The DCF Model: The Complete Guide… to a Historical Relic?

It may be an understatement to say that we live in “interesting times.”

Cryptocurrencies based on dog memes suddenly spike up 500%, meme stonks seem to drive mainstream discussion of “investing,” celebrity investors go on TV to talk their books, and real celebrities’ tweets often drive stock prices.

In this environment, it’s fair to ask if the discounted cash flow (DCF) analysis and DCF models are still relevant at all.

I’ll address this question at the end of this article, but the short answer is that the DCF model still matters – but perhaps less so for a tiny percentage of overhyped companies and less so in crazed market environments.

But let’s start by describing each step of the analysis and giving you a few simple examples:

DCF Model: Video Tutorial and Excel Templates

If you’d prefer to watch rather than read, you can get this [very long] tutorial below:

Table of Contents:

- 2:29: The Big Idea Behind a DCF Model

- 5:21: Company/Industry Research

- 8:36: DCF Model, Step 1: Unlevered Free Cash Flow

- 21:46: DCF Model, Step 2: The Discount Rate

- 28:46: DCF Model, Step 3: The Terminal Value

- 34:15: Common Criticisms of the DCF – and Responses

And here are the relevant files and links:

- Walmart DCF – Corresponds to this tutorial and everything below.

- Walmart 10-K Excerpts.

- Slide presentation for this tutorial.

- Uber Valuation and DCF – Different DCF model for a high-growth company (sort of).

- Snap Valuation and DCF – Different DCF model for a different high-growth company.

The Big Idea Behind a DCF Model

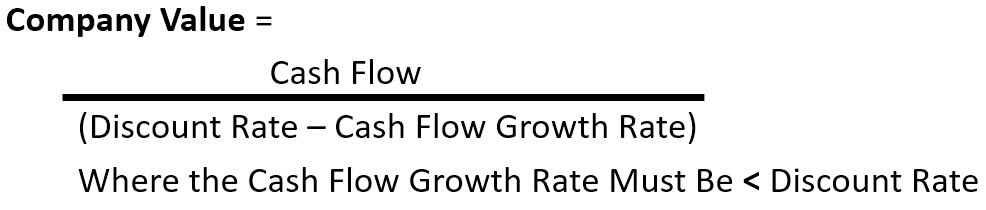

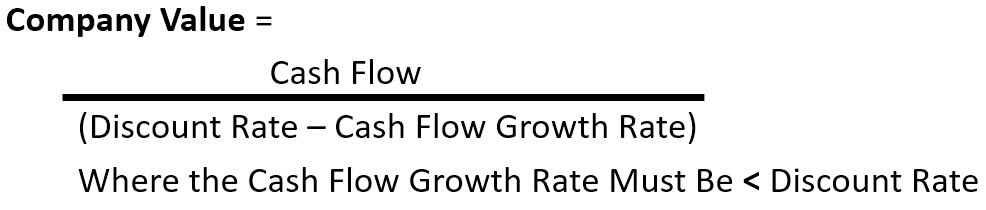

The big idea is that you can use the following formula to value any asset or company that generates cash flow (whether now or “eventually”):

The “Discount Rate” represents risk and potential returns – a higher rate means more risk, but also higher potential returns.

A company is worth more when its cash flows and/or cash flow growth rate are higher, and it’s worth less when those are lower.

The company is also worth less when it is riskier or when expectations for it are higher, i.e., when the Discount Rate is higher.

If a company’s Discount Rate and Cash Flow Growth Rate stayed the same forever, then investment analysis would be simple: just plug the numbers into this formula.

But that never happens!

Companies grow and change over time, and often they are riskier with higher growth potential in earlier years, and then they mature and become less risky later on.

Valuation is more than this simple formula because companies’ Discount Rates and Cash Flow Growth Rates change over time.

To represent that change, you divide companies’ lifecycles into two periods:

- Period #1 (Explicit Forecast Period): The company’s Cash Flow, Cash Flow Growth Rate, and potentially even the Discount Rate change over 5, 10, 15, or 20+ years, but the company reaches maturity or “stabilization” by the end.

- Period #2 (Terminal Period): The Discount Rate and Cash Flow Growth Rate stop changing because the company is mature. Its Cash Flow will still change, but the valuation formula above works because it requires only the first year of Cash Flow in this period.

You value the company in both these periods and then add the results to get its total value from today into “infinity” (AKA until the Present Value of its cash flows falls to near-0).

Company/Industry Research

Before you jump into Excel and start entering numbers, you should do a bit of company and industry research to establish the following:

- What are the top 5-10 most important drivers for the company?

- How can you project its revenue beyond a simple percentage growth rate? What about its expenses?

- What do its historical trends look like, ideally going back 5-10 years?

The company’s annual report and investor presentations are the best starting points.

You could also search for industry data from companies like IDC, Gartner, and Forrester, but it’s not necessary for a quick analysis of a mature company.

And if you are dealing with a rapidly changing company or a tech startup (e.g., Uber or Snap), it’s often more useful to get KPIs and financial stats from similar companies that were once growing quickly but have since matured.

In theory, you could spend days, weeks, or months on industry and company research, but that much effort is not necessary.

We recommend reading through the annual report and investor presentation to the extent that you can come up with those 5-10 key drivers.

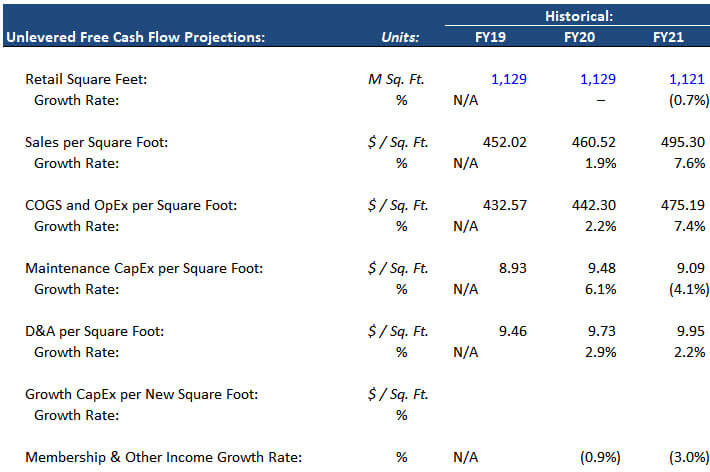

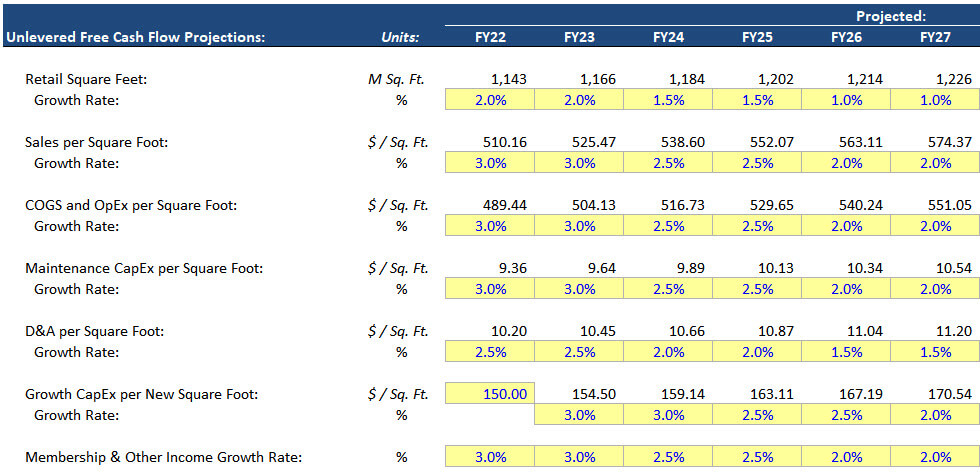

For Walmart, we came up with the following:

Its annual filing repeatedly cited its total square feet, so we made the total retail square feet the top-line driver and based other numbers on $ per square foot figures.

DCF Model, Step 1: Unlevered Free Cash Flow

While there are many types of “Free Cash Flow,” in a standard DCF model, you almost always use Unlevered Free Cash Flow (UFCF), also known as Free Cash Flow to Firm (FCFF), because it produces the most consistent results and does not depend on the company’s capital structure.

Unlevered Free Cash Flow should include:

- Revenue

- COGS and Operating Expenses

- Taxes

- Depreciation & Amortization and sometimes other non-cash adjustments*

- The Change in Working Capital

- Capital Expenditures

*Depreciation & Amortization gets a bit more complicated, especially if you’re analyzing a company that follows IFRS (see the next section).

This list means that you ignore almost everything else: Net Interest Expense, Other Income / (Expense), most non-cash adjustments, most of the Cash Flow from Investing section, and the Cash Flow from Financing section.

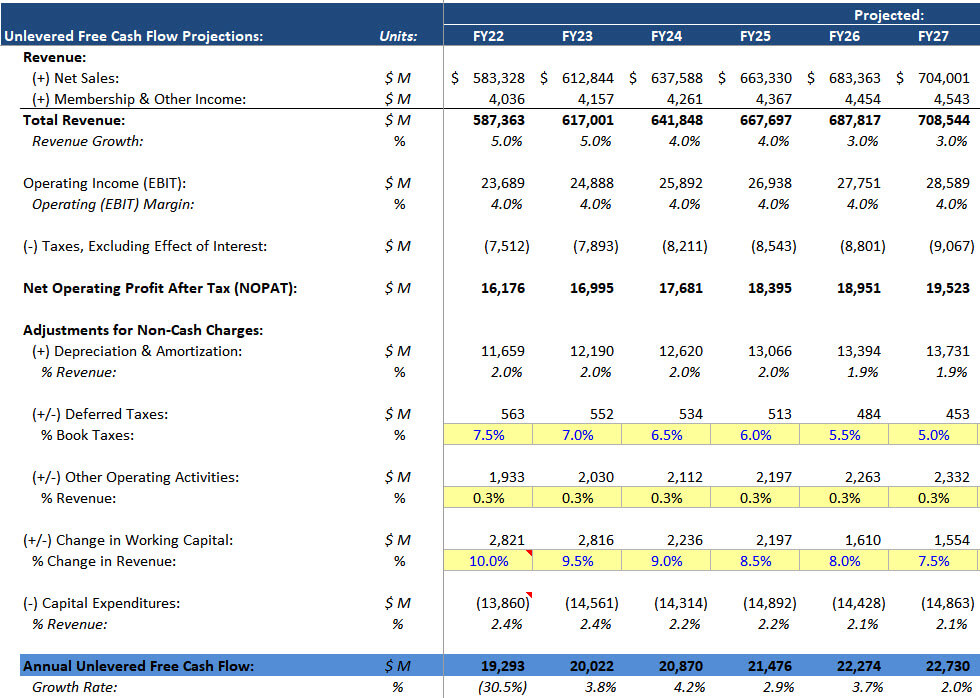

For Walmart, many of the items in UFCF are simple $ per square foot figures:

To calculate UFCF, start with Revenue and subtract COGS, OpEx, and Taxes (which are now different since they’re based on Operating Income).

Then, add back D&A, factor in Deferred Taxes, any other recurring operating activities, and the Change in Working Capital, and subtract CapEx:

In some cases, we recalculate items such as Deferred Taxes because we’re modifying the company’s historical Taxes to make them comparable to future Taxes.

Most of these items should be fairly low as percentages of revenue or the change in revenue.

For example, it would be highly unusual if the Change in Working Capital represented 50% of a company’s UFCF.

For most companies, Working Capital is not a major value driver because it represents simple timing differences.

We also made sure that CapEx as a percentage of revenue stays ahead of D&A as a percentage of revenue in each year because Walmart’s cash flows are growing.

Even if the growth is modest, the company will need to increase its Net PP&E over time to support that growth.

If you don’t know what some of these items mean, please see our coverage of the Change in Working Capital and Unlevered Free Cash Flow for more details.

But Wait! What About Operating Leases in DCF Models?

Accounting for operating leases has become more complicated with the introduction of IFRS 16 in 2019, which required companies to put Operating Lease Assets and Liabilities directly on their Balance Sheets (see: our full tutorial to lease accounting).

The equivalent rules under U.S. GAAP aren’t too bad because U.S. companies still record Rent as a simple operating expense on their Income Statements.

Under IFRS, however, Rent is split into an Amortization or Depreciation element and an Interest element, similar to the treatment for Finance Leases.

Over a large portfolio of leases with different start and end dates, the Lease Amortization + Lease Interest is about the same as the Rental Expense under U.S. GAAP.

The goal in a DCF is to reflect the company’s cash revenue, cash expenses, and cash taxes, so we believe the best approach is to deduct the entire Operating Lease Expense in UFCF.

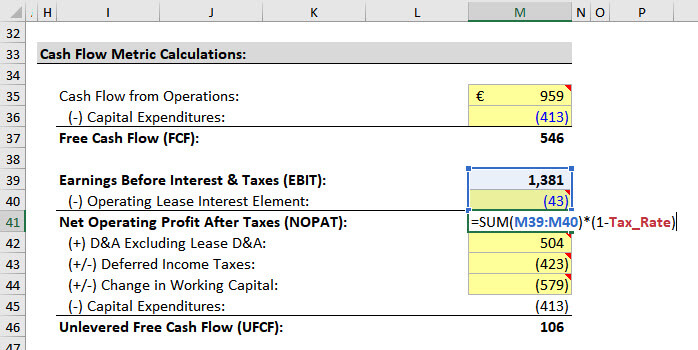

For IFRS-based companies, that means you’ll have to deduct the Interest element in the EBIT and NOPAT calculations:

Also, you should not add back the Operating Lease Depreciation or Amortization because in this case, it represents part of an actual cash expense.

If you follow this treatment, the UFCF number will reflect the deduction for the full Lease Expense.

Some argue that you should add back the entire Lease Expense and count Operating Leases as an item in the Equity Value to Enterprise Value bridge.

We don’t favor that approach because UFCF does not reflect the company’s cash expenses if you do that, and it’s more difficult to compare companies that way.

DCF Model, Step 2: The Discount Rate

Once you’ve projected the company’s Unlevered Free Cash Flows, you need to discount them to their Present Value: what they’re worth today.

That value today depends on how much you could earn with your money in other, similar companies in this market, i.e., your expected, average annualized returns.

The Discount Rate expresses these expected, average annualized returns, and in an Unlevered DCF, it’s equal to WACC, or the “Weighted Average Cost of Capital.”

The name means what it sounds like: you estimate the “cost” of each form of capital the company has, weigh them by their percentages, and then add them up.

“Capital” means “a source of funds.” So, if a company borrows money in the form of Debt to fund its operations, that Debt is a form of capital.

And if it goes public in an IPO, the shares it issues, called “Equity,” are also a form of capital.

The exact formula is:

WACC = Cost of Equity * % Equity + Cost of Debt * (1 – Tax Rate) * % Debt + Cost of Preferred Stock * % Preferred Stock

The Cost of Equity represents potential returns from the company’s stock price and dividends, or how much it “costs” the company to issue shares.

For example, if the company’s dividends are 3% of its current share price, and its stock price has increased by 6-8% each year historically, its Cost of Equity might be between 9% and 11%.

The Cost of Debt represents returns on the company’s Debt, mostly from interest, but also from the market value of the Debt changing.

For example, if the company is paying a 6% interest rate on its Debt, and the market value of its Debt is close to its face value, then the Cost of Debt might be around 6%.

You also multiply that by (1 – Tax Rate) because Interest paid on Debt is tax-deductible. So, if the Tax Rate is 25%, the After-Tax Cost of Debt would be 6% * (1 – 25%) = 4.5%.

The Cost of Preferred Stock is similar because Preferred Stock works similarly to Debt, but Preferred Stock Dividends are not tax-deductible, and overall rates tend to be higher, making it more expensive.

The Discount Rate in Real Life vs. Simple Approximations

The calculations for the Cost of Debt and Preferred Stock are straightforward, but the Cost of Equity is more challenging because it’s subjective and depends on how other, similar companies have performed relative to the market.

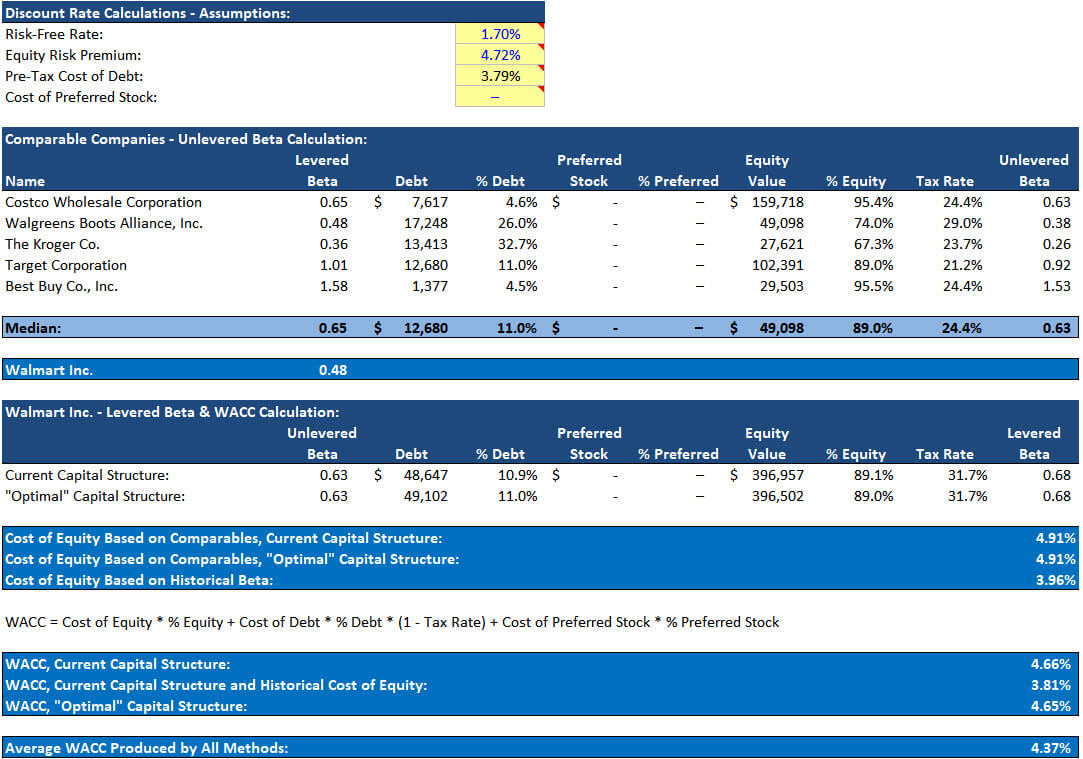

In many DCF models, you’ll see a sheet dedicated to this calculation, where the modeler “un-levers Beta” for each peer company to estimate its risk/volatility independent of its capital structure and then re-levers it for the subject company:

The problem with this approach is that you need quick access to data for comparable companies, which may be tricky without Capital IQ, FactSet, or similar services.

Luckily, there is a “shortcut method” as well, which involves using the same formula but simplifying the last input:

Cost of Equity = Risk-Free Rate + Equity Risk Premium * Levered Beta

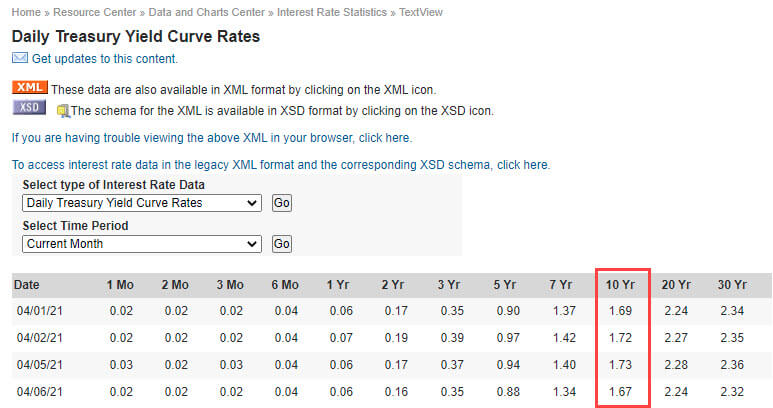

The Risk-Free Rate (RFR) is what you might earn on “safe” government bonds in the same currency as the company’s cash flows (so, U.S. Treasuries here).

The Equity Risk Premium (ERP) is the percentage the stock market is expected to return each year, on average, above the yield on these “safe” government bonds.

And Levered Beta tells you how volatile this stock is relative to the market as a whole, factoring in both business risk and risk from leverage (Debt).

If it’s 1.0, then the stock follows the market perfectly and goes up by 10% when the market goes up by 10%; if it’s 2.0, the stock goes up by 20% when the market goes up by 10%.

Rather than finding comparable companies and un-levering and re-levering Beta, you could just look it up for the company on Yahoo Finance:

You can then combine it with easy-to-find data on 10-year U.S. Treasury yields and the Equity Risk Premium from Damodaran’s collection (or other sources – there are plenty of estimates for the current ERP in different markets):

![]()

The Discount Rate is around 4.0% with this approach (assuming ~90% Equity and ~10% Debt for Walmart), close to the 4.37% in the full model.

Sure, you could make it more complicated, but I would argue it’s a waste of time in a case study or modeling test unless they specifically ask for it.

The important part is that the company’s Discount Rate is closer to 5% than 10% or 15%, so we can use a range of values with 5% in the middle.

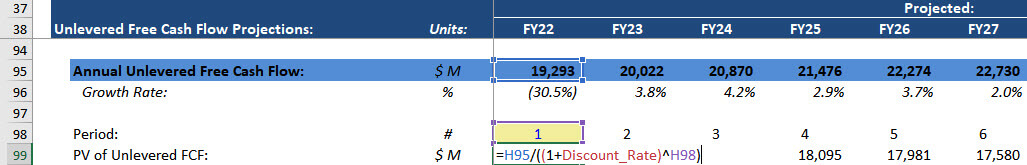

Also, you can now use this Discount Rate to take the Present Value of each UFCF (PV = UFCF / ((1 + Discount Rate) ^ Year #):

DCF Model, Step 3: The Terminal Value

The Terminal Value goes back to the “big idea” behind a DCF model.

Put simply, the “Company Value” in this formula:

IS the Terminal Value – assuming that each input represents the Terminal Period in the DCF model.

To calculate it, you need to get the company’s first Cash Flow in the Terminal Period and its Cash Flow Growth Rate and Discount Rate in that Terminal Period.

In an Unlevered DCF, this formula becomes:

Terminal Value = Unlevered FCF in Year 1 of Terminal Period / (WACC – Terminal UFCF Growth Rate)

And you can estimate the UFCF in Year 1 of the Terminal Period like this:

Terminal Value = UFCF in Final Year of Explicit Forecast Period * (1 + Terminal UFCF Growth Rate) / (WACC – Terminal UFCF Growth Rate)

This “Terminal Growth Rate” should be low: below the long-term GDP growth rate, especially in developed countries.

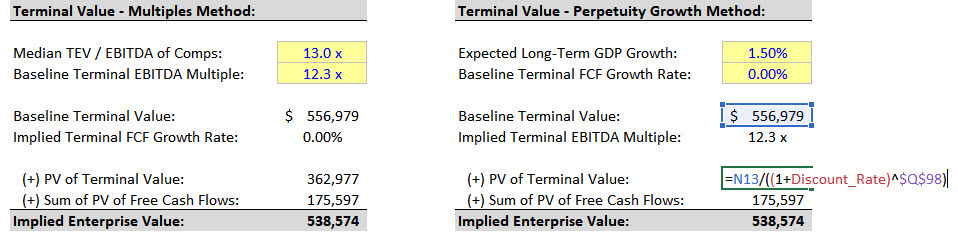

You could also estimate the Terminal Value with an EBITDA multiple based on median multiples from the comparable companies, but we don’t recommend that as the primary method.

It’s too easy to pick multiples that imply ridiculous Terminal FCF Growth Rates, so it’s safer to start with the growth rates and then check their implied multiples.

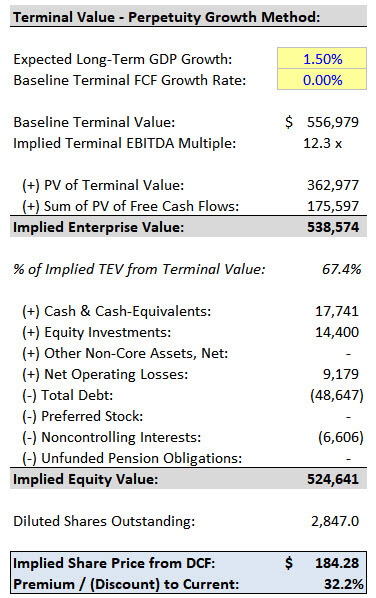

Once you have the Terminal Value, you can discount it back to Present Value and add it to the Sum of the Present Values of the Free Cash Flows:

And then, you can back into the Implied Equity Value and Implied Share Price from there:

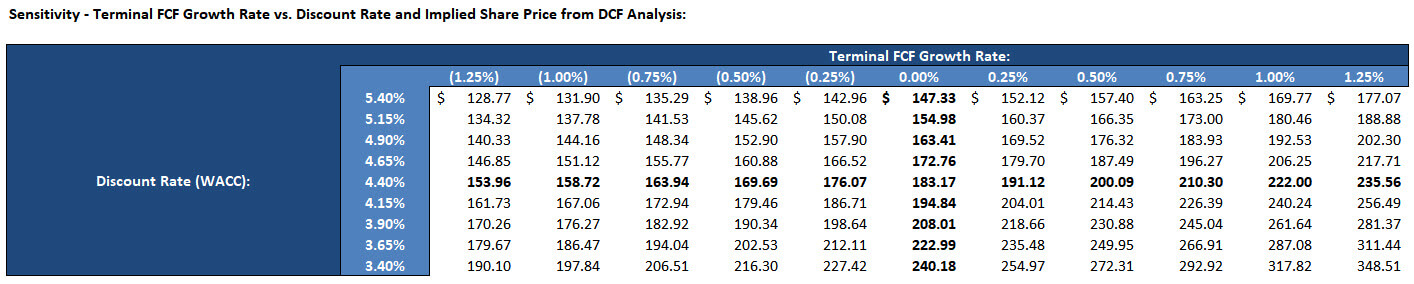

You can also set up sensitivity tables to assess what the company’s valuation looks like with different assumptions for the Terminal Growth Rate, Terminal Multiple, Discount Rate, and so on:

One Final Note: This Terminal FCF Growth Rate should be fairly close to the UFCF growth rate in the final year of the explicit forecast period.

You don’t want UFCF to grow at 10% or 20% and suddenly drop to 2% in the Terminal Period.

If it does, you need to re-think your assumptions or extend the analysis.

Because of this problem, we extended the explicit forecast period to 20 years in the Uber valuation.

Conclusions from This DCF Model

Overall, Walmart seems modestly undervalued because its implied share price in most of the sensitivity tables is above its current share price of ~$140.

There is one problem with this analysis, though: we’re assuming that Walmart keeps growing its retail square feet, even though that number has been declining in recent years.

Therefore, if we had more time and resources, we might create a few operating scenarios, similar to the Uber and Snap models, to assess the results in “growth” vs. “stagnant” vs. “decline” cases.

Common Criticisms of the DCF Model – and Responses

People often criticize the DCF model for the following reasons:

- “But how can you possibly predict a company 5, 10, or 15 years into the future? No one can!”

- “The DCF is too sensitive to small changes in assumptions, such as growth rates and margins.”

- “A DCF ignores market conditions and comparable companies, so it might not give you the accurate market value.”

- “The DCF is no longer applicable because stocks are valued based on memes / crypto / Reddit! No one cares about cash flow.”

My response to the first three objections is similar: it’s not about the exact numbers but ranges, scenarios, and sensitivities.

No, you don’t know whether the Year 10 growth rate will be 10% or 8% or 12%, but you should have an idea of whether it will be closer to 10% or 20%.

And if you don’t, it’s fine to build a DCF with a wide valuation range that reflects high uncertainty.

The complaint about a DCF being “too sensitive” raises other questions: for example, is the FCF growth rate in the final year of the explicit forecast period close to the Terminal FCF Growth Rate?

If not, you need to re-think your assumptions or extend the projections.

And the critique about ignoring market conditions conveniently ignores that the Discount Rate is always based on current market conditions, no matter how you calculate it.

The DCF is indeed less reflective of the current market than comparable company analysis (for example), but it still reflects some market conditions.

And finally, for the crypto/meme/Reddit objection: yes, I agree that certain stocks seem to defy all logic and cash flow-based analysis.

That said, these stocks represent a tiny fraction of all the public companies worldwide.

The media gives them excessive attention, but they ignore the hundreds of thousands (millions?) of other companies that follow some semblance of logic.

And as for crypto, I agree that you cannot use a DCF to value Bitcoin, Ethereum, or Dogecoin.

But this is nothing new: a DCF only works for assets that generate cash flow, whether now or in the future.

No one has ever suggested valuing gold or silver with a DCF, and I’m not sure how crypto is any different in this regard.

DCF Models: Further Learning

If you want to learn more about DCF models and get a step-by-step walkthrough in more detail, sign up for our free financial modeling tutorials.

These tutorials provide a 3-part series on the valuation of Michael Hill, a retailer in Australia and New Zealand, and they go into each step in more depth than we did above.

And if you want in-depth case studies backed by real-world data and research, the Core Financial Modeling course delves into valuation/DCF analysis in even greater detail:

Core Financial Modeling

Learn accounting, 3-statement modeling, valuation/DCF analysis, M&A and merger models, and LBOs and leveraged buyout models with 10+ global case studies.

learn moreA few modules are dedicated to valuation and DCF analysis, and there are example company valuations in other industries.

If you want even more complex examples, the Advanced Financial Modeling course might be more appropriate since it deals with topics like the mid-year convention, stub periods, a normalized terminal year, and net operating losses in a DCF:

Advanced Financial Modeling

Learn more complex "on the job" investment banking models and complete private equity, hedge fund, and credit case studies to win buy-side job offers.

learn moreFree Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews