Uber Valuation: The Most Overhyped Company Ever?

Despite all the controversies, executive turnover, ethical “issues,” lawsuits, and other drama, everyone comes back to the same question with this company: what is it worth?

Back when it was private and raising money at valuations of $51 billion… and then $66 billion… and then $72 billion, many people said Uber was overvalued.

Others argued that the company had unlimited potential and might be worth $1 trillion one day.

But the company’s IPO lets us perform a reality check and see which side is more likely to be right:

Uber Valuation: The Video, the Short Answer, and the Full Tutorial

Disclaimer: This article is not “investment advice.” It is for informational and illustrative purposes and represents only my own opinions and analysis. Seek a licensed professional to make investment decisions, and do not regard this article as advice or a recommendation regarding any securities.

The short answer is that I don’t think Uber is worth anywhere close to its IPO price of $45.00 per share (~$83 billion market cap).

There is a small chance that the company’s current share price range of $40 – $50 per share is reasonable if you make some optimistic assumptions about its future cash flows and minority-stake investments.

Realistically, though, it’s worth closer to $10 – $20 per share, and there’s a decent probability it’s worth $0.

I spent a week digging into the company’s numbers and building a DCF model for it, and you can see the results in the YouTube video below (click here for the direct link):

Table of Contents:

- 2:31: Part 1: How to Think About Uber at a High Level

- 7:38: Part 2: Scenarios and Free Cash Flow Projections

- 14:52: Part 3: Discount Rate Calculation

- 18:48: Part 4: Terminal Value and Conclusions

- 21:43: Part 5: Why I’m Not Shorting Uber

- 24:24: Recap and Summary

You can download the Excel file and PDFs below:

- Uber Valuation – Excel

- Uber Valuation – Presentation Slides (PDF)

- Uber S-1 – Key Pages and Highlights (PDF)

NOTE: There is a small mistake in the WACC tab in cells F69, H69, and J69. The capital structure percentages there should be averages of both “mature” sets of companies.

It affects the final Discount Rate by less than 0.10%, and I didn’t want to redo the entire video and presentation to fix it, so I left it in.

How to Think About Uber as Company

Uber is tricky to pin down because it has different business lines, operates in different geographies, and also owns significant stakes in many other companies.

We’d say it’s a mix of a transportation company, a marketplace company, and a food delivery company:

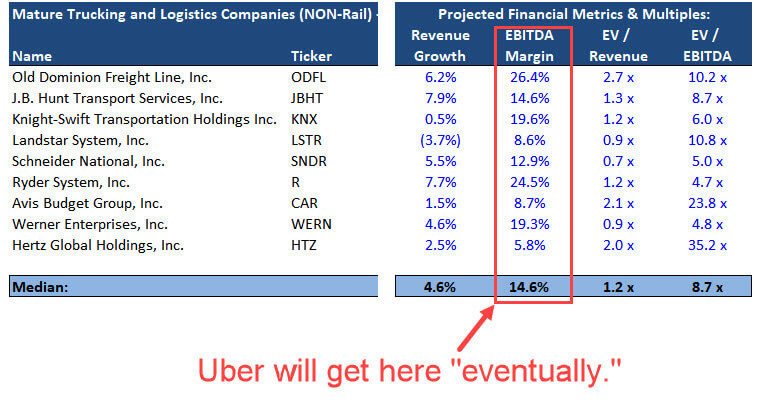

We reviewed these mature companies’ financial and market stats and projected Uber’s revenue and expenses such that it resembles those companies in the long term.

This was more difficult than it sounds because Uber’s S-1 filing was borderline useless.

It’s 396 pages of bold claims and confusing data, signifying nothing.

There were so many omissions and problems that someone else made a list of them.

Still, we had to do something, so we split the company into Ridesharing + Uber Eats in one segment and Uber Freight in the other segment.

Yes, it would have been better to create three segments, but the way they disclosed data made that impossible.

On the Ridesharing + Uber Eats side, Revenue is driven by:

- “Monthly Active Platform Consumers” (MAPCs) AKA Active Users

- Annual Trips per MAPC (how many times do you use Uber each year?)

- Bookings per Trip (how much do you pay, on average, each time you use it?)

- The “Take Rate,” or the percentage of each trip’s fare that Uber collects.

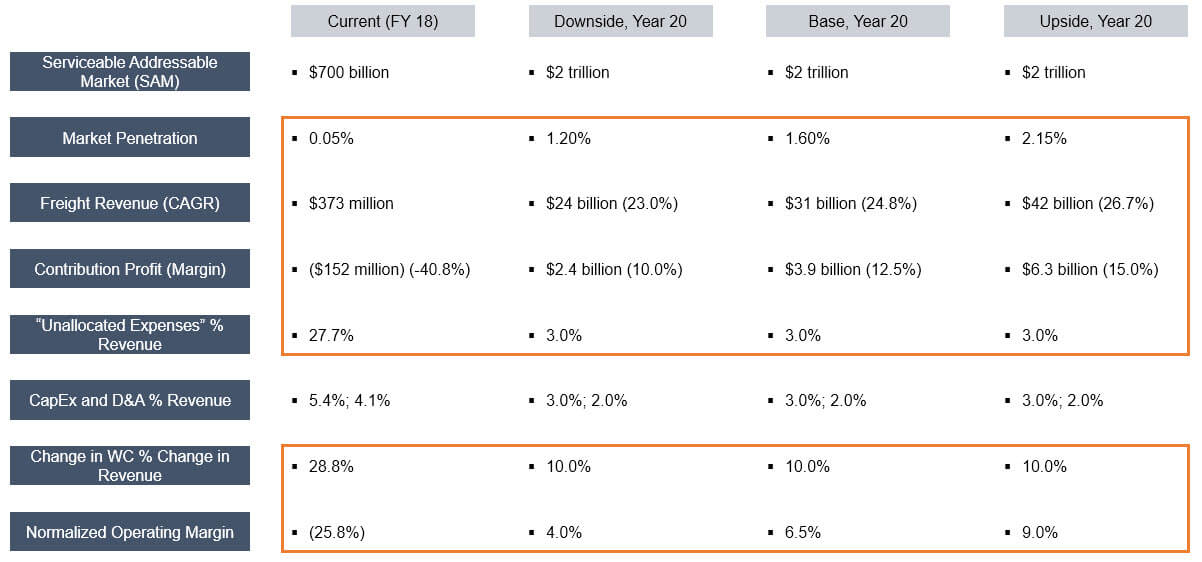

On the Uber Freight side, we assumed a Market Size and Growth Rate for freight shipping in the U.S. + Europe and a Market Share for Uber.

For both segments, the segment-level operating income (“Core Platform Contribution Profit / (Loss)”) is a simple percentage of revenue because there was no way to do anything better with the available data.

Scenarios and Free Cash Flow Projections

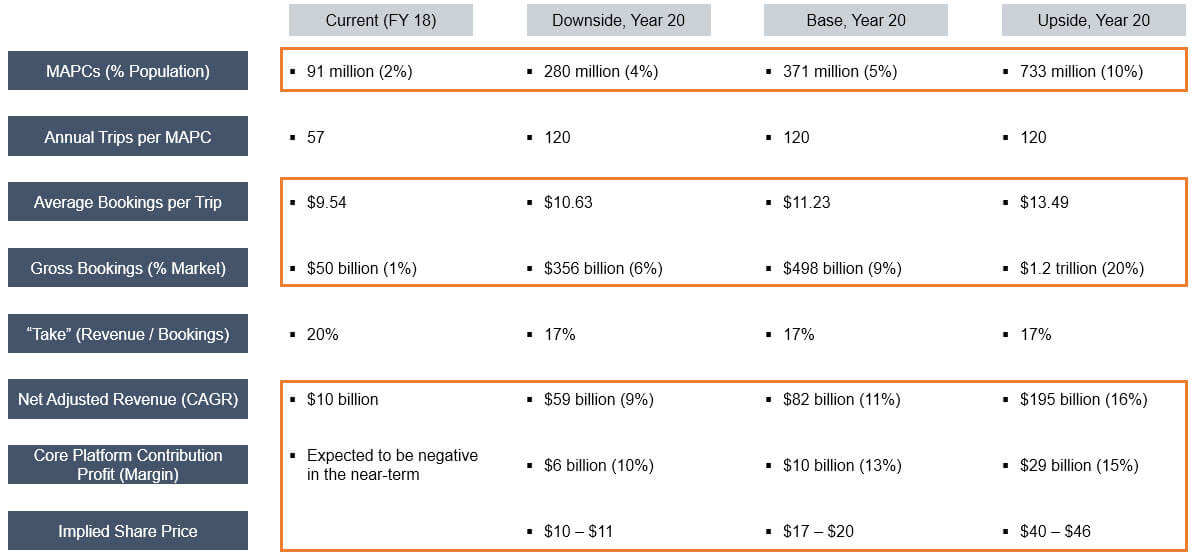

We then created Downside, Base, and Upside scenarios:

For example, eBay had around 180 million active users at this time, which was 7-8% of the total population in its countries of operations.

So, we assumed that Uber grows its userbase from ~2% of the population in its countries of operation (currently) up to 4%, 5%, or 10% over 20 years, depending on the scenario.

Mature transportation companies often have EBITDA margins in the 10-15% range, so we assumed that Uber reaches that level… in a decade or two:

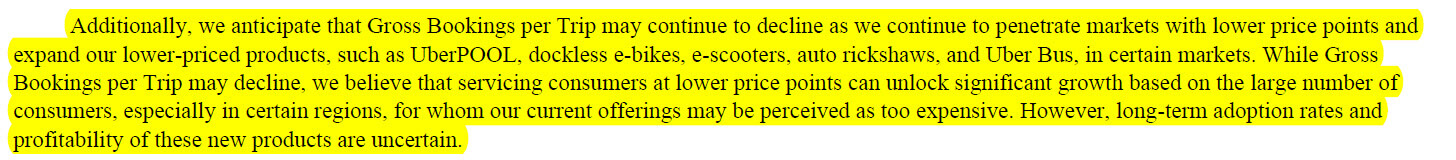

The statements in the S-1 filing also inform the near-term trends in these metrics. For example, take a look at this one about Bookings per Trip:

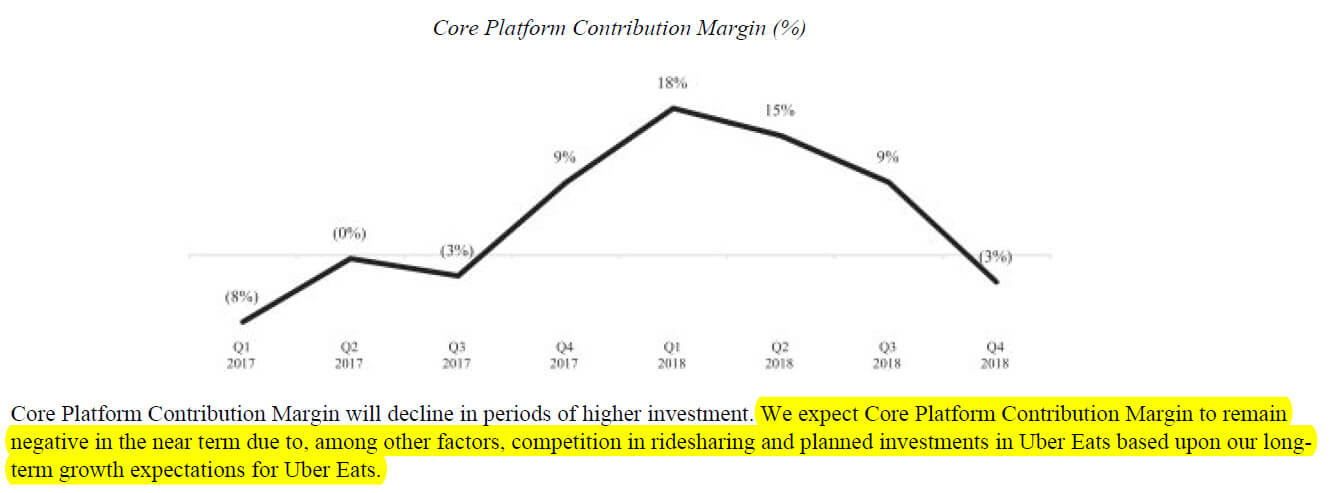

The same applies to the “Core Platform Contribution Margin”:

If the management team admits it will probably be negative, then it will probably be negative.

Other Assumptions for the Uber Valuation: Uber Freight and Entire Company

We also created scenarios for the Uber Freight division and the company as a whole:

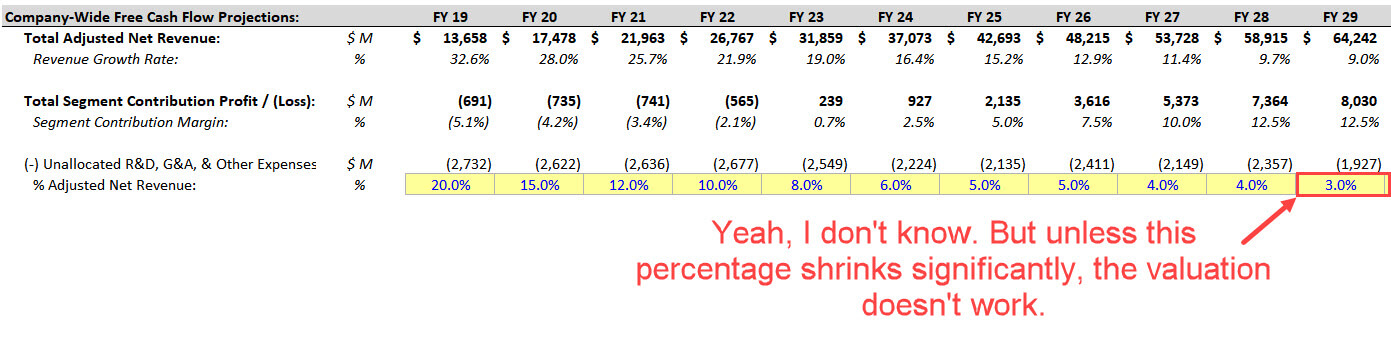

The most important assumption here is for the company’s “Unallocated Expenses.”

Some of these expenses relate to Uber’s self-driving car research & development, and others relate to insurance and general & administrative expenses.

This line item fell from ~50% of “Adjusted Net Revenue” to only ~28% in the past two years.

The company also points out, repeatedly, that it is profitable… if you ignore these “corporate overhead” expenses.

Given those historical trends – and since we’re not factoring in self-driving cars directly (see the bottom of the article for more on this) – we think it’s reasonable to assume that this item will continue to decline as a percentage of revenue.

Will it reach only 3% by Year 11 of the projections, as we assumed?

On that note, the company-wide operating margins here go from (26%) in FY 18 to 4.0%, 6.5%, or 9.5%, depending on the scenario, over 10 years.

Yes, eBay and Cars.com have margins of 30%+, but Uber’s cost base will always be higher than those companies’, and many mature transportation companies are in the 10-15% range (see the screenshot above).

It’s possible that Uber will never achieve a positive operating margin, but the numbers don’t work if you make that assumption.

The Unlevered Free Cash Flow and Terminal Value would be negative, and the company’s Implied Enterprise Value and Equity Value would be negative as well.

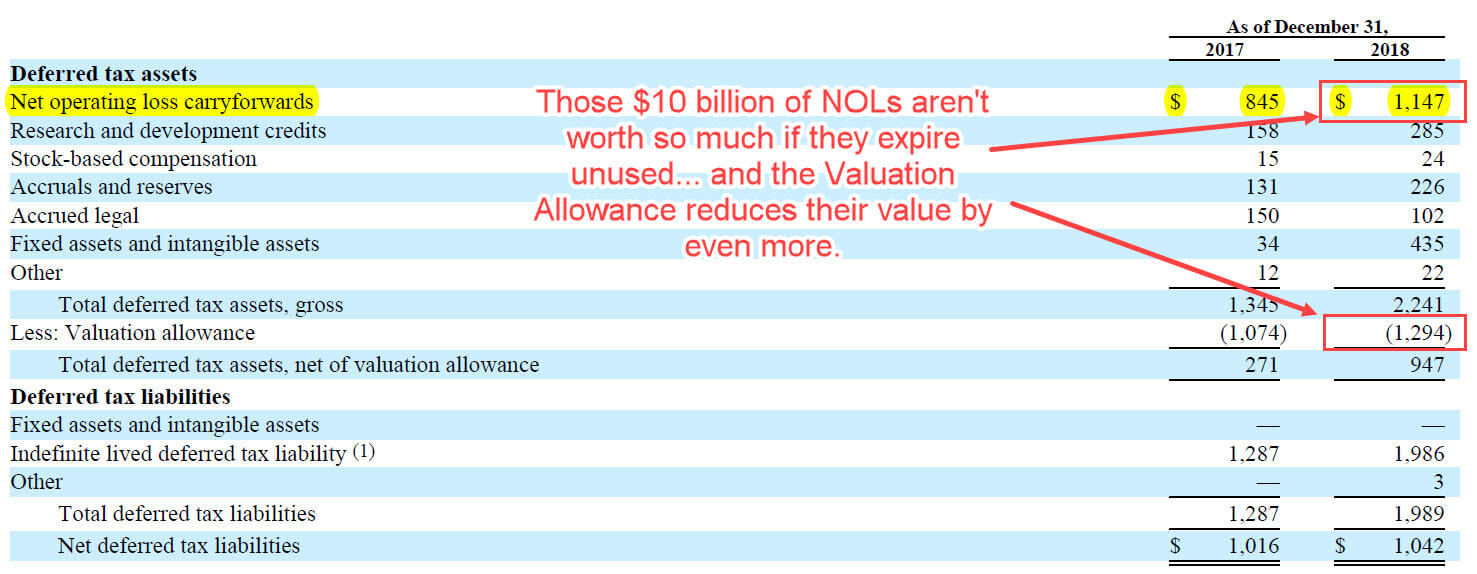

Net Operating Losses (NOLs)

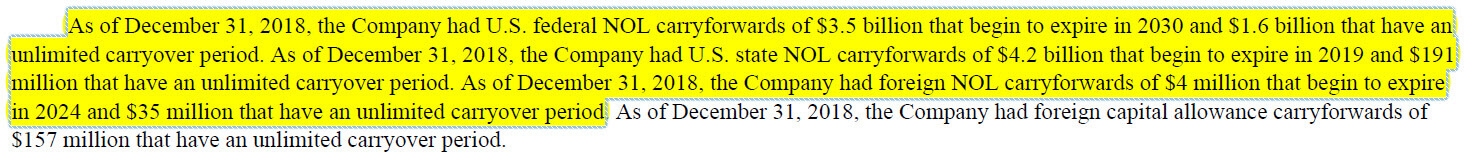

If you made it to page 373 of the company’s S-1 filing without falling asleep or killing yourself, you would have seen that it has a huge Net Operating Loss balance:

The NOL schedule follows the usual pattern: create NOLs if Operating Income is negative, and use NOLs to reduce the Operating Income subject to taxes if it’s positive.

If any NOLs remain at the end of Year 20, we add their Present Value to calculate the Implied Enterprise Value.

For more on this topic, please see our tutorial on Net Operating Losses (NOLs) in a DCF or our tutorial on Section 382 limitations in M&A deals.

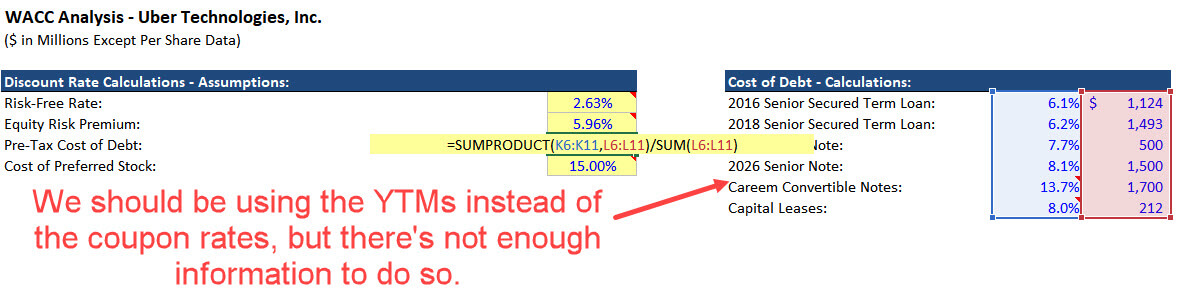

Uber Valuation: Discount Rate Calculation

We used a mix of high-growth marketplaces, mature marketplaces, and trucking/logistics companies to calculate the Discount Rate:

And all the other ridesharing companies were still private, so it wasn’t possible to use them.

The Cost of Debt is murky because we don’t know the fair market value of the company’s Senior Notes or Convertible Notes, but we made reasonable guesstimates:

It was always in the 8.50% to 9.50% range, so we made it start at 9.36% and decline to 8.75% over the projected period.

Those rates may seem low, but remember: despite losing massive amounts of money, Uber is not a “startup” anymore.

It has over $10 billion in revenue, so a Discount Rate of 20%, 30%, or 50% is not appropriate.

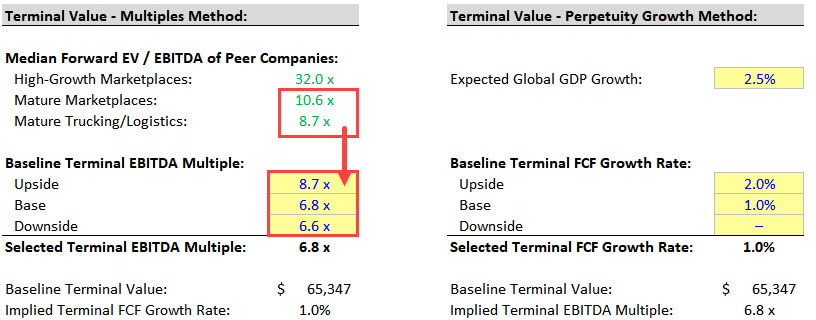

Uber Valuation: Terminal Value and Conclusions

The Terminal FCF Growth Rate ranged from 0% to 2%, depending on the scenario, while the Terminal Multiple went from 6.6x to 8.7x, in-line with the multiples of the more mature companies:

In the Base and Downside cases, we get per-share values of $10 to $20, and in the Upside case, it’s more like $40 to $50.

Why I’m Not Shorting Uber – Despite Everything Above

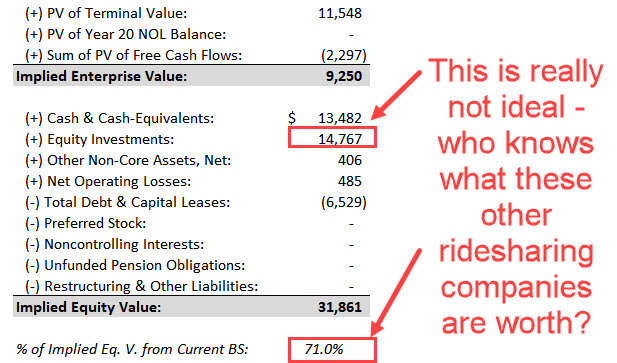

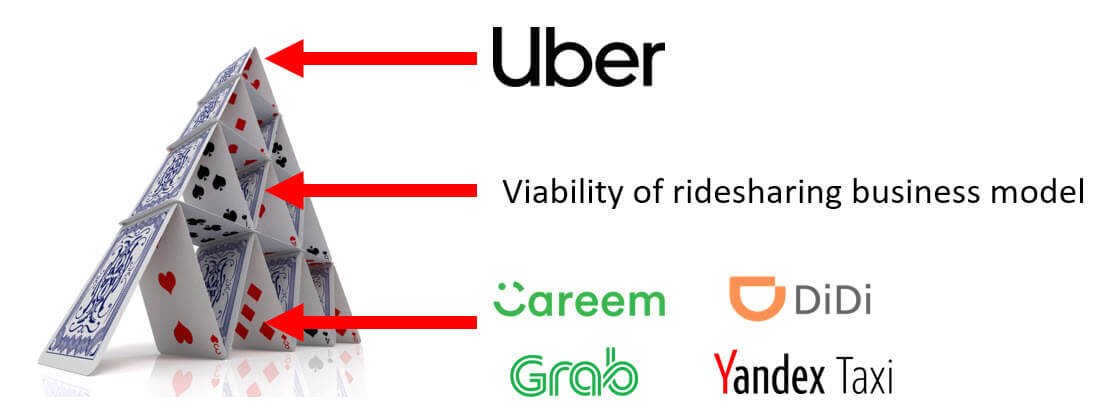

Any valuation of Uber suffers from a “house of cards” problem: a huge part of its potential value comes from its Equity Investments (minority stakes) in other ridesharing companies like Didi, Grab, Yandex Taxi, and Careem:

So, an investment in Uber is an investment in the entire ridesharing sector: if these companies somehow turn themselves around and become profitable, you’ll do well.

And if it goes poorly, the house of cards comes crashing down on your head and kills you:

Also, there may not be any near-term catalysts that push down the company’s stock price.

Overhyped companies like this can stay mispriced for long periods until something dramatic happens, and I’m not sure when that will happen or what it will be.

Wait, What About Self-Driving Cars? They’ll Change Everything!

The Uber bulls will read everything above and say, “But self-driving cars will change everything! Robots will replace humans! AI will change the world! The company will reach 90% operating margins once it no longer needs to pay drivers!”

First of all, self-driving cars are nowhere near ready for worldwide, mainstream adoption (source: the CEO of one of the leading companies in the field).

They’re decades away, not months or years away.

But even if we assume that engineers eventually solve all the technical challenges, the financial picture does not necessarily change.

Fundamentally, Uber is still a money-losing company that is unlikely to generate positive cash flow anytime soon.

If it switches business models and builds or purchases self-driving cars instead of using human drivers, its Operating Expenses shift to Capital Expenditures.

Yes, that still gives the company a long-term cost advantage, but how much will it be worth in today’s dollars if that transition happens in 20-30 years?

Technology does not change the time value of money.

Uber Valuation: Final Thoughts

People on both sides of the Uber debate have used various arguments to make their cases – some very qualitative, and others based on data.

I focused on the numbers above, but gut feeling also matters because valuation is an art, not a science.

From that perspective, the argument against Uber is simple:

If taxi companies had had solid mobile apps from the start, would Uber have taken off?

If taxi apps continue to improve, as they already have, will Uber continue to be useful?

And has Uber done something completely new, or did it take advantage of a broken market and poor service from legacy providers?

You can guess my answers to all three of these.

Put simply, Uber is a far less transformative company than Google, Facebook, or even eBay.

I don’t necessarily think it will die, or even stagnate, but I also think it’s worth far less than its current share price.

We’ll see what happens as the reality check of the public markets continues…

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

it’s an interesting article with solid data to support your comments. I bought the Uber stock in the very first day of its IPO and gained about 6% in the day trade. however, I do believe that now it’s a good time to short Uber. the Uber price is at 33 dollar right now. as it may go up a little bit in September, and shorting at 27 should be profitable within 2 month as winter is coming and the lockout period expiration day approaches.

Perhaps… I actually regret not shorting the company now. But I might still do that before the lockup period expires. I honestly don’t think it’s worth more than $20 per share, and that’s if you’re being quite optimistic.

Interesting write up.

If you did a similar analysis on Amazon’s IPO figures, could you come up with anything close to a 1tt valuation today?

I’m not sure I agree that Google/Facebook were more transformative than Uber – LOTS of search engines debuted around the same time as Google, and social networking had been done as well.

I think because Tesla owns the whole system from manufacturing to energy generation & distribution, Tesla gets to full self driving inside of 3 years, captures the high end of the market, and the rest of big auto throws in the towel and partners with Google for the low end.

(Anthony Levandowski issued a mea culpa and said Lidar is unnecessary)

Amazon takes over the stuff delivering space, and Uber is doomed.

I don’t think you could get to a $1 trillion valuation *today* based on an analysis done in the late 90s, but valuation can only tell you what a company is currently worth, not what it might be worth in 20 years after all the assumptions change. I think you could probably get to a 20-year Terminal Value in the hundreds of billions based on the numbers from the late 90s, though, especially since Amazon was always closer to being profitable.

“More transformative” wasn’t the best way to describe Google/Facebook. My real point is that they both had more of a moat than Uber. Google solves a ridiculously complex and challenging technical problem that requires hordes of the top CS/engineering people in the world and which can’t be easily replicated (ask Microsoft how that one went), and Facebook has a moat due to the network effects of a social network.

Yes, search engines existed before Google, but they were all terrible. I remember using them on an AOL connection in the 90s, and they were barely functional next to Google. Social networks existed before Facebook, but they were the first one to get it right and then to get a critical mass of active users.

What does Uber have? Drivers and riders can easily switch between different apps and services, and it doesn’t solve a problem that’s even close to as challenging as the one Google solves.

I would bet a significant amount that no one, including Tesla, will achieve full self-driving cars anytime soon. I think there’s a 50% chance that Tesla goes bankrupt or gets acquired by someone else after its stock price plummets some more.

I agree that Amazon is one of the biggest threats to Uber.

Thanks for responding!

Interesting that you don’t think the problems Uber is trying to solve are complex.

You mentioned Microsoft.

Nathan Myhrvold – MSFTs former CTO – said Uber is working to solve one of the most technically demanding challenges of this generation, akin to operating systems back when Gates and co were starting out (his son works there).

Would you be interested in a Long Bet re: Tesla and self driving?

Some of the problems may be complex, but overall, Uber solves a less complex problem than Microsoft or Google (I was a CS major and still do a bit of programming sometimes).

Google’s ranking algorithm is extremely demanding data-wise and requires constantly changing assumptions and processes to tweak it and get the best results; Microsoft has to deal with tons of different system configurations, 3rd party software, etc., and it is very complicated to make Windows and Office work as well as they do while not taking up a ton of system resources.

By contrast, Uber… matches drivers with riders. With the built-in GPS on phones, it’s just not that hard – you just find the nearest driver in a radius of XX km.

This is why Uber has so many competitors everywhere, while Google and Microsoft have no serious competitors in their core markets – the technical challenges are just too high.

Maybe you could argue that self-driving cars are on par with what Microsoft and Google do in terms of difficulty level, but so far, they’re a pipe dream that do not work well enough to be in widespread use.

I wouldn’t bet on Tesla either way because I haven’t dug into the company’s filings and other documents myself yet. I normally spend at least 40-50 hours doing that before investing in individual companies. And sometimes after spending that much time on the process, I don’t even long or short the company because there are no catalysts, or it’s still too speculative (as was the case with Uber here).

I might consider it in the future if I decide to do a Tesla valuation. But I’m a bit hesitant because valuing Tesla is almost like getting into a debate about religion or politics.

Well done Brian. An easy and simple explanation to use. I do have a question; would it be better to simply use a metric like IRR to show what type of return an investor would expect to return for their investments instead of trying to get a range for the intrinsic value based on the FCF discounted back. For me, looking at the yield that an investment produces is a good way to compare it to other opportunities in the market.

I would not use IRR for a company like Uber because you would run into the same issues: negative cash flow, so everything depends on capital appreciation and a much higher Terminal Value in the future. IRR tends to be better for assets that have positive cash flow, such as stabilized real estate, bonds, dividend-paying stocks, etc.

My issue with using a higher terminal value and capital appreciation is that you have to make alot of assumptions about the future health of the company. Some of these assumptions are nearly impossible to figure out or predict with a certain level of accuracy. There doesn’t seem to be a large margin of safety if you were to invest in uber. The entire thing seems to border on the realm of speculation rather than a sound investment in my opinion. Either way great job on the presentation, you took a lot of information and summarize it pretty well in 30 minutes or less. It would be a nice new series financial valuations in 30 minutes or less.

Yes, but you still have to make those future assumptions even if you use metrics such as IRR. All investment analysis is forward-looking.

Yes, the whole point of companies like Uber is that they’re highly speculative and, therefore, have a high chance of losing money. This is why public market investors are skeptical of cash-burning “unicorns,” even if VCs keep pouring in money.

Anyone who’s actually bullish on the company either knows something no one else does or has a very, very optimistic view of its potential.

I would simply try and project out the cash flow into the next 5 years and get an IRR from that. If it’s negative or too low considering all of the business risks, you can always pass on the stock.

In terms of the VC world, I’m not too familiar with their way of thinking. I guess most of them were hoping to get in early and sell out when Uber IPO.

Great article Brian! I check your recent posts every day and it’s great to see a lot of posts lately. Long-time reader from UK

Thanks for reading!

Beautiful work Bryan!

Thanks!

What a wonderful presentation.Good work Brian.

Thanks for reading!