Debt Capital Markets (DCM): The Definitive Guide

If someone tells you, “I work in Debt Capital Markets (DCM)”, you might immediately think: Bond. Investment-grade bond.

Or, you might not think of anything at all, since there’s much less information about the debt markets than there is about the equity markets.

Everyone can recall famous IPOs of technology companies, but hardly anyone outside the finance industry can name a “famous” debt offering.

Debt is lower-profile than equity, but it also offers many advantages – both to the companies issuing it and the bankers advising them in the context of DCM.

Similar to its counterpart, Equity Capital Markets, Debt Capital Markets is a cross between sales & trading and investment banking.

But that’s where the similarities end:

Debt Capital Markets Explained: What You Do in the DCM Group

Definition: A Debt Capital Market (DCM) is a market in which companies and governments raise funds through the trade of debt securities, including corporate bonds, government bonds, Credit Default Swaps etc.

Therefore, in the DCM Team, you advise companies, sovereigns, agencies, and supra-nationals that want to raise debt.

“Raising debt” means that an entity borrows funds and then pays interest on those funds – as opposed to equity, where the entity sells a percentage ownership in itself and pays no interest.

It’s similar to borrowing money for a student loan or mortgage, but organizations do it on a much greater scale than individuals.

As a junior-level banker in this group, you’re responsible for three main tasks:

- Pitching clients and potential clients on debt issuances and answering their questions.

- Executing debt issuances for clients.

- Responding to requests from other groups, updating market slides, and creating case studies of recent deals.

As a specific example of task #1, a company might come to you and say:

“We have $500 million of debt maturing in 5 years. Interest rates have fallen, so we think we could ‘refinance’ by raising new debt at a lower interest rate and using the proceeds to repay the existing issuance.

However, we’d also have to pay a prepayment penalty fee if we do that. Does this plan make sense? What terms could we get on the new debt? What interest rate is necessary for us to come out ahead?”

Or, a company might ask you something like:

“We want to raise debt to fund our everyday operations – what type do you recommend, and what should we expect regarding the interest rate, maturity, and prepayment penalty?”

You’ll answer these types of questions and advise organizations on their best options.

On the execution side – task #2 – much of your work will consist of drafting memos for internal committees and sales teams.

These memos help get your bank comfortable with deals and provide the sales force with the numbers and analysis they need to ‘sell’ the offerings to institutional investors.

Finally, you will also spend a fair amount of time answering requests from industry groups and product groups, updating market slides, and creating case studies of recent debt deals.

There is some quantitative and financial modeling work, but it is usually not as in-depth as you might think.

DCM tends to be a higher-volume, lower-margin business than ECM.

The global credit markets are far bigger than the global equity markets, there are more deals, and the deals happen more quickly – days rather than weeks or months.

As a result, investment banks charge lower fees than they do for, say, IPOs, and they have to make up for it with higher deal flow.

Debt Capital Markets vs. Leveraged Finance vs. Corporate Banking

Several other groups at investment banks also advise on debt issuances; the two most similar ones are Leveraged Finance and Corporate Banking.

The differences between these three departments vary from bank to bank.

DCM is different from Leveraged Finance because it focuses on investment-grade issuances that are used for everyday business purposes.

By contrast, Leveraged Finance focuses on higher-risk, higher-yielding issuances (“high-yield bonds”) that are often used to fund acquisitions, leveraged buyouts, and other transactions.

Corporate Banking groups focus on “bank debt” (Revolvers and Term Loans) that is kept on the bank’s Balance Sheet and not syndicated to outside institutional investors.

By contrast, DCM focuses on investment-grade bonds that are syndicated and sold to outside investors.

These are general guidelines, but in practice, there can be significant overlap between these groups, and there may be exceptions to these guidelines.

For example, Leveraged Finance is sometimes called “Leveraged Debt Capital Markets,” and a DCM team might focus exclusively on syndicated debt assignments of all types.

DCM Interview Questions and Answers

As with any other IB group, some students intern in DCM and accept full-time offers there, while others are placed into the group via a sell-day or off-cycle recruiting.

Sometimes lateral hires with credit analysis experience at rating agencies or corporate banking join, and you’ll find former industry coverage bankers here as well.

The recruiting process is similar to the one for any other investment banking role: Start early or be left behind!

The main difference is that the interview questions are often closer to the ones you might receive in sales & trading interviews.

Since DCM is a hybrid group and often sits on the trading floor, interviewers from fixed-income trading desks could easily ask you questions about how to hedge interest rate or FX risk (for example).

You could even get macroeconomic questions about the activities of central banks or the impact of trade policy on FX rates.

At the minimum, you should have a solid understanding of bond analysis: Yields, prices, call and put options, the yield to maturity (YTM) and yield to worst (YTW), make-whole analysis, and how companies think about refinancing decisions.

You should also know something about how credit ratings are assigned, why companies raise debt vs. equity, and how to advise a company on the most appropriate type of debt.

We cover these points in the IB Interview Guide in the Equity vs. Debt section and in more depth in the Core Financial Modeling (CFM) course:

Core Financial Modeling

Learn accounting, 3-statement modeling, valuation/DCF analysis, M&A and merger models, and LBOs and leveraged buyout models with 10+ global case studies.

learn moreThe Interview Guide is best for more of a “quick review,” while the CFM course is more about learning the concepts from the ground up, for both interview prep and internship/full-time job preparation.

You should also be prepared to discuss debt market trends; you can find that information on sites such as LeveragedLoan.com and sometimes directly from banks (ex: Société Générale’s year-end reports).

To prepare for deal discussions, you can look at GlobalCapital’s list of recent bond issuances and research the names you find there.

Finally, if you’re still in the networking phase, check out the Fixed Income Analysts Society, Inc. (FIASI) and the CFA Society.

The DCM Team Structure: Variance 101

The structure of Debt Capital Markets teams varies a lot because of the hybrid nature – some banks might even combine DCM with Leveraged Finance.

Some teams are divided into corporate vs. government issuers, and then they are further divided into industry verticals.

Just as in ECM, there’s also a syndicate team that’s responsible for allocating orders between different investors and building the books for bond offerings.

Junior Analysts typically work across a few verticals and then specialize as they move up the ladder.

DCM Jobs: Workstreams, Projects, and Sample Assignments

As in ECM, your main task in DCM is to tell stories about companies, governments, and other organization so they can raise capital more easily – but the plot points and characters in those stories differ.

For example, equity investors like to hear about the growth potential and upside of a company’s business, but debt investors care most about avoiding losses since their upside is capped.

As a result, they’ll focus on the stability of a company’s cash flows, its recurring revenue, the interest coverage, and the business risk.

They want to hear a story that ends with: “You’ll earn an annual yield of XX%, and even in the worst-case scenario, the company will still repay your principal.”

If you’re working in Debt Origination, you can expect these types of tasks:

- Market Update Slides: You might work with an industry coverage team to present your thoughts on financing alternatives in the current market. These pages can include details on the volume of capital raised, the number of offerings completed, the market’s total leverage, and the terms of recent offerings. Here are a few examples:

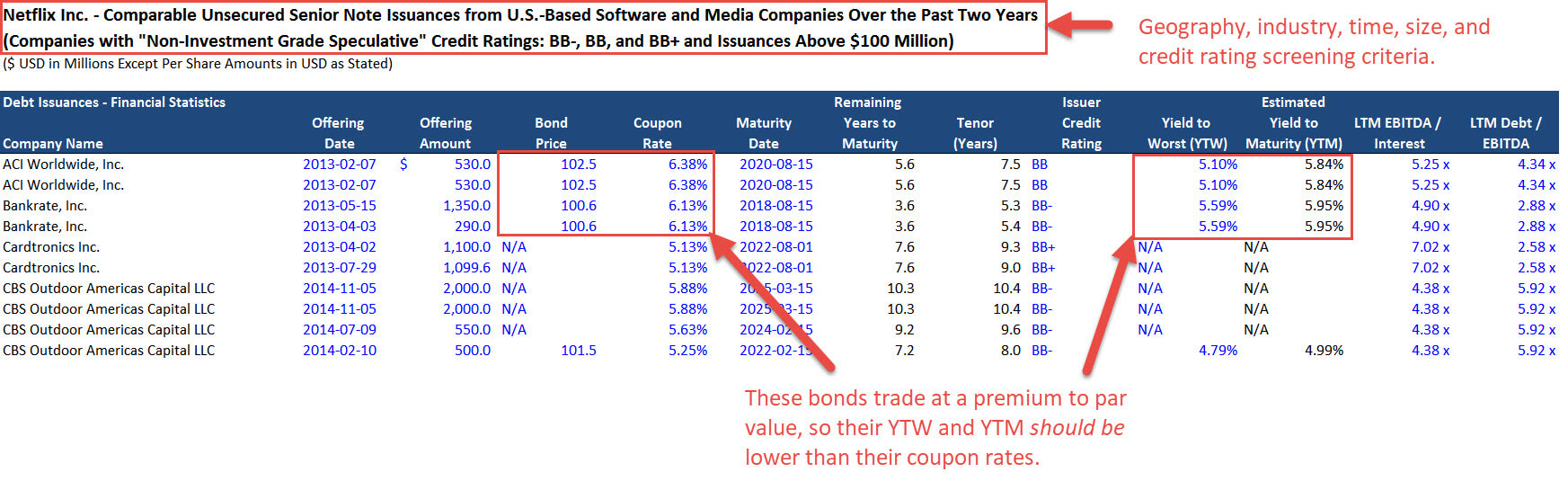

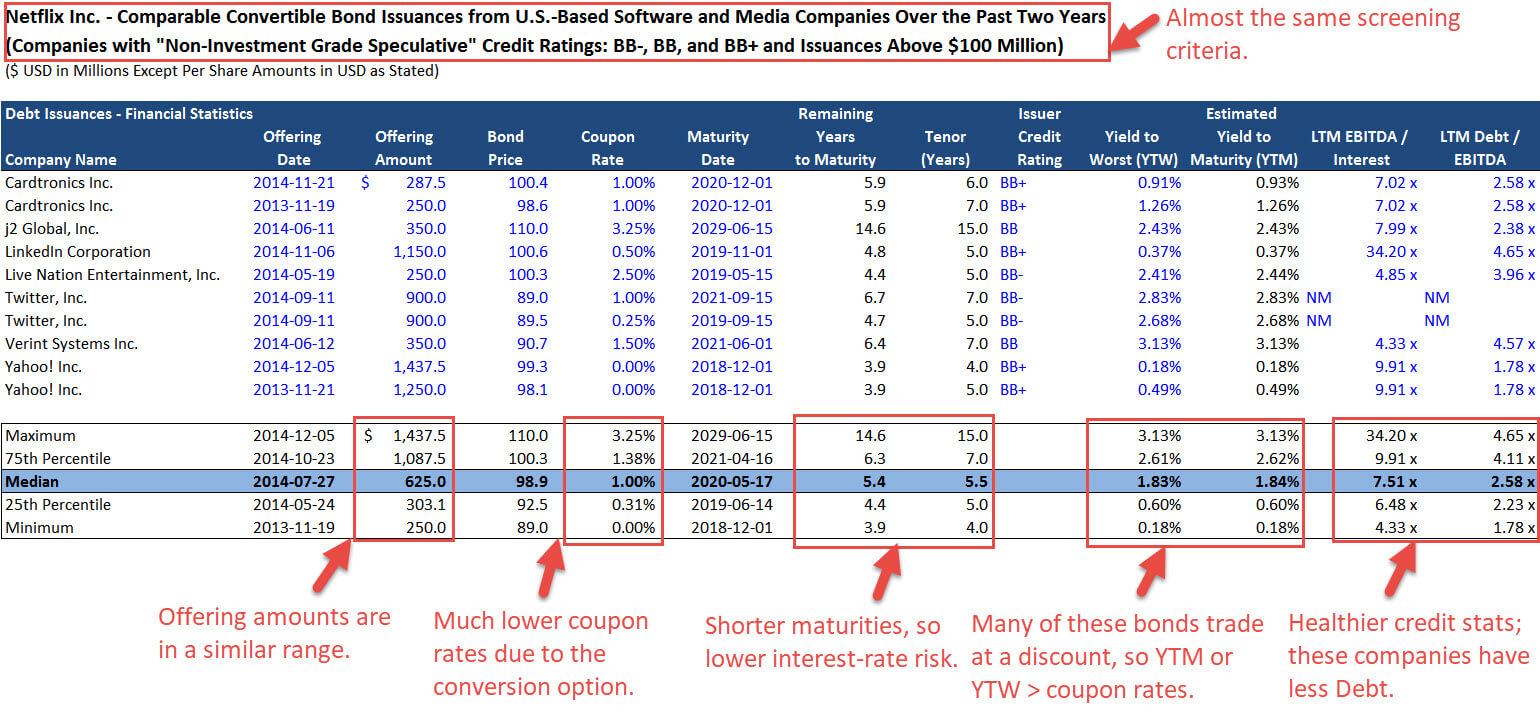

- Debt Comparables (Comps): The idea is similar to comparable public companies (public comps) or Comparable Company Analysis, but since these are for debt issuances, they present very different data. You might show the issuer’s name, the offering date and amount, the coupon rate, the security type (e.g., senior secured notes vs. subordinated notes), the current price, the issuer’s credit rating, the Yield to Maturity (YTM) and Yield to Worst (YTW), and credit stats and ratios such as Debt / EBITDA, EBITDA / Interest, and Free Cash Flow / Interest. You can see a few examples below:

- Case Studies: You will also create slides on similar, recent offerings to motivate and inform prospective clients. To do this well, you’ll need to research an individual offering’s details, read through the term sheet, and assess the company’s performance following the offering. Here are a few examples:

- Internal Memorandum: You’ll draft this document to set the narrative about the proposed debt offering and to inform your bank’s internal committee of the risks involved. Typical sections include:

- Situation Overview

- Credit Considerations

- Risk Factors

- Transaction Analytics and Financial Overview

- Sources & Uses

- Capitalization Table

- Operating Summary and Credit Statistics

- Company Information

- Industry Overview

- Business Unit Overviews

- Comparables Analysis

It’s incredibly difficult to find public examples of this type of memo, so our team of ninjas did the next-best thing: They found leaked examples from everyone’s favorite failed bank:

- Debt and Equity Financing for Archstone-Smith Trust by Lehman Brothers

- Bridge Loan for Archstone-Smith Trust by Lehman Brothers

Yes, they’re old, but these memos do not change much over time, and it’s almost impossible to post anything recent and not get sued.

- Sales Team Memorandum: This one is similar to the equity sales force memorandum, but it’s slightly more technical. It helps sales professionals pitch the bond offering to potential investors, and it includes details such as:

- Offering Summary (the purpose of the offering)

- Key Dates and Road Show Schedule (an abbreviated timetable outlining the sequences of marketing to investors to offering pricing)

- Summary Financials

- Company Overview

- Investment Highlights (why the investors should participate)

- Summary Valuation

- Products/Services Overview

- Growth Strategy

- Sources & Uses

- Capitalization

- Comparables Analysis and Operations Benchmarking

- Risk Factors

- Speaking with Clients and Investors: You’ll do more of this as an Associate, but frequently investors will call the group to find out more about a company’s issuance – sometimes via the sales force. If everyone else is busy or gone, you’ll take these calls. The DCM group will also send out indicative pricing to clients each week so they can get an idea of the terms of new potential offerings.

- Financial Modeling: In credit analysis, you focus on building 3-statement models with different scenarios (e.g., Base, Downside, and Extreme Downside) and assessing how a company’s credit stats and ratios (Debt / EBITDA, EBITDA / Interest, etc.) change… at least in theory. In practice, you do little financial modeling in many DCM groups because investment-grade issuances are so straightforward to analyze. Bond pricing and terms are often based on a client’s credit rating and basic financial stats.

DCM Products: Originate, Structure, and Market

DCM deals differ based on the type of issuer (corporation vs. sovereign vs. agency vs. supranational vs. municipal) and the terms of the issuance.

For example, issuing senior secured notes for a mature industrial company will be quite different than issuing a 10-year bond for the government of Brazil.

Many people put debt into different categories, such as Senior Secured Notes vs. Junior Subordinated Notes vs. Subordinated Notes vs. Senior Notes vs. a laundry list of others.

That’s a useful start point, but it can get confusing because there’s overlap between the categories, and sometimes the dividing lines are not clear-cut.

It’s more helpful to think about the key terms of any bond issuance:

- Principal Amount: How much money the organization raised or is planning to raise.

- Coupon Rate: This is usually a fixed rate for corporate bonds, such as 5.0% or 7.0%. On the other hand, government bonds are often priced at spreads to prevailing rates such as the 10-year U.S. Treasury rate.

- Maturity Date: When does the organization need to repay the bond in full? Five years? Ten years? Thirty years (for government bonds)?

- Frequency: Many corporate bonds have semiannual (twice per year) interest payments, but some bond payments are annual, quarterly, or even monthly.

- Seniority: Where does this bond rank in the company’s capital structure? This point is critical in the case of a bankruptcy or liquidation scenario.

- Redemption / Redemption Prices: Can the organization repay the bond early? If so, how much extra will it pay to do so? Normally, corporate bonds cannot be repaid for the first few years after issuance, but they can be repaid as the maturity date approaches, according to a downward sliding scale of prepayment premiums (e.g., 103%, 102%, and 101% in the three years before maturity). A company might want to repay debt early to reduce its interest expense (if rates have fallen).

- Covenants: What does this issuance prohibit the company from doing? Maintenance covenants limit the company’s credit stats and ratios (e.g., it must stay below 5x Debt / EBITDA at all times), while incurrence covenants limit its actions (e.g., it cannot divest a division or issue dividends above a certain level).

- Original Issue Discount (OID): Was this bond issued at a discount to par value? If so, why? How is the amortization of this discount reflected on the financial statements?

To further complicate things, there are also different types of mandates besides bonds: Loans (more senior, with floating interest rates), asset-backed securities, and commercial paper, for example.

Other teams, such as corporate banking or structured finance, may take the lead on these assignments, with DCM involved but not necessarily leading the deal.

And Debt Capital Markets itself has grown to include products for hedging interest-rate and FX risk – which is yet another reason why it’s a hybrid group.

At PwC, there is even a team that covers debt capital advisory.

In a financing assignment, your team might act in any of the following roles:

- Bookrunning Manager

- Lead / Co- / Sole Manager

- Initial Purchaser

- Sole / Joint Placement Agent

Similar to equity deals, the bookrunners have the most responsibility and earn the highest fees.

When you work with an industry group at the bank, the industry group will provide the market analysis and valuation, and DCM will handle the credit analysis and answer questions about the pricing and terms of an offering.

The process of executing a debt deal isn’t that much different from the process of executing an equity deal.

The main differences are that borrowers issue debt more frequently and deals happen more quickly, so you don’t need to do as much work educating investors.

Finally, there are also block trades (bought deals) and agency transactions in some regions, such as Canada.

In bought deals, the bank acts as a principal and buys the client’s debt before reselling it to investors, and in agency deals, the bank acts as an agent and allocates the debt to institutional investors on a “best-efforts” basis.

DCM Hours

Since DCM sits between sales & trading and investment banking, the culture is also somewhere between those two.

In the best-case scenario, you might work close to “market hours,” i.e., roughly 12 hours per day on weekdays.

In practice, however, many DCM bankers work more than that, and the hours can approach the traditional IB grind.

That’s partially because it’s a higher-volume business, so you’re more likely to get staffed on deals consistently.

An average day might start with you at the desk at 7 AM, followed by team meetings with the sales force and traders.

Those two groups leave, and syndication stays behind to discuss possible and pending deals.

You finish up with meetings at 8 AM and then spend the next hour catching up on the news, overnight events, and monitoring traders in other offices.

Deals start launching when the market opens at 9:30 AM in NY (the market open time varies based on your region), so you’ll be quite busy if your bank is leading deals.

After that, the day varies based on your team’s deal flow. If you’re launching deals, you’ll have to monitor their performance and be around to answer questions.

If there are no live deals, a “quiet day” might consist of updating market slides, responding to requests from industry groups, and creating case studies based on recent bond offerings.

Debt Capital Markets Salary and Bonus Levels

At the Analyst level, compensation in DCM is similar to compensation in any other group.

However, the pay ceiling for Managing Directors and senior bankers is lower because fees and margins are lower, and the fees are split more ways.

A decent-performing MD in a financial center can still earn $1 million+ USD per year, but he/she is unlikely to go far beyond that.

Some argue that DCM offers better long-term career prospects than ECM because it’s “more stable” and bankers are less likely to be cut in downturns.

There is some truth to that because equity markets tend to shut down more quickly and decisively than debt markets; also, the skill set in DCM transfers to a wider variety of other fields.

But this claim is also a bit exaggerated because in a true recession, a lot of bankers across all groups will be cut.

DCM Exit Opportunities: Credit-Related Anything?

The good news is that you do have access to a wider set of exit opportunities in DCM than you do in ECM.

Not only could you move to different groups at your bank, but you could also apply to Treasury roles in corporate finance at normal companies, credit rating agencies, corporate banking, and credit research.

The bad news is that DCM is still not an ideal group for getting into private equity or getting into hedge funds.

“But wait,” you say, “you work with debt in DCM. Private equity firms use debt to do deals! And many hedge funds are credit-focused! They should want DCM bankers.”

Yes, but the problem is that PE firms use debt to fund transactions – whereas most debt issuances in DCM are not M&A/LBO-related.

As a result, you don’t get much practice with modeling acquisitions or leveraged buyouts or understanding the dynamics of those deals.

Also, while there are quite a few credit-focused hedge funds, most invest in high-yield bonds, mezzanine, or other securities with higher risk/potential returns instead of investment-grade issuances.

So, if you’re interested in private equity careers or hedge fund exits, you’re better off joining a strong industry group or M&A team.

But if you want to make a long-term career out of banking, DCM is a good option since you’ll have a better lifestyle and you’ll still earn a lot.

And if you’re interested in other credit-related roles, or in corporate finance at normal companies, Debt Capital Markets also gives you solid options.

So Why Work in Debt Capital Markets?

Similar to ECM, DCM tends to attract a lot of negative comments online – often from people with zero experience in the finance industry.

It isn’t necessarily “the best group,” but it’s still far better than most entry-level jobs outside of investment banking.

And if you intern or work in the group and find out it’s not for you, just transfer to another team – they’re always looking, especially after bonuses are paid.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

Brian – love your content. I have 1 year experience in FI S & T at a MM IB. It is a client facing role, with little modeling experience. Graduated with a 3.4 from a non-target, majored in FINE/minored in ACCT, and have experience in equity research as well. Would I be able to lateral into DCM with a little bit of luck and a lot of interview prep? I have no urge to lateral into corporate banking –> DCM because that would take longer but would that look better in terms of gaining skills/ being more of a generalist? Especially for my long term career skills? Also, how would you navigate this job market right now? With the interest rate environment, it seems most banks are in a hiring freeze. Thanks for the help!

Thanks. Yes, I think you can probably go from fixed income S&T to DCM. I don’t really think it’s worth doing corporate banking first because DCM doesn’t require that much technical knowledge / that many hard skills vs. other groups, and it has a lot more overlap with S&T than other groups already.

Unfortunately, the current hiring market is terrible due to macro factors, banks over-hiring during covid, etc., and you can’t do much about that. All you can really do is keep networking, consider other firms, and hope that an opening pops up eventually. Even in a terrible job market, people still quite unexpectedly, and when they do, you want to be top of mind for anyone in the group who’s tasked with finding a replacement.

Hi, thank you so much for an insightful article!

In terms of lateral hiring, between fixed income sales and corporate banking, which one would be easier to make a move from aforementioned place into dcm?

Also, is it possible to leverage fixed income sales or corporate banking internship experience and get a full time directly at dcm?

Thanks again!

I would say corporate banking because it’s much more closely related than a sales role at the junior levels, and you’d presumably be moving over from an internship or entry-level full-time role. I don’t know if you can switch right after the internship, though. Normally it’s easier to do that when you’re already in a FT role.

Hi Brian,

Thanks so much for posting this article — I found it very insightful.

I was curious to know, as DCM is closer to the markets side of things, is the math required harder than other IB teams?

I’ve recently committed to a DCM team at a reputable IB firm, and after reading some articles it seems that in some situations calculus level math is essential. I wouldn’t say I’m comfortable with much beyond algebra. Is this something I should improve before starting?

Thanks in advance.

Thanks. Traditionally, DCM requires very little math or financial modeling skills. This is why people often say it’s a lot of mindless market updates, slide creation, etc. There may be groups where more math is required, but that is mostly on the S&T side of fixed income with some of the more complex products they trade. So… I think algebra is more than enough for most DCM roles.

what does a “debt advisory” or “capital markets” group do at a boutique bank (EVR/PWP) on the debt side. How is that job different day-to-day and functionally from the larger levfin/DCM groups at BBs?

Good question. I’m not 100% certain because those groups have not been the focus of boutique banks traditionally, but I would assume that they perform a similar function to LevFin/DCM at the large banks, but focus more on the external process raising funds from investors in syndicated deals, as these firms do not have real Balance Sheets in the same way the BB banks do.

Hi

Thank you for such a great and insightful article. I am planning to make a move from Auditing to DCM. I wanted to check how tough it would be to crack the interview.

Thanks,

Ravina

Thanks. DCM interviews are about the same difficulty as any other entry-level IB interview. You should know the accounting very well, but need to be prepared for valuation and M&A/LBO questions as well.

Hi Brian, great article btw, learned lots! I was wondering if you could give me some of your insights on my career plans. I will be interning in Corporate Banking this summer (Cdn Big 5) but my team isn’t the usual credit team, I work in Cash Management/Transaction Banking role. After a couple months of research and taking courses, I noticed I became very interested with the bond market and was wondering if pivoting into a more credit heavy side of Corporate Banking would help my transition to DCM? Or will staying in my current team for full time and then network my way into DCM also work? Thank you very much in advance!

Yes, try to get into something more credit-heavy within corporate banking.

Hi Brian,

Thank you for the great article. I have the opportunity to choose among the following three teams for my full time team placement at a BB: municipal syndicate desk, municipal underwriting team under DCM, credit research within Sales and Trading Division (I am leaning toward to cover distressed sector once I am onboard). Besides above, I can also choose desks within S&T division. I am a more fundamental person and I want to either transfer to traditional IBD groups within my firm, or exit to buyside straightaway, so I am trying to get into a team that is closer to IBD. I would really appreciate if you could give some insights regarding these options. Thank you!

Usually, sales desks within S&T are the best options if you want to transfer into IB. Credit research may also work because it’s a bit closer to what credit-focused IB groups do. I would avoid municipal desks because then then it may be more difficult to transfer unless you go for something like public finance rather than a traditional IB group.

Thank you Brian! Quick follow up question, what do think of ABS syndicate desk in DCM? My rationale is if I am in DCM, it is in Captial Markets so closer to IBD compared to S&T.

I don’t know, ABS is also fairly specialized and not that relevant to most IB teams except for structured finance (if you consider that a part of IB). Sales and credit research are still probably better bets, but if this desk is actually within DCM and not classified as S&T, it may be about the same.

Hi Brian! Before anything else, I’d like to thank you for running this extremely helpful website. So, I’m currently in the process of being interviewed for an Associate role for a local bank in the Philippines (very small IB market, few deals). I just got interviewed by the recruiter and they said they’ll get in touch in a week or two. The bank has around a 30% share in the country’s bond market and has repeatedly won awards as the Best Bond House / equivalent.

My background is quite unique. I took up Business Administration in college, interned at ING as I wanted to get into investment banking, but I accepted a full-time sales and marketing role at a large multinational consumer goods company because starting salaries for investment banking analysts are much lower than the offer that i got and i needed to provide for our family. I spent a year at the large multinational, and I now work at a middle market management consulting firm.

Was hoping to get your advice on how best i can prepare myself for the (hopefully) succeeding interviews for the job. Thank you!

I’m not sure I can add much beyond what’s in this article: study accounting, financial statement analysis, and valuation, learn the markets, and be able to explain the debt issuance process, why companies choose debt or equity, and so on. You can’t master all those concepts in 1-2 weeks, but you can learn enough to perform better in interviews.

Hi Brian. Thanks so much for sharing your insights!

I am now a corporate banking SA at a BB bank, working for treasury service team. But I am quite keen on getting a FT job in DCM or any other roles in investment banking after graduation. Do you think it’s possible to make this move? BTW, I had a DCM internship before at a large bank, but only did some daily work and not much exposure to the deal.

How should I best prepare for next job hunting for IB? Thanks in advance.

Yes, it’s possible to move from corporate banking to DCM, but you probably won’t be able to go directly from an internship in CB to a FT role in DCM. It’s better to win a FT offer in CB, work there for a while, and then transition to DCM through the normal networking tactics.

Thanks for the great article. It seems DCM only covers investment grade. Many countries (sovereigns) are not investment grade (ie. countries in LatAM , Africa and Asia). So, at most banks, are some sovereigns covered by the DCM group and some by the LevFin group? Or even non-investment grade sovereigns are covered by the DCM group?

I believe that even non-investment-grade sovereigns are covered by DCM teams, but it may vary a bit by bank.

Thanks, Bryan!

Hi Brian,

Is it possible to move from a Market Risk role to DCM?

Sure, you probably interact with DCM and trading desks frequently, so it should be possible.

Hi Brian,

Thanks for your informative article. I just wanted to ask your advice. I am a recent grad starting a role in January in Fixed income emerging market sales at Morgan Stanley, but I am keen to break into Capital markets ECM/DCM/LevFin. Do you think this transition could be possible over the coming months? I don’t know how easy it will be to move from S&T towards such a role? Figured some internal networking perhaps? Or maybe my CV doesn’t fit here?

Thank you

Yes, it should be possible because there’s a lot of overlap between the different groups in fixed income. It will probably be some combination of internal networking + waiting for someone to leave the DCM (or other) team unexpectedly and asking about the opening as soon as it comes up.

Hi Brian, I am currently an analyst within a coverage CIB group at a MM bank. I am very interested in making a move to a DCM group at another bank in a financial center around the next bonus cycle. Just wanted to know if this is doable and if there is a certain way I should go about the networking process in the meantime? I also come from a Semi/full target school if that’s still relevant.

Yes, it’s doable. People often move from corporate banking to capital markets. I don’t think there’s anything special you have to do, it comes down to the normal networking tactics – reach out several months in advance, ask for advice about the switch, follow up to check on openings, etc.

Hi Brian,

Thanks in advance for answering my question.

I’m a junior at a semi-target school who recently received a DCM Summer Analyst offer from a BB In NYC. I was wondering about your thoughts on how best to

(continued) lateral to an M&A /coverage group. Should I pursue recruiting FT or stay in this role and then lateral after 1-3 years?

Thanks

It is generally best to focus on winning a full-time return offer in the DCM group, perform well there, and then move to another group after a year or so. It’s not a great idea to try to switch groups at the end of your internship in many cases because everyone else is trying to do the same thing, some banks hold accelerated recruiting, etc., so it is a giant scramble with a lot of competition. But people start dropping out once they’re on the job, so more opportunities pop up then.

Thanks so much for your insight!

Also, I would greatly appreciate if you could make my name anonymous on my previous post. Thanks!

Hello,

Thanks for the fantastic post M&I, really useful info.

I will be interning in DCM at an EB soon in Italy, I was expecting to be placed in a M&A/Restructuring team, and will probably transition at a later date if I get a grad offer (as analyst program has 3 rotations). The DCM team is very small and I am excited to start and learn. I was hoping to get some advice from you.

The DCM team actually sit with the restructuring/M&A (Chemicals) teams. I was hoping to get exposure in either restructuring/chemicals while I’m working there too. The internship is long (6 months minimum) so I think it’s possible.

I was wondering how I should best approach this situation to get into the restructuring/chemicals team. I don’t want to say to HR I want to switch immediately as it won’t give a good impression + I am now also interested in DCM after researching. I have already asked HR if I could move to another M&A team (once I found out allocation of groups) earlier and they said I should talk to my manager, but I will be based in DCM. Basically, I want to learn some financial modelling skills in the 6 months too to open up opps. How should I approach restructuring/chemicals desk and when? If you have already written an article about networking with other teams I will try search for it on your site.

Thanks for all your help and your website is truely awesome.

Regards,

BT

You can approach the restructuring/chemicals team maybe around the halfway mark of your internship and ask about working there. You should focus on proving yourself with the DCM team first and getting a strong reference so that if you apply for other teams, someone in your group will recommend you.

Hi, i was interested to know if it is possible to move to a capital markets team with a background in Financial control in CIB working for the CFO) in a major Investment bank?

thanks for yout help

Yes, I think so, especially since capital markets is closer to CIB than other groups in IB.

Thanks a lot for your post, it looks exhaustive and covers a lot the subject and goes in-depth. Thanks a lot as well for the examples, they are trully adding values. I’ll begin an off-cycle in DCM in a G-SIB bank soon, in the meantime I’ll work on the subjects you mentioned.

Thanks! Glad to hear it.

Would be great if you could also provide some content on the corporate derivatives units within the capital markets groups (day-to-day, skillset, lifestyle etc.). Thanks!

We don’t have anything on that at the moment, but I’ll see if we can cover it in a future interview.

Super chill role. Great in terms of work you are doing. If you like arithmetic and are into stuff like caps, floors, SWAPS, and understand basic markets, this is great because it is intellectually challenging enough to not make it monotonous. Hours will fly by quick when executing trades. Either way, you don’t work more than 12-14 (max., only sometimes) on weekdays. Weekends exist for you.

A GREAT GUIDE AND POST. THXX!!

Thanks for reading!

Hi, this is a fantastic article. I need a little advice. I was wondering, do you think it’s possible to break into DCM after having some sort of credit analysis experience with? Assuming I network as best as humanly possible? I am 23 with a B.S. in Finance from Louisiana state public school, and working towards a Master of Finance at Colorado state public school. So no ivy league schools for me. I currently work as a market research analyst at a hotel wit one internship at a city government. I am also willing to move anywhere!

Just looking for real advice on how to leverage my little experience. Thank you!!!

Thanks. Yes, it’s possible to get into DCM if you gain credit analysis experience in some other field first. The lack of brand-name schools will count against you, but if you can use your experience to do something directly focused on credit, it’s possible to make a move. I’m not sure that “market research analyst” will look relevant on your resume, though.

Thanks for this detailed article into DCM.

I am currently in a rotational graduate scheme (2yrs) at a BB based in London within Corporate Banking. My long term goal is to eventually transition into DCM.

How/when would I kick off the networking process internally to transition into a DCM group within the bank? (bearing in mind HR requires me to complete a 2yr rotational scheme within CB, before seeking any other jobs internally).

Is it easier to make the leap externally at some point instead (say a year), and is this leap from IB to non IB a relatively difficult one, or an easier one?

I don’t think it’s worth staying 2 years just to move into the DCM group at the same bank. You should probably move externally after a year or so, and stay only if that doesn’t work out. It is usually not that difficult to go from CB to DCM, but it depends heavily on deal activity.

Thanks Brian for the insight

Just wondering whether the internal move is not worth it because chances of transitioning internally are low after 2 years, or because its simply easier to move externally – so waiting 2 years would be wasting time?

It’s just easier to move externally, and you don’t need to wait 2 years to do it.

Thanks for another great post! Will be starting SA gig at BB DCM, any advice on how to prepare myself before the internship starts? Thanks again

Learn about the topics mentioned above: bond math basics, how various fixed-income instruments work, get good at Excel and PowerPoint (PPT is especially important in most DCM roles and is consistently overlooked by people), and do a bit of networking with people in the group.

Thanks a lot Brian!

Thanks so much for your introduction. In fact, I am interested in DCM in IBD. Currently, I am very likely to win an internship offer (in the summer of my second year) as a credit analyst at a BB bank. And I will deal with the liquidity risk for the DCM group on the issuance of bonds of the bank. Therefore, I was wondering if this experience will benefit a lot for me to get an IB internship in the summer of my third year?

Yes, credit analysis will help with IB/DCM internships.

So what if the credit analysis work I mentioned is in a back office? e.g. the credit risk group. Would you say this transition is probable: credit risk internship ? DCM analyst ? coverage analyst ? hedge fund?

The question marks above are rightwards arrows.

Assuming you network and prepare effectively, yes.

So moving from dcm to a regular ib coverage group within a BB shouldn’t be too difficult after bonuses are paid? Should I be prepared for standard ib interview questions if trying to make the move, in addition to networking and building a reputation as a good analyst within the dcm group?

Moving around to different groups within IB is fairly common, so yes, it should be possible to do that. Yes, the interview questions for that other group will be standard, but they’ll focus more on your deal experience and how much you have learned about non-debt deals. Industry trend/specific company questions will also come up if you’re moving to an industry group.

As someone who spent a couple years as a DCM analyst, it should be made clear that you pick up zero modeling skills. At a BB firm, you do a fair amount of acquisition financing analysis but all of the financial analysis will be outsourced to industry team and you will be left with mind-numbing market update. I was able to jump to a distressed credit firm through a LOT of self-study and some luck, but there is virtually no buyside exit opp coming out of DCM. I would caution against believing that direct lending is an available option – you will not be competitive against lev fin candidates as an average DCM analyst.

Thanks for adding that. I mostly agree with you, but I hesitate to write “zero modeling skills” because someone will inevitably reply and say that their group was different, or it was combined with LevFin, or something else happened and they learned some modeling as a result. But yes, if it’s a pure-play DCM group at a large bank, your buy-side options are limited.

Great article. You mention corporate banking a few times, would you be able to provide insight into this area? I know you have a corporate banking 101 article, but it’s not quite as extensive as this and I think corporate banking is even less covered than DCM in all the forums out there.

Thanks. Yes, the current corporate banking article is not as detailed. We don’t have much on the topic at the moment, but we are planning to publish an updated article on corporate banking with links to outside resources (and more) later this year. I would summarize corporate banking as “DCM lite” – the analysis can be even simpler because you’re mostly working with Term Loans and Revolvers, but the hours/lifestyle are better (but lower bonuses to compensate). It’s a good starting point if you want to move elsewhere at a bank, especially other credit-related groups. It’s probably not as appealing as a long-term career since the pay differential vs. IB is large, even though it’s not really that much different than DCM.