Investment Banking Hours: Will You Really Work 105 Hours per Week at Goldman Sachs?

I never thought I would write about investment banking hours yet again.

We’ve covered this topic multiple times in the past, including in the articles on IB Analysts, Associates, VPs, MDs, and so on.

But every few years, a new controversy goes viral on social media, and the world at large says, “Wait, do you really work that much in investment banking? How are those hours legal?!!”

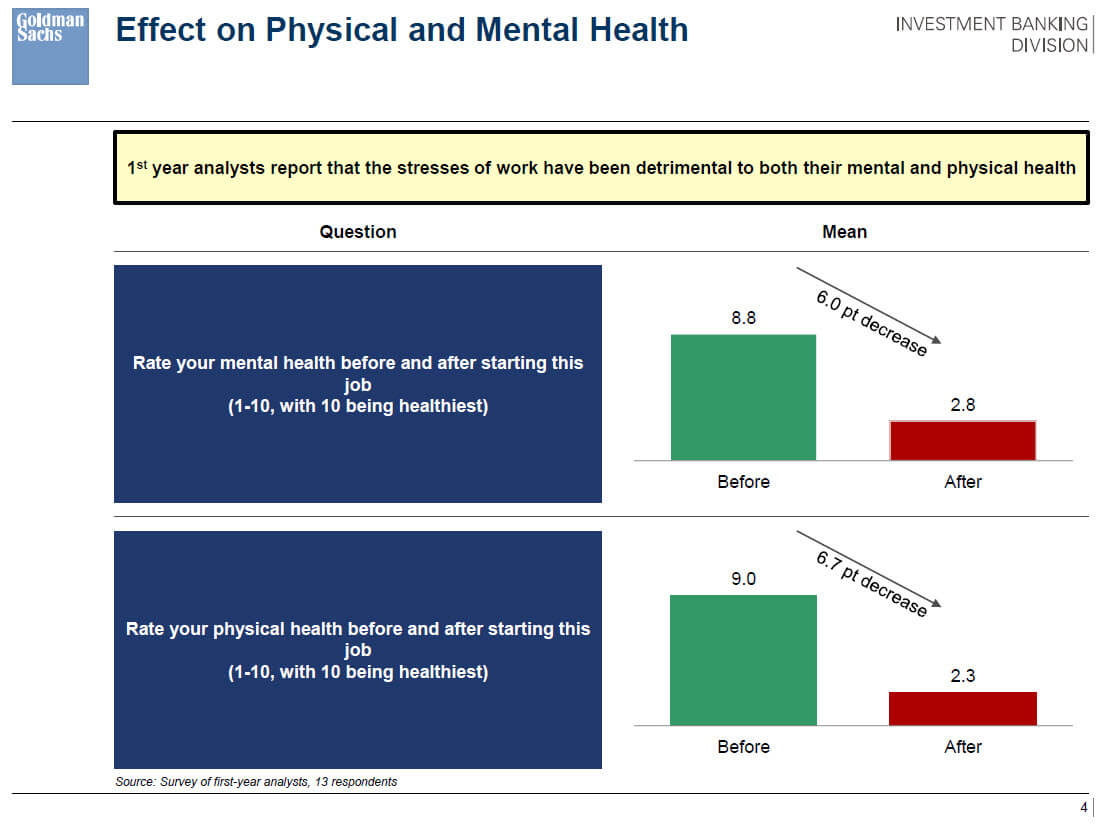

In case you have been offline for the past week, an “internal presentation” based on survey responses from 13 Analysts at Goldman Sachs made the rounds last week.

The headline numbers in the presentation for 1st Year Analysts were as follows:

- Average Hours Worked in the Past Week: 105

- Average Hours Worked per Week Over the Past ~2 Months: 98

- Average Hours Slept per Night: 5

- Average Time to Sleep: 3 AM

The unstated claim here is something like: “Yes, investment banking hours are always bad, and we knew that going into the job, but work-from-home policies during the pandemic have made the hours unbearable and inhumane.”

I’m going to start with my quick take on the presentation, explain why IB hours, even in “normal times,” are bad, and then suggest a few possible solutions to the current problems:

My Quick Take on Investment Banking Hours in Pandemic Times

The short version here is:

- Yes, investment banking hours, especially in your first year or two, are always bad (think: 70-80 hours in the office per week).

- But junior bankers also tend to exaggerate their hours, often by not subtracting downtime or breaks during the day.

- And contrary to expectations, working from home has made the hours worse than usual, to the point where many people are getting burned out and leaving.

- But you should keep in mind that this “presentation” is based on responses from only 13 Analysts. For context, Goldman Sachs hires hundreds of IB Analysts each year, and there are several thousand IB Analysts at all banks worldwide.

Going into the current crisis, some people expected that work hours would improve because there would be less “face time” (i.e., pressure to stay in the office late for no reason).

Unfortunately, “Zoom time” and “24/7 availability” have replaced “face time.”

Since you’re always at home, you’re expected to respond to messages and work requests right away.

There’s no such thing as “taking a break” or “going out to eat” because many governments have eliminated normal human activities, and banks have fully embraced the restrictions.

But a few other factors have also made the hours worse:

- Non-Stop Zoom Pitching – Since MDs no longer travel to deliver pitches, they can do 10+ remote pitches per day. That means Analysts and Associates need to grind out even more presentations and meeting materials, even if the clients or potential clients barely look at them.

- Lack of Variety and Socializing – If you go to an office every day, you change your environment, socialize a bit, and see the human side of your co-workers. It’s easier to tolerate long hours when you can chat casually with your bosses in between assignments. But if you’re in a tiny apartment all day, working from 9 AM to 3 AM is a bit like a prison with internet access and better food.

- Difficulty Coordinating Presentations – Since multiple people work on most presentations, coordination is challenging when the team is remote. Issues that might take 15 minutes to resolve in an in-person meeting could drag on for hours when everyone is emailing or texting. Video calls may help, but they also create other issues, such as constant interruptions.

- Non-Stop Scam SPAC Deals – SPACs have become the equivalent of dot-com IPOs, and they involve a lot of copying and pasting of templates. You need to grind out many documents, but the work is really boring. Even something like a standard 3-statement model is more interesting because it’s different for each company, requiring some thought.

- Real Deal Activity Has Not Slowed Down – Finally, real M&A and capital markets deals are still taking place, largely because central banks turned on the non-stop printing press, and money is cheaper than ever before (though that may be changing).

Putting these factors together, it’s easy to see why banking has become so miserable over the past year.

I do not think that every single 1st Year Analyst is working 105 hours per week, but I do think the hours have worsened significantly.

Many Analysts might be working more like 80-90 hours per week rather than 70-80.

That may not sound significant, but it’s the difference between 12.5 hours per day for 6 days with one day off and 12.1 hours per day with no days off.

I’ll suggest a few possible solutions, but let’s first review why the hours are so bad even in normal times:

What Do “Investment Banking Hours” Mean?

Bankers (and most knowledge workers) typically measure their hours based on their time in the office. For example:

- 9 AM: You arrived at the office.

- 1 AM: You left the office. That was 16 hours! You worked 16 hours!

But this is not quite accurate because this person was not “working” this entire time.

They were probably waiting around for a client or a senior banker and reading the news.

They probably went to get food or coffee at some point.

And they probably spent some time chatting with co-workers about non-work topics.

Even if you subtract that time, the average workday is still long.

But it’s not quite as insane as it sounds because 80 hours in the office might equate to 60 hours of “real work” due to significant downtime.

There are exceptions, and some firms and groups do more “real work” than others.

Investment banking hours are much longer than those in other jobs because of four main reasons:

- Huge Clients Pay Your Bank Huge Fees: When a company is paying your bank $50 million, $10 million, or even $1 million to advise on a deal, you have to do whatever it wants at any time of the day.

- Unpredictable Work Demands: Unlike with engineering projects or audits at Big 4 firms, it’s difficult to use “project planning” for investment banking deals because the processes are more random and difficult to predict.

- Division of Labor Failures: Banks can’t necessarily hire more people to reduce the workload because one person has to “own” each aspect of a deal. Multiple people writing a CIM or building a model simultaneously would be like writing a novel with multiple authors.

- Culture: Since senior bankers all worked long hours on their way up the ladder, they assume that new entry-level bankers must suffer through the same rituals, similar to hazing in a fraternity.

Banks have tried to improve the work environment by offering “protected weekends” to junior bankers (i.e., no work from Friday night through Sunday morning).

The results of these policies were mixed, at best, as most people reported that the total number of hours did not change.

Yes, it was nice getting a free Saturday each month, but your hours on Sunday – Friday usually got worse as a result.

Here’s a bit more detail on each factor above:

Huge Clients Pay Your Bank Huge Fees

If a single executive at a client company gets upset over something, they could immediately cancel the deal, resulting in millions of dollars in lost revenue for your bank.

Bankers sell their time and attention – not a tangible product – so they need to provide it, even if a client calls at 1 AM on Christmas with an urgent request.

If a bank did 1,000 deals per year and earned $50,000 per deal, the service requirements would decline.

But that business model would also be far less profitable; it’s why you earn much less in Big 4 Transaction Services.

Unpredictable Work Demands

When you work on an M&A deal, much of the work happens in the beginning (creating marketing materials, presentations, and financial projections) and at the end (negotiating the definitive agreement, arranging the financing, resolving last-minute disagreements, etc.).

But in the middle of the process, random events, requests, and problems always come up.

You might get an acquisition offer from a buyer who dropped out but then came back at the 11th hour.

Or maybe your client just missed its earnings forecast, and you need to revamp your 10,000-row financial model.

Or maybe the CEO is having a bad day, and he wants to see unnecessary analysis, just for fun.

Other firms that deal with unpredictable work demands, such as web hosting companies and oilfield services companies, handle these issues by hiring teams to work in shifts.

One team works from 8 AM to 4 PM and fixes a website that just crashed; another team works from 4 PM to 12 AM and replaces a part of an oil pipeline.

But that approach doesn’t work well in banking because it’s more difficult to divide the labor (see below).

Division of Labor Failures

The problem in IB is that many deals are different and require client-specific knowledge.

You normally set up financial projections one way, but you had to modify rows 95-110 for one client because of an issue that came up in an email exchange with the CFO last year.

Or there are 17 versions of the company’s internal projections, and you’re using different versions in different slides of the management presentation – and only you know the logic.

You can come up with rough guidelines, but you can’t describe all the steps universally and comprehensively.

There might also be thousands or tens of thousands of documents for a single deal, so it’s impossible to “learn” everything quickly.

Senior bankers also want to ensure accountability by designating one go-to person for each part of a project.

If a VP wants to change a model, they do not want to ask 2-3 Analysts – just the one person in charge of it.

Cultural “Quirks”

Finally, there is enormous cultural gravity in favor of long hours because many senior bankers view them as “paying your dues.”

Plenty of bankers introduce more work or last-minute requests not because they’re necessary, but because they want extra analysis “just in case.”

Most meetings do not require 100-page pitch books; many clients barely even read the full presentations.

And most changes requested at 3 AM for a 9 AM meeting are not important – or they would have been requested much earlier.

Investment Banking Hours by Position and in Regions Outside the U.S.

In general, the hours tend to improve as you move up the ladder (though, again, work-from-home has upset this rule).

Investment Banking Associates will work a bit less than Analysts, VPs will work a bit less than Associates, and MDs even less.

A Managing Director still does not have a 40-hour workweek – it might be more like 50-60 hours per week – but it is more manageable.

Some groups, such as Equity Capital Markets, have also been known for reduced hours and better work/life balance (well, at least until SPACs came along).

Outside the U.S., people often argue that hours are “better” in London and other European locations and “worse” in Hong Kong and other parts of Asia.

There may be some truth to these claims, but they tend to be a bit exaggerated. Yes, your life will be marginally better or worse in some places, but it’s still investment banking.

Overall, working in a smaller, regional financial center (e.g., Houston in the U.S.) and at a regional boutique bank rather than an elite boutique or bulge bracket bank make more of a difference.

What’s the Solution to Investment Banking Hours During the Pandemic?

As you can see, even in a normal environment, it’s difficult to “improve” the hours in investment banking because of these cultural, work, and business model issues.

The pandemic has made it even more challenging, and I don’t think there’s a great solution until people finally return to the office.

A few partial solutions might be:

- Limit the Number of Pitches or the Materials Required for Pitches – Not every meeting needs a pitch book with dozens of slides, and the materials don’t need to be unique for each meeting. And not every MD needs to deliver 10+ Zoom pitches per day, as most of them will go nowhere.

- Set a “Hard Stop” for Each Day’s Work and Dedicated Break Times – For example, setting the cutoff at 11 PM or midnight would give junior bankers at least a bit of guaranteed free time. Creating shifts for time to run errands, get food, etc., during the day would also relieve some of the monotony.

- If Truly Necessary, Hire More Analysts – If an MD feels it is necessary to deliver 10 Zoom pitches per day, each with unique materials, make them responsible for finding and hiring more Analysts to do the work. If these pitches eventually generate advisory fees, the new hires will pay for themselves. And if not, the MDs will pitch less.

Normally, “hiring more people” is not a feasible solution because deal work is unpredictable and difficult to divide.

But much of the added workload this past year has come from speculative pitches, not deals – or nearly identical deals, like SPACs.

Pitch work is easier to divide, and a pitch does not necessarily require one dedicated Analyst because it’s more of a “one-time event.”

Banks seem to be hinting that they’ll hire more junior bankers to address these issues, but they also like to make their employees suffer, so who knows.

There is no perfect solution, but implementing one or more of these points might make investment banking hours more bearable.

And in the meantime, you can wait for “work from home” to end in approximately 567 years.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

As someone who was born and raised in asia i was wondering if it was possible for me to be hired by investment banks or big firms in the US like goldman sachs and JP morgan if i go to a college thats in my country but is ranked among the top colleges of my country??

It is difficult to get a work visa in the U.S. without actually attending university there and then staying in the country, so your best option is to find a job at a large company in your country and then see if they can sponsor you for the transfer.

Do you know job opportunity for masters in Finance from Stevens Institute of technology. I am Mechanical engineer from Virginia Tech with 2 years experience in HVAC And CFD. what is the best concentration to get a job in NYC? Please advice.

I don’t know how to answer your question because I don’t know what types of jobs you’re looking for or anything else about your work experience. In general, a pure engineering background with no finance roles is not enough to get into IB directly. Maybe if you attend one of the very top schools it can work, but you normally need some type of smaller finance internship first.

It is totally insane, in-human, to treat junior analysts like this. They are intellectual “labors” nothing more than that.

Well, tell that to the banks. It’s tough to change these policies inside an institution that keeps promoting people and then attempts to keep them around for a long time…

What is the most soft skilled focused career path with the most salary?

Probably sales in any field.

Brian, I’ve reading every article on this site, and enjoy them all.

I got accepted to both Stanford MBA & BYU MBA. I worked 4 years in GS Ops and 2 years as controller (mainly strategy i.e. process improvement & project management)

Thinking about two options:

#1: I am thinking about getting into IB, but not sure if my BO past alone will deny me. Also, I’d have to choose Stanford mba (which cost me 250k)

#2: Choose BYU MBA (which would cost me 20k and try management consulting ( McKinsey and Bain recruit quite heavily at BYU nowadays from my research)

Which do you think is a better shot in your opinion?

If you don’t care that much whether you get into IB, consulting, or a related field, BYU is probably better because of the vastly lower cost. If you’re 100% set on IB, then you have to go with Stanford. The problem is that you’ll be competing against people with more relevant backgrounds, so even if you go there, your chances won’t necessarily be great. So BYU is the lower-risk option.

Do you know something about being an economist in asset management or at a bank? Like hours, or pay? Seems like a cushy and more mentally fulfilling job.

Sorry, don’t know much about it, as we don’t cover that job on this site.

Do you think WFH will end by July? Incoming IB at a BB in NYC and not sure whether or not to lock down an appartment.

Think it depends on the bank. GS seems to be in favor of bringing everyone back into the office, but other firms are moving more slowly. So at least some interns will still be working from home when internships begin, which is ridiculous.