Investment Banker Salary and Bonus Report: 2023 Update

If you want to know how investment banker salaries and bonuses are trending, look at the discussion and news stories about compensation.

When you see stories about “outrageous bonuses” or “Wall Street greed,” you know it has been a good year for bankers.

And when most stories are about layoffs or people pushing back their planned retirements, you know things are bad.

That leads us to this salary and bonus update for 2023, which you can find below:

| Position Title | Typical Age Range | Base Salary (USD) | Total Compensation (USD) | Timeframe for Promotion |

|---|---|---|---|---|

| Analyst | 22-27 | $100-$125K | $150-$200K | 2-3 years |

| Associate | 25-35 | $175-$225K | $250-$450K | 3-4 years |

| Vice President (VP) | 28-40 | $250-$300K | $500-$700K | 3-4 years |

| Director / Senior Vice President (SVP) | 32-45 | $300-$350K | $600-$800K | 2-3 years |

| Managing Director (MD) | 35-50 | $400-$600K | $700-$1500K+ | N/A |

NOTE: All numbers are pre-tax for New York-based front-office roles and include base salaries and year-end bonuses but not signing/relocation bonuses, stub bonuses, benefits, etc.

As expected, these numbers are substantially worse than the 2021 numbers across all levels.

Base salaries mostly stayed the same, but total compensation fell by ~15% to ~50%, depending on your level.

Before you leave an angry comment, here are two quick notes:

- Yes, the elite boutiques pay above these ranges. I am summarizing the data across most banks, which means that some firms pay above and below these numbers.

- Yes, the compensation in other regions – anywhere outside the U.S. – is lower. We have a survey estimate this year for Asia-Pacific (see below).

OK, So What Happened to Investment Banker Salaries and Bonuses Last Year?

As I predicted in my last update, banks used COVID and the resulting disruptions, inflation, and panic as an excuse to raise base salaries while cutting bonuses.

Many people go into investment banking jobs thinking, “My base salary doesn’t matter much; I’ll earn another base salary with my year-end bonus!”

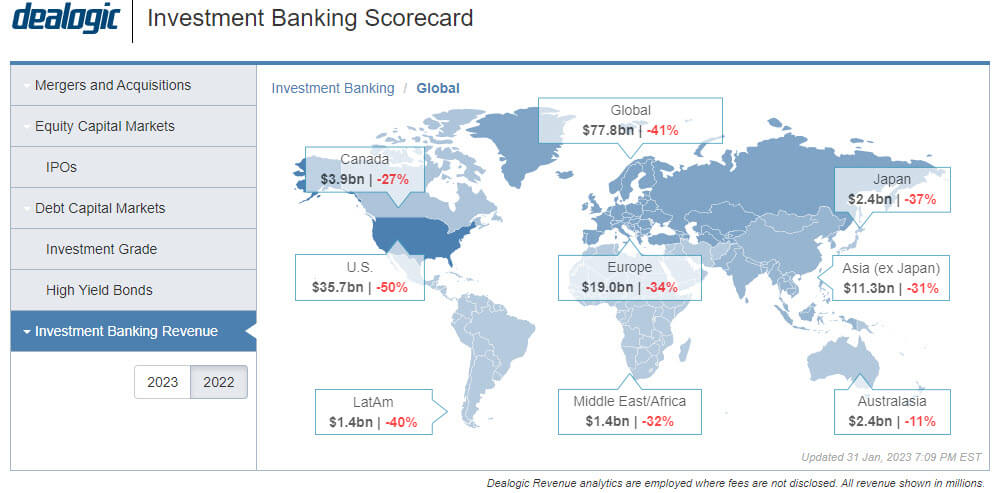

But this is wrong because banks base total compensation on a percentage of revenue, and revenue last year plummeted due to weaker deal activity:

It’s easy to interpret the much lower bonuses and deal activity as terrible news, but I would point out the following:

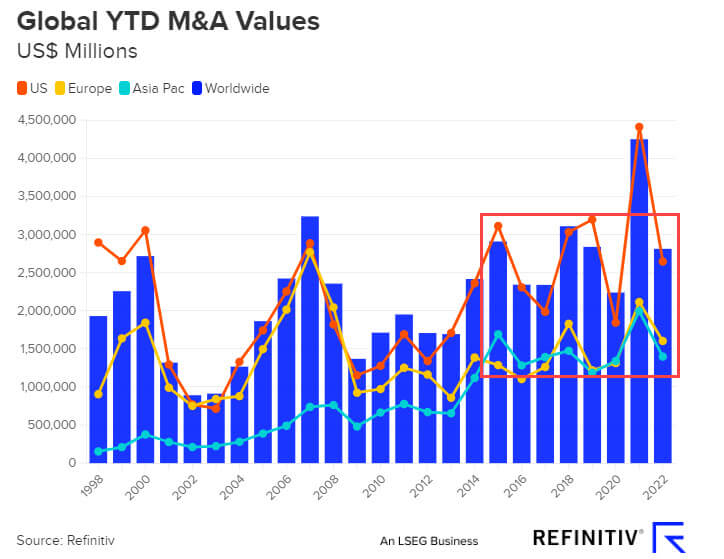

1) Return to Normal – M&A activity in 2022 mostly represented a return to “2016 – 2019 normal” after a very inflated 2021. Refinitiv has a good chart:

2) Hours / Lifestyle – Yes, deal activity was much lower… but the average hours were also down. Of course, bankers always exaggerate their hours, but quite a few at the Associate level and above were working 50-60 hours per week for $300-$400K in total compensation.

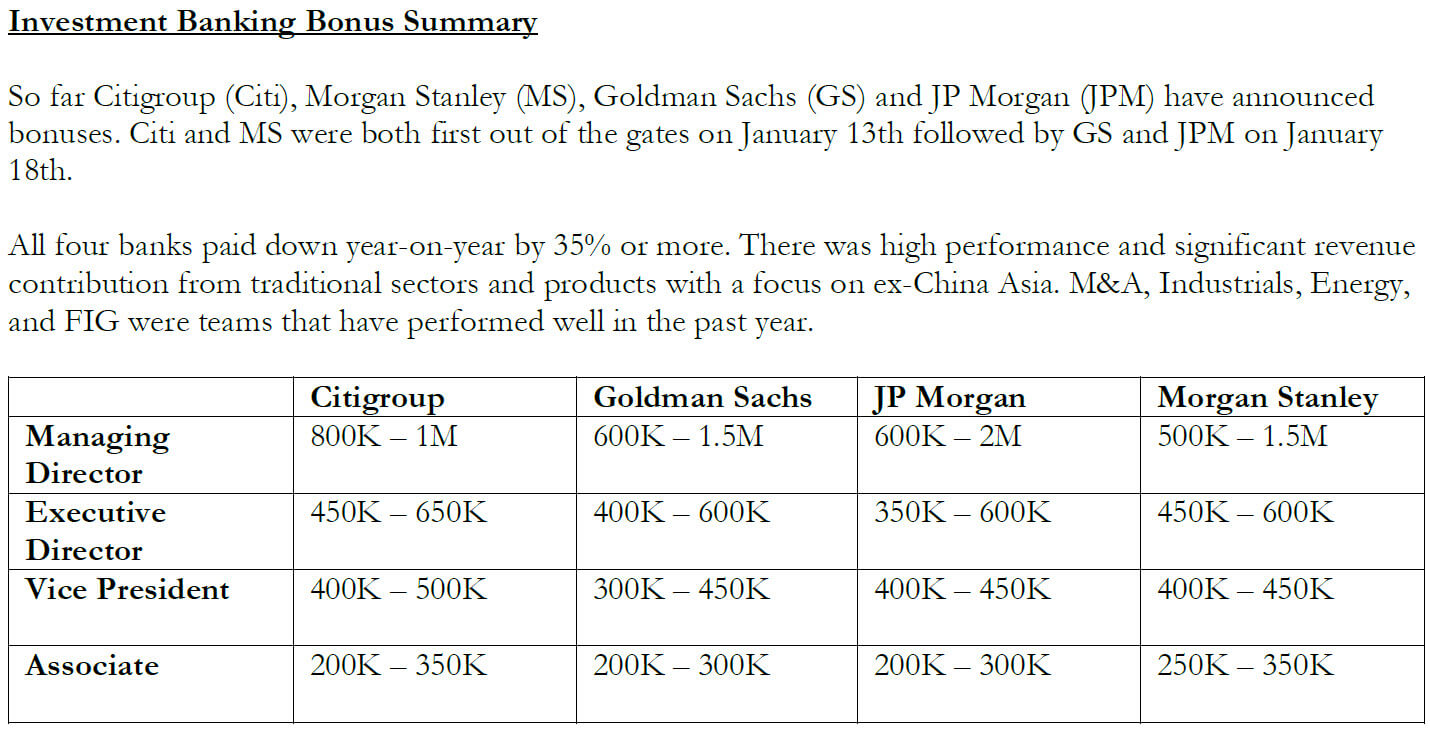

3) Bonus Distributions – While bonuses at all levels were down, Managing Directors took the brunt of the damage. Their compensation is always the most tightly linked to deal activity, so it’s no surprise that it fell by nearly 50% this year.

These developments raise many questions, such as:

- What will happen to bonuses in the future? Should you expect this level, or will 2021 ever return?

- Given these lower bonuses, are private equity and hedge fund roles now even more attractive?

- Is a plan like “stay in IB, grind your way up, and retire at age 40 with $10+ million” still plausible/realistic?

But let’s do a refresher on compensation and go level-by-level first:

Investment Banker Salary and Bonus Levels: The Main Components

For most bankers, there are five main components to “compensation”:

- Base Salary: This is what you earn via paycheck or direct deposit every two weeks. These numbers tend to stay the same for years at a time and then move up substantially in a short period, as they did in 2021.

- Stub Bonus: Since Associates graduate from MBA programs and start working in the middle of the calendar year, they receive “stub bonuses” for their first ~6 months on the job. These are typically low percentages of Year 1 base salaries, such as ~20-30%. Banks started doing this for Analysts, but most reverted to mid-year bonus payments in the summer (OK, “Northern Hemisphere summer”).

- End-of-Year Bonus: You earn this after your first full year of work. Analyst bonuses are almost always 100% cash, but a percentage will shift to stock and deferred compensation as you move up. For example, Associates might get 10-20% deferred, VPs and Directors might get 20-30% deferred, and MDs might get 30-50% deferred.

- Signing/Relocation Bonus: This applies to Analysts and Associates who graduate and accept full-time offers. This signing bonus might be around $10-$15K at the Analyst level and $50-$60K as an Associate.

- Benefits: Finally, you’ll get health insurance, vacation days, and participation in the firm’s profit-sharing or 401(k) retirement plans. In places like Europe, this one mostly takes the form of “more vacation days” since healthcare is either “free” or much cheaper than in the U.S.

Investment Banker Salary and Bonus Levels: Analysts

IMPORTANT NOTE: The estimates above for Analysts are guesswork because most banks have reverted to paying Analyst bonuses in the middle of the calendar year.

So, I’m extrapolating from the 2022 mid-year numbers and the remaining few banks that pay Analysts at the end of the year.

The overall drop in total Analyst compensation wasn’t terrible – ~15% by my estimates – but the base salary increases in 2021 contributed to this not-so-bad drop.

Year-end bonuses for the few banks that still pay Analysts at year-end seemed to be 30-50% of base salaries.

The exceptions were the elite boutiques, which, again, often pay higher base salaries and higher bonuses.

We’ll see the full numbers in the middle of this year, but I wouldn’t be surprised to see some of these firms paying bonuses well above 50% of base salary.

But if you’re at a middle market or bulge bracket bank, I don’t see total compensation going too far above $200K unless there’s a huge increase in deal activity in the next few months.

Put simply, expect lower bonuses now that base salaries are higher.

Investment Banker Salary and Bonus Levels: Associates

Associate total compensation was down by 15-20%.

Base salaries still progress from $175K to $225K at most firms, so lower bonuses explain most of this.

To give you a rough idea of the total compensation numbers across levels at the large banks, factoring in deal flow and ranking/performance differences:

- Associate 1: ~$235K to $350K

- Associate 2: ~$285K to $400K

- Associate 3: ~$350K to $450K

There were some outliers, with a few elite boutiques paying Associates over $500K for the year.

Interestingly, some of the EB banks got to those numbers with higher-than-normal base salaries, and others did it with higher-than-normal bonuses.

Investment Banker Salary and Bonus Levels: Vice Presidents

VPs were also down by 15-20%, as base salaries stayed the same and bonuses tumbled.

Elite boutiques paid above the bulge brackets, with many BBs in the $500 – $600K total range and some EBs closer to $700K.

Some VPs almost certainly earned less than $500K as well, especially if they were in underperforming groups.

Investment Banker Salary and Bonus Levels: Directors

I have almost no data on this one, but if many MDs were down 50%, Directors were likely down by at least ~30%.

That still adds up to a lot of money (mid-to-high six figures), but it’s also a substantial drop from the previous year, when some Directors were above $1 million.

Investment Banker Salary and Bonus Levels: Managing Directors

As mentioned above, MDs “took one for the team” this year and experienced the biggest compensation drop of all bankers.

In previous years, I quoted ranges such as $1 – 2 million or even $1 – 3 million for MD total compensation, but this year, a fair number of MDs earned less than $1 million.

You can read that as: “Very few closed deals or much smaller closed deals.”

In short, they earned their high base salaries but often earned bonuses well below 100% of base.

Bloomberg reported it like this (admittedly, for Asia ex-Japan):

“On average, managing directors at banks including Goldman Sachs Group Inc., Morgan Stanley, and Bank of America Corp. have seen their total compensation drop by 40% to 50%, with payouts for senior MDs falling to between $800,000 to $1.5 million and for first-year MDs to $600,000 to $1 million, the people said, asking not to be named discussing internal matters.”

Regional Differences

The Arkesden and Dartmouth compensation reports are good sources for the numbers in London; unfortunately, I could not find anything updated for this year’s numbers.

However, I assume the standard 30% discount in London still applies, so you can reduce the levels above by 30% and convert them into GBP to get the numbers.

If you’re wondering about Asia, here’s a report from Executive Access that quotes the following numbers:

These numbers are on the low side – as Associates in the U.S. can clearly earn more than $350K.

So, I’m not sure how seriously you should take this one.

It seems well-researched, but it also implies that pay is much lower in Asia (possible) or that bankers in the U.S. are simply lying about their bonuses (also possible).

So, Is Investment Banking Worth It? Is It the Best Path a $10+ Million Net Worth?

These results are a good reminder that bonuses are far less predictable than most people think, especially in an unstable macro environment.

Many people now in the finance industry joined in the 2010 – 2019 period, which was comparatively quiet.

Deal activity and compensation rose modestly in most years, and supposedly “shocking events” like Trump and Brexit were quite mild compared to the events of 2020 – 2022.

In the future, I expect compensation to continue to fluctuate significantly from year to year, so you should expect less of a “straight line” in your career and earnings.

If you can perform well, these changes make buy-side roles more appealing.

The pay ceiling has always been higher, but with lower IB bonuses, there’s also more of a difference in average compensation.

I want to close by discussing one specific goal/dream: Many people plan to grind their way up in the finance industry and “retire early” at age 40 with a net worth of $10+ million.

If you consider the total compensation numbers above, taxes, and the cost of living, you’ll see that this is quite difficult to achieve in places like New York and London.

Just for fun, let’s go through the math of after-tax savings as an MD:

- Anywhere from 30% to 50% of your bonus will be deferred or paid in stock, so even if you earn a $500K base + $700K bonus ($1.2 million) as an MD, that’s more like $900K in cash, assuming a 40% bonus deferral.

- You’ll lose ~45% to taxes in a place like New York, bringing you down to about $500K.

- The cost of living is quite high, and you will no longer want to live in a studio apartment and eat ramen to save money. Of course, everyone has different spending patterns, but you should expect to spend at least $100 – $200K per year on rent/housing, food, activities, vacations, etc. In addition, many MDs are married and have kids, which also increases their expenses (look at the cost of private schools in NY).

- The bottom line is that even if you earn over $1 million as an MD, you will not save anywhere close to that in cash each year. A more realistic estimate might be $300K per year in savings +/- $100 to $200K depending on bonus/stock payouts, lifestyle, spending habits, etc.

If you also assume that you’ve saved up $1 million before becoming an MD and that you earn 5% per year on your savings, you could reach around $5 million after 10 years.

At a 10% rate of return, that changes to just above $7 million, and if you save closer to $500K per year, it’s more like $8 million, even at 5% annual returns.

Obviously, this is still a lot of money and would make you wealthy by most standards.

But my point is that reaching $10 million (or beyond) is less of a “sure thing” than you might think, especially since MD turnover is quite high.

Few people start at age 22 and work in the industry non-stop for 18 years; they might do an MBA, quit, or take other jobs in between.

If you want to reach this level more quickly or amass a lot more wealth than this, you’ll need some combination of:

- A lower cost of living or lower taxes (e.g., Hong Kong as a non-U.S. citizen).

- A side business or other investments that perform very well (difficult when you’re working 60 hours per week and traveling a lot).

- The ability to earn more than $1 – 2 million per year, such as in buy-side roles with higher pay ceilings or at certain boutique banks that pay you higher percentages for your closed deals.

- Or the willingness to quit finance, start your own company, and either sell it or earn a high income from it for a long time.

On the other hand, it is possible to become a multimillionaire if you stay in the industry for a moderate amount of time, which could be good enough for you.

It might not be “retire forever” money, but it could easily be “quit and do something more interesting” money.

For Further Reading

You might be interested in The Investment Banking Vice President: The Toughest Job at a Bank?

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

How does IB comp in Chicago compare to New York? I’m looking to pivot out of Big Four tax in a Midwest location via an MBA. I’d prefer to live in Chicago over New York for a number of practical reasons, so am just curious if the pay is comparable or is there’s a sizeable discount.

Pay is not much different at the junior to mid levels. And it’s also still cheaper than NY, so you can probably save more in Chicago.

Similar to the above, can you please confirm if everything on SaaS KPIs (Bookings, cARR, Pipeline analysis, cohort analysis) is in the FMM course and your YouTube videos? Some of the content seems to be organized by product (M&A, LBO etc.) so wanted to make sure I don’t miss anything – have the full course access (busy with the day job and want to cover the relevant modules / sub-sets). Module 14 seems ro cover some topics, any others? Thanks!

If you have detailed questions about the course, please ask through the site or the Contact form so we can send you the direct links. This site is not for technical questions or how to approach case studies, study plans, etc., but is intended for general career topics and questions.

As mentioned above, we don’t have “everything” related to SaaS in the current course because it’s a “short” 10-hour module of a very long, 120+ hour course. There is analysis around bookings, deferred revenue, CAC, related metrics, and VC funding rounds, but there is no cohort analysis currently. I am aware that people want to see it. So when it is split off into a separate course, yes, we will re-do the entire case study and add it.

No, I don’t have an exact time frame because creating this volume of content takes months/years. But there will be more on these topics at some point this year.

As mentioned in my other comment, the Atlassian case study in the old/deprecated case studies section has more of a pure growth equity investment recommendation.

Hi,

Are you planning a VC/GE course that discusses pre-money / post-money valuation, detailed term sheets, cap tables for Series A, B, C (impacts of things like liquidation preferences, converts, option pools etc.)? Both WSP and WSP have some version of this, with the latter covering things like retention and cohort analysis as well. Would be great for people to know if this is something coming down the pike and what the timing may be.

Thanks!

Already covered in the Financial Modeling Mastery course. See the comments here: https://mergersandinquisitions.com/2022-end-of-year-reader-qa/

It is already more comprehensive than the WSP version (see the comments at the end). But we are going to split up the entire course and start selling parts of it, including this one, separately.

I have bought the course. Is Module 14 really the VC portion? While the content is great, the TOC is not the most intuitive. Are there any other places we should watch for core VC/GE materials. Have bought master access and want to make sure I’m not missing anything. Thanks!

Module 14 of the course is what we currently have on these topics. You can also look at the old/deprecated case studies section for the Atlassian case study, which is decent but maybe not the most representative of a growth equity model. The written solutions and analysis at the end are more useful than the model itself.

Regarding the table of contents, yes, this is the issue when a module or chapter has 30-40 lessons. There is no good way to easily look through everything. This is why we are splitting up the entire course into shorter modules of 10-15 lessons each.

Brian, based on your experience of running an online business for a long time, if you have a less demanding finance job (35-40 hours per week with remote working 3-4 days a week), is e-commerce or other online side business the most feasible solution? How about non-online side hustles (real estate rent, vending machine)? Do you think it’s more challenging given the travel time required, etc?

Yes, I would definitely start with something online if you only have to work 35-40 hours per week and can do so remotely. Ideas like real estate or vending machines can work, but they’re usually better for people who don’t have much money but who have time and can travel (vending machines) or people who already have enough money to comfortably buy properties (real estate). It’s also quite a pain to deal with all the tenant issues that come up 24/7, and if you hire a manager, that reduces your margins.