Investment Banking in Singapore: The Best Gateway to Asia for the Non-Chinese?

I’ve found that two main groups care about investment banking in Singapore:

- Students who are from Southeast Asia and are considering whether they want to work in Singapore, NY, London, or other places.

- People who want to work in Asia but have no chance of winning an offer in Hong Kong and see Singapore as their “Plan B” option.

If you’re in the first group, congrats! You’ll learn about the trade-offs of Singapore and other locations in this article.

If you’re in the second group, you might want to think again because Singapore may not be quite the “Plan B” option you think it is.

But before I crush your hopes and dreams, I’ll start with an overview of the industry and the top banks:

What is Investment Banking in Singapore All About?

Singapore (SG) serves as a hub for Southeast Asia and the many cross-border deals that take place there.

It’s safe, stable, low-tax, and light on corporate regulation – you can safely ignore the occasional executions of cannabis traffickers.

As a result, many companies from nearby countries want to do deals there.

Even though Singapore itself is not an emerging market, you’ll be exposed to plenty of emerging markets if you work there because most Southeast Asian countries fall into this category.

That said, it is also much smaller than NY, London, and HK in terms of average office size, deal volume, and deal size.

The IB industry there is arguably even smaller than in countries like Australia and Canada, which makes it quite difficult to get hired.

Yes, Singapore is a hub for Southeast Asia, but Southeast Asia has relatively few deals in the Asia-Pacific region vs. places such as China/HK or even Australia.

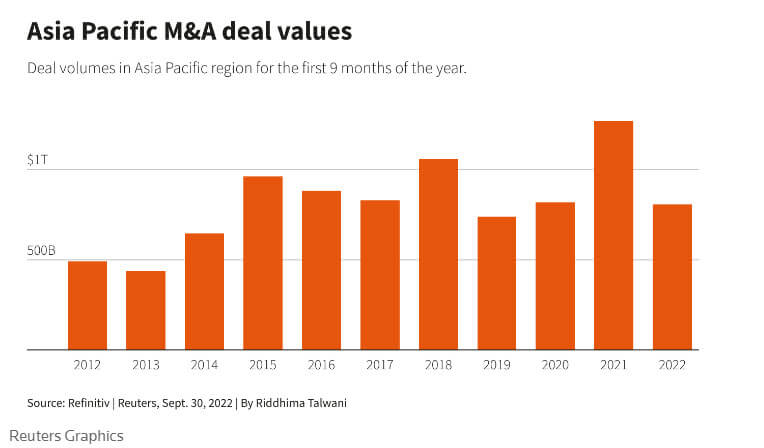

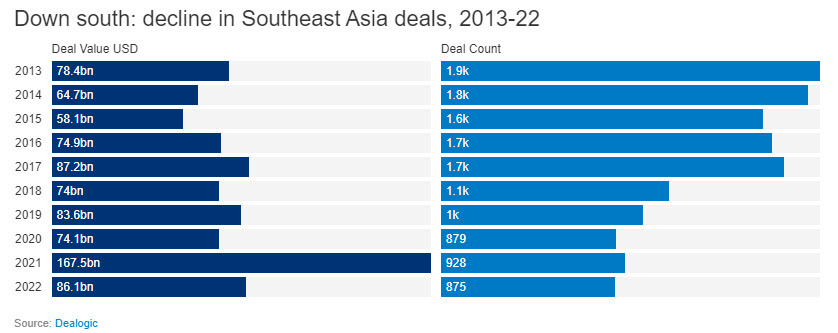

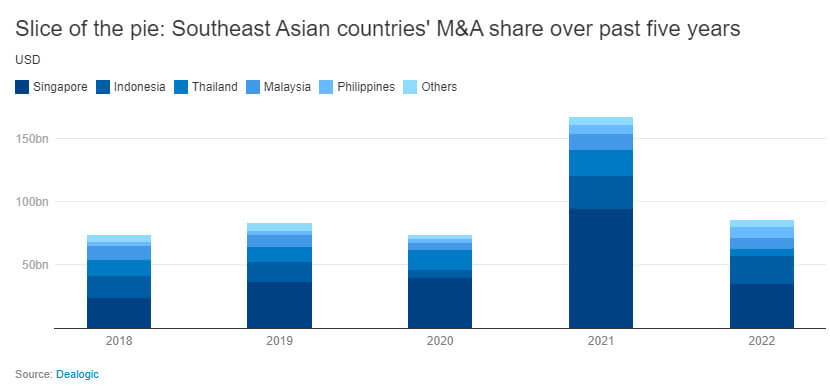

Asia-Pacific sees ~$1+ trillion of M&A deal activity per year, and SE Asia accounts for only ~10% of that (note that the first image below is only for 9 months of the year, so the full-year numbers are higher):

You can see a breakout of deals by specific country below, based on the same sources (ION Analytics, Dealogic, and Merger Market):

It’s just that it’s smaller than you might expect, which means a lower investment banking headcount than true financial centers.

Investment Banking in Singapore: Top Banks, Industries, and Deals

You can divide firms in Singapore into “large international banks” and “Asia/Singapore-focused banks.”

The basic difference is that the international bulge bracket banks tend to be stronger in M&A advisory and weaker in equity and debt capital markets.

If you look at the M&A league table for Southeast Asia, you’ll see the expected names: Morgan Stanley, Citi, BofA, JP Morgan, Credit Suisse (now acquired by UBS), and so on.

Goldman Sachs’ status has been questionable for a few years due to the continued fallout from the 1MDB scandal in Malaysia.

Among the elite boutiques, Evercore has the strongest presence in Singapore, and Rothschild also works on many deals, mostly in the middle-market space.

Lazard also used to be active but has since shut down its Southeast Asia M&A practice.

If you focus on the capital markets, you’ll still see some of these names (e.g., Morgan Stanley, BofA, and UBS/CS), but also a huge range of other firms.

The top three domestic banks in Singapore are DBS Group, United Overseas Bank (UOB), and Overseas-Chinese Banking Corp (OCBC), which, despite the name, is actually Singaporean.

You’ll also see banks from other Southeast Asian countries, including CIMB, Bangkok Bank, Kasikornbank, and Maybank, and various Chinese banks, such as CITIC and the Bank of China.

Then there are the European “In-Between-a-Banks,” such as HSBC, Standard Chartered, and BNP Paribas, the Japanese banks (Nomura, Sumitomo, and Mitsubishi UFJ), and Australian firms like ANZ and Commonwealth Bank Australia.

These banks focus on the capital markets, so you should target the bulge brackets if you want to work on M&A deals.

In terms of industries and deal types, Singapore is quite diversified.

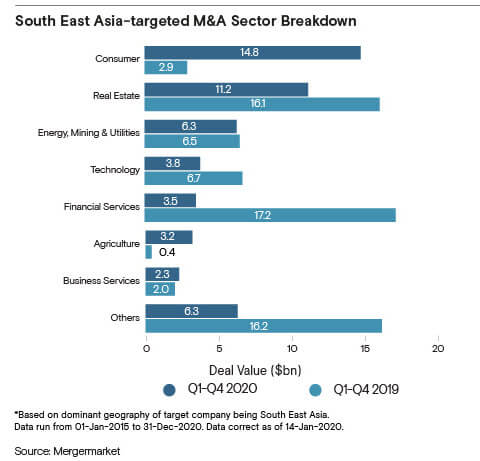

You can expect to see everything from energy, mining, and agricultural deals to real estate, consumer retail, chemicals, semiconductors, and pharmaceuticals; technology has also become increasingly popular.

Some of the most common industries for M&A deals are shown below:

The deal types span a wide range, but equity and debt deals are more common than M&A since many companies in emerging markets are in “growth mode.”

Investment Banking in Singapore: Recruiting and Interviews

The overall recruiting process, timeline, and interviews are not that different in Singapore.

The main differences are:

- Candidate Profiles – You are at a huge advantage if you are a Singaporean citizen or Southeast Asian national with language skills and attend a top university in the U.S. or U.K. (but the top few Singaporean schools can also work).

- Target Schools – The top target schools in the U.S. and Europe are also targets in Singapore, but the top few SG universities also join the list (see below).

- Small Intern Classes – Many bank offices in SG hire 4-5 summer interns per year, so there might be a total of 50-100 spots available, putting it in the same size range as Australia.

As in the U.S., the undergrad recruiting process starts a year or more in advance of internships, and it has moved up over time.

The most important controllable factors are your university’s quality/ranking, your GPA, your previous internships, and the networking you do.

(You cannot control whether you’re a Singaporean citizen or a native speaker of Thai or Vietnamese, so these points are not on the list).

As in other regions, the most important point is to start as early as possible in Year 1 of university because you need time to complete off-cycle internships at boutique firms.

A few smaller IB/PE firms known to offer these internships include Reciprocus, Redpeak, Titan Capital, Pickering Pacific, and Provident.

Some bulge bracket banks, such as JP Morgan, also offer off-cycle internships as a “pipeline” into summer internships and eventual full-time offers.

Interviews are not much different, and you can expect the same behavioral, deal, and technical questions you’d get in other regions.

Firms do not appear to use formal assessment centers as they do in the U.K., but they might still ask you to complete a case study or group exercise.

Do You Need to Know Southeast Asian Languages to Work in Singapore? Do You Need to Be a Citizen?

The short answer is: “Technically, no, but Southeast Asian languages and Singaporean citizenship help a lot.”

Since there are so many cross-border deals in Singapore, English is the common business language.

But many companies do not necessarily have all their information in English, so knowing a language like Vietnamese, Thai, Tagalog, or Indonesian can give you a huge boost.

Chinese might also help, but most deals involving Chinese companies have shifted to Hong Kong, so it has become a bit less relevant over time.

On the question of citizenship: For many decades, Singapore actively encouraged foreigners to work in the country as it developed.

But more recently, it has taken a protectionist/nationalist turn and made employers jump through more hoops to hire foreigners (often requiring them to “prove” that no local candidates could do the job).

You could still apply and get a firm to sponsor your work visa, but it’s more difficult than it was in, say, 2015 or 2005.

Investment Banking Target Schools for Singapore-Based Roles

The U.S. and U.K. target schools are also target schools for Singapore IB recruiting (especially the top 2-3 in each country).

You could even argue that recruiters prefer candidates from Southeast Asia who attend top schools in the U.S. or Europe and plan to return to Singapore.

Within the city-state, there are also 3 target universities: Singapore Management University (SMU), Nanyang Technological University (NTU), and the National University of Singapore (NUS).

People often say that SMU is the “best” among these due to its alumni network and placement record, but I’m not sure I want to get into that argument/debate in this article.

The specific degree/major you choose doesn’t matter that much, but Business Administration & Accounting (or “Accountancy & Business”) is a popular choice.

Accounting is far more relevant for IB than general “business” skills, and at a place like NTU, it’s a 4-year degree rather than a 3-year degree, giving you more time for internships.

Investment Banking in Singapore: Salaries, Bonuses, and Taxes

As with the IB in Australia article, I found contradictory data from different compensation reports.

The main claims were:

- Base salaries are similar to those in NY, but bonuses are slightly lower percentages of the base.

- Or base salaries are similar numbers to the ones in the U.S., but they’re all in Singapore Dollars (SGD) instead. So, instead of earning a $120K USD base salary, you would earn the $120K in SGD, which is about $90K USD.

I do not know which claim is correct, but if you split the difference, you can assume that you’ll earn at least slightly less pre-tax in Singapore than in the U.S.

On the other hand, the pay seems higher than in London and most European countries.

And if you factor in taxes, the post-tax compensation is quite good because the top rate is currently 24%.

As an Analyst, you’ll pay something in the 15 – 20% range, similar to Hong Kong.

Singapore is an expensive city, but it’s also cheaper than NY in terms of rent, food, and other expenses (and about on par with HK; maybe slightly more, depending on the metric).

So, even if total compensation is lower in USD, you could easily save more in Singapore due to the lower taxes and reduced cost of living.

And if you have better numbers for the base salaries and bonuses, please feel free to leave a comment.

The Lifestyle and Hours in Singapore

The hours are somewhat better than in Hong Kong or New York but worse than in London and most other parts of Europe.

Like investment banking in other regions, if you’re at a large firm and have a relatively “easy day,” you might arrive home after ~10-12 hours at the office.

If you have a bad day (client emergency, deal blow-up, last-minute pitch book, etc.), you might be at the office until 5 AM.

The average is somewhere in between, so expect lots of office stays past midnight and limited free time outside of weekends, at least as an Analyst.

In terms of the actual work, there are relatively few mega-deals, so even at the largest firms, you’ll see a lot of transactions in the $500 million – $5 billion range; the non-BB banks will go well below that range.

Offices also tend to be smaller, with perhaps a dozen or two people in each, which is both good and bad: you get more exposure but also less “cover” when something goes wrong.

Sector specialization tends to occur later because no single industry dominates all deal activity.

Investment Banking in Singapore: Exit Opportunities

The standard exit opportunities – private equity, hedge funds, and corporate development – are all available in Singapore, but everything is smaller.

I’ll contextualize this with Capital IQ search results for PE firms and hedge funds in different regions:

- Private Equity Firms: U.S.: ~7,200 | U.K.: ~1,000 | Singapore: ~170

- Hedge Funds: U.S.: ~3,200 | U.K.: ~500 | Singapore: ~50

Even Hong Kong has 50-100 more firms in each category, and that’s not counting the China-based funds with HK offices.

That said, the private equity mega-funds all operate in Southeast Asia, and most have offices in Singapore.

PE recruiting mostly follows the “off-cycle” process, which can be long, drawn out, and somewhat random.

The large firms recruit Analysts from Singapore and occasionally other locations, like London, NY, and HK, so you’re not necessarily region locked.

Outside the biggest firms are Asia-focused funds like Barings (now owned by EQT) and L Catterton Asia, followed by firms that invest in smaller deals or only in specific countries.

Other PE names here include Hillhouse Capital (East Asia focus), Affinity Equity (Pan-Asia), Lighthouse Canton, Aura Private Equity (Pan Asia), Creador (SE Asia), Dymon Asia Private Equity (SE Asia), Navis (SE Asia), Makara Capital, Axiom Asia, Northstar (SE Asia), and Gateway Partners (EM focus).

Then there are pension funds and sovereign wealth funds, including Singapore’s own Temasek and GIC, which are very active in deals there.

Because of the emerging markets focus, most “private equity deals” are more like growth equity deals, with minimal leverage and more complexity operationally than financially.

You’ll still get modeling experience, but you won’t be building the same LBO models that you would in the NY office of Blackstone.

The hedge fund side is much sparser, and while many of the large multi-managers operate in Singapore, there aren’t many domestic funds.

To be fair, hedge fund activity anywhere outside the U.S. and U.K. is limited, so Singapore is not unique here.

Many bankers also stay in banking and advance up the ladder, as it’s tough to beat the after-tax savings and somewhat-better lifestyle.

But be careful about staying too long if your long-term goal is to work elsewhere.

Deal experience in Singapore doesn’t always translate well to other regions because of the focus on emerging markets, so leave early if you want something else.

Investment Banking in Singapore: Final Thoughts

The biggest takeaway is that Singapore is not a great “Plan B” if your goal is to work in Asia without knowing a local language or having a strong connection to the region.

Yes, it’s more plausible to win a role in SG than HK as a foreigner, but both have become more difficult over time.

Singapore has its advantages, but it is very much geared toward people with a background in the region who want to be there long-term.

I think the more relevant question here is: “If you’re from Southeast Asia, should you aim to start working in Singapore, or should you start in NY or London?”

And I would still recommend NY or London for the networking, resume/CV value, higher number of positions, and exit opportunities.

Singapore could be interesting after you gain experience in a bigger financial center and then return to the region (due to family, higher savings, or a desire to specialize).

It could also make sense to transfer to Singapore for 1-2 years and then move elsewhere to get a unique experience without getting “stuck.”

And if you ever find yourself disappointed by the downsides of Singapore when you’re stuck at the office at 2 AM, just think about the taxes vs. NY or London for a quick boost.

Want More?

You might be interested in reading about Investment Banking In Dubai.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

Hi Brian, thanks very much for the article! I’m currently a Singaporean about to begin studies at a UK target school, but my long term plans are ultimately to come back and work in Singapore. I would love if you could answer the following questions:

1. Is there still any value to having overseas work experience on my CV if my long-term plans are in SG?

2. Am I better off pursuing the spring/summer grind in London and transferring back as an associate, or should I try to apply for summer internships in Singapore and get FT offers that way?

3. Would this process be different for IB and MC?

Thanks!

Hi Brian, thanks for your helpful article! I’m a Singaporean studying in a target school in the UK, but my long-term plans are ultimately still to work in Singapore, although I do believe there is still some value to having some overseas work experience on the CV (your thoughts?). Do you think I would be better off pursuing the spring/summer grind in the UK, and then transferring back as an associate, or should I begin my summer internships in Singapore? Additionally, do you know if there would a difference depending on whether I was in IB or MC as to which option I should pursue? Thanks!

Thanks for the article Brian.

I lived in Singapore for a while growing up and would like to return, but unfortunately am not a citizen nor do I speak any SEA languages. I’ve just finished my first year at a target school in the UK and have managed to convert a spring week at a BB, so have an offer for a summer internship in 2024 there. I was wondering what I should do from here to maximise my chances of being able to work in Singapore. Apply for 2024 SA positions in Singapore and renege if I get an offer (I realise this is incredibly unlikely, but no harm in applying)? Or work in London for a couple of years and try and transfer to Singapore later? To be clear, I have little interest in exit opps or rapid career advancement and my main aim is to work in SG.

Thanks in advance.

Thanks. I very strongly recommend against giving up a summer internship in London just for a chance of working in Singapore. It’s not even a great idea to apply and then renege if you get an offer, as you’ll just burn bridges and start out in a less-ideal location.

You should work in London for at least 1-2 years and then transfer to SG later.

Hey Brian, thanks for the awesome post – really helpful. Do you know how important networking is in Singapore and do you have any advice for Singaporean studying overseas who want to do IB in singapore? For context, im a singaporean student studying in a target school in the UK. Currently starting my 2nd year soon (havent went thru penultimate summer internships yet). Any advice would be highly appreciated but im particularly worried abt not having contacts/connections since im studying overseas. Thank you in advance!

Networking always helps, but the real question is how much time/effort you should put into it. In Singapore, it’s less useful if you already have a target UK school on your resume/CV, but I don’t think you can completely ignore it. My advice here would be to start reaching out to Singaporean bankers right now so you don’t miss out on internships next year and say that you’re studying in the UK but from SG and plan to return there. I am not sure about the application dates because they change each year, but SG internship recruiting should still be slower than the US timeline (which is already done for 2024 summer at the large banks).

I would start by reaching out to maybe 10-15 bankers you can find on LinkedIn and try to set up 5-10-minute calls with them. Focus on your situation and the best way to back from the UK to SG to work. I think you’re better off interning in SG to start, but some might recommend aiming for London-based roles and then transferring.

Why investment banking instead of data science in one of the top three banks in Singapore??

I know of a few data science expats working in Sg banks etc.?

I don’t understand your question. Are you asking why people, in general, would pick IB over data science? Are you asking if one is easier/better as an expat in Singapore? Or are you asking for you, personally, whether IB or data science would be better? Happy to answer or explain if you can clarify.

Hi Brian, do you know what is the compensation like for private equity roles in Singapore? Is it similar to IB that it is comparable to US but in SGD?

I am not sure offhand, but I would assume that compensation is quite a bit lower due to the smaller fund sizes, the growth-stage deals, and (probably) more inconsistent performance. So it might be closer to (lower) middle-market compensation in the U.S. I have no real data and didn’t look up any compensation reports, but this is how it works in various other countries with similar types of PE industries and an EM focus.