healthcare include:

- Demographics – As the population ages, it tends to consume more healthcare. Also, as more people join the middle class, consumption tends to increase. These two trends should drive demand for healthcare in developed markets (aging populations) and emerging ones (a rising middle class).

- Government Policies and Regulations – The government is heavily involved in healthcare in most countries, but its exact role varies. Sometimes it acts as a true “single-payer,” as in the U.K., while in other countries, such as the U.S., it funds part of the system, and private companies do the rest. Governments may set prices, reimbursement rates, and coverage requirements, and they also approve new drugs, devices, and treatments. They may also fund significant research and development efforts.

- Product Pipelines and Innovations – Since branded drugs (and devices) are patent-protected for limited periods, companies must always be developing new products to make up for lost revenue when the patents expire. Even generic-drug companies need to think about pipelines so they can monitor expiring patents and plan new, lower-cost manufacturing processes.

- Broader Economic and Credit Conditions – In theory, healthcare is a “defensive” sector that tends to hold up better when there’s an economic contraction or a weak credit environment. We saw this in 2008-2009 when many large healthcare companies could borrow money easily, despite a credit crunch in other sectors.

Healthcare Sector Overview

Firms like Baird break up their healthcare investment banking groups into Biotechnology & Pharmaceuticals, Healthcare Services & IT, Healthcare Facilities, Life Sciences, and Medical Technology.

However, we’re going to stick with the split above – Biotechnology, Pharmaceuticals, and Life Sciences vs. Equipment and Services – and add a sub-category for Medical Devices & Equipment.

In practice, pharmaceutical and biotechnology (“biopharma”) companies account for the vast majority of the total healthcare market cap worldwide – often over 75% – so it’s not that useful to split up the non-biopharma companies into many segments.

Also, some of these other segments don’t exist in the same way outside the U.S.

Pharmaceuticals, Biotechnology, and Life Sciences (“Biopharma”)

Representative Large-Cap, Global, Public Companies: Johnson & Johnson, Roche, Novartis, Pfizer, Bayer, Merck, GlaxoSmithKline (GSK), Sanofi, AbbVie, Abbott Laboratories, AstraZeneca, Amgen, Gilead, Eli Lilly, and Teva.

Many of these firms are diversified and operate in other areas, such as devices and equipment; some, like Johnson & Johnson, even operate outside the pure “healthcare” sector.

There are some differences between pharmaceutical and biotech firms, but their business models are quite similar: spend a lot of time and money discovering and developing drugs, go through expensive clinical trials, pray wait for FDA/EMA approval, and then make as much money as possible until patent expiration.

So, it may be more helpful to divide this segment into these sub-categories:

- Branded Biopharma Companies – These companies follow the model described above. It’s “high-risk, high-reward” because most drugs fail, and of the ones that succeed, only a small percentage turn a profit. But a blockbuster drug can bring in billions of dollars and might generate sales even after patent expiration.

It takes an average of ~10 years to develop a new drug and win government approval and another ~10 years to bring it to market and ramp up sales & marketing. Conveniently, drug patents in most developed countries last for around 20 years.

- Generic Biopharma Companies – These companies do not compete based on innovation because they simply produce drugs with expired patents, or ones where the patent is invalid or not recognized. So, they aim to reduce prices as much as possible by competing based on manufacturing efficiencies and economies of scale. Many generic companies are based in countries like India and China to take advantage of lower production costs there (although this may be changing as the world shifts away from globalization).

- Diversified Firms – Finally, these firms have portfolios of both types of drugs and spend a lot on R&D, acquisitions, and JV deals to keep replenishing their pipelines.

Branded companies tend to be more valuable than generic companies because they have time-limited monopolies and enjoy much higher margins.

If you work with companies in this segment, you’ll spend time projecting drug prices and patient counts and figuring out which drugs have the highest chance of succeeding.

Life sciences companies support these drug development efforts with instruments, consumables, and software; the best-known big company in the sector is Thermo Fisher Scientific.

Medical Devices & Equipment

Representative Large-Cap, Global, Public Companies: Medtronic, Koninklijke Philips, Danaher, Becton, Dickinson and Company, Siemens Healthineers, Stryker, Baxter International, and Boston Scientific.

The devices & equipment segment is usually the second-largest one within healthcare, so it’s worth breaking out separately from services.

Companies may produce either “conventional products,” such as scalpels, tables, and trays, that tend to be lower-margin, or “high-tech products,” such as stents, pacemakers, and other implantable devices that are higher-margin and require significant R&D.

The basic difference compared with the biopharma segment is that patent protection is much weaker for equipment/device companies; exclusivity might last for only 1-2 years rather than 10+ years.

In the U.S., the FDA divides medical devices into Class 1, Class 2, and Class 3.

Class 1 devices offer the lowest risk to patients, while Class 3 devices relate to life-threatening events and therefore have the toughest regulations.

The key drivers in this segment are similar to those for biopharma companies: the product pipeline, pricing power, demographic changes, FDA/EMA approvals, and regulations.

Another difference is that device & equipment companies are often more economically sensitive than biopharma companies because a lot of their equipment is used for elective procedures.

If the economy is doing well, people might opt for that knee or hip replacement right away.

But if the economy is falling apart, they might put it off.

Healthcare Services & Facilities

Representative Large-Cap, Public Companies: UnitedHealth, McKesson, AmerisourceBergen, Cigna, Cardinal Health, Anthem, Centene, Fresenius SE & Co., HCA Healthcare, Tenet Healthcare, Alfresa Holdings, Shanghai Pharmaceuticals, MediPal Holdings, Quest Diagnostics, and Labcorp.

You’ll notice that I removed the “global” part here because many of these companies are limited to their home markets.

Also, since many of the companies in this list are private health insurance firms, they are far less prevalent outside the U.S.

This category includes everything from distribution companies, like McKesson and Cardinal Health, to healthcare services firms, which include pharmacy benefit managers (PBMs), lab testing services, and others, to managed health care, AKA “private health insurance.”

You’ll notice that there are no facilities providers, i.e., dedicated companies that operate hospitals or nursing homes, in the list above.

That’s because most of these companies are smaller, and many are private – even if they earn billions of dollars in revenue.

One example of a public hospital operator in the U.S. is Community Health Systems; HCA and Tenet also operate hospitals, among other services.

Key drivers in this sector include patient enrollments, population growth, and government reimbursements, as well as pricing power for distributors and PBMs.

Insurance is a whole separate topic that we’re not going to delve into here; please see the FIG article for more.

In theory, healthcare service & facility companies have “stable” cash flows because hospital visits, demand for medical supplies and drugs, and nursing home populations stay in similar ranges regardless of economic conditions.

That makes these firms prime candidates for leveraged buyouts, which is why KKR has acquired companies such as HCA and Envision in the past.

Healthcare Valuation and Financial Modeling

Unlike other sectors, such as commercial banks, insurance firms, and oil & gas companies, there are no huge accounting, valuation, or financial modeling differences in healthcare.

You still use standard methodologies such as the DCF, comparable company analysis, precedent transactions, accretion/dilution, and LBO models.

That’s why we cover healthcare in several of our courses: Core Financial Modeling, Advanced Financial Modeling, and the Interview Guide.

The main technical differences include the following:

- Different Deal Types – As mentioned above, joint ventures, earn-outs, royalties, asset swaps, and spin-offs are all more common in this sector. Modeling something like a royalty arrangement often requires complex formulas and Excel work, even though it’s not a traditional 3-statement model.

- Biopharma DCFs – When valuing branded drug companies, you often build a probability-weighted DCF that multiplies future cash flows from products by their success probabilities.

The probability varies based on the stage the product is at; if it has not even passed Phase I clinical trials yet, the success probability will be low because most products fail.

But if it has already passed Phase II, the chances of making it through Phase III will be much higher.

Here’s an example from our Jazz Pharmaceuticals case study in the Advanced Financial Modeling course (click to view larger version):

- Capital Structure – Many smaller biopharma companies use convertible bonds in their capital structures. To companies, it’s cheaper than normal debt, and to investors, it’s “hedged equity.” So, you’ll have to understand note hedges, capped call transactions, and related concepts (again, covered in the Advanced Financial Modeling course).

- Synergies Valuations – When a huge company is acquiring a smaller one, it’s common to estimate the present value of revenue and cost synergies and compare it to the premium paid. If they’re dramatically different, the buyer may be overpaying or underpaying.

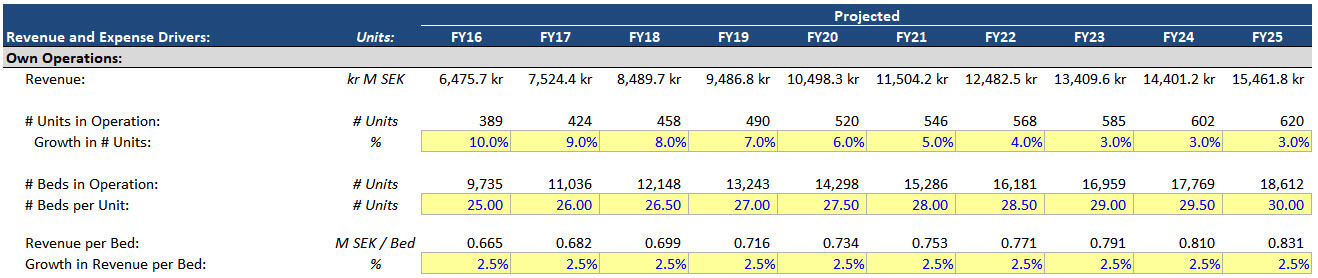

As another example, we cover Attendo AB, a Swedish healthcare services company, in one of the case studies in the IB Interview Guide.

There, the key drivers are based on assumptions such as the # of beds in operation and Revenue per Bed (click to view larger version):

Metrics such as Average Length of Stay (ALOS) and Net Revenue per Adjusted Admission are also important in this segment.

If you want to see a few examples of valuations, Fairness Opinions, and investor presentations for large deals, please take a look at these:

Pharmaceuticals, Biotechnology, and Life Sciences

- Novartis / AveXis – Goldman Sachs and Centerview

- Thermo Fisher Scientific / Qiagen N.V. – JPM and MS

- Bristol-Myers Squibb / Celgene – MS, JPM, Citi, Evercore, and Dyal Co.

Medical Devices & Equipment

- Stryker / Wright Medical Group – Guggenheim and JPM

- 3M / Acelity – CS, JPM, and GS

Healthcare Services & Facilities

- KKR / Envision – JPM, Evercore, and Guggenheim

- Fairness Opinions (starting on pg. 48)

- Centene / WellCare Health Plans – Allen & Co., Barclays, and GS

Healthcare IB League Tables: The Top Banks

The “rankings” change from year to year and quarter to quarter, so I’m not going to provide them here.

Instead, I’ll just say that most of the bulge bracket banks are strong in healthcare: JPM, GS, MS, Barclays, Citi, CS, and DB are usually in the top ~10.

Among the elite boutiques, Lazard, Centerview, Evercore, and Guggenheim all have a presence (see the links above).

You’ll also see middle market banks like Houlihan Lokey, Cowen, and Piper Jaffray on smaller deals, and Jefferies does a lot of work in the space as well, sometimes ranking closer to the BB banks by fees generated.

And then there are the industry-specific boutiques, such as KeyBanc (from its Cain Brothers acquisition), SVB Leerink, Ziegler, Triple Tree, Brentwood, and Crosstree (not sure of the classification of these last two).

Healthcare is such a diverse sector that no single bank or group dominates each vertical; some firms are stronger in pharmaceuticals, others are stronger in medical devices, and some focus on smaller areas like HCIT.

Exit Opportunities

Since you work on so many different deal types in healthcare, and since the technical skills are not specialized, your exit opportunities are quite broad.

You could pursue all the standard ones: private equity, venture capital, hedge funds, corporate finance, corporate development, startups, or almost anything else covered on this site.

However, depending on the companies you’ve worked with, you’ll be a stronger or weaker candidate for some of these.

For example, if you mostly worked on biopharma deals, you’ll be a stronger candidate for hedge funds and corporate development at large pharma companies.

Private equity does little in that space because most target companies are early-stage, with unpredictable cash flows (some are even pre-revenue).

You could be a good candidate for venture capital careers as well, but in life science venture capital, you usually need a science background for early-stage funds.

So, if you’re stronger in finance than science, you may have to focus on later-stage VC and growth equity funds.

If your deals involved device, equipment, service, and facility companies, then you’ll be a stronger candidate for private equity roles.

Those companies are more mature and have more predictable cash flows, so there has been far more PE activity in those sectors historically.

Is Healthcare Investment Banking Truly “Recession-Resistant?”

And now we arrive at the punchline: “Sort of, but maybe not as much as you think – and it depends on the type of recession and your vertical within healthcare.”

In a generic recession driven by a credit bubble that bursts (e.g., 2008-2009), yes, healthcare holds up relatively well.

Unemployment rises, but people still go to hospitals, take their medicine, and get surgeries; nursing homes are still populated.

But if it’s a recession caused by a pandemic or another health issue, all bets are off.

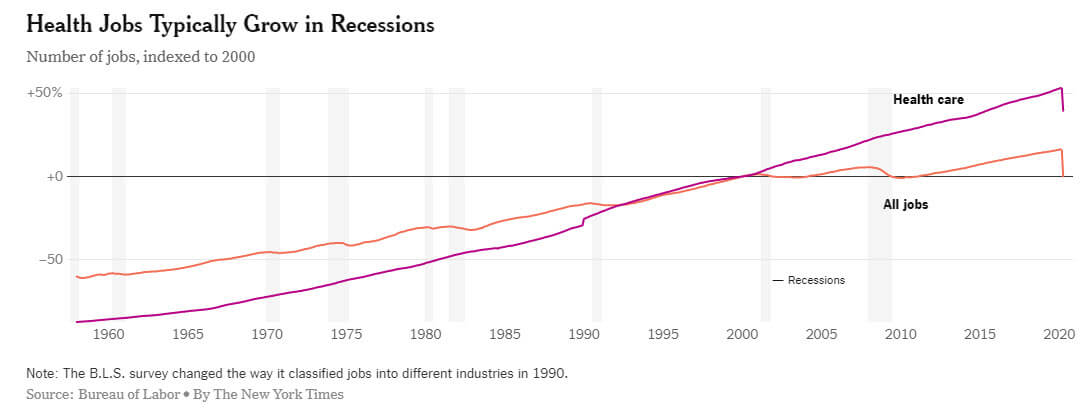

The New York Times Upshot describes this well: in 2020 so far, 1.4 million healthcare jobs have been lost in the U.S.:

The problem is that hospitals in the U.S. earn most of their money from elective surgeries, and people are now afraid to go to the hospital because of COVID-19.

That creates a “death spiral” where hospitals can’t afford to keep everyone on staff, which then results in even less capacity for elective surgeries, which then results in even less demand.

Sectors like branded pharmaceuticals have held up better, and job losses are still not as bad as they are in restaurants, hotels, and retail.

But healthcare investment banking deals are being pulled from the market (see: EQT and Metlifecare in New Zealand), and it’s clear that the sector is not the safe haven that many people had believed.

For Further Reading

If you want to learn more, start with the links below:

- Fierce Healthcare, Fierce Biotech, and Fierce Pharma

- BioCentury

- MassDevice

- Healthcare Finance News

- Healthcare Dive

- Fisher Investments on Health Care [Book]

Pros and Cons of Healthcare Investment Banking

So, is healthcare the best industry group in investment banking? I’d summarize it as follows:

Pros:

- You’ll work on a wide variety of deal types across different sectors, no matter which bank or group you join.

- You gain skills that apply to many industries, so the exit opportunities are good – and you could easily move to another group at your bank.

- The sector is somewhat “defensive” in the face of standard recessions, as people are always getting sick and in need of treatment.

- Depending on your vertical focus, you could position yourself well for PE, HF, VC, or CD roles.

- Healthcare will never be “solved” – the market is always changing, and so are the problems, so deal activity will remain strong as long as big companies need to make acquisitions to replenish their pipelines.

Cons:

- You may need a stronger science/medical background for certain exit opportunities; healthcare IB helps but isn’t always sufficient.

- Outside biopharma, sectors such as nursing homes are sometimes perceived as “boring” because companies’ share prices don’t suddenly pop by 80% on an FDA announcement.

- It’s not quite as “recession-resistant” as people claim, and, ironically, health crises can hurt the sector.

I’ll add one final, subjective word of caution here: the entire U.S. healthcare system is likely to be upended in the coming years.

That could mean a full government takeover with single-payer care, or it might mean “universal coverage” in the same way that countries like France and Germany provide it (i.e., a mix of government and employer-based coverage).

Either way, though, government involvement is likely to increase.

In the short term, these disruptions may create more deals, but in 20-30 years, the entire sector could be dramatically different.

That’s significant because U.S.-based healthcare companies dominate the sector, often charging higher prices domestically to offset the lower prices mandated by other governments.

But what happens if price controls exist everywhere, insurance companies disappear, or the government takes full control?

Join the healthcare investment banking team, and you’ll get to find out first-hand.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

Hey Brian! I hold a Master’s degree in Biotechnology specialising in genetics and genomics. I have been working in a Neurobiology lab for 7 months now. I am interested in administration and management in healthcare sector. I came across this article and felt like a good option to pursue. Do I have to pursue MBA in finance and get into companies through internship? Since my domain will be changed, will it be difficult for me to blend in? If I take up MBA, will I need work experience? or wouldn’t that matter?

Also, do you know about the IB opportunities in India?

Thank you and Regards.

I don’t think you “have to” pursue an MBA if you want to switch to business, but it would help past a certain experience level. I would recommend these articles for ideas:

https://mergersandinquisitions.com/medical-school-to-investment-banking/

https://mergersandinquisitions.com/mba-investment-banking-recruiting-process/

How good are the healthcare groups at BNP Paribas, Wells Fargo, or SVB Leerink? What are the biggest differences among between these banks in the healthcare space?

Sorry, but we don’t track groups that specific in any level of detail. Given the high turnover in the finance industry, it would be several full-time jobs just to keep track of which banker is where and which group is doing which deal. You generally want to decide based on the bank’s overall strength, with some exceptions for industry-specific boutique banks like SVB Leerink.

What about MTS Health Partners? Any thoughts?

I don’t know the specifics about them, but I believe they are well-regarded in the space (though they seem to focus on smaller deals according to the website).

Hi Brian – –

Great article as always! I have an IB interview soon in the HC sector and the office that I’m applying to mainly deals with clinics (portfolio of doctor’s practices or mental health clinics, etc). I know you said explicitly that the valuation metrics and methodologies don’t change much for the industry, but for something specific as this are there other ways to valuate the practice?

Also, is this a good subvertical to continue in the future?

Thanks!

No, not really. You might look at the # of clinics and per-clinic efficiency, but those are metrics, not valuation multiples. Yes, I think it’s a fairly good area within healthcare because many private clinics are springing up, and traditional healthcare will face huge changes over the next decade.

Hi

Thanks for the great contents. Is there any other book or online course that you would recommend besides Fisher Investment to give an overview of healthcare invesment? Thanks.

VBrian,

I can’t recommend anything specific offhand, sorry.

Hey Brian…a bit late but I have just finished undergrad with a degree in the biomedical sciences. I have been offered a Phd position(4yr program) in Biotechnology though healthcare IB is more aligned with my career interests. I took some finance classes in college and online courses in modelling etc. What advice would you give to someone looking to make this transition? Is doing a Phd then going into perhaps Equity Research a more likely option? Thanks

Yes, a Ph.D. into equity research or VC is more likely than healthcare IB. These articles have some tips on how to make the transition:

https://mergersandinquisitions.com/biotech-equity-research/

https://mergersandinquisitions.com/life-science-venture-capital-jobs/

Hi, I’ve come from a medical bioscience background and have spent two and a half years with an agency doing comms for pharma companies. I’m now starting an MBA in health economics at a London bussiness school. Do you have any tips for what I could be doing over the next year to make myself more attractive to healthcare IB employers? Ive been doing lots of online courses related to finance and will be choosing elective models related to finance

Am I likely to have a shot?

At the MBA level, it comes down to work experience + networking if you’re already at a top school. Since you’re already enrolled, all you can do is network extensively with alumni at different banks and find opportunities like that. It’s hard to say what your chances are without knowing your full background.

Where do banks typically have their biopharma folks sit? Seems like a lot are on the west coast, but do at least some also have them in NYC?

A mix of both, but yes, some are also in NYC because there are many healthcare companies in New Jersey. Some banks also have groups in Boston since that’s a center for biopharma as well.

You should add MTS Health Partners to this article for sure. Take a look at mtspartners.com

Hey Brian

I am an MBA candidate at top tier Business school in South Africa for 2021 having recently completed the Honors Business Administration Post graduate Diploma with a B+ grade average. I am medical doctor by training and would like to go into Healthcare investment banking but struggling to attract the required attention with our local banks, Do i take the risk and compete in the generalist Investment banking graduate program with the hope of getting in and specialising in Healthcare later? or completing the MBA first?. I have also just secured a spot on the virtual Investment banking internship with Brightnetworks London who has partnered with major banks like JPM, GS and Mcquire group. What is the real value of this 3 day virtual internships with full-time job offers and future career mapping because i suppose its organised primarily by recruitment agencies trying to secure good in a difficult economy

I don’t think 3-day virtual internships will help much. The main problem you’re facing is that there aren’t that many IB jobs in South Africa next to hubs like London and New York, so you’ll probably have to go to one of those places to improve your chances. Some doctors to get into IB, but usually only with a big networking effort first.

As far as business school: if you’ve already been in medicine a long time, you might need it to switch industries. If not, you could probably get in via networking and a location switch.

Hey Brian, Great content. 1 extra point to add is the telehealth trend, the virtual consultation platforms provided by companies have been growing. I have recently interviewed for an ER role that shifts focuses on healthcare IT firms, and am glad my experience had been found relevant

-aspiring ER associate with healthcare background + MBA

Yup, that is a good point. We didn’t include it here because HCIT is sometimes classified under Tech / TMT, but if it’s within Healthcare, it is a quickly growing industry.

Brilliant! Hats off to Brian and team for coming up with such highly informative posts that turn on a lightbulb Great work guys!

Keep it coming!

– Aspiring healthcare investment banker

Thanks, glad to hear it!