2022 End-of-Year Reader Q&A: Bank and School Rankings, the “New Normal” Environment, Twitter and Other Bad Deals, and Plans for Next Year

We’re at the end of another year, and, in many ways, 2022 was quite disastrous.

Just look at the financial markets, the crypto meltdown, deal volume at banks, inflation, energy prices, Russia/Ukraine, supply chains, and the hiring environment in tech and finance.

All these factors resulted in one of my worst years in terms of both business performance and portfolio performance…

…but I found myself not caring that much.

Part of it is that I no longer obsess over the numbers like I used to.

But the other factor is that everything outside of work improved as countries re-opened and life approached “normal” once again.

I traveled more than I had since 2018, which was a welcome break from staring at screens for 14 hours per day.

So, although 2022 looked bad on paper, it was better than 2020 or 2021 in real life.

But let’s start with my favorite topic: “ranking” banks, schools, and maybe a TV series or three.

Bank, School, Dragon, and TV Rankings

Q: Now that the Credit Suisse investment banking division is being spun off, will CS no longer be considered a bulge bracket? What about the other European banks?

A: Once the spin-off is complete, I expect that Credit Suisse (or “First Boston”) will be classified as an elite boutique rather than a bulge bracket bank.

And since Michael Klein is taking over, I expect that M. Klein & Co. will move off the “up-and-coming elite boutique” list as it merges with CS/FB.

Despite its performance and risk management issues, CS still generates higher fees from deal advisory than UBS and DB (see below).

If CS is no longer a BB bank, I’m tempted to remove DB and UBS, but I’m not sure where they should go – which means they’ll probably stay for now.

And there are no doubts about Barclays, easily the strongest of the European banks, so it will remain.

Q: Based on banks’ 2022 performance, will any other rankings change?

A: I hesitate to change any rankings because 2022 was a strange year, as deal volumes fell by 50%+, and different banks reacted differently.

Looking at the data, the biggest Chinese banks, such as CITIC, have moved up, and some of the “In-Between-a-Banks,” like Wells Fargo and BNP Paribas, are now approaching bulge-bracket territory:

But I want to see what happens over the next 1-2 years before changing much.

Q: You finally gave in and “ranked” universities and business schools.

How do the non-business schools at the undergraduate target schools fit in? For example, what about NYU CAS or non-Wharton options at UPenn?

A: I would put most of these in the “low-target-to-semi-target” range, depending on the school and alumni network.

You can get into IB from outside the business school at places like NYU and UPenn, but you need to be more proactive and have a slightly better profile.

Q: What about the target schools outside of investment banking? Does the list vary for private equity and hedge funds?

A: First, note that “target schools” do not apply quite as readily to PE/HF jobs because these firms focus on hiring people with full-time work experience (though some firms have been moving into undergrad recruiting).

The list would be nearly the same for private equity, but you might see more variability for hedge funds.

Larger/established firms still care about brand names, but smaller/newer firms care more about performance than pedigree, similar to prop trading firms.

And in fields like corporate finance, much of the recruiting happens at schools that are “semi-targets” for investment banking, such as ones in the #30 – #50 range in the U.S.

Q: Forget ranking banks and schools. What about House of the Dragon vs. Rings of Power?

A: Did ChatGPT write this question?

If you watched both shows and have a functional brain, I don’t understand how you could think they’re even close to comparable.

To me, House of the Dragon was a 6 or 7 out of 10, while Rings of Power was more like a 3 or 4. It wasn’t the worst show I’ve ever seen, but it was a huge disappointment considering the franchise and the budget.

Putting aside all the controversy over the casting and other “woke” elements, the characters in RoP were bland and terrible, and most of the narrative, such as the “origin story” of Mordor, made no sense.

House of the Dragon had issues, such as jarring time skips and some actions lacking logical consequences (e.g., everything Criston Cole does), but I still cared about what was happening and wanted to see the next episode each week.

Q: Other TV recommendations/rankings?

A: Of the new shows/seasons this year, my favorite was the final season of Better Call Saul. The show was a bit slow in the early seasons, but it picked up over time, and the last few seasons are just as good as Breaking Bad.

Andor was also a pleasant surprise and easily the best series on Disney+, with the best writing in the Star Wars franchise since 1980.

I also continued to like Cobra Kai, despite the many contrivances and ridiculous plots, but the show needs to end before it gets even more ridiculous.

Internships and Jobs in the New, Terrible Macro Environment

Interest rates and inflation are up, and deals and bank hiring are way down. What could possibly go wrong?

Q: I’m set to start a BB summer internship next year. With news of hiring freezes, layoffs, and declining deal activity, how can I prepare to win an offer?

Should I learn programming in addition to Excel, PowerPoint, and accounting/finance?

A: All you can do is assume that banks will award fewer full-time offers to interns and plan accordingly (i.e., do some networking for “Plan B” options afterward).

Unfortunately, doubling down on technical skills is unlikely to help much.

You need some proficiency in Excel, PowerPoint, and accounting/finance to do the job, but learning real programming languages such as Python or R is overkill for an IB internship.

Save the technical prep until close to your internship start date (within 1-2 months), and focus on getting to know your group.

Knowing about the Associates and VPs to avoid and the ones to work with will be far more useful than knowing several extra Excel tricks.

Remember that you usually need at least one strong advocate and 0 “no” votes to win a return offer, and plan your time around that.

Q: I’m in a Big 4 Transaction Services group in London, and I want to move into IB.

But all my contacts at banks are saying that they’ve frozen hiring or are preparing to make cuts. How should I change my networking approach? Should I switch to our internal M&A advisory team?

A: This one depends mostly on how long you’ve been there.

If it’s 1-2 years or less, you could stay and see if things improve next year and start networking more aggressively then.

If you’ve been there longer than that, I recommend switching to the M&A group sooner rather than later so you get more relevant experience and don’t get “stuck” in TS.

Having “too much experience” is less of an issue in London because lateral and off-cycle hiring are more common, but there are still some limits, and it always helps to have experience that looks closer on paper.

Q: How will this new environment affect private equity?

On the one hand, fewer deals hurt their returns, but on the other hand, they also have a lot of “dry powder” (committed, unallocated capital).

A: My prediction is that it will be like what happened to many PE firms after 2008.

Yes, they still had plenty of capital, but the funds they raised in 2006 – 2008 performed poorly, and it took years for fundraising and large deals to recover.

Many PE firms bought companies at inflated valuations in 2020 – 2021, which will come back to haunt them over the next few years.

I don’t think PE firms will “fire” many Associates or Analysts, but hiring for new Associates will probably be down for a while.

Q: Does this new environment benefit anyone?

A: The simple answer is that it helps certain hedge funds that trade based on volatility, inflation, or commodities, such as global macro funds. And yes, we will cover commodity trading advisors (CTAs) soon.

I could also see some distressed PE firms and hedge funds benefiting, along with certain infrastructure and real estate funds because of their perception as “inflation hedges.”

Q: What about an updated “Is Finance a Good Career Path?” article?

A: It’s set for January. The short version is that finance is still a fine career, but I expect the outsized pay premium to fall over the next few decades.

The 2020 – 2060 period will be very different than the 1980 – 2020 period, as many of the key trends that boosted tech and finance will diminish or reverse (demographics, interest rates, energy, urbanization, anti-trust, emerging markets, etc.).

Twitter and Other Questionable Leveraged Buyouts

Q: You wrote a skeptical article about the Twitter buyout earlier in the year. Now that the deal has closed, what do you think? Is Elon Musk crazy/unstable?

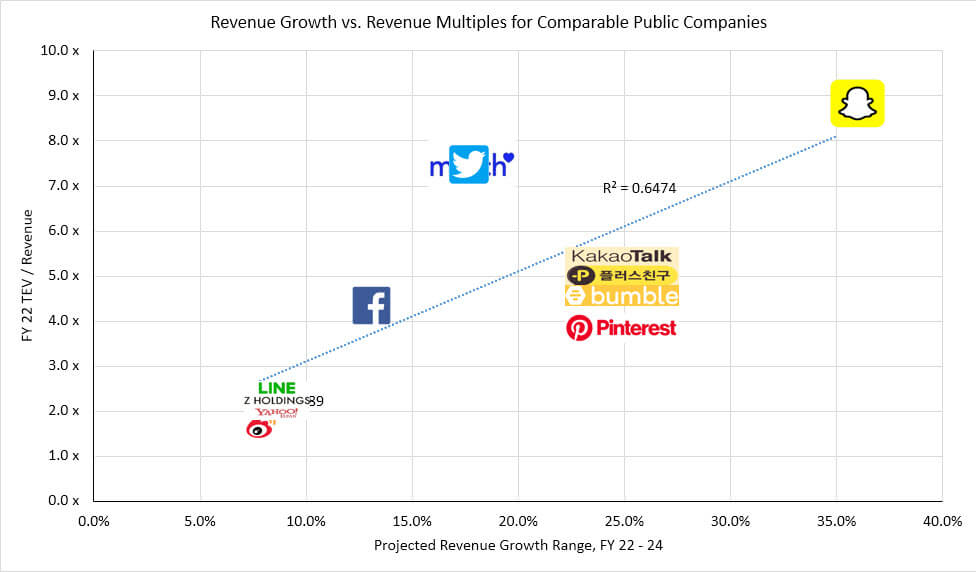

A: My views haven’t changed much since April – it’s a tough deal because he paid a very high price for a company that will be difficult to turn around:

I was surprised that he fired almost everyone so quickly, but realistically, Twitter didn’t need anywhere close to 7,500 employees to operate.

But the problem is that revenue will also fall if advertisers flee, so even if the company’s margins improve, cash flow, EBITDA, etc., will all decrease in dollar terms.

The biggest problem, though, is that Elon Musk may not be the right person to turn Twitter around.

He’s great at building companies to tackle engineering challenges, such as producing EVs or launching rockets, but Twitter’s challenges are mostly social/legal/ethical.

There’s also something of a contradiction between “free speech” and “advertising revenue,” and I’m not sure how that gets resolved.

Q: Which other large LBOs done in 2022 will turn out poorly?

A: All of them?

Any of the ones on that list with “hung debt” (debt that could not be sold initially and had to stay on banks’ Balance Sheets), such as Citrix, will probably not do well.

But even deals struck before 2022, such as Athenahealth, may not turn out well because PE firms paid insane prices for mediocre assets.

I don’t have the EBITDA multiple for Athenahealth, but it appears to be in the 30-40x+ range for a company growing at 10% (or even declining), which makes the math quite difficult.

Q: Will Microsoft’s acquisition of Activision Blizzard go through? Should It?

A: I think the FTC will probably succeed in blocking it on anti-trust grounds, or it may win concessions that result in much different deal terms (such as guaranteed cross-platform games).

Whether it “should” go through is interesting because Activision Blizzard is a broken company, as anyone who plays games knows.

The culture is terrible, and some of its key franchises are not doing well, so Microsoft could improve the core business.

But Microsoft’s claim that it’s “#3” in games after Sony and Nintendo is also deceptive. While that is true based on market share, MSFT is also around 20-40x bigger by market cap and financial resources.

Unlike its competitors, Microsoft can afford to pour money into unprofitable ventures for years/decades, so most governments will be opposed to these huge deals.

Plans for Next Year

Finally, back to those questions that never go away…

Q: Will you write an updated article on IB in Singapore? What about Australia? India? China? Dubai?

A: There will be updated articles on IB in Singapore, Australia, and Dubai [UPDATE: They’re all here now.]

With other countries and cities, it depends on the overall traffic and interest level. I’m not going to update the old articles for smaller countries, but some larger regions might get new versions.

So, yes, we’ll do something for China and India, but I’m not sure about the others yet.

Q: What about new courses? Venture capital? Project finance / infrastructure? Distressed / restructuring?

A: We added an entire module on venture capital, early-stage companies, and SaaS modeling to the Financial Modeling Mastery (FMM) course earlier this year (see some early feedback below):

It has two full case studies to get you up to speed on the key topics (cap tables, valuation differences, pre/post-money, earn-outs, etc.).

I may also turn it into a separate course in the future, as the current FMM course feels too long and detailed, and these specialized topics should probably be separate.

UPDATE: We decided to split up this entire FMM course, and it’s now available as shorter, separate financial modeling courses.

Other plans for next year include:

- New PowerPoint Course – This will arrive in January. It focuses heavily on VBA and macros (10+ hours of training) and will include a custom macro package for PowerPoint, an updated presentation database, 50+ editable templates recreated based on bank presentations, and more.

- Insurance / FIG Additions – I plan to update the Bank Modeling course and add insurance models/valuations and case studies on fintech and asset management.

- Project Finance / Infrastructure – This will initially be a $100 course based on short case studies, and the price will increase as the content expands.

Q: How long do you plan to write articles for this site? Is there anything new to say?

A: I started this site 15 years ago, so, yes, I am tired of certain topics by now (low GPAs, the CFA, etc.). And most of the core topics have been covered to death.

There is value in updating the articles and covering new areas, such as specific HF/PE strategies, but it is difficult to justify spending 10+ hours per week on it (and some articles take more like 30 hours to research and write).

Also, there’s quite a disconnect between this site’s readership and customers of the courses; in a recent promotion, hardly any sales came from emails sent to tens of thousands of newsletter subscribers.

With all that said, I would like to keep the site going, but the format and frequency are likely to change in the future.

So, I don’t expect to be writing everything for another 15 years, but the site should still exist in some form.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

Hey Brian – I am a low GPA grad from a non-target, should I get my CFA to lateral from Northwestern Mutual to a top BB IB group OR should I pick an EB?

Kidding of course. Thanks for all the information over the years, it has helped me significantly.

Best

Thanks! And we both know the answer: take the CFA 4 times and stay at Northwestern Mutual for life.

(This is sarcasm for anyone else reading who has trouble understanding sarcasm in writing.)

Hi Brian,

I’ve been an accountant for several years before I joined the strategy team at a public company. I’ve been interested in moving into a direct M&A role, whether that’d be like a private equity analyst, something in corporate development, or even some type of business advisory role. Ive managed to get several interviews and have done well in them. I’ve gotten to the final round in nearly all of them but I havent won any offers. Ive asked and gotten feedback from the hiring manager and the most common feedback I get is “we really liked you, but we need someone with a stronger knowledge base on M&A transactions”. So to the effect of, we need someone with direct M&A experience.

I feel like Im in a catch 22. No one will hire in M&A because I dont have experience in M&A. I feel like I am approaching the time where my seniority makes me too old to be an analyst but not experienced enough to be considered for associate roles, especially if Im not getting analyst roles. Is there something I’m missing that could put me over the edge? Would a certificate program help show employers I am committed and have the knowledge necessary? I have a CPA, but that isnt going to get me too far.

The main thing that might help you at this point is an MBA because you could use the degree to move into an IB Associate role if you use it correctly. But it is expensive and time-consuming, so I’m not sure I would recommend it until you’ve exhausted all other options.

If you’re already in a strategy role, probably your best bet is to keep looking for corporate development roles and see what turns up; if that does not work after multiple interviews, maybe think about something like corporate banking that uses similar skills but is less competitive and not as strict with the entrance criteria.

Other than the CFA / maybe the CPA, other certificates do not really prove much and, more importantly, they don’t give you direct access to recruiting in the way an MBA or Master’s program does (yes, we offer certificates, but only because competitors also offer them).

Hi Brian,

Are you going to shut down the site by any chance?

Your site is a knowledge powerhouse and it will help lot of people now and down the line as well. Even if one doesn’t get a job in the field we can use the knowledge for our personal use and other purposes as well.

Please keep it going

No.

“With all that said, I would like to keep the site going, but the format and frequency are likely to change in the future.”

OK, if there is a zombie apocalypse or the entire finance industry is wiped out, maybe it does not make sense to host the site anymore. But otherwise I would keep it up as long as it generates some amount of income. But I’m not sure how useful it is, given the many copycat/competitor sites out there. People are mostly just repeating the same information over and over.

Would you consider selling? If so, what price would you accept?

Probably not because this business isn’t worth that much (my current net worth is several multiples of a fair value). If someone came along and offered a sky-high price with good terms, sure, maybe.