Investment Banking in Australia: Impossible Barriers to Entry, or the Best Place for a Long-Term Finance Career?

When it comes to investment banking in Australia, it’s easy to find complaints online.

These complaints center on a few aspects of the banking industry there:

- Recruiting – People often claim that it’s much more difficult to win interviews and job offers, that nepotism is widespread, and that there aren’t many “side doors” into finance.

- Compensation – As with most other regions outside the U.S., you will typically earn less than in New York.

- Exit Opportunities – Finally, there appear to be fewer traditional exit opportunities than in regions such as the U.S., U.K., and Canada.

There is some truth to these complaints, but they also miss the country’s positive aspects, which we’ll cover below.

Personally, I’ve spent about a year living/nomading in Australia.

When people ask me what it’s like, my answer is always the same: “It’s a mix of the U.S. and the U.K., with some added quirks.”

And that description also applies to the investment banking industry there:

Investment Banking in Australia: Top Banks

If you look at the Australian league tables, you’ll see many of the “usual suspects” at or near the top: Goldman Sachs, JP Morgan, Morgan Stanley, Citi, and Bank of America.

The big difference is that UBS is unusually strong in Australia, often ranking #1 or in the top 3-5 by advisory fees.

Also, “large domestic investment bank” Macquarie tends to rank well, often above the international bulge brackets.

The Big 4 Australian banks – ANZ, Commonwealth, NAB, and Westpac – are also very active, but primarily in debt capital markets, where they do more volume than the international banks mentioned above.

However, these banks have minimal involvement in M&A, equity, and other non-debt deals, so they’re perceived as less desirable in terms of careers, compensation, and exit opportunities.

Many “In-Between-a-Banks,” such as RBC and HSBC, also have a presence in Australia, but more on the capital markets side than M&A.

Most U.S.-based middle-market banks have little presence in Australia; you’ll see Jefferies but not many others.

Similarly, the U.S. and European elite boutiques do not have a huge presence in the country.

Of the EBs, Rothschild is the strongest if you go by deal volume, but you’ll see the likes of Moelis, Lazard, Qatalyst, and Greenhill as well.

Taking the place of many EB and MM banks in Australia are domestic boutique banks that are quite strong, surpassing some of the bulge brackets in terms of M&A deal volume.

The two best-known firms are Barrenjoey and Jarden, both of which were formed by former UBS bankers (among others).

Other names include Gresham, Luminis (affiliated with Evercore), Record Point, Clairfield, Allier Capital, Highbury Partnership, Grant Samuel, and J.B. North & Co.

Some of these act as “small Big 4 firms,” so they work on more than just M&A and capital markets deals.

Locations, Industries, and Deals

As you might expect, Sydney is the center of the finance industry in Australia, so most deal activity takes place there.

Many banks also have smaller Melbourne offices, and the few offices that exist in Perth are dedicated to the natural resources / mining sector there.

Traditional investment banks do not have much of a presence in other cities, such as Brisbane, Adelaide, Canberra, etc.

In terms of industries, materials, mining, and natural resources represent a significant percentage of all deals, and power & utilities companies are common M&A targets and equity issuers.

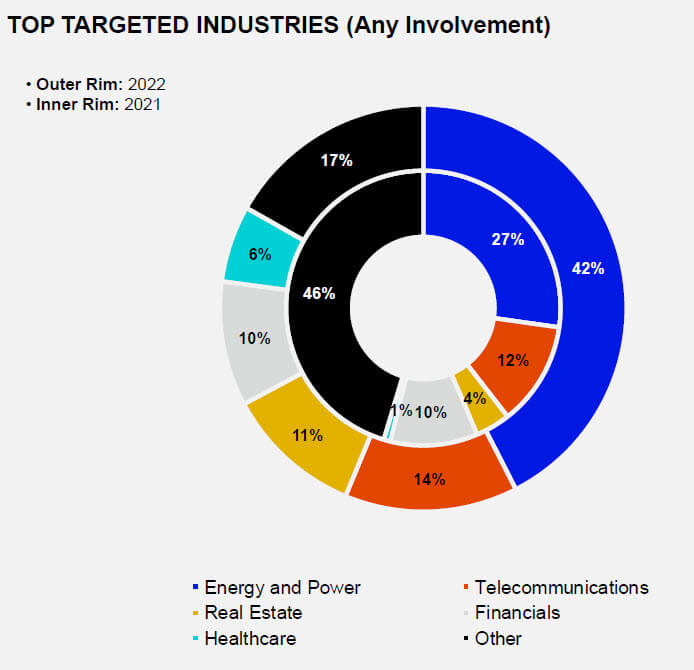

Refinitiv has a good breakout of the top “targeted industries” in M&A deals:

Outside of M&A, the industries are a bit more diversified.

Materials is still significant, and financials represents the highest percentage of total deal activity due to its high volume of debt deals.

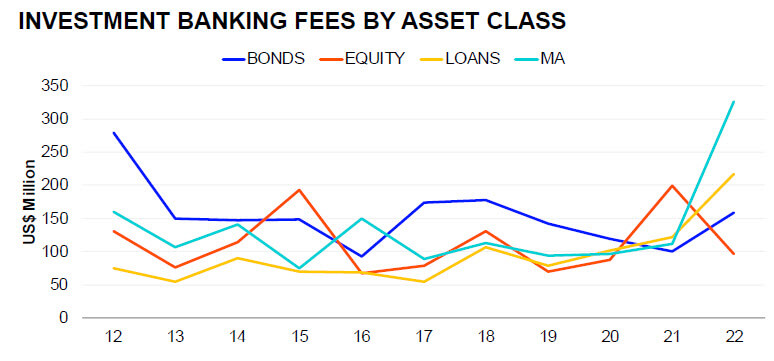

No single deal type dominates the market if you look at the fee data:

Investment Banking in Australia: Recruiting and Interviews

While the top banks and industries differ in Australia, the recruiting process really is a mix of the ones in the U.S. and the U.K.

As in these other regions, you still need previous finance-related internships to have a good shot, and you should intern at a large bank and convert it into a full-time role for the best chance of breaking in.

If we use the U.S. recruiting process as a baseline, the key differences in Australia are:

- Very Small, Fiercely Competitive Market – In the entire country, investment banks might hire fewer than 100 interns each year (~5-10 students at each bulge bracket bank and fewer at the boutiques). And thousands of students apply for these jobs, so your odds are not great – they’re worse than in the U.S., U.K., and even Canada.

- Widespread Nepotism – The dearth of positions in Australia also means that nepotism is an even bigger problem than in other markets. In other words, expect a good percentage of the interns and full-time hires to have a family or other connection with the senior bankers, clients/prospective clients, etc.

- Online Tests – Similar to the U.K., various psychometric tests are common in the first round of the recruiting process. You will still go through a HireVue or phone/in-person interview and multiple interviews after that, but the first step may be a bit closer to the U.K. process.

- Superdays or Assessment Centers – Banks in Australia do not necessarily label the final step of the recruiting process a “Superday” or an “assessment center,” but it usually includes elements of both, such as back-to-back interviews, case studies, group presentations, and some evaluation in a social setting, such as a dinner or cocktails.

- Types of Candidates – Most successful candidates come from the “Group of 8” universities (see below) and complete Commerce/Law degrees with top grades. Unfortunately, MBA and Master’s-level recruiting is almost non-existent, and if you’re an international student, your chances are low because it’s extremely rare for banks to sponsor international students.

If I had to put a number on it, I’d say it’s at least 2-3x more difficult to get into IB in Australia than in the U.S. or the U.K.

Is It Impossible to Break into IB in Australia as a “Career Changer”?

The biggest issue here is that MBA-level recruiting is not well-developed, so career changers lose a major pathway into the industry.

There is occasionally lateral hiring, but mostly for people who already have similar jobs: accountants, corporate lawyers, and management consultants.

Therefore, if you’re working in a completely unrelated field, Australia is probably one of the worst places to move into finance.

Your best option, in this case, is to move abroad to the U.S. or the U.K. and do a top MBA or Master’s degree there.

If you can’t do that, do not even bother with an advanced degree in Australia if you have no corporate finance experience because your chances of getting hired are close to 0%.

Instead, think about related options that might be a bit easier, such as working at one of the Big 4 firms, entering commercial real estate, or joining a sovereign wealth fund.

Investment Banking Target Schools in Australia and the Top Degrees

The “target schools” in Australia consist primarily of the Go8 universities:

- University of Sydney

- University of New South Wales

- University of Melbourne

- Monash University

- Australian National University

- University of Queensland

- University of Adelaide

- University of Western Australia

If you’re not going to one of these, getting into IB will be even more difficult.

Traditionally, banks have preferred the Commerce/Law dual degree, but you’ll also find bankers with just Commerce, Commerce/Engineering, Science/Commerce, and other combinations.

“Commerce” is a mix of Finance and Accounting, with options for actuarial studies, economics, marketing, and related areas.

Banks also prefer candidates who complete an “Honours” year in undergrad, which is nice since it gives you more time to win internships.

Universities in Australia use a grading system based on the “Weighted Average Mark” (WAM), which differs from the scales in the U.S. and the U.K.

In most cases, banks want candidates with WAMs above 75%, which is roughly comparable to a 3.7 – 3.9 GPA in the U.S. [NOTE: 75% may be closer to a 4.0 in the U.S. system – see the comments to this article.]

Finally, extracurricular activities, such as business/investing societies, case competitions, and sports, also matter, and you’ll usually need 1-2 solid ones to win interviews.

UBS runs a famous case competition each year in Australia (the “Investment Banking Challenge”), which many successful candidates participate in.

Investment Banking in Australia: Salaries and Bonuses

In the interest of full disclosure, I have never found comprehensive, reliable data for IB salaries and bonuses in Australia across all levels.

I’ve found one site that does Australian corporate salary surveys, but it’s missing bonus data and numbers for senior bankers.

On average, though, you should expect a 10-20% discount to U.S. compensation because of a few factors:

- AUD/USD Exchange Rate and a Weaker AUD – There have been periods where the AUD was trading at parity to the USD or even above it, but it has been at a 10-30% discount for most of the past decade.

- Similar/Higher Base Salaries (But paid in AUD) – Similar to regions such as Canada, base salaries are close to ones in the U.S. but paid in AUD instead. In some cases, they may be slightly higher, which offsets some of the weaker exchange rate.

- Superannuation Oddities – In Australia, all employers must pay ~10-12% of each employee’s earnings into a “superannuation” (pension) fund. You may benefit from this money far in the future, but you cannot access any of it today, and some compensation reports include it, while others ignore it.

Using the U.S. salary/bonus levels as a guide, you might expect something like the following ranges in Australia (converted to USD for comparative purposes):

- Analyst: $130K – $170K

- Associate: $200K – $400K

- VP: $425K – $600K

- Director: $500K – $700K

- MD: $600K – $1.3M

But, again, I have low confidence in these numbers, so if you have better data, feel free to share it in the comments.

IB Lifestyle and Hours in Australia

The overall culture varies widely from bank to bank, with some resembling sweatshops and others offering better work/life balance.

On average, you will probably work less than in New York or Hong Kong (London is debatable because the hours there are also better).

So, a “busy week” at the junior level might be 80+ hours, while a “less busy week” might mean 60-70 hours.

A few factors account for the slightly better hours/lifestyle:

- Smaller Industry with Smaller Deals and Less Deal Flow – Smaller deals tend to be less stressful because there’s less urgency to close, and fewer stakeholders are involved.

- Less Financial Sponsor Activity – Deals involving private equity firms tend to be more stressful because PE professionals work a lot and expect everyone else to work long hours as well. But there’s less domestic PE activity in Australia, and much of it is focused on asset-level deals in real estate and infrastructure (see below).

- Less of an “Up or Out” Culture – It’s more common for bankers to start as Analysts and advance up through the ranks in Australia, so senior bankers don’t necessarily want to kill their junior staff with impossible workloads.

Investment Banking in Australia: Exit Opportunities

The bad news is that traditional exit opportunities such as private equity and hedge funds are scarce in Australia because there aren’t too many of these firms.

To quantify this statement, Capital IQ searches produce the following numbers of PE firms and hedge funds in the U.S., U.K., and Australia:

- Private Equity: U.S: ~7,200 | U.K.: ~1,000 | Australia: ~250

- Hedge Funds: U.S: ~3,200 | U.K.: ~500 | Australia: ~50

The private equity mega-funds all operate in Australia, but private equity recruiting is ad hoc and follows the off-cycle process; people also tend to move over a bit later, sometimes as Associates (like the London process).

There are also some larger domestic private equity funds, such as Pacific Equity Partners (PEP), BGH Capital, Quadrant, CPE, Crescent (more for credit), Archer, Allegro, and Advent.

By U.S. standards, most of these would be considered middle-market or upper-middle-market funds based on their AUMs and typical deal sizes.

However, the #1 point is that Australia is more of a center for private equity activity in real estate and infrastructure.

For example, Blackstone in Australia focuses on real estate, and many traditional funds, such as Brookfield and MIRA (Macquarie’s PE fund), also focus on asset-level investing.

There are even domestic PE funds dedicated to these sectors, such as CP2 in infrastructure and RF Corval in real estate.

And then there are the “superannuation funds,” such as Australian Super, that often focus on RE and infrastructure to aim for lower-but-theoretically-more-stable returns.

So, exit opportunities exist, but corporate-level private equity roles are much rarer than in the U.S. or Europe.

The most common paths for bankers in Australia include:

- Stay in IB and move up the ladder.

- Transfer overseas to work in IB or use it to win a PE/HF/other role.

- Move into corporate development or corporate finance at a normal company.

- Move to a real estate or infrastructure fund.

- Complete an MBA or Master’s degree abroad to access more opportunities.

- Win one of the few corporate-level PE roles or an even-more-elusive hedge fund role.

Investment Banking in Australia: Final Thoughts

So, considering everything above, is investment banking in Australia worth it?

Is there any reason to prefer it to other countries/regions?

And if you’re in another country right now, is there any reason to push for a transfer so you can work in Australia?

My answer to all three questions is the same: “Probably not – unless it is your only option.”

Australia’s main advantage over other regions is that it may be better for a long-term career in banking since the pace is a bit slower, advancement up the ladder is more common, and compensation is still good (though lower than in the U.S.).

These are nice benefits, but they mean nothing unless you can break into the industry in the first place – and breaking in far more difficult than in the U.S. or Europe.

If you’re currently in Australia and want to work in investment banking there, but you’re a non-traditional candidate, go overseas or forget about IB for now and aim for finance-adjacent roles.

And if you’re in another country but have your heart set on working in Australia, get a few years of experience at a large bank elsewhere and request a transfer – and hope that a spot is available, and your bank can sponsor you.

I have nothing “against” Australia and enjoyed my time there as a nomad / tourist / remote worker.

But visiting a place is quite different from working at a company there.

And if you can work in the U.S., Europe, Hong Kong, or even Canada, I recommend all of them as better starting points for an IB career.

But if you enjoy fighting uphill battles, feel free to ignore this advice and continue toiling away on your IB applications in Australia.

If you have enough family connections, you might even succeed!

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

Am interested in your gpa to WAM conversion, I’d put an 85% at about top 0.5%-1% of class (literally only 1 or 2 people out of a class of 100-200, that is only those that top the class get the mark) and 75% at about 10-15% of class (as marks are aggressively bell curved) per subject, so the chance of a 85% WAM across a degree (24 subjects, so call it 0.5-1%^24) is incredibly low. My logic would put a degree with a WAM of 75% at closer to a 4.0 but I may be wrong.

Thanks for adding that. I saw different numbers for the WAM conversion online, so you could be right about 75% being closer to a 4.0. It’s hard to say because in the U.S. system, different universities use wildly different grading curves and standards. So a fixed percentage of people do not necessarily earn a 4.0, 3.5., etc. But I’ve updated the article with a note about this.

Given the small size of the market in Australia, I think it is plausible that banks would only want to accept the top 10-15% of each class as IB Analysts, so the cutoff may be more like 75%.

Thanks for taking the time to cover Australia! As an Aussie banker who moved to the US a couple years ago, this was a lot of fun to read

A few extra thoughts:

– Comp is decently lower than what you’ve outlined. Even if those figures were in AUD, they look high (not sure how much has changed since Covid)

– EB comp between banks can literally vary in multiples, or be affected by weird factors such as favoritism and how secure the MD is feeling that year

– I used to work 70-80 weeks sometimes in Aus, but they were the “busy” weeks. Even then, a 70-80 hour week in Aus feels completely different to a 70-80 hour week in US IB in terms of overall pressure/expectations, pace etc.

– I actually thought it was easier to break into IB in Australia since it’s such a small market and less competitive, the thought of being a college student in the US looking to IB makes me very anxious. It was really nice to leverage the IB experience and take it to the US where I managed to literally quadruple my comp

– “Tall poppy syndrome” is deeply embedded in Australian culture, and it shows in the workplace. Lots of weird angry small dog vibes/”big fish in small pond”. The US is really great for that “good for you” attitude and entrepreneurial spirit, I never felt I had that space to grow back home

– Cultural differences really stand out when it comes to working hours and PTO. In Aus, I would never send an email starting with, “Hope you’re having a nice weekend…” for fear of upsetting my client. Email flow is generally quiet after 6pm, so when you’re working more than 40 hours, it feels like there’s a decent amount of downtime to “catch up” on everything, and less pressure to turn everything within 24 hours. Also, there’s never really a question of whether you need to work on a holiday because 100% of the time without needing to say anything, safe to assume your client is also observing that holiday/going to the beach/fishing

– All being said, my experience in the US has been life changing, but I’m definitely looking forward to moving back home one day. Likely close to a beach…

Thanks for adding all that. Regarding compensation, I don’t know, but nothing I’ve found for the 2010 – 2022 period seems to match what you’re saying about salaries/bonuses being that much lower. Another comment here also lists salaries/bonuses from the most recent cycle, which are higher than the ones in the article. So I am assuming this is an issue of weird/random bonuses at different banks, FX rate effects, compensation data taken from different years, or a combination of all of these.

I don’t doubt that you earned more by moving to the U.S., but quadrupling your compensation seems like a very unlikely outcome unless you were also promoted, joined in an exceptional year for deals in the U.S. vs. a terrible one in Australia, etc. Just trying to set expectations for anyone else reading this: don’t expect to earn $100K as an Analyst in Australia and then move to the U.S. and instantly earn $400K.

With all the cultural/lifestyle/hour points, yes, in all those ways, you could argue AU is better for a long-term career, especially if you have other priorities past a certain age.

Hi Brian, would highly appreciate if you could produce a post on the UAE market! Many thanks for your valuable sharing over the years.

There will be an updated IB in Dubai article later this year.

However, Do you think it is better for a Student from India to pursue Master’s in Finance in Group of 8 Australian Universities. And then go for Investment banking Jobs there, compared to U.S. As one has to face this Student visa and Sponsorship problems in U.S.

No, not at all. It can be difficult to get a visa and sponsorship for a job in the U.S., but it is possible (most of the large banks sponsor international students; smaller firms do not or rarely do it). Your chances of winning sponsorship and an eventual job offer are higher than in Australia, especially if you do something that qualifies as STEM gets you the OPT extension to work in the country.

Analyst Base salary comp ranges (in AUD) – after recent increases

– A1: 110-140

– A2: 140-160

– A3: 160-190

Current exchange rate is ~1.40

Bonuses this year were 50-60%, 2021 were 70-80%

Having worked in both Syd and NYC as an analyst, Aus hours are very consistent at around 70-80 hours. Whereas in the US you get a bigger swing, some firms / groups you’d hit 110-120, some groups (especially in downturns like now) are sitting at 60, even 55 sometimes.

Culture is chiller and people are nicer, but very nasty towards exiting to buy side / other banks.

Best place to go international / New York is Goldman Sachs, they sent half of their analyst class this year to NYC after completing 2.5 years in syd (but again have to stay)

Industry tends to be very generalist outside of specialty groups (NR / FIG / RE). “General Industrials” often encompasses indus, consumer, HC, sponsors, TMT.

Thanks for adding all that! Guess my Analyst numbers were on the low side (although Analyst 3’s are increasingly rare in the U.S.; maybe not as rare in Australia).