Venture Capital Careers: The Complete Guide

- What Do Venture Capitalists Do?

- Why Venture Capital?

- Venture Capital Job Skills and Requirements

- The Venture Capital Career Path

- Venture Capital Analyst Job Description

- Venture Capital Associate or Pre-MBA Associate Job Description

- Venture Capital Senior Associate or Post-MBA Associate Job Description

- Venture Capital Principal or VP Job Description

- Venture Capital Partner or Junior Partner Job Description

- Venture Capital General Partner or Managing Director Job Description

- Venture Capital Pros and Cons

If you go by the news, movies, and TV shows, venture capital careers seem glamorous.

You meet with amazing entrepreneurs all day… dig into their businesses… and then decide who will receive a 7, 8, or 9-figure check from your firm.

Then, company executives do the work, you “monitor performance,” and you cash in when the company gets acquired or goes public.

What could go wrong?

As you’ll see, the venture capital career path in real life is more complex and challenging than its portrayal in the media.

We’ll dig into the reality of the job here, including the work itself, an average day on the job, the hierarchy and promotions, salaries and bonuses, and more:

What Do Venture Capitalists Do?

Venture capital firms raise capital from Limited Partners, such as pension funds, endowments, and family offices, and then invest in early-stage, high-growth-potential companies in exchange for equity (i.e., ownership in the companies).

Then, they aim to grow these companies and eventually exit via acquisitions or initial public offerings (IPOs).

Most of these high-growth-potential companies are in technology and healthcare, but some VCs also invest in cleantech, retail, education, and other industries.

Since the risks are so high, VCs expect most of their investments to fail.

But if they find the next Google, Facebook, or Uber, they could earn exceptional returns even if all their other portfolio companies fail.

Venture capitalists spend their time on this process of raising funds, finding startups to invest in, negotiating deal terms, and helping the startups grow.

You could divide the job into these six areas:

- Sourcing – Finding new startups to invest in and making the initial outreach.

- Deal Execution – Conducting due diligence on potential startup investments, analyzing their markets and financial projections, and negotiating deal terms.

- Portfolio Company Support – Helping portfolio companies with everything from recruiting to sales & marketing to engineering to fundraising and administrative and financial issues.

- Networking and Brand-Building – Attending events and conferences, publishing content online, and speaking with others in the industry, such as lawyers and bankers who work with startups.

- Fundraising and LP Relations – Helping the firm raise new funds, reporting to existing Limited Partners (LPs), and finding new investors for future funds.

- Internal Operations and Other Tasks – These include administrative tasks, such as hiring for jobs in investor relations, accounting/legal, and IT, and improving internal reporting and deal tracking.

Most venture capitalists spend the bulk of their time on the first three tasks in this list: sourcing, deal execution, and portfolio company support.

Junior VCs, such as Analysts and Associates, spend more of their time on sourcing and deal execution, while senior VCs, such as the Partners, spend more of their time on portfolio company support.

Why Venture Capital?

Venture capital is a “get rich slowly” job where the potential upside lies decades into the future.

If your main goal is becoming wealthy ASAP or advancing up the ladder as quickly as possible, you should look elsewhere.

Salaries and bonuses are a significant discount to investment banking, private equity, and hedge fund compensation, and junior-level roles rarely lead to Partner-track positions.

The technical work is much simpler than in most IB and PE roles, and you spend more time on qualitative tasks such as meetings, research, and brand-building.

There is only one great reason to aim for junior-level VC roles: because you are extremely passionate about startups and you want to use the role to learn, build a network, and leverage it to win other startup-related roles in the future.

Senior-level VC roles are a different story – there, the job is the endgame, and it’s something that you might target after significant experience at startups or in executive roles at large companies.

Venture Capital Job Skills and Requirements

The required skill set and experience depend on the level at which you enter the industry.

The main entry points are:

- Pre-MBA: You graduated from university and then worked in investment banking, management consulting, or business development, sales, or product management at a startup for a few years. In some cases, you might get in straight out of university as well.

- Post-MBA: You did something to gain a background in tech, healthcare, or finance for a few years before business school (e.g., engineering or sales at an enterprise software company), and then you went to a top business school.

- Senior Level / Partner: You successfully founded and exited a startup, or you were a high-level executive (VP or C-level) at a large company that operates in an industry of interest to VCs.

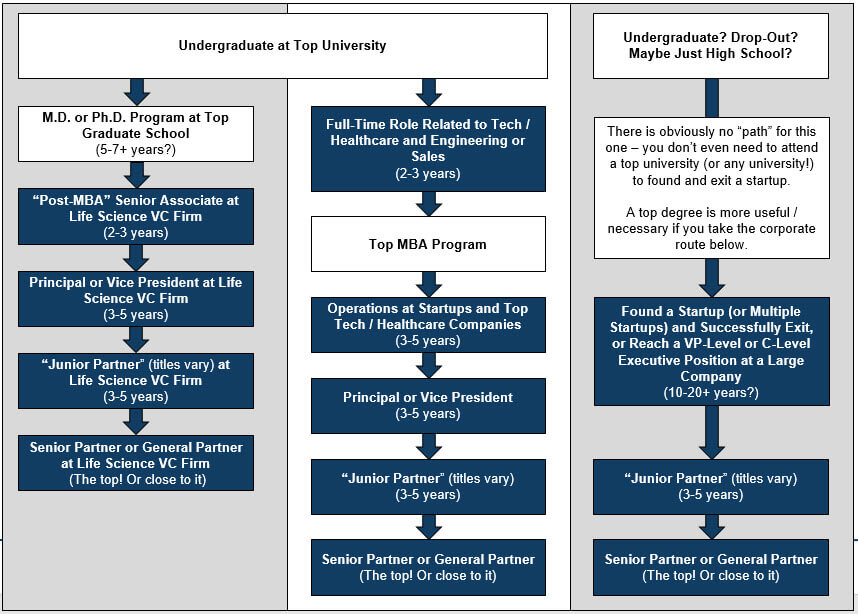

In life science venture capital, especially at early-stage funds, you can also complete a Ph.D. in a field like biology or chemistry and break into the industry because deep scientific knowledge is essential there.

VC firms want people who are passionate about startups, highly articulate, and capable of understanding the market/customer side in addition to the technical product details.

Late-stage and growth equity firms care more about deal execution and financial analysis skills, such as the ones you might gain in IB and PE roles, while early-stage firms care more about your ability to network, win meetings, and find promising startups.

At the senior level, your value is tied 100% to your Rolodex: can you tap your network to find unique, promising deals and then support portfolio companies and turn them into success stories?

For more about recruiting and interviews, see our article on how to get into venture capital.

The Venture Capital Career Path

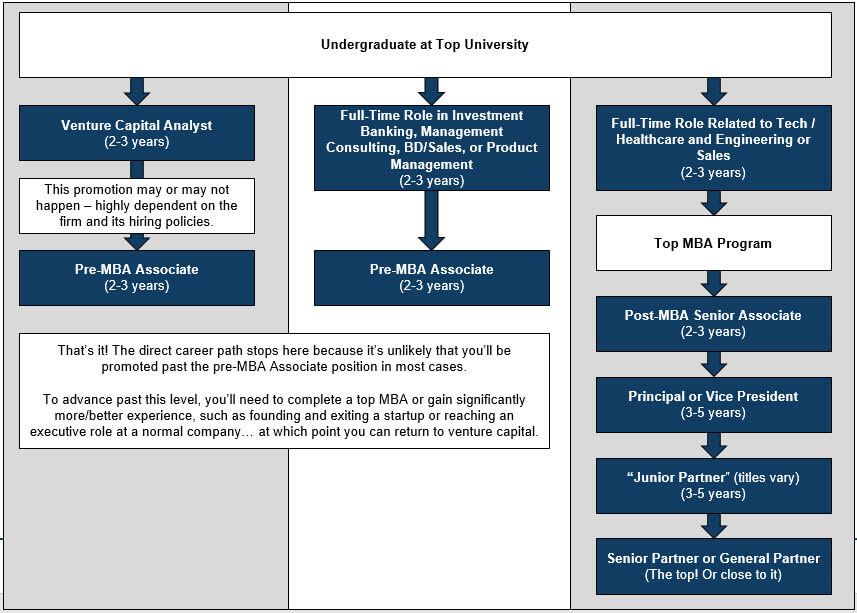

Yes, we’ll give you that “career path” diagram that we like to use in these articles…

…but please note that the structure of venture capital firms varies a lot, so the titles and levels are less standardized than in the investment banking career path or the private equity career path.

For example, some firms are very flat, with only Partners and administrative staff, while others have a detailed hierarchy.

Some firms combine the Analyst and Associate roles, and some split Principal and VP into separate roles, while others combine them.

And then some firms have just one level corresponding to the “Partner” title, while others have 2-3 levels (or more!).

The normal hierarchy looks like this:

- Analyst – Number Cruncher and Research Monkey.

- Pre-MBA Associate – Sourcing, Deal, and Portfolio Monkey.

- Post-MBA or Senior Associate – Apprentice to Principals and Partners.

- Principal or VP – Partner in Training.

- Partner or Junior Partner – General Partner in Training.

- Senior Partner or General Partner – Decision Maker and Firm Representative.

Here’s the path for junior-level roles, including the standard MBA track:

And then there’s the “life science” path as well as options for startup and industry executives:

We’ll focus on how these roles differ in terms of daily responsibilities, compensation, and promotion time.

As with private equity, compensation in venture capital consists of base salaries, year-end bonuses, and carry (or “carried interest”).

Base salaries and bonuses come from the management fees the firm charges, such as 2% on its $500 million in assets under management, while carry is a portion of its investment profits for the year.

For example, let’s say a VC firm invested $5 million in a startup 5 years ago for 25% of the company.

This startup sells for $100 million this year, so, assuming no additional funding rounds or other dilution, the investment profits are $100 million * 25% – $5 million = $20 million.

If the VC firm earns 20% of these profits, its “carry” would be 20% * $20 million = $4 million, and most of this would go to the General Partners.

The remaining $16 million would be distributed to the Limited Partners.

Carry in venture capital careers is very “lumpy” compared with carry in private equity roles, especially since most VC firms perform poorly – so, don’t get your hopes up.

Venture Capital Analyst Job Description

Analysts are hired directly out of undergrad.

This role is rare, especially in life science VC, and usually not a great idea next to standard options such as consulting, investment banking analyst roles, and corporate finance jobs.

In this role, you will do a lot of number crunching, industry research, and support work, such as helping Associates with due diligence and internal processes.

You may learn some financial and market analysis, but you do not drive deals in the same way Associates and Principals do, and even if you contribute to the sourcing process, you’ll rarely be the first point of contact for companies.

The Analyst position is more of a “training” role, and most Analysts leave within a few years to join a portfolio company, complete an MBA, or move to a different firm as an Associate.

Some Analysts do get promoted internally to the Associate level, but it’s less common than the equivalent investment banking promotion.

Age Range: 22 – 25

Salary + Bonus and Carry: The normal range for total compensation might be $60K – $100K.

Don’t even think about carry; it’s not happening at this level.

Promotion Time: 2-3 years, if your firm does promotions at this level.

Venture Capital Associate or Pre-MBA Associate Job Description

Next up is the pre-MBA Associate role, which you win after working in a related industry, such as investment banking, management consulting, product management, sales, or business development, for a few years.

At early-stage VC firms, Associates do more sourcing and less deal execution, and at later-stage firms, it’s the reverse.

Associates act as the front-line filter to find the best startups, pre-qualify them, and recommend them to the Principals and Partners.

Pre-MBA Associates normally stay for a few years and then leave for an MBA, a portfolio company, or another business or finance role at a technology or healthcare company.

An average day for a tech VC Associate might look like this:

- Morning: Read up on news and market developments, contact a few companies that look interesting, and review a draft agreement for a Series A round your firm is negotiating.

- Lunch: Meet with a lawyer friend who wants to win more of your firm’s business, and discuss startups his law firm has worked with recently.

- Early Afternoon: Conduct meetings with a few startups that are potential investments, and dig into their market and financial projections.

- Late Afternoon: Respond to a portfolio company that’s in “crisis mode” by introducing them to a marketing agency that can improve their sales funnel and conversion rates and make some of their campaigns profitable.

- Evening: Run to an event for AI and machine-learning startups, where you network, introduce your firm, and find promising companies.

You might only be in the office for 50-60 hours per week, but you still do a lot of work outside the office, so venture capital is far from a 9-5 job.

This work outside the office may be more fun than the nonsense you put up with in IB, but it means you’re “always on” – so you better love startups.

Age Range: 24 – 28

Salary + Bonus and Carry: Total compensation at this level is likely in the $150K to $200K range.

Carry is extremely unlikely unless you’re joining a brand-new VC firm, in which case your base salary + bonus will also be lower.

Promotion Time: N/A because you normally don’t get promoted past this level – you need an MBA or significantly more work experience to keep moving up in VC.

If your firm actually promotes pre-MBA Associates, it might take 3-4 years to reach the Senior Associate level.

Venture Capital Senior Associate or Post-MBA Associate Job Description

At most VC firms, the post-MBA Associate or “Senior Associate” role is a Partner-track position.

As the name implies, you win the role after completing a top MBA (ideally at Harvard or Stanford), or, in some rare cases, from a direct promotion.

In life science VC, Senior Associates sometimes have advanced degrees (M.D., Ph.D., etc.) and come in with deep scientific knowledge but not as much business/finance experience.

The day-to-day job does not differ that much from what pre-MBA Associates do, but post-MBA Associates act as “firm representatives” in more situations and have more influence with the Principals and Partners.

While neither pre-MBA nor post-MBA Associates sit on company Boards, post-MBA Associates are more likely to be “Board observers.”

Post-MBA Associates act as apprentices to the Principals and Partners, support them, and demonstrate that they can find unique opportunities that the firm might profit from.

Post-MBA Associates who don’t get promoted have to leave and find an industry job, such as product management or finance at a portfolio company.

Age Range: 28 – 30

Salary + Bonus and Carry: Total compensation here is likely in the $200K to $250K range.

You might get some carry at this level, but it will be small next to what the Principals and Partners earn, and it will be useful only if you stay at the firm for the long term.

Promotion Time: 2-3 years

Venture Capital Principal or VP Job Description

Principals or VPs are “Partners in Training.”

They are usually the most senior investment team members that are directly involved with deal execution and contract negotiation, and they need to know both the technology/science behind the company and the business case very well.

Principals “run deals,” but they still cannot make final investment decisions.

Unlike Associates, they sit on Boards and spend more time working with existing portfolio companies.

In most cases, post-MBA Associates are promoted directly into this role, but in some cases, industry professionals with significant experience in product management, sales, or business development can get in.

With an MBA, 3-5 years of industry experience might be enough; without an MBA, it might be more like 7-10 years.

To advance, Principals must show that they can add enough value for the Partners to justify giving up some of their profits.

“Add enough value” means bringing in unique deals that wouldn’t have crossed the Partners’ radar otherwise, or saving troubled portfolio companies and turning them into successes.

Age Range: 30 – 35

Salary + Bonus and Carry: Likely total compensation is in the $250K to $400K range.

You will earn carry at this level, but it will be far less than what the Partners earn.

Promotion Time: 3-5 years

Read more about Venture Capital Principals here.

Venture Capital Partner or Junior Partner Job Description

Many VC firms distinguish between junior-level Partners and senior-level ones.

The names get confusing, so we’re going to use “Junior Partner” for the junior version and “General Partner” for the senior version.

Junior Partners are often promoted internally from Principals, but sometimes industry executives and successful entrepreneurs are brought in at this level as well.

Junior Partners are in between Principals and General Partners (GPs) in terms of responsibilities and compensation.

They’re less involved with deal execution than Principals, but not quite as hands-off as the GPs.

And they’re more involved with Boards, portfolio companies, and LPs, but not quite as much as the GPs.

Junior Partners can sometimes kill deals, but, unlike GPs, they do not have final say over which investments get approved.

Age Range: 33 – 40

Salary + Bonus and Carry: Total compensation is likely in the $400K to $600K range.

You will earn carry, but most of it will still go to the GPs.

Promotion Time: 3-5 years

Venture Capital General Partner or Managing Director Job Description

General Partners have had successful track records as entrepreneurs or executives, or they’ve been in a venture capital career for a long time and have been promoted to this level.

They don’t need to find the next Google or Facebook to get here; a record of “solid base hits,” rather than grand slams or home runs, could suffice.

GPs rarely get involved in sourcing or deal execution, but instead focus on the following tasks:

- Fundraising – They raise funds, wine and dine the LPs, and convince them to invest more.

- Public Relations – They act as firm representatives by speaking at conferences and with news sources.

- Final Investment Decisions – GPs have the final say on all investments. They do not get into the weeds of due diligence, but they perform the final “gut check.”

- Board Seats – GPs also serve on Boards, but sometimes they’re less active than the Junior Partners or Principals.

- Human Resources – GPs also have the final say on hiring and firing decisions and internal promotions.

General Partners also contribute significant amounts of their own capital to the fund so that they have “skin in the game.”

That means that much of the upside in this role comes from carry, which isn’t necessarily a great bet.

Age Range: 36+ (Unlike bankers, VCs rarely retire because it’s a less stressful job)

Salary + Bonus and Carry: Total compensation is likely in the $500K to $2 million range, depending on firm size, performance, and other factors.

Carry could potentially multiply that compensation, or it could result in a total of $0 depending on the year and the firm’s performance.

Since GPs must contribute a significant amount of their net worth to the fund, the compensation is less impressive and riskier than it might appear.

Promotion Time: N/A – you’ve reached the top.

Venture Capital Pros and Cons

Summing up everything above, here’s how you can think about the pros and cons of a venture capital job:

Benefits / Advantages:

- You do interesting work and get to meet smart, motivated entrepreneurs and investors instead of revising pitch books or fixing font sizes.

- VC jobs offer much better work/life balance than IB, PE, or HF jobs, and there are fewer last-minute fire drills for deals.

- You earn high salaries and bonuses at all levels, relative to most “normal jobs.”

- Unlike traditional finance fields, you do something useful for the world in venture capital because you fund companies that could transform industries or literally save peoples’ lives.

- The industry is unlikely to be disrupted because it’s based on human relationships, and it takes years or decades to assess investment performance.

Drawbacks / Disadvantages:

- It is very difficult to advance to the Partner level, or to even get on the path to doing that; venture capital is often better as the last job in your career rather than the first.

- You spend a lot of time saying “no” to startups and working with struggling portfolio companies, and it might take 7-10+ years to assess your performance.

- Work/life balance is better than in IB, but work/life separation is worse – you’re always in “networking mode,” and friends and acquaintances will start approaching you with pitches and company introductions once they hear you’re in VC.

- While exit opportunities do exist, they’re more limited than the ones offered by investment banking or private equity because VC mostly leads to more VC or operational roles in certain industries.

- Finally, you earn significantly less than you would in IB, PE, and HF roles – unless you reach the GP level and you’re at a top firm that consistently outperforms.

So, are venture capital careers right for you?

I asked myself this question a long time ago when I was in investment banking and considering different career options.

On paper, I had the perfect background for VC: computer science at a top university, investment banking, and some experience running a small business.

But I landed on “no” for some of the reasons described above. Most importantly, it seemed like a better career option for 15-20 years into the future rather than a direct IB exit opportunity.

Also, VC didn’t play to my skill set – content production and online marketing – except in indirect ways.

But if you’re a better match than I was, or you’re a lot more senior, the wheel could easily land on “yes” for you.

Further Reading

You might be interested in The Venture Capital Associate: Tech + Finance = Overpowered Professional? or The Venture Capital Case Study: What to Expect and How to Survive.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

Excellent information about career in VC. I have completed Master in engineering from Stanford and presently doing PhD in Regenerative Medicine at Stanford. I am keen to build my career in VC. Is it necessary to complete MBA before joining VC?

As mentioned in the article, biotech VCs are a bit different and will sometimes hire people with mostly technical backgrounds who can evaluate new technologies properly (as someone without a medical or advanced science degree isn’t well-equipped to do this). So an MBA is less necessary if you are targeting biotech VCs.

Hello Brian,

Interesting material!

Thank you for writing the article.

I am a research scientist with 45 years of experience in mass spectrometry and spent the last 20 years working for Agilent Technologies. I would like to work with a VC to review proposals and provide input on various technologies that I am familiar with!

Any advice?

I can’t really tell you anything more than what was in this article and the other VC-related and networking coverage on this site. It’s just a matter of finding people on LinkedIn or asking around your professional networking, reaching out to VCs who invest in this area, following up, etc.

First of all excellent information and introduction to the VC world.Thank you.

I am 17 rn and am sure I wanna join a vc. what certification courses shall I choose along with my undergrad(commerce) in order to build the most suitable profile for a vc

Certifications do not help. Read the VC recruiting article. Learn about tech and work at a startup and advance to more senior roles.

Hey Brian, thanks for the article, this was very insightful. I’m a little confused right now about pre-MBA roles. Why would people go for those roles if they don’t lead to partnership?

You mention they’ll go to Bschool or startups after, but assuming their background was impressive enough for the pre-MBA associate position, why won’t they just go straight for Bschool or startup?

People often aim for pre-MBA roles because they might lead to other opportunities, such as manager/executive roles at startups. Some people might also take the experience and go into other tech-related finance roles. Not everyone wants to go to business school or a startup right after a job like IB or product management. The advantage of VC is that you can test the waters a bit and see if you actually like working with startups before joining one or paying for expensive business school tuition.

Thanks for amazing article. I am currently attending MBA that consistently ranks within top 5. I have offers from MBB, PE Consulting firm (working on turnaround), and CEO role of Search Fund’s portfolio companies. Among these offers, do you see any offer being able to enter VC after few years?

Thanks!

You could potentially get into VC from any of those, but the MBB offer is probably best due to the brand name. PE consulting on turnarounds and search funds are less directly applicable because most startups don’t really need a turnaround, they need higher growth and more capital.

Brian, I love this article. Thank you so much for writing it. It is clear and concise an gave me exactly what I needed. You are a great writer and explainer. I have recently joined a VC as an entrepreneur in residence (Medtech)and had no clue what all these roles meant. I didn’t even know what ‘carry’ is. Everyone there talks about terms as if they are common knowledge but they are not. Many thanks again. And…glad you’re keeping Sauron at bay. Thanks for that too.

Thanks! Glad to hear it. Sauron is still firmly under control as well.

Thank you for the read Brian!

The way the article is written, an MBA seems like a MUST HAVE if you want to become a partner. Why do you think and MBA is valuable to the partners in the VC firm? Going through the curriculum of MBA programs, it seems that they cover and awful lot of material in a very short period of time – it is impossible to get any debt given the time pressure.

Maybe the VC firms think you will obtain a valuable network they can use afterwards? But in an MBA class you will have students interested in PE, consulting AND also VC. A much more efficient (and less expensive) way to network seems to be VC conferences/happenings and linkedin – these connections would be specific to VC.

Maybe the VC firms want the image – a stamp from Stanford, Harvard etc that would likely look good to LPs and be easier for the fund to get money? But median returns over a period definitely carry more weight in distinguishing vc funds.

Kind of discouraged to be honest – I would hate to waist 1,2 years of my life learning 0 to nothing, earning nothing and spending a large amount of money on a self-fulfilling prophecy.

Please do let me know how much I underestimate the value of an MBA.

I don’t think an MBA is required if you get into VC at a later stage of your career, e.g., after exiting a startup as the CEO or founder. Also, at some firms, it is possible to work your way up from the Associate level (just less common).

This focus on MBAs is probably more about tradition and artificially limiting the pool of applicants more than anything (and an obsession with top brands). Most VCs horribly outperform the market and other VC firms (returns are very lopsided toward the top few), so they need something to latch onto if they can’t point to high returns.

Thank you so so much Brian!

I am a PhD holder in Organic Chem and currently working for a biotech startup in Korea.

(Graduated from the top university here & studying for CFA Level I at the moment)

Based on “Life Science VC” path, I’d like to give it a shot to life science VCs in US.

Do you think it’s a viable path or do you think I should work for a Korean VC for a couple of years and then try US VC?

Thank you!

I think it will be very difficult to move to the US and find a job when you require visa sponsorship, regardless of previous experience. So… I would recommend working in VC in Korea first and then using that to move elsewhere.

What do you consider a large company for purposes of entering as a junior partner from an industry executive position? I’m currently a director in the corporate office of a $5B company with over 8,000 employees, three reporting relationships from the CEO, and specifically focused on R&D / biz dev. I’m in the process of looking to move to a smaller company, maybe $250-500MM, in a higher role, but in 5-6 years would like to look at going into VC as a junior partner. Would moving to a smaller company compromise that, or is it reasonable to think that’s a feasible plan?

Thanks.

You could do that, but if your goal is VC, you might as well go to an actual startup and do the same role there instead. They would probably value that experience more vs. working at a large company and then a smaller-but-non-startup company.

Excellent and informative piece, thanks a lot for writing this!

I appreciate the distinction between “Life Science VC” and the rest.

I was wondering though, does this perhaps apply to other highly-technical fields?

The reason I am asking: I have a PhD in machine learning from a top university and I have a strong publication record. I have then been working 3+ years as research scientist in a well-funded startup.

I have been seriously considering a significant career change and VC seems well suited for me for a number of reasons.

Do you think I should target the post-PhD Senior Associate level (similar to what indicated in the Life Science panel)?

I think this is less likely because in software, a huge part of any product’s success is the sales & marketing, no matter how technical it is. Yes, sales/marketing matters in biotech as well, but the difference is that if your drug *just works* to cure a certain disease or reduce the symptoms, doctors will prescribe it, and sales will go up. This is why you can forecast revenue from pipeline drugs based on the estimated market size and pricing, but why it’s much more speculative for software products.

It is true that certain fields within software are more technical than others, but I still think it’s a bit of a longshot to get into a VC firm directly from a machine learning PhD. You would probably have a better chance if you joined a startup, gained some finance and operational experience there, and then looked for VC jobs.

This is so awesome! Thank you so much for sharing this really great post. I took 3 pages of notes and spent the past few hours reflecting on my circuitous career thus far.

I’m a little sad that I didn’t find this post 25 years ago at the start of my career. Maybe things will be different now.

I’m wondering, do you work individually with people that are trying to reboot their career? If you do I would love to find out more.

We have coaching services, but primarily for entry-level students and professionals looking to get into the industry. We don’t have anything for mid-level or top-level professionals at this stage.

Great stuff, incredibly helpful. Thank you!

Thanks!

Any precedent for a master’s in CS and several years of technical work experience serving as a proxy for getting a MBA?

Not that I’ve seen, but newer funds like a16z have a somewhat different hierarchy/advancement system and may not care about an MBA as much. The legacy firms probably wouldn’t view that as a substitute.

Agreed– very well written and insightful article. Thinking about transitioning from PhD to VC world myself! Thank you.

Thanks!

Super interesting that you NEED an MBA to move past a certain point. That’s unlike any other role in finance. Why do you think that is?

I don’t think you “need” an MBA at all firms, but it is more helpful in VC. This is probably because there’s more of a division between junior roles and senior roles in VC than there is in other areas of finance.

Thanks for your article! I am a graduate in education and also found my own educational startup. Both VC and IB seem interesting for me as a potential career in the future. How would you recommend me to plan for my career pathways? Would it be better to work in an educational company for a few years then get into education specific department in either VC or IB?

And I just wonder since IB generally make more money than VC, why is VC a better option for later career to tap in than IB?

I would start by reading the IB Careers article here so you understand both options. In VC, there is rarely a path to the top if you start as a pre-MBA Analyst or Associate. It makes much more sense to enter at the post-MBA level or as a senior executive. If you are still young, work at a startup in the sector, start a company, or move up the ranks in a field like IB that has clear promotion paths.

Hello Brian,

This is an insightful article. Thanks!

I have 6+ years post university experience with 4 of those working at Tech startups. I’ve been in my current company(one of the fastest growing startups in Europe) for the last 3+ years and have risen fast, currently reporting to a VP of global business development and in charge of international expansion.

I have gained interesting experience figuring out where next the company should launch in and managing operations post launch. At this point in my career, I am eyeing VC as the next move.

What do you think my chances are right now (pre-MBA) and if I decide to/get into a top MBA program. Would I be assessed for a post MBA Associate position or a Principal?

I look forward to hearing from you.

You have some chance of getting into VC now, but you might be a bit over-qualified. Also, there are many fewer legitimate VC roles in Europe, so it’s not the ideal place for the job. You would have a much higher chance if you completed a top MBA program. I don’t think they would bring you in as a Principal, though, probably just a post-MBA Associate.

Hello Brian,

Really nice article. I am working as a Architect at FAANG and planning to do EMBA from UK. I am targeting LBS, Oxford and Cambridge. My goal is to either start a startup and/or work in VC firm. So with respect to my goal which BSchool mentioned above will benifit more?

They’re all top schools, so there’s no substantial difference.

Great article and thanks for the info! I will be getting my chemistry PhD from Northwestern (I work on preclinical drug development) in a year and I am very interested in breaking into the biotech VC world. I have a few questions:

1. How likely is it for someone like me who has a good biomedicine background but zero experience in financing to get a job like post-MBA Associate Job at a biotech VC?

2. If the chance is low what would be the best job for me after I get my PhD to later exit to the Associate role at VC? Which of the following do you think is the best: A. a research scientist job at a big pharma. B. financing or management type job at pharma. C working at a biotech startup. D. Something else

3. Do you think I would be better off doing some kind of internship before I graduate? If so what kind of internship would you recommend?

Thank you for your time!

1) Possible, but not that likely. You usually need something business-related to have a good shot.

2) Probably B or C.

3) If you can, yes. Maybe an internship in B or C above or informally advising startups.

Hi Bryan, this is by far the clearest and most comprehensive article I’ve read on VC career paths.

After 5 years in the military I completed an IB internship at a BB bank before being lucky to secure an Associate role at a seed VC fund.

I’ve reached the pre-MBA ceiling you described which is the key downside of taking a junior VC role.

To break through it’s clear that a top MBA, or experience further up the capital curve (growth equity / IB / PE) is required.

Do you think it would be possible to break (back) into IB, or maybe even secure an offer from a growth equity / PE group with only this early-stage VC experience? Would really appreciate your thoughts on strategy!

I think it would be quite difficult to win a PE role with only early-stage VC experience. Growth equity might be more doable. IB is a “maybe” because it depends on how long you’ve been at the firm. Beyond 2-3 years, it gets quite difficult to win entry-level roles in IB because you’ll be seen as overqualified. So, an MBA might be the best bet if you don’t mind the massive cost in time and money and you want to stay at the same firm and move up without switching jobs.

Hi Brian,

My aim is to eventually join a start-up and, as you said, going into VC will be a good idea for this. Would it matter whether I joined a growth equity firm vs a seed VC for this goal? Would I learn different skills/experiences?

Yes, you will learn different things. Growth equity is more about deal analysis and ramping an already successful company, while seed VC is more about sourcing and relationship building. I don’t think either one is 1:1 applicable to starting something new because the skill sets are different, but seed VC is probably more relevant because sourcing is similar to finding new customers in some ways.

Brian,

Your guides have been very helpful, thank you so much! I recently graduated from school and currently work at a fund of funds, specifically working to invest in hedge funds. I did an internship with a solo venture capitalist back in my sophomore year of college but found it hard to break into a fund coming from a non-target school. How would you suggest I approach recruiting for VC and based upon my current situation would you recommend I move forth with VC or would you think a hedge fund would be a better path? Thank you!

Well, what do you want to do? I can’t answer this question because I don’t know your long-term goals. Hedge funds and VC are completely different and require very different skill sets. Both will require a fair amount of networking to break into. And in both, you’re generally better off working in IB first to gain relevant experience.

I do not think it is a great idea to work in VC directly out of undergrad because these roles tend to teach you very little, and they don’t give you great exit opportunities. Hedge funds can be a better bet directly out of undergrad, but only if you win an offer at a larger/reputable fund and you want to stay in the industry long-term.

Brian,

After much thought and research, I’m set on pursuing a career in VC. I am targeting venture lending or Product related roles as startups as those interest me quite a lot even if i am unable to use them as a bridge to get into VC. Which one would you suggest would be more beneficial for the near term (with the virus situation) and the long-term for gaining experience for VC?

Either one could work for getting into VC, but in the current environment, product roles at well-funded startups are a safer bet because very few startups want to raise debt when there’s massive economic uncertainty.

Got it and appreciate your help! Would you also say it is beneficial to network through the VC which funded your startup? I am thinking that networking and building experience are the best ways to then get into VC because you said recruiting is so unstructured. What would generally be other ways I could network or break in?

Sure. A lot of networking strategies currently don’t work so well due to the pandemic, so you’re more limited to LinkedIn/emails/informational interviews over the phone. In normal times, you could try networking through avenues like coding boot camps, events/conferences, etc.

Hello Brian,

Big fan of your work. One small thing I would add is that some VC funds (such as a16z) give junior people the title of “partner” which can be confusing as a founder – since you may not realize you are wasting your time talking to someone who doesn’t have decision-making authority.

Thanks for adding that. Yes, a16z and a few other firms are really confusing with their titles. This is why you have to look up everyone on LinkedIn before doing calls or meetings. “Partner” means nothing if the person has, say, 2-3 years of work experience.

Have to really thank you for that piece.

You addressed topics that seem too unique to VC to ignore when considering that “path”; likely due to industry specific background being more valuable than in IB/PE?

I work in pharma, learning M&A and (venture) debt financing, and that challenges my “get to life science VC ASAP to wreck cancer, get money” goal.

Thanks. Yes, an industry-specific background is definitely more useful in VC because the job requires more understanding of markets, products, and customers, and less knowledge of finance and deals. This is especially true on the life science side because you’re not very useful if you don’t know enough science to say whether the company will be the next Genentech or the next Theranos.

Excellent information and introduction to the VC world.Thank you.

Thanks for reading!