Metals & Mining Investment Banking: The Full Guide to Ground Zero for the Energy Transition

Metals & mining investment banking used to be a “sleepy” group.

Many people viewed the sector as a short, poorly dressed cousin of oil & gas, but concentrated in places like Canada and Australia.

The two industries have a lot in common, but in the current cycle, different forces are driving mining – such as the demand created by renewable energy, electric vehicles (EVs), and the promised “energy transition.”

The good news is that if you work in mining IB, and your clients produce the cobalt, copper, or lithium that ends up in EV batteries, you can feel good about saving the world.

The bad news is that your clients might also be exploiting underpaid workers and child labor in the Democratic Republic of Congo, which may slightly offset “saving the world.”

But let’s forget about the children temporarily and focus on the verticals, the drivers, deal examples, and the exit opportunities if you escape from the underground mines:

What Is Metals & Mining Investment Banking?

Metals & Mining Investment Banking Definition: In metals & mining investment banking, professionals advise companies that find, produce, and distribute base metals, bulk commodities, and precious metals on debt and equity issuances and mergers and acquisitions.

The concepts of upstream (“find”) and midstream/downstream (“produce and distribute”) still exist, as they do in oil & gas.

For example, an iron ore miner is “upstream” since it extracts the raw materials, and the steel producers that turn that ore into steel and distribute it to customers are downstream.

However, mining companies are usually classified based on their focus metal.

For example, Capital IQ splits up the sector by metal type (aluminum, diversified, copper, gold, precious metals, silver, and steel).

I think this is a bit too complicated, so this article will use these 3 categories:

- Base Metals and Bulk Commodities – Anything used for energy (coal), as a precursor to other metals (iron ore), or to produce electronics, batteries, and other products (copper, cobalt, lithium, aluminum, etc.) goes here.

- Precious Metals – Gold is the biggest component here, but metals like silver, palladium, platinum, diamond, and emerald also go in this category. Some of these may be used for non-industrial purposes, such as investment or jewelry, but others, such as silver and platinum, have many practical uses in cars and electronics.

- Diversified Miners – These companies have a wide global portfolio of mines, and they extract, produce, and distribute just about every metal in the two categories above.

The metals & mining team’s classification varies based on the bank.

Sometimes, it’s in the broad “Natural Resources” group, but it could also be in Industrials, Renewables, or even Power & Utilities.

And in regions where it’s especially important, such as Canada and Australia, metals & mining is often a separate team at banks.

Recruitment: Tunneling Your Way into Metals & Mining Investment Banking

Metals & mining is highly specialized, so you have an advantage if you have a background in geology, geophysics, or mining.

But it’s not necessarily required, and plenty of undergrads join these groups via internships without detailed knowledge of the engineering side.

If you have an engineering background, you might get hired for your ability to read and interpret technical analyses such as feasibility reports and help bankers incorporate them into financial model assumptions.

Aside from that, banks look for the same criteria as always: a high GPA, a good university or business school, previous internships, and networking and interview preparation.

You don’t need to be a technical mining expert to pass your interviews, as all the standard topics will still come up, but you should know the following:

- The main categories of metals and the factors that drive their prices, production, and supply (see below).

- A recent mining deal, especially if the bank you’re interviewing with advised on it.

- Valuation, such as the different multiples used for mining companies and the NAV model in place of the DCF (see below).

What Do You Do as an Analyst or Associate in the Group?

If you’re advising mostly large companies like BHP or Rio Tinto, expect lots of debt deals, occasional M&A mega-deals, and many smaller asset-level deals.

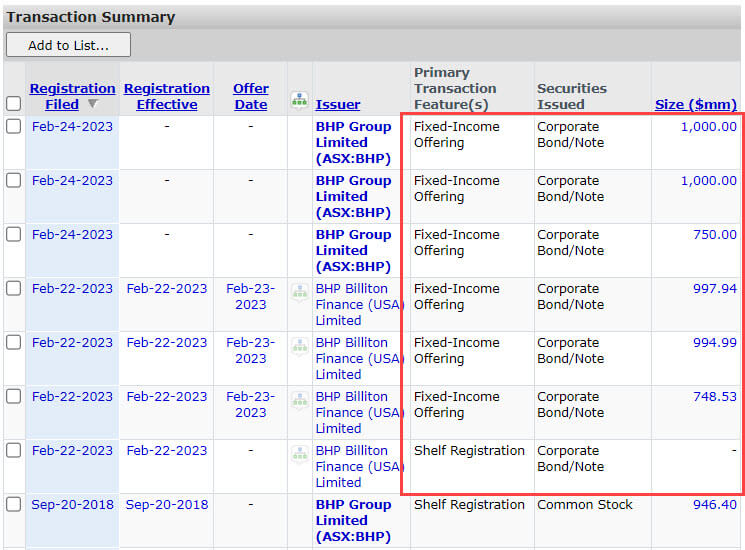

Here’s an example from BHP’s deal activity:

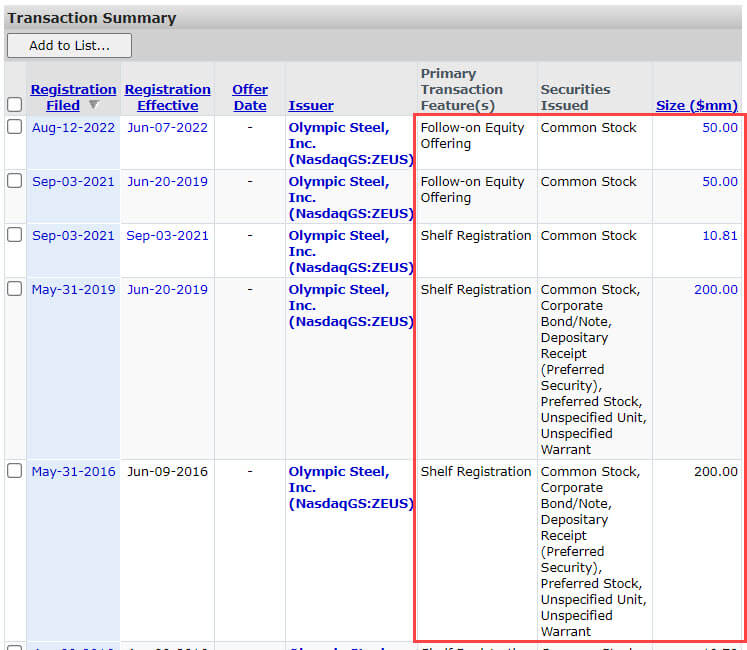

If you’re at a smaller bank that advises growth-stage companies, expect more equity deals, private placements, and sell-side M&A transactions.

Here’s an example from Olympic Steel’s deal activity:

If you’re wondering about the modeling and technical experience, most differences relate to the company type rather than the specific metal.

In other words, a gold miner and a copper miner are slightly different, but they are much closer than a pure-play miner and a pure-play producer.

In practice, you’ll usually work with various companies (miners, producers, vertically integrated, royalty-based, etc.) in your focus area.

Metals & Mining Trends and Drivers

The most important sector drivers include:

- Overall Economic Growth – When the economy grows more quickly, companies need more raw materials for cars, TVs, infrastructure, and everything else in modern life. The sources of growth also matter; emerging markets’ infrastructure spending drove up metal consumption for a long time, but now there’s a rising demand in developed markets due to EVs and renewable energy.

- Commodity Prices – Higher metal prices help upstream mining firms but hurt downstream firms that purchase raw material inputs from other companies. And vertically integrated firms are in the middle since they experience both higher prices and higher costs. Oil, gas, and electricity prices also factor in because most metals are extremely energy-intensive to produce.

- Production and Reserves – All mining companies deplete their resources as they extract more from the ground, so they’re constantly racing to replace them. But new mines take a very long time to come online – years or even decades. As a result, supply and demand shocks tend to make a much greater short-term impact on prices than growth from new projects.

- Capacity and Spreads – Production companies always have a certain amount of “capacity” in their plants and factories, and they earn revenue based on the percentage capacity used to produce finished products and their realized prices. Profits are based on the spreads between the cost of the raw materials (iron ore) and the finished products (steel).

- Exploration and Development (Capital Expenditures) – How much are companies spending to develop new mines and expand existing ones? CapEx spending affects everything in metals, but because of the long lead time required to launch new mines, it’s a greatly delayed effect. On the producer side, you can see how much they spend to build new plants, factories, and processing centers.

- Taxes, (Geo)Politics, and Regulations – Many mining projects are in regions with unstable governments, wars, and other problems. These governments are often eager to charge foreign companies a premium to access their resources, and the rules and taxes around extraction can change at any time.

You might be wondering if “inflation” should be on this list.

It is a driver for precious metals, especially gold, but it’s less of a demand driver for metals with mostly industrial purposes.

Metals & Mining Overview by Vertical

Here’s the list:

Base Metals and Bulk Commodities

Representative Large-Cap Public Companies: ArcelorMittal (Luxembourg), Jiangxi Copper Company (China), POSCO Holdings (South Korea), Nippon Steel (Japan), Baoshan Iron & Steel (China), thyssenkrupp (Germany), Vale (Brazil), Aluminum Corporation of China, Nucor (U.S.), JFE (Japan), Tata Steel (India), Hindalco (India), Hunan Valin Steel (China), Cleveland-Cliffs (U.S.), Freeport-McMoRan (U.S.), and Steel Dynamics (U.S.).

Note that most of these firms are steel producers, not iron ore miners, so they’re closer to “normal companies.”

Also, note that some of these companies, such as Freeport-McMoRan, also mine precious metals, but they’re classified as “copper” since most of their revenue comes from copper.

Finally, some significant companies are missing from this list because they’re state-owned – the best example is Codelco in Chile, the world’s first or second-biggest copper producer.

With those disclaimers out of the way, let’s assume that you’re analyzing a copper mining company. You’ll think about issues such as:

- Production and Consumption: Chile is the world’s largest producer, while China is the largest consumer, which means that shocks in one can greatly impact prices and production.

- Costs: These vary based on the region and metal; for example, some metals are more energy-intensive (aluminum), while others are more labor-intensive. Shipping costs may also be a major factor for some metals, especially those with lower “value to weight” ratios, such as coal and iron ore.

- Key Uses: Since copper is the best conductor of electricity among non-precious metals, it’s widely used in machinery, appliances, batteries, and even electrical wiring for entire buildings.

All mining companies care about their production and reserves and always want to convince investors that they can grow them over time.

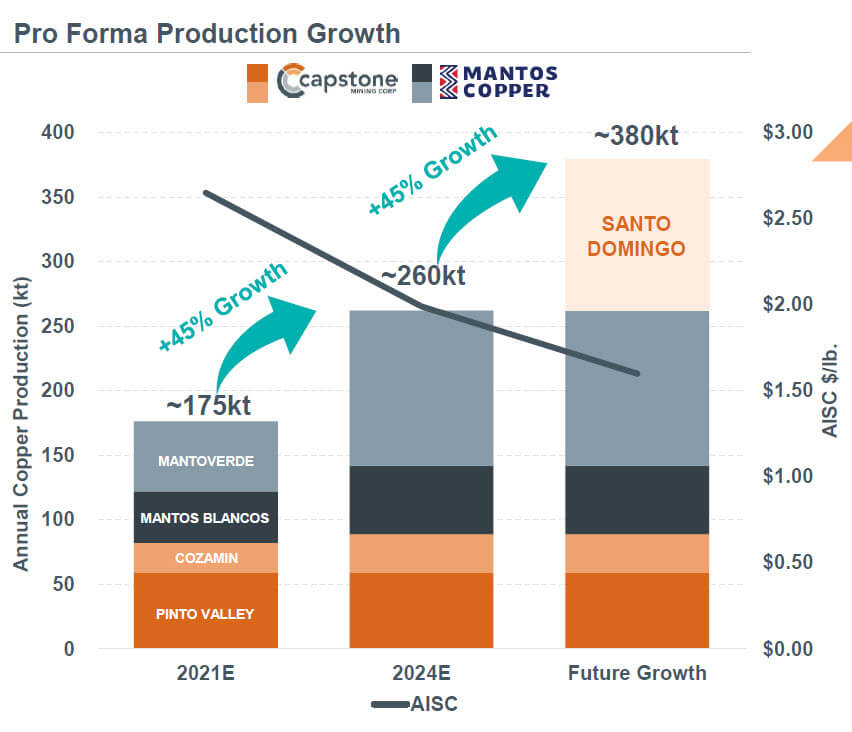

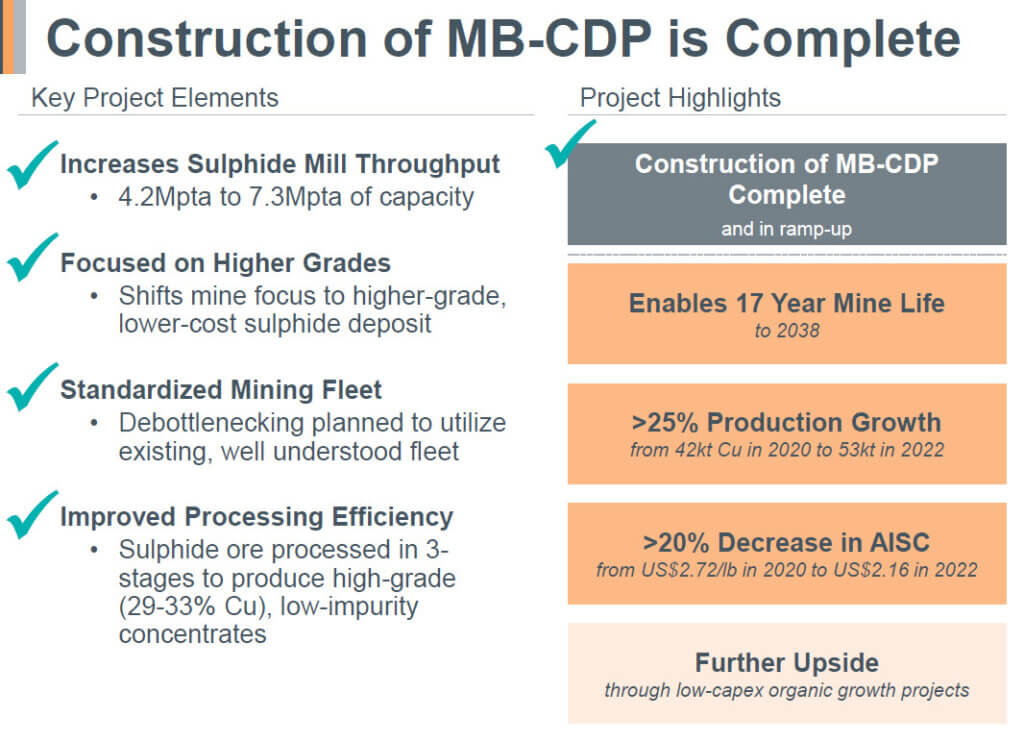

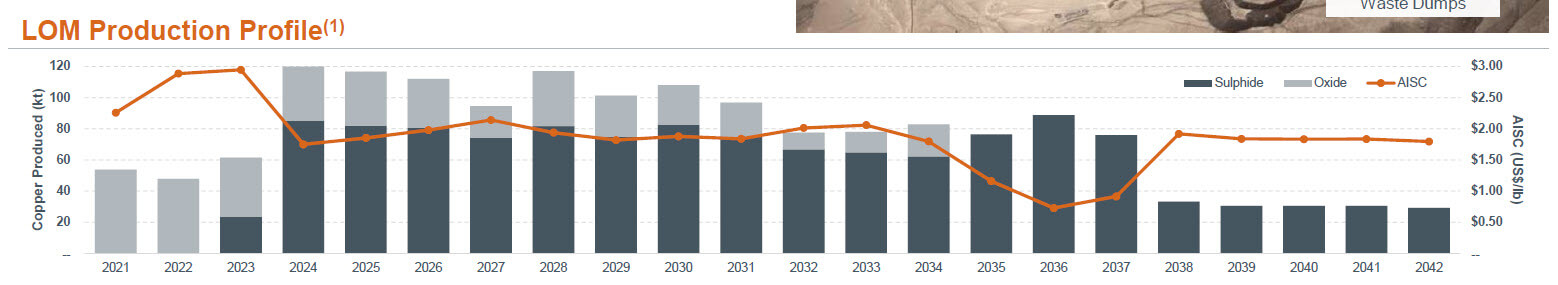

Here’s an example from the Capstone / Mantos Copper presentation below:

Companies often go into detail on individual mines, with estimates for their useful lives, annual production, and “all-in sustaining costs,” or AISC.

AISC is usually defined as the cash costs to operate the mine plus corporate G&A, reclamation costs, exploration/study costs, and the required development and CapEx.

Companies often provide long-term production forecasts in their investor presentations, so you don’t necessarily need to make many judgment calls in your models:

Gold and Precious Metals

Representative Large-Cap Public Companies: Zijin Mining (China), Newmont (U.S.), Barrick Gold (Canada), Anglo American Platinum (South Africa), Sibanye Stillwater (South Africa), Zhongjin Gold (China), Shandong Humon Smelting (China), Impala Platinum (South Africa), Sino-Platinum Metals (China), Agnico Eagle Mines (U.S.), and Industrias Peñoles (Mexico).

The big difference here is that the end markets differ – but many precious metals still have industrial uses beyond wealth storage and jewelry (e.g., silver and platinum).

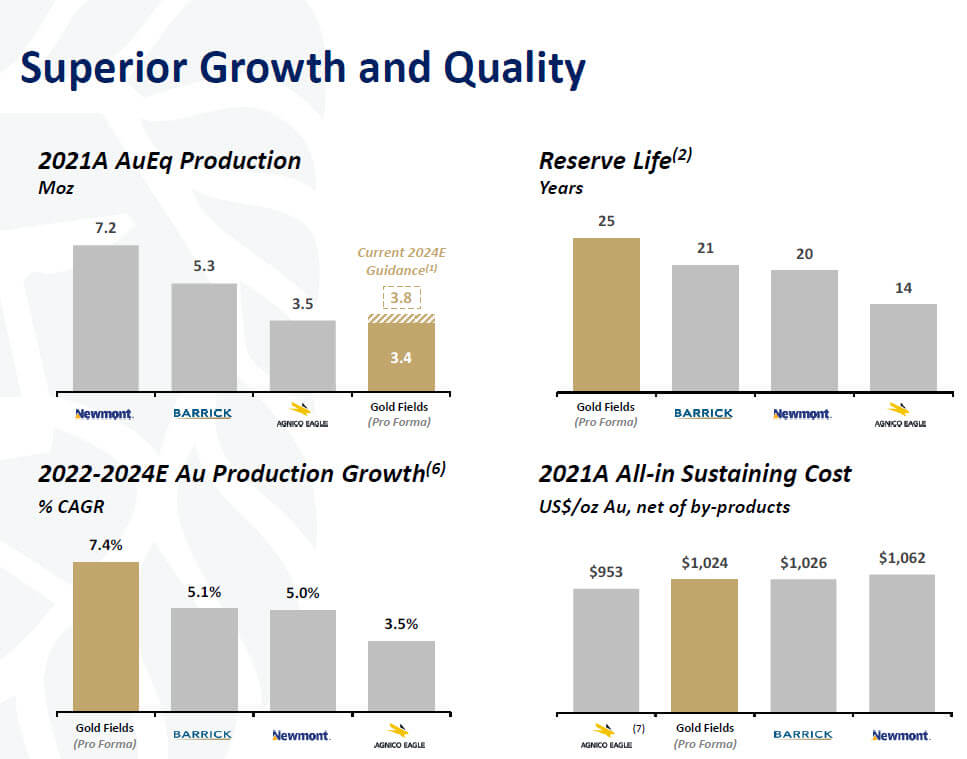

Precious metals miners are driven by many of the same factors as the base metals ones above: reserves, production, all-in sustaining costs (AISC), and the lives of individual mines:

But there are some key differences:

- Reserves and Extraction – Since metals like gold and diamond are rare, companies usually present their reserves in tonnes and estimate a “grade” they expect to find (in grams or ounces per tonne). On the other hand, gold also requires little to no refining once it is extracted, so at least part of the process is “easier” than the one for base metals such as copper.

- Global Pricing and Market Dynamics – The value-to-weight ratio of precious metals is high, so the freight costs are insignificant, and they can be shipped anywhere in the world. As a result, they operate in more of a global market, with fewer regional disparities. By contrast, metals like coal, iron ore, and steel are much more localized, and copper and aluminum are in between.

- Valuation – Since many people perceive gold as a stable, irreplaceable store of value, gold miners often trade at higher multiples than base metal miners (see the examples below).

Precious metals miners earn much less revenue than companies that focus on copper or steel, but the sector gets a disproportionate share of M&A activity because of the factors above.

Diversified Metals & Miners

Representative Large-Cap Public Companies: Glencore (Switzerland), BHP (Australia), Rio Tinto (U.K.), Anglo-American (U.K.), CMOC (China), Vedanta (India), Norilsk Nickel (Russia), Grupo México, Mitsubishi Materials (Japan), Teck Resources (Canada), Baiyin Nonferrous Group (China), Saudi Arabian Mining Company, and Sumitomo Metal Mining (Japan).

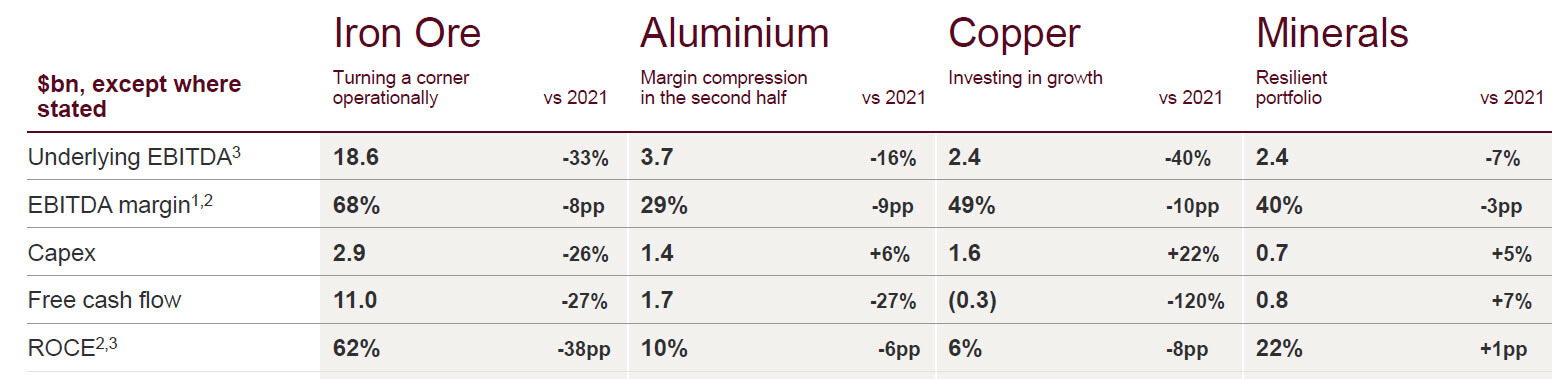

These companies are so large and diverse that their performance reflects mostly sector-wide trends rather than regional or metal-specific issues.

This entire vertical is highly concentrated because of the huge barriers to entry and economies of scale at this level.

Companies tend to present their results in a high-level way, rarely going down to the level of individual mines:

So, you tend to create equally high-level forecasts for these firms unless one is a client company sharing much more detailed information with you.

You focus on the mix of different metals, production levels, and long-term prices and use them to project revenue, expenses, and cash flow.

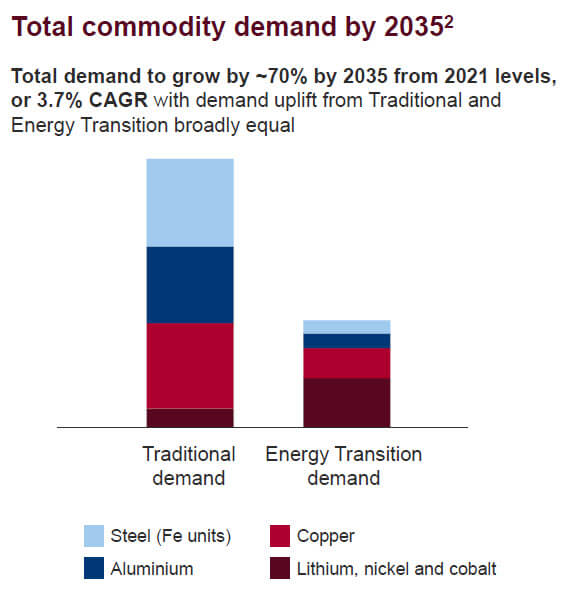

For example, many of these companies have been expecting stronger demand for lithium, nickel, and cobalt to power renewables, so you might tweak your long-term production assumptions based on that:

Metals & Mining Accounting, Valuation, and Financial Modeling

Let’s start with the easy part: there are virtually no differences for “production-only” companies.

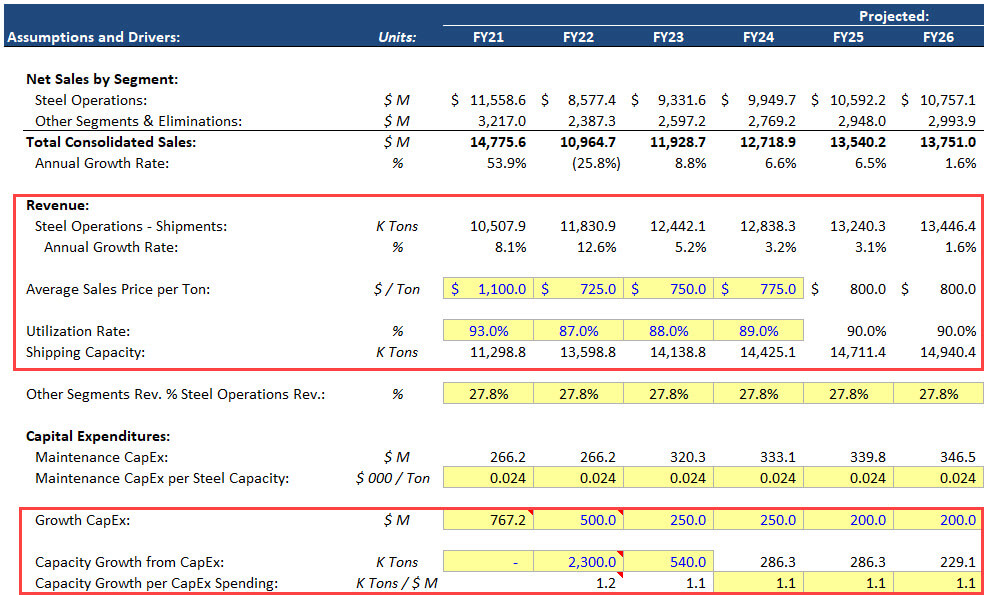

One example is Steel Dynamics, which we feature in our Core Financial Modeling course:

Core Financial Modeling

Learn accounting, 3-statement modeling, valuation/DCF analysis, M&A and merger models, and LBOs and leveraged buyout models with 10+ global case studies.

learn moreTo value it, we build a standard DCF based on production volumes, CapEx to drive capacity, and assumed steel prices:

The valuation multiples are also standard (TEV / Revenue, TEV / EBITDA, and P / E).

Most of the differences emerge on the mining side.

As with oil & gas, I’d split the differences into three categories:

- Lingo and Terminology – You need to know about different reserve types and resources, mine types (underground vs. open pit), and the extraction and refinement processes used for different metals. Standards like NI 43-101 in Canada or JORC in Australia are also important.

- Metrics and Multiples – You can use standard multiples, such as TEV / EBITDA, to value mining companies, but you’ll also see a few new ones and some resource-specific metrics.

- New or Tweaked Valuation Methodologies – As in the E&P segment of oil & gas, there’s also a Net Asset Value (NAV) model for mining companies, and it’s set up similarly (essentially, it’s a long-term DCF with no Terminal Value).

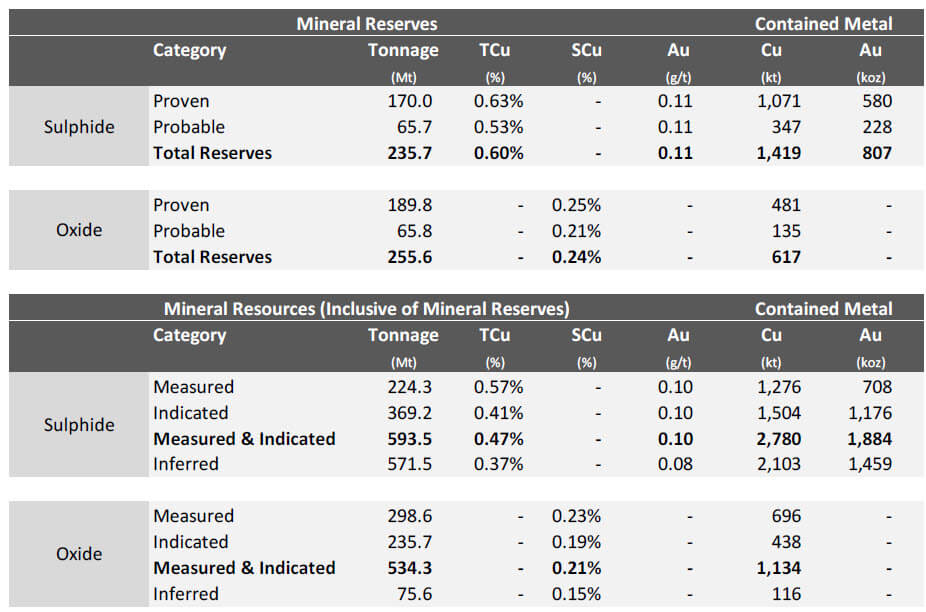

Starting with the terminology, mining companies split their minerals into “Reserves” and “Resources.”

Reserves have a higher probability of recovery, and they’re divided into the “Proved” and “Probable” categories.

Resources are split into Measured, Indicated, and Inferred, with the first two often grouped as “M&I Resources” (I like this name!).

You can see an example of a company’s Reserves and Resources here:

You might build a NAV model based on Reserves if you want to be more conservative or include the Resources if you want to be more speculative (but discounted by some percentage).

The NAV model follows the same steps as the one in oil & gas but uses different inputs:

- Split the company into “developed mines” and “undeveloped/potential mines.”

- Assume that the existing mines produce over their lifespans (usually 10-20 years, and sometimes more) until they become economically unviable.

- Assume the development of the new mines, which might take years or decades, and estimate the CapEx required for each one.

- Forecast the production levels for each new mine until it becomes economically unviable. There’s usually a ramp-up of a few years in the beginning, a peak, and an eventual decline.

- Build a price deck with different long-term metal prices. You might assume differences from current levels in the near term, but you’ll set these to long-term assumed averages after the first few years.

- CapEx will depend on each mine’s reserves and geography, while OpEx and the cash costs to operate the mine will usually be based on a per-unit metric, such as $ per ounce produced for gold miners.

- Aggregate the cash flows from all the mines, add corporate overhead, and use these to estimate the company’s cash flows over the next few decades. Again, there is no Terminal Value since you forecast production until the mines stop producing at viable levels.

- The Discount Rate is often fixed at some pre-determined level, such as 5% for gold or 8-10% for copper. You might also add a premium for emerging/frontier markets and mines in the middle of war zones and pirate camps.

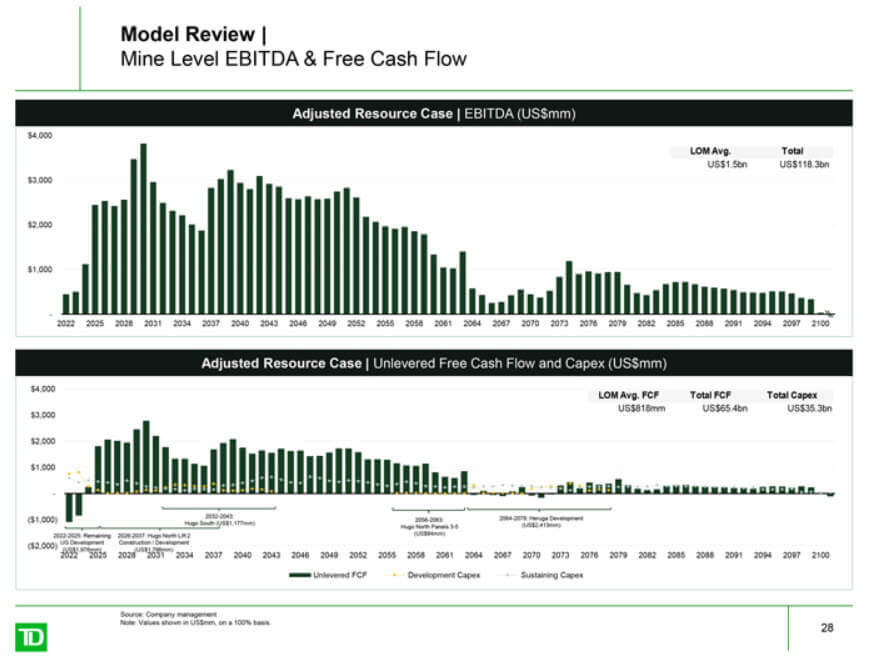

I don’t have a great visual of a mining NAV model, but here’s a good example of long-term cash flow projections from TD’s presentation to Turquoise Hill Resources:

And yes, you read that correctly: they forecast cash flow until the year 2100.

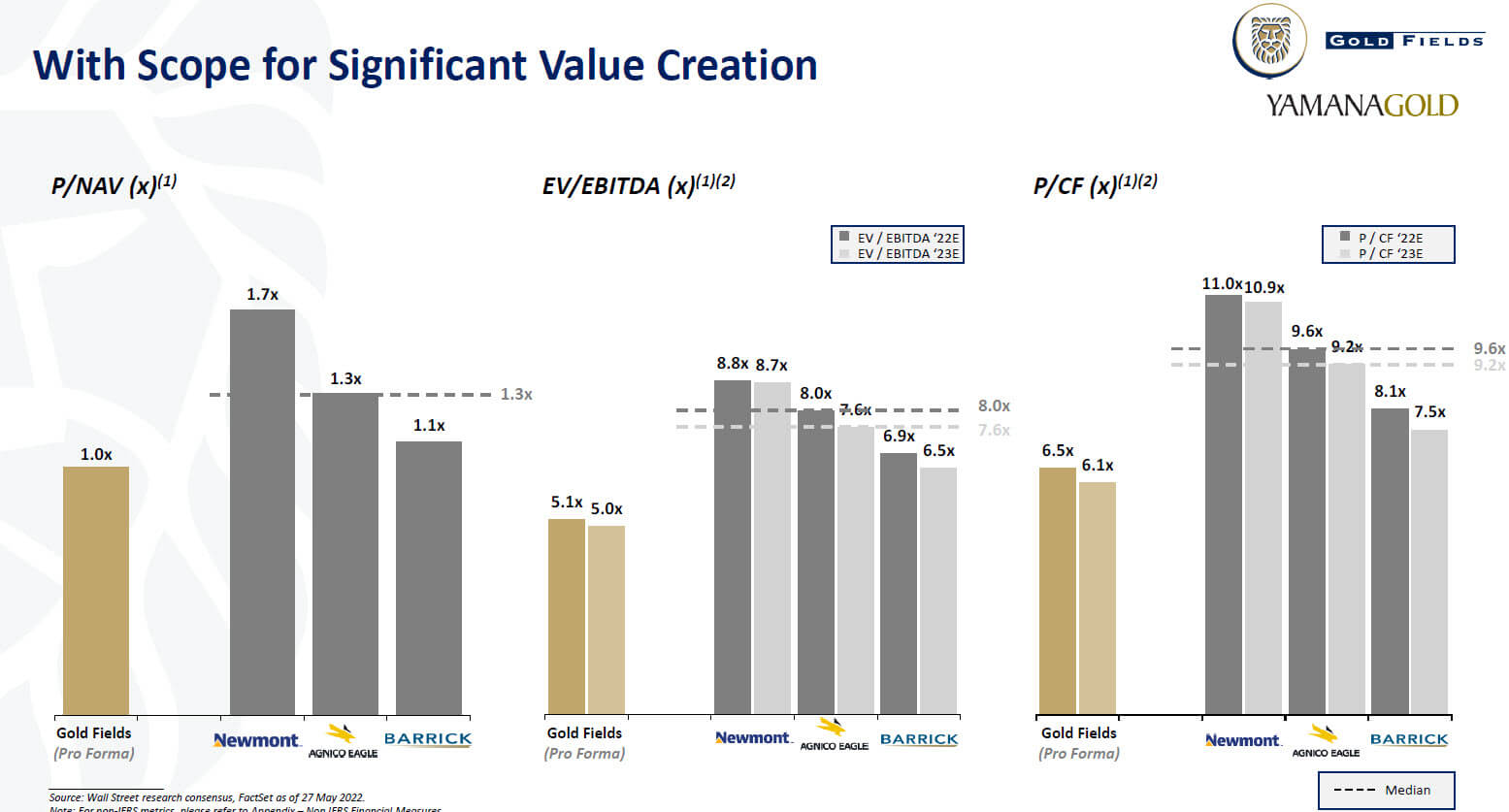

In terms of metrics and multiples, this slide from the Gold Fields / Yamana Gold presentation sums it up well:

These multiples are high because gold miners often trade at premium valuations; P / NAV multiples are often below 1x for other miners.

This P / NAV multiple is based on the Net Asset Value methodology output above, but it’s often simplified for use in valuation multiples.

You can still use the TEV / EBITDA multiple, but it’s more appropriate for the diversified miners since their output fluctuates less.

Another common multiple is TEV / Resources or TEV / Reserves, which values a mining company based on its “potential capacity.”

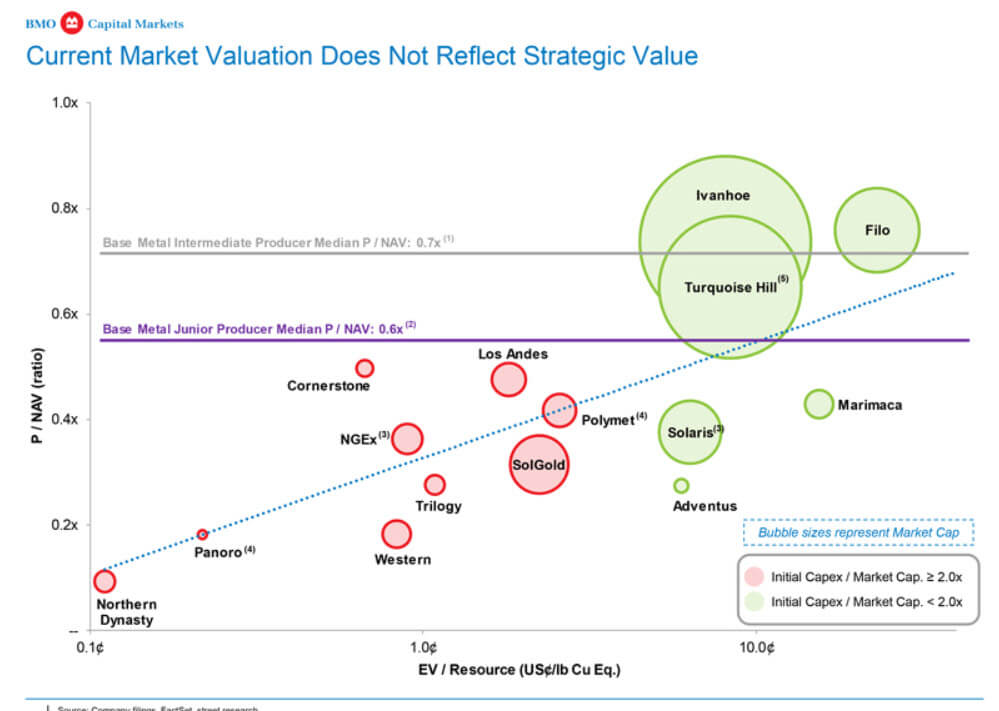

Some banks even combine these metrics and use them to illustrate companies’ relative valuations, as in this example from BMO for Turquoise Hill:

You’ll often see references to metrics like “Au Eq.” and “Cu Eq.”; these stand for “Gold Equivalent” and “Copper Equivalent.”

If a company owns/mines several metals but is dominant in one, you can convert the dollar values of their other metals into this dominant metal to create an “equivalent” metric.

For example, if they have 1,000 ounces of gold and 10,000 pounds of copper, and prices are currently $2,000 per ounce for gold and $4.00 per pound for copper, the “Gold Equivalent” resources are 1,000 + 10,000 * $4.00 / $2,000 = 1,020 ounces.

Example Valuations, Pitch Books, Fairness Opinions, and Investor Presentations

There are many examples here, so I will split these into Base Metals and Bulk Commodities vs. Precious Metals:

Base Metals and Bulk Commodities

- Rio Tinto / Turquoise Hill – Acquisition (CS, Rothschild, RBC, BMO, TD, MS)

- Capstone Mining / Mantos Copper – Acquisition (Scotia, CIBC, and GenCap)

- Investor Presentation

- Fairness Opinions (go to page 322)

- Westmoreland – Restructuring (Centerview)

- Cosan / Vale – Minority Stake (Citi, JPM, Bradesco, and Itaú)

- Cleveland-Cliffs / AK Steel – Acquisition (Moelis, BofA, CS, GS):

- Investor Presentation

- Fairness Opinions – Moelis | GS

Precious Metals

- Gold Fields / Yamana Gold – Acquisition (JPM, BofA, CIBC, Canaccord, Scotia, Stifel)

- Kinross / Great Bear – Acquisition (BMO, CIBC, GenCap, Canaccord, Trinity Advisors)

- Investor Presentation

- Fairness Opinions (page 204)

- Newcrest / Pretium Resources – Acquisition (Lazard, RBC, BMO, Citi)

- Investor Presentation

- Fairness Opinions (page 204)

- Impala Platinum / Royal Bafokeng – Acquisition (JPM, Macquarie, Ned Bank, Standard Bank, PSG, BofA, QuestCo)

- South32 / Sierra Gorda – Minority Stake (UBS and RBC)

Metals & Mining Investment Banking League Tables: The Top Firms

If you look at the investment banking league tables, you’ll see the usual large banks at or near the top: GS, MS, JPM, BofA, Citi, etc.

But you’ll also see many Canadian banks there, including BMO, which is usually viewed as the top metals and mining group in all banking (but is also a complete sweatshop).

The other large Canadian banks (CIBC, TD, Scotiabank, and RBC) also make a strong showing in most league tables.

The elite boutiques do not have a huge presence in mining, but you’ll sometimes see Rothschild or Perella Weinberg on the list.

Macquarie also shows up occasionally, likely due to its HQ in Australia and all the mining deals there.

A few middle market and regional boutique names in the space include Canaccord Genuity, Maxit Capital, Cormark, Haywood Securities, and Eight Capital.

Some of these, like Canaccord, do more than just mining but happen to have a strong presence in the sector.

Exit Opportunities

Let’s start with the bad news: As with any other specialized group, metals & mining investment banking will tend to pigeonhole you.

Also, few private equity firms are dedicated to the sector because commodity prices are volatile, and mining companies are levered bets on commodity prices.

Even if you work with standard spread-based companies, such as steel manufacturers, headhunters will rarely take the time to understand your full experience.

OK, now to the good news: This situation is starting to change.

More private equity firms are springing up to invest in the sector, driven by the “energy transition” and the importance of mining for renewables.

Some private equity mega-funds do occasional mining deals; outside of them, several smaller firms do equity and credit deals in the sector.

A few names include Appian Capital, Resource Land Holdings, Greenstone Resources, Proterra, Denham, Tembo, Sun Valley, Resource Capital, Ibaeria, Waterton Global Resource Management, Orion Resource Partners, EMR Capital, and Sentient Equity.

There are also quite a few hedge funds in the space, and many global macro funds and commodity funds will be interested in candidates with mining backgrounds.

(You’d still be better off working in sales & trading if you want to enter one of these, but a mining IB background gives you a higher chance than other bankers.)

The most common exit opportunity for mining bankers is corporate development since you can apply all your modeling, technical, and deal skills directly to acquisitive companies.

Another option is to aim for PE firms that work in broader areas that have some overlap with mining, such as in industrials or power/utilities.

For example, KPS Capital technically operates in the “manufacturing” space, but it does deals involving basic materials, including metals and mining companies.

So, the exit opportunities aren’t great, but they’re a bit better than in oil & gas, and they are improving due to the ESG/renewables/EV craze.

For Further Reading and Learning

No, we don’t have a metals & mining financial modeling course.

I’ve considered it before, but it’s a niche area, and the economics never made sense.

There’s an outside chance we might release a short version as a $97 course, but I can’t estimate a time frame.

For other resources, I recommend:

- News: Mining Feeds | com | Financial Times

- Research: EY | PwC | KPMG | Deloitte | McKinsey

- Market Data: London Metals Exchange (LME)

- Books: Fisher Investments on Materials | The Mining Valuation Handbook

Is Metals & Mining Investment Banking for You?

Despite the positive recent trends, I still wouldn’t recommend metals & mining over sectors like technology, TMT, healthcare, or consumer retail for most people.

If you really like mining and want to specialize in it, sure, go ahead.

Of the “specialized” sectors within IB (real estate, FIG, and oil & gas), metals & mining probably has the most growth potential through ~2030.

But cyclicality and specialization are major issues.

Yes, mining is hot right now due to renewables and EVs, but I wouldn’t bet money that this will last “forever.”

Traditionally, these shorter commodity cycles tend to run for 5-10 years – which matters if you enter the industry or get promoted at the wrong time.

Finally, you have more exit options than bankers in other specialized groups, but you still have worse overall access than bankers in the generalist groups.

But at least you’ll get to make the world a better place – if you forget about those child laborers in the Congo.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

“Many mining projects are in regions with unstable governments, wars, and other problems.” One of the most unique features of metals and mining is the heavy involvement of geopolitics and political science. If you had wanted to be a political scientist but ended up in a downtown office, metals and mining might be the practice area for you. Understanding the political economy of an African country hosting the project and assessing political risk for instance is part and parcel of doing a good job.

Well, yes, sure, mining has always equaled geopolitics + political science + actual science. I made this point here because a lot of people think that “mining” is confined to places like Canada or Australia.

How to handle circumstances related to geopolitics and war in valuations? For example, probably the biggest ticking time bomb in industrial mining in Africa is the Essakane gold mine located at the center of jihad in the Sahel where the borders of Burkina Faso, Mali, and Niger meet. A transport convoy to the mine got ambushed and wiped out by jihadists.

I’m sorry, I don’t know. It’s way above my pay grade. We don’t really cover geopolitics on this site; it’s about careers and recruiting in the finance industry for students and professionals. I have no idea what to do if your transport convoys are getting attacked in a war zone.

Can you do an updated article for business services investment banking next?

Yes, eventually.

Would you not consider Infrastructure a specialized IB sector?

Infrastructure is specialized, but less so than groups like FIG or oil & gas. It’s more in-line with real estate, where it’s mostly specialized if you work on deals involving individual assets and less so if you work on corporate-level deals. But the infrastructure IB article is due for an update, so we’ll publish a new version later this year.