Infrastructure Private Equity: The Definitive Guide

If I put together a list of the longest-running “unfulfilled requests” on this site and BIWS, infrastructure private equity would be near the top of that list.

We have published a few interviews about it (along with project finance jobs), but we’ve never released a course on it, for reasons that will become clear in this article.

And while I’m skeptical about the long-term prospects of private equity, especially at the mega-funds, there are some bright spots – and I think infrastructure is one of them.

But before delving into deals, top firms, salaries/bonuses, interview questions, and exit opportunities, let’s start with the fundamentals:

What is Infrastructure Private Equity?

At a high level, infrastructure private equity resembles any other type of private equity: firms raise capital from outside investors (Limited Partners) and then use that capital to invest in assets, operate them, and eventually sell them to earn a high return.

Profits are then distributed between the Limited Partners (LPs) and the General Partners (GPs) – with the GPs representing the private equity firm.

Just as in traditional PE, professionals spend their time on origination (finding new assets), execution (doing deals), managing existing assets, and fundraising.

The difference is that infrastructure PE firms invest in assets that provide essential utilities or services.

Real estate private equity is similar because both firm types invest in assets rather than companies.

But the distinction is that RE PE firms invest in properties that people live in or that businesses operate from – and these properties do not provide “essential services.”

Sectors within infrastructure include utilities (gas, electric, and water distribution), transportation (airports, roads, bridges, rail, etc.), social infrastructure (hospitals, schools, etc.), and energy (power plants, pipelines, and renewable assets like solar/wind farms).

Many of these assets are extremely stable and last for decades.

Some, like airports, also have natural monopolies that make them incredibly valuable (well, except for when there’s a pandemic…).

Infrastructure assets have the following shared characteristics:

- Relatively Low Volatility and Stable Cash Flows – Power plants can’t just “shut down” unless human civilization collapses.

- Strong Cash Yields – Unlike traditional leveraged buyouts, where all the returns might depend on the exit, infrastructure assets usually yield high cash flows during the holding period.

- Links to the Macro Environment and Inflation – Investors often view infrastructure assets as “inflation hedges” because they’re linked to population growth, GDP, and other macro factors that change the demand for infrastructure.

- Low Correlation with Other Asset Classes – For example, returns in infrastructure investing don’t correlate that closely with those in traditional PE, equities, fixed income, or even real estate.

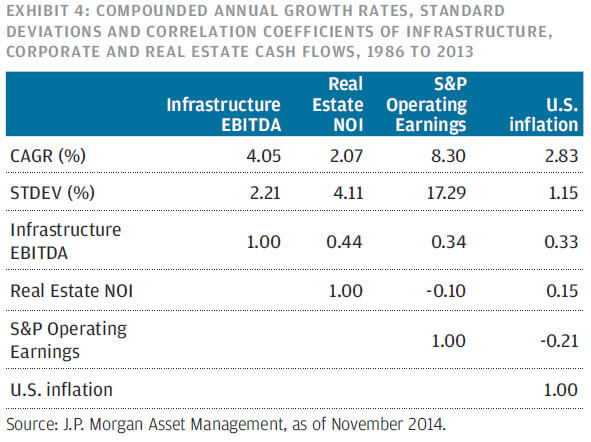

On the last point, here’s what JP Morgan found when comparing infrastructure, real estate, and the S&P 500 from 1986 to 2013:

As a result of these factors, the targeted returns in infrastructure PE are also lower – somewhere in the 8% to 15% range rather than 20%+ for traditional PE.

Holding periods are also longer, partially because customer contracts tend to be lengthy, such as power purchase agreements that last for 15 years.

Overall, infrastructure private equity sits above fixed income but below equities in terms of risk and potential returns; it might be comparable to mezzanine funds.

The History and Scale of Infrastructure Investing

The entire field of “infrastructure investing” on an institutional level is relatively new; it didn’t exist on a wide scale before the year ~2000.

It started in Australia in the 1990s, spread to Canada and Europe in the early 2000s, and eventually made its way to the U.S. as well.

Partially because it is a newer field, infrastructure private equity has raised less in funding than real estate private equity or traditional private equity:

- Infrastructure PE: $50 – $100 billion USD per year globally

- Real Estate PE: $100 – $150 billion

- Traditional PE: $200 – $500 billion

Despite the lower fundraising, “small deals” are quite rare in infrastructure because of the nature of the assets.

The average deal size is over $500 million, and the top 10 deals each year are in the multi-billions, up to $10+ billion.

Public Finance vs. Project Finance vs. Infrastructure Private Equity vs. “Infrastructure Investing”

Several terms are closely related to infrastructure, so let’s go down the list and clarify the differences before moving on:

- “Infrastructure Investing” – This one is the broadest term and could refer to investing in the debt or equity of infrastructure assets. Investors could fund the construction of new assets or acquire existing, stabilized ones. And the investors could be PE firms, pensions, sovereign wealth funds, and many others.

- Infrastructure Private Equity – This term refers to investing in the equity of infrastructure assets to gain ownership and control. There are dedicated infra PE firms, but plenty of pensions, large banks, SWFs, and other entities also make “equity investments in infrastructure.”

- Project Finance – This one refers to investing in the debt of infrastructure assets (both new and existing ones), which is mostly about assessing the downside risk, how much money could be lost in the worst-case scenario, and then offering terms commensurate with the risk.

- Public Finance – This one also relates to investing in the debt of infrastructure assets, but in this case, it’s to support governments and tax-exempt entities that need to raise funds to build assets.

Infrastructure Private Equity Strategies

The main investment strategies are similar to the ones in real estate private equity: core, core-plus, value-add, and opportunistic.

The main difference is slightly different names: “greenfield” refers to brand-new assets that a sponsor is building, while “brownfield” refers to existing assets that it is acquiring.

Here’s a quick summary by category:

- Core: There’s limited-to-no growth here; examples might be regulated electricity distribution assets, such as power lines. Governments set rates, so there’s little revenue risk. Most of the returns come from the asset’s cash flows, and the expected IRRs are usually below 10%.

- Core-Plus: These assets have modest growth potential (via additional CapEx or other improvements), or they’re stabilized assets operating in regions outside developed markets. The expected IRRs might be in the low teens.

- Value-Add: These assets require serious operational improvements or re-positioning. The risk and potential returns are higher, and more of the potential returns come from capital appreciation rather than cash flows during the holding period. An example might be acquiring a small airport and then performing additional construction to turn it into more of a regional hub.

- Opportunistic: These deals are the riskiest ones because they often produce limited-to-no cash flow for a long time, and they depend on building new and unproven assets (e.g., a new power plant or toll road). The potential IRRs might be 15%+, but there’s also a huge downside risk.

A single infrastructure PE firm could have different types of funds, each one specializing in one of these categories, but in practice, the first three strategies are the most popular ones.

One final note: in addition to everything above, public-private partnerships (PPP) represent another strategy within this sector.

For example, a private firm might build a toll road, and the local government might guarantee a certain amount in revenue per year as an incentive to complete the project.

Sometimes PPP deals are labeled “core” even when the asset changes significantly or is built from scratch because the revenue risks are much lower if there’s government backing.

Yes, construction overruns and delays could still be issues, but the overall risk is lower.

The Top Infrastructure Private Equity Funds

You can divide infrastructure investors into a few main categories: actual private equity firms (“fund managers”), large banks, pension funds, sovereign wealth funds, and the investment arms of insurance companies.

Technically, only the private equity firms count as “infrastructure private equity” – but each firm type here still invests in the equity of infrastructure assets.

For many years, fund managers dominated the market, but institutional investors such as pension funds have been building their internal investment teams to do deals directly.

Private Equity Firms and Fund Managers

Some PE firms focus on infrastructure; examples include Global Infrastructure Partners, IFM Investors, Stonepeak Infrastructure Partners, I Squared Capital, ArcLight Capital, Dalmore Capital, and Energy Capital Partners.

Then, some firms invest in a broader set of “real assets,” with Brookfield in Canada being the best example (it has also raised the third-highest amount of capital for infrastructure worldwide).

In the U.S., Colony Capital and AMP Capital are examples (they do both real estate and infrastructure).

Finally, there are large, diversified private equity firms that also have a presence in infrastructure, such as KKR, EQT, Blackstone, Ardian, and Carlyle.

Large Banks

The biggest “infrastructure investing firm” worldwide is Macquarie Infrastructure and Real Assets (MIRA), which is a branch of the Australian bank Macquarie.

Many of the other large banks also do infrastructure investing, but they often use different names for their infra businesses (e.g., Goldman Sachs and “West Street Infrastructure Partners” or Morgan Stanley and “North Haven Infrastructure Partners”).

JP Morgan and Deutsche Bank are also active in the space.

There are also infrastructure investment banking groups, which advise sponsors and asset owners on deals rather than investing in debt or equity directly.

Pension Funds

Canadian pension funds, such as CPPIB and OTPP, are some of the biggest investors in the infrastructure space, and they all have internal teams to do it.

These funds have advantages over traditional PE firms because their returns expectations are lower, and they’re non-taxable in Canada, so they can afford to out-bid other parties and pay high prices for Canadian assets.

In Europe, various pension managers, such as APG and PGGM in the Netherlands and USS in the U.K., also invest in infrastructure, and in Australia, plenty of “superannuation funds” (AustralianSuper, QSuper, etc.) also do domestic infrastructure deals.

Sovereign Wealth Funds

These are very similar to pension funds: historically, they acted as Limited Partners, but they’ve been building their internal teams to invest in infrastructure directly.

Just like pensions, they also target lower returns, but they also have far more capital since they’re backed by governments in places like the Middle East and Asia.

Names include the Abu Dhabi Investment Authority, the Abu Dhabi Investment Council, the China Investment Corporation, and GIC in Singapore.

For more about these points, please see our coverage of investment banking in Dubai and sovereign wealth funds.

Insurance Companies

Most insurance companies do not invest directly in infrastructure, but many are Limited partners of existing funds.

Well-known names include Swiss Life, Allianz Capital Partners in Germany, and Samsung Life Insurance in South Korea.

Other Investment Firms

There are plenty of “miscellaneous” firms that do infrastructure investing as well.

For example, some construction companies invest their cash into infrastructure, and some larger, energy-focused PE funds such as Encap and Riverstone have also gotten into it.

There’s a blurry line between “energy private equity” and “infrastructure private equity” in the U.S., which is why firms like ArcLight and Energy Capital could be in either category.

Infrastructure Private Equity Jobs: The Full Description

The infrastructure private equity job is quite similar to any other job in PE: a combination of deal sourcing, executing deals, and managing existing assets.

Deal sourcing consists of inbound flow from bankers, competitive auctions, secondary deals from other financial sponsors, and sometimes buying entire infrastructure companies or individual assets.

Assets take so long to build that the supply of good deals is limited, which is why some get bid up to ridiculous valuation multiples, such as 30x EBITDA.

When evaluating deals, assessing the downside risk is critical because the upside is quite limited.

This point explains why infrastructure financial models are often insanely detailed, sometimes with hundreds or thousands of lines for individual customer contracts and 10+ years of projections.

You can’t just say, “Assume revenue growth of 5%” – it has to be backed by contract-level data and extensive industry research.

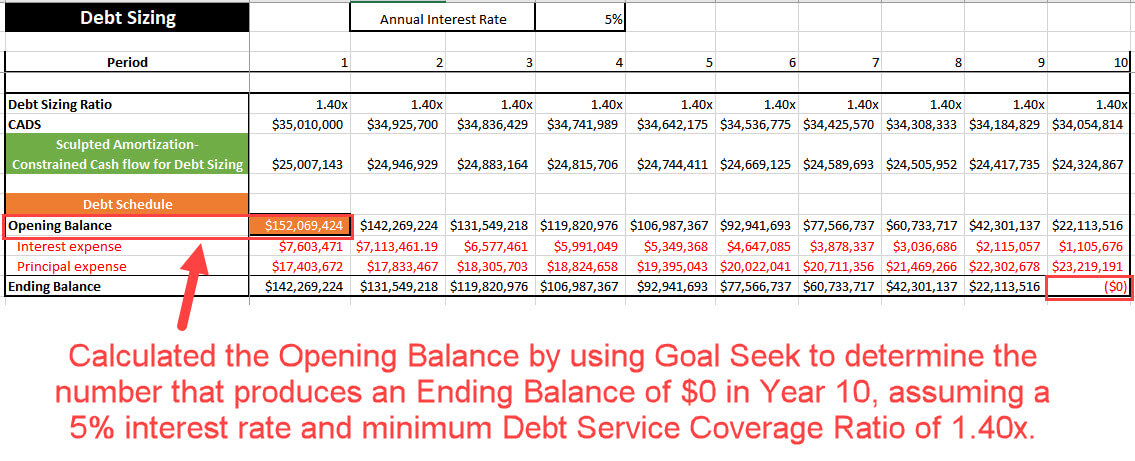

As in real estate, infrastructure deals often use high leverage (think: 80%+), and the debt may be “sculpted” to meet a minimum Debt Service Coverage Ratio (DSCR) requirement:

When you evaluate deals, you focus on:

- Contracts – How does the asset earn revenue, how much water/electricity/energy has it promised to deliver, and are there any onerous terms? Are there step-ups for inflation? Are any counterparties promising to pay for fuel or other expenses?

- Expenses and CapEx – Will the asset need major CapEx for maintenance or expansion? What do its ongoing operating expenses look like, and are they expected to grow in-line with inflation or above/below it?

- Growth Opportunities – The asset’s overall growth rate should be aligned to its key macro drivers, especially for “core” deals. For example, if air traffic in the region is growing at 2% per year, but an airport’s revenue is growing by 5%, something is off – unless the airport is planning to expand in some way.

- Downside Protection – What happens if inflation exceeds expectations? How easily can customers cancel their contracts? If something goes wrong, does the government back the asset or promise anything? What if there’s a construction delay or cost overrun?

- Debt – How much leverage is being used, what are the rates, and how much refinancing risk is there? Could the asset potentially support a dividend recap? Is there any chance that it might not be able to comply with covenants, such as a minimum Debt Service Coverage Ratio (DSCR)?

Infrastructure Private Equity Salary and Bonus Levels

Now to the bad news: salary and bonus levels in infrastructure range from “a bit lower” to “quite a bit lower” than traditional private equity compensation because:

- Management fees tend to be lower (1.0% to 1.5% rather than 2.0%).

- Carry is still based on 20% of the profits and an ~8% hurdle rate, but since holding periods are much longer, it takes more time to earn the carry. Also, it’s more difficult to exceed the hurdle rate.

Infrastructure Investor has a good set of recent compensation figures, excluding carry.

To summarize and round the numbers a bit, compensation ranges at dedicated infrastructure and energy PE firms are:

- Associates: $150K – $300K total compensation (50/50 base/bonus)

- Vice Presidents: $250K – $500K

- Directors: $400K – $900K

- Managing Directors: $750K – $1.8 million

If you also factored in carried interest, these numbers would increase modestly for Directors and MDs.

Expect lower compensation at pension funds, sovereign wealth funds, and insurance firms because they do not have carried interest at all.

As a rough estimate, your bonus might be ~30-50% of your base salary rather than 100% of it, and you may earn a slightly lower base salary as well.

The upside is that the lifestyle is also much better: you might work only ~40-50 hours per week at some of these funds.

You get busier when deals are heating up, but it’s still a vast improvement over the typical IB/PE hours.

The Recruiting Process: How to Get into Infrastructure Private Equity

Similar to real estate private equity, infrastructure private equity firms are also more forgiving about candidates’ backgrounds.

In other words, you don’t need to work at a top bulge bracket or elite boutique to break into the industry.

You could potentially get into the industry from many different backgrounds:

- Investment banking, ideally in groups like infrastructure, energy, renewables, or power & utilities that are directly related.

- Project finance since PF represents the debt side of infrastructure deals, and you need to understand both equity and debt to evaluate any deal.

- Real estate since some segments of infrastructure, such as schools and hospitals, overlap quite a bit; also, many companies structured as REITs own infrastructure assets.

- Other areas of private equity, such as firms that focus on renewables, energy, or power and utilities, since they’re all related to infrastructure.

- Infrastructure corporations/developers for obvious reasons (especially if you target greenfield-focused firms).

Some people also get in from areas like infrastructure/project finance law or infrastructure groups at Big 4 firms.

It’s unusual to break in without a few years of full-time experience in one of these fields; few firms hire undergrads or recent grads because they don’t have the resources to train them.

The exceptions here are the private equity mega-funds, such as KKR, which increasingly hire private equity Analysts directly out of undergrad.

Most infrastructure PE firms use off-cycle processes to recruit (i.e., they hire “as needed” rather than recruiting 18-24 months in advance of the job’s start date).

Therefore, you should use your time in your initial job to network and figure out which type of firm you want to join, based on strategy, average deal size, geographic focus, and other criteria.

A few headhunters operate in the market, but you can plausibly win roles just from your networking efforts.

One Search is the one recruiting firm dedicated to “real assets” (infrastructure, energy, and real estate), and they’re the best source for positions at infra PE firms – if you decide to go through recruiters.

The Infrastructure Private Equity Interview Process

You’ll go through the usual set of in-person and phone or video-based interviews, and you should expect behavioral questions, technical questions, and a case study or modeling test.

The behavioral/fit questions are all standard: walk me through your resume, describe your past deals, tell me your strengths and weaknesses, and so on.

The technical questions tend to focus on the merits of different infrastructure assets, the KPIs and drivers, and how you evaluate deals and use the right amount of leverage.

And the case studies and modeling tests are much simpler than on-the-job models because you usually have only 1-3 hours to complete them.

If you’re already familiar with Excel, LBO modeling, and/or real estate financial modeling, these tests should not be that difficult.

You do need to learn some new terminology, but projecting the cash flows and debt service and calculating the IRR are the same as always.

Infrastructure Private Equity Interview Questions And Answers

Here are a few examples of sector-specific interview questions:

Q: Why infrastructure investing?

A: You like working on deals involving long-term assets that provide an essential service and also do some social good.

Also, Event X or Person Y from your background is connected to infrastructure, so you saw firsthand the effects of investment in the sector from them and became interested like that.

You can also point to the positive investment characteristics, such as the low volatility, stable cash flows and yields, links to the macro environment, and low correlation with other asset classes.

Q: What are the key drivers and key performance indicators (KPIs) for different types of infrastructure assets?

A: This is a broad question because each asset is different, but to give a few examples:

- Power Plants: Capacity (maximum output), production (electricity produced, which is a fraction of the total capacity), contracted rates for both of those, fixed and variable operating expenses, annual escalations for the revenue rates and expenses, and required maintenance or growth CapEx.

- Airports: Total passenger volume and average fees per passenger, fees from rent and fuel, operating expenses such as payroll, insurance, maintenance, and utilities, required CapEx, and assumed inflation rates for all of these.

- Toll Roads: Traffic levels and growth rates, the toll rate per vehicle per day, fixed expenses for operations and maintenance and variable expenses linked to per-car figures, required CapEx, and inflation rates for all of these.

Q: Walk me through a typical greenfield deal/model.

A: You assume a certain amount of construction costs and a timeline for the initial development, and you draw on equity and debt over time to fund it, putting in the equity first to satisfy lenders. Interest on the debt is capitalized during the construction period.

When construction is finished, the construction loan may be refinanced and replaced with a permanent loan as the asset starts operating and eventually stabilizes.

Then, you forecast the revenue, expenses, and cash flow in different scenarios and size the debt such that it complies with requirements, such as a minimum Debt Service Coverage Ratio (DSCR).

At the end of the holding period, you assume an exit based on a percentage of the asset’s initial value or a multiple of EBITDA or cash flow.

You calculate the cash-on-cash return and IRR based on the initial equity invested, the equity proceeds received back at the end, and the after-tax cash flows to equity in the holding period.

Q: Walk me through a typical brownfield deal/model.

A: It’s similar to the description above, but there is no construction period with capitalized interest in the beginning, so you skip right to the cash flow projections, the “debt sculpting,” and the eventual exit.

Q: How would you compare the risk and potential returns of different infrastructure assets? For example, how does a regulated water utility differ from an airport, and how do they differ from telecom infrastructure like a cell tower?

A: Regulated utilities for water and electricity have lower risk, lower potential returns, and a higher percentage of total returns coming from the cash yields.

That’s because local governments set the allowed rates, and demand doesn’t fluctuate much unless the local population grows or shrinks significantly.

On the other hand, there’s also little downside risk because people can’t stop drinking water or using electricity even if there’s an economic crisis.

Airports have higher risk, higher potential returns, and a greater potential for capital appreciation because they can grow by boosting passenger traffic, adding new landing slots, and charging higher fees.

But there’s also more risk because passenger traffic could plummet in an economic recession, a war, or a pandemic.

With telecom assets like cell phone towers, the risk and potential returns are even higher, with much of the returns expected to come from capital appreciation.

There are different lease types (ground leases and rooftop leases), and location is even more critical than with other infrastructure, so these assets are closer to real estate in some ways.

Q: How would you value a toll road or an airport?

A: You almost always use a DCF model for these assets because cash flows are fairly predictable.

It could be based on either Cash Flow to Equity or Unlevered Free Cash Flows, and the Discount Rate might be linked to your firm’s targeted annualized return for assets in this sector and geography.

If the Discount Rate is the Cost of Equity, then it’s linked to the targeted equity returns; for WACC, the Cost of Debt is linked to the weighted average interest rate on the debt used in the deal.

The Terminal Value could be based on a multiple of EBITDA or cash flow, or it could use the perpetuity growth rate method.

Q: Why can you use high leverage in many infrastructure deals? And what are some of the important credit stats and ratios?

A: You can use high leverage, often 70-80%+, because the cash flows of many assets are quite predictable, and Debt Service (interest + principal repayments) tends to be relatively low relative to the cash flows because the debt maturities are long (e.g., 10-15+ years).

Some of the most important ratios include the Debt Service Coverage Ratio (DSCR) and the Loan Life Coverage Ratio (LLCR), along with standard ones like the Leverage and Coverage Ratios used in debt vs. equity analysis.

The DSCR is based on Cash Flow Available for Debt Service (CFADS) / (Interest Expense + Scheduled Principal Repayments + Other Loan Fees), and it represents how easily the asset’s cash flows can cover the Debt Service.

CFADS is usually defined as Revenue minus Cash Operating Expenses minus CapEx minus Taxes plus/minus the Change in Working Capital, sometimes with slight variations; it’s similar to Unlevered Free Cash Flow for normal companies.

Importantly, depreciation must be excluded, except for its tax impact, because it’s non-cash.

The LLCR is defined as the Present Value of the total Cash Flow Available for Debt Service over the loan’s life divided by the current Debt balance.

The Discount Rate should be based on the weighted average interest rate on the Debt.

Higher numbers are better because it means the asset’s cumulative cash flows can more easily pay for the debt.

Q: What is “debt sculpting” in infrastructure deals, and why is it so common?

A: In infrastructure, the amount of Debt is often based on a minimum DSCR or LLCR rather than a percentage of the purchase price or a multiple of EBITDA.

Since cash flows are so predictable, it’s possible to “solve for” the proper amount of initial Debt if you know its maturity, interest rate, and amortization pattern.

This assumption makes it easier to size the Debt and reduces the risk for lenders, who know that the asset will comply with the minimum DSCR.

Infrastructure Case Study Example

Real-life infrastructure models can be complex, but time-pressured case studies are a different story.

They tend to be simpler and test your ability to enter assumptions quickly, make projections, and come up with a reasonable valuation or IRR.

Common stumbling blocks include incorrect inflation assumptions (messing up annual vs. quarterly vs. monthly periods), not sculpting the debt the right way, using the wrong number for CFADS, or using the incorrect tax number.

Here’s a simple example of a valuation case study (no solutions, sorry):

“Your firm is considering acquiring a brand-new natural gas power plant with the following characteristics:

- Capacity: 500MW

- Heat rate: 7,500Btu/kWh

- Annual dispatch: Expected capacity factor of 50%

The plant’s revenue sources include:

- Capacity payment: $135/kW-year

- Energy payment: $10/MWh, escalating at 2% per year

Operating expenses include the following:

- Fixed O&M expense: $30/kW-year, escalating at 2% per year

- Variable O&M expenses:

- Labor and operations: $5/MWh, escalating at 3% per year

- Water and consumables: $1/MWh, escalating at 2% per year

Annual fuel is not an expense because the contract counterparty provides it.

Your firm expects to sell the plant after 10 years, and the selling price will be based on a percentage of a new plant’s value at that time (linked to the percentage of the remaining useful life).

Comparable projects cost $1,000/kW currently and are expected to increase in price at 2% per year, with a useful life of 40 years.

The Debt will be based on the following terms:

- Tenor: 10 years, fully amortizing

- Interest Rate: 5%, fixed rate

- Amortization: Sculpted amortization to achieve a 1.40x Debt Service Coverage Ratio (DSCR) in each year based on Cash Flow Available for Debt Service (CFADS)

Please value the power plant on an after-tax basis using a 12% Cost of Equity and assuming a 25% tax rate and 20-year depreciation based on MACRS.”

Infrastructure Private Equity Exit Opportunities

The most common entry points into infrastructure PE are also the most common exit opportunities: investment banking, project finance, real estate, other areas of PE, infrastructure corporates/developers, and Big 4 infrastructure groups.

It tends to be difficult to move into generalist roles coming from infrastructure because the perception is that it’s very specialized.

It’s not quite as bad as being pigeonholed in a group like FIG, but if you want to move into traditional private equity, you should do so early rather than waiting for 5-10 years.

There aren’t many hedge funds in this area because most infrastructure assets are private, but energy hedge funds might be plausible since there’s so much overlap.

Venture capital is not a likely exit opportunity because infrastructure assets are the opposite of early-stage startups: stable, with highly predictable cash flows and growth profiles.

Resources for Learning More About Infrastructure Private Equity

Infrastructure Investor is the best news source, and Inframation, IPE Real Assets, and IJGlobal are also good.

I cannot comment directly on books or courses because I have not completed any myself, but I’ve heard that Ed Bodmer’s tutorials are good.

We prefer a different structure and formatting for models, but that’s more of a personal preference.

Preqin issues good infrastructure reports once per year, which you can Google, and this guide from JP Morgan also has a concise sector overview.

Infrastructure Private Equity: Pros and Cons

Summing up everything above, here’s how you can think about the industry:

Benefits/Advantages:

- High salaries and bonuses, at least if you work at a dedicated PE firm rather than a pension, SWF, or insurance company.

- You get to work on deals that do some social good, at least in certain sectors, and that provide benefits to individuals, such as diversification, inflation hedging, and strong cash yields.

- Each asset requires different assumptions and drivers, so you’re always learning new skills (compared with vanilla IB/PE, where deals start to look the same after a while).

- The hours and lifestyle are better if you’re at a pension, SWF, or insurance company – but total compensation is also below standard PE pay.

- It’s more feasible to get into the industry without working at a top BB or EB bank for two years; they care more about your skills and sector experience than your pedigree.

Drawbacks/Disadvantages:

- It is a small industry if you go by the number of dedicated, independent PE firms, so it can be tricky to find openings and advance.

- It is also specialized, though arguably less so than something like FIG; that said, you can still get pigeonholed if you stay too long and then decide you don’t like it.

- Compensation is lower at the non-PE firms, and even at the dedicated PE firms, the MD/Partner-level compensation has a lower ceiling.

- You’re further removed from real life than you might expect because finance professionals cannot “evaluate” a power plant or water treatment facility in the same way they could inspect an apartment building; you rely on outside specialists for much of this process.

- Although each deal is different, some of the modeling work can become repetitive because you have to look at so many individual contracts and build very granular assumptions.

Overall, infrastructure private equity is a great career option, but it’s a bit less of a “side door” or “back door” than real estate private equity because you do need some relevant deal experience first.

The best part is probably the optionality – if you want higher pay and longer hours, you have options, and if you want a better lifestyle with lower pay, you can also do that.

And with the dismal state of infrastructure in most countries, it’s safe to say that there will always be demand for investment – even if it takes a few broken bridges and toll roads to get there.

Further Reading

You might be interested in The Full Guide to Direct Lending: Industry, Companies & Careers or Private Equity Salary, Bonus, and Carried Interest Levels: The Full Guide.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

Hi Brian. Thanks for writing such articles, I find them really helpful as a beginner. I do have a quite different background than most aiming to head into infrastructure investment banking/PE and thought it would be great if I could have your perspective.

I did my undergrad in Civil Engineering, from one of the top 5 unis in Asia (HKU) and graduated with a 2:1. I have since worked for about three years now, at a leading engineering and consulting firm within the infrastructure sector, in the capacity of both an engineer and a management consultant concurrently. I have worked on some really high profile infrastructure projects worth 3.5 Bill USD and have been involved in management consulting projects that have influenced the infrastructure sector at a national level within Asia. I am really passionate about working within the infrastructure finance space and thus I also ended up taking CFA on the sides. I have passed both Level 1 & 2 of the program with good scores. I am headed to UCL coming fall for their MSc program in Infrastructure Investment & Finance, it’s a specialized program focused specifically on infrastructure and is offered by their faculty of Built Environment which is currently ranked the world’s best department as per QS Subject Rankings.

I do really wanna switch over to the finance side of infrastructure, but I do lack direct work experience in the finance aspect of it. Do you think that my profile is decent to target the big investment banks/funds in London/Asia focused in the infra space? I am specifically interested in advisory or buyside roles. I will be applying for analyst roles in the coming intake and wanted someone’s independent perspective.

Thanks. Yes, I think your profile is good enough since PF/infrastructure is quite specialized and they want people who know the sector really well. Finance is easy to learn if you’re already an engineer – it’s much harder to find people who know the sector and everything that can happen on the ground with infrastructure projects.

Thank you very much for your answer Brian! Really appreciate your perspective.

Hi, thank you for the article, very helpful. Could you please share any insights on how easy it would be to move from renewable energy infra PE to another sector in infra PE? Thanks in advance!

I think it should be doable because you use the same modeling techniques and analysis in all areas of infra PE. It’s just that the numbers and assumptions differ between different asset types. But it’s not like you’re moving from FIG to oil & gas, for example, where everything is different.

This may be the single best resource on the internet for an infrastructure finance overview. I used this to initially break into project finance and now work at an infra-PE fund. The quality on this website always blows me away. Thank you for taking the time and effort to write such high quality guides, this infra one and the many others!

Thanks! Glad to hear it.

Hi Brian,

I’ve found your article really insightful and was hoping to ask for a bit of advice on breaking into the industry.

I’ve been looking into a PPP investment arm of a construction conglomerate. Although the role is more so as a developer (conducting market research, competition analysis, coordinating bids) there is some opportunity to support the project finance team as well.

Do you feel this is a good opportunity in general to gain industry experience, rather than perhaps in an infra advisory big 4 capacity?

Yes.

Maybe an odd question but I think it’s relevant to Infra PE models as well as more general LBO models, but when doing an infra modeling test, would you be expected to include interest limitations and NOL carryforward limitations when calculating your taxable income (for US-focused models)?

So, we don’t officially teach infrastructure modeling currently, which means I can’t answer your question definitively, but in the models I’ve gathered, I’ve seen both approaches (factor in these tax elements or ignore them). I think it mostly depends on the model complexity and if you’re doing it at the corporate or asset-level.

Hardly any LBO models, in practice, include the bits around interest deduction limitations because they’re not common constraints with normal leverage levels.

is it possible for the section where you mentioned TV is determined by the perpetuity growth rate or an exit multiple, that for infrastructure assets, i generally see them modelled to the end of concession in which case there isn’t really a terminal value.

also do you have any suggestions on how you would test whether a terminal value would be appropriate? i.e. not too big or smal?

We don’t officially cover infrastructure modeling on this site and do not usually answer technical questions in these articles, so I can’t tell you for sure. The approach you suggested sounds reasonable, but many infra assets do assume a Terminal Value if the asset is expected to last for decades. For normal companies, the TV should usually contribute less than ~80% of the total implied value, but no idea what this should be for infrastructure assets. I assume much less because of the longer holding periods/projections.

Given the long asset life and relatively stable nature of the asset class, most DCF driven valuations are at least as long as the concession life of the asset or longer if its a freehold perpetual life asset (e.g. landlort ports in the UK). For this reason TV usually tends to be a smaller proportion of the PV compared to other asset classes. In terms of methodology, people tend to use both perpertuity and multiple based methodologies. Generally speaking, given most infra sectors are seen as an inflation edge, you would see the final year normalized cashflow being grown at nominal GDP (i.e. real GDP growth + inflation). Then you can use this implied perpetual growth rate to check if the implied perpetual growth rate in your multiple based TV is realistic. If you are running a levered DCF, i.e. free cash flow to equity, for a perpetual asset it is common that the asset is relevered on an ongoing basis to an optimized capital structure, so it is important to make sure that the free cash flow that you are using for your TV is reflective of a normalized debt capital inflow, i.e. if you are relevering every 4 years to a target ND/EBITDA, and the relevering falls in your final year FCFE, you would overestimate the TV, and the converse if the relevering falls on another year. You could avoid that if you relever every year. Regarding assets with concession life, I have seen concession life extension assumptions being included in models, but in that case you would need additional assumptions, as you would effectively be capturing the PV of the spread between the concession rights payment (outflow) and the inflows from the later years. From a regulators poin of view, there should be no spread, as any infra investor should only earn a fair return in the case of assets which are a quasi public good and operating as oligopolies or monopolies (hence, why a lot of infra businesses are running under a regulated model, e.g. RAB based returns). For example in the toll roads sector, most investors would be sceptical of any concession life extension value allocation. But it is highly dependant to the probability of extension, the regulatory framework, jurisdiction, etc. Hope this helps.

Hi Brian – I wanted to enquire what financial modelling foundation would set me up for a Infra PE role. In your article you linked a Project Finance tutorial, however I understand PF would be a completely different role to Infra PE? Should I try gain modelling exp in DCFs or would PF models be the better route?

Project Finance and Infrastructure PE are similar. Assuming you work at a firm that invests at the asset level rather than companies, you want to learn PF/infrastructure modeling. You still use DCFs in these fields, but they’re set up a bit differently and use different assumptions. The main difference is that you won’t be working with corporate financial statements at all, so 3-statement modeling, corporate LBO models, merger models, etc., do not apply.

Brian, this was incredibly thorough and very appreciated, thank you!

Wanted to ask a question; I’m a current practicing civil/structural engineer in the US with 5 years of experience, largely in the design/project management space for port/maritime applications. Is there a path to Infra PE with this background? Would an MBA/MSF be a necessary stepping stone? Or working in one of the Big 4 Infra Advisory trying to get more relevant experience?

I think you would need another degree or an actual finance/advisory role to get in. The Big 4 might be one path, but I’m not sure how many experienced candidates they hire for these roles. The MBA/MSF route is safer but also costs more time and money.

Any chance we can get the solution to the case study? Just want to compare with what I’m putting together.

Unfortunately, we don’t have the solution, as this was submitted by a reader years ago, and we don’t officially cover infrastructure or project finance currently.

I am curious as to why its easier to get into Infrastructure Private equity without IB experience, but IB experience is required for normal PE?

It’s because of the specialization and deal/modeling skill set. Infrastructure is very specialized and doesn’t follow the accounting rules that standard corporations do because everything is cash flow-based, and you need to know the nuances of things like customer contracts for individual assets, escalation rates, etc., none of which you learn in most IB groups.

Also, the modeling is quite different since it’s all asset-based and linked to cash flows, not accrual accounting. Therefore, most IB modeling experience won’t carry over that well.

So, all else being equal, they’d prefer someone who knows infrastructure very well to someone with IB experience but in an unrelated group with no exposure to asset-level modeling.

Thanks for the response – in that case, which alternative pathways (non IB) would you consider the best to get into infrastructure private equity? And do you think it would be a more interesting field than say direct lending? (as i think Direct lending / credit investing roles also don’t require IB?)

I don’t think there is one “best” option because people tend to get in from varied backgrounds. There’s a list of possibilities under “The Recruiting Process” here. Anything infrastructure-related works, whether it’s project finance, a normal company, the same sector at a Big firm, etc. It’s hard to compare to direct lending because it depends on what you’re looking for. Direct lending compensation is lower, and you tend to see and close more deals, but you don’t go as in-depth into each one. It’s probably a bit easier to get into direct lending because it doesn’t have “private equity” in the name.

Hi Brian. Thanks for the great article. I was wondering how difficult you think it would be to break into infra PE as an analyst from a tech IB group. Will the difference in coverage group be too large of a hurdle to overcome? Can a bank’s “prestige” override that? Thanks!

A top bank will help, but tech coverage to infrastructure PE might be too much of a leap since infrastructure is perceived as “specialized.” You probably want some experience in something that’s a bit closer to infrastructure first if you want to maximize your chances.

Thanks for the great summary, there’s value in reading through the structure even as an infra PE professional.

Would caveat that because of the higher prevalence of auctions due to pricings getting competitive the work-life balance I see is getting worse even on the pension fund end of the scale and so comp is adjusted accordingly. Smaller funds that can avoid competition and do bilaterals pay less and can offer better hours but not always as that highly depends on deal flow vs team size and the number of people on the deal team and the level of detail required in the DD, at least in Europe.

Thanks for adding that.

Brian – great guide, as always. Really appreciate you taking the time to put this together.

I’m a civil engineer by training, with a few years of Big 4 infra advisory experience (Canada and UK).

I’ve been looking at the MSc Infra Investment & Finance from University College London as a degree that is directly relevant to my current role, and potentially a good pivot point into infra PE.

Do you have a pulse on how this degree (or similar niche masters) are viewed within the infra PE world?

For reference: https://www.ucl.ac.uk/prospective-students/graduate/taught-degrees/infrastructure-investment-finance-msc

Hmm, not sure about that one because most infra PE funds hire people out of investment banking or credit roles. If you’ve already had Big 4 infra advisory experience, I’m not sure the degree adds a whole lot because it’s not like you’re an engineering with no other experience making a huge change. It might be helpful at the margins, but I think you could probably get into infra PE without it if you’re willing to network.

Appreciate the detail and comprehensiveness of this post!

One thing – on the definition of project finance, I am used to hearing a much broader definition that includes the entire capital stack of a separate legal entity (the project), all of which have senior claims over the (multiple) parent owners’ equity holders or debtors. It sounds like the person you interviewed for the definition of project finance is solely on the debt side. In renewable energy, for example, project finance refers to the project’s sponsor equity, tax equity, and debt financing.

Yes, that may be true. We tend to refer to equity investing in the sector as “infrastructure private equity” and debt investing as “project finance” for clarity. Otherwise it gets too confusing if both terms potentially refer to the same thing.

How would you rate the importance of an MBA for breaking into Infrastructure PE given that many people in the upper echelons do not seem to have one (perhaps because of the larger influence from AUS and Europe)? If someone was infra PE-adjacent (Fund of Funds), would it be better to simply hustle to build up a network?

Not important. Networking and work experience are far more important.

Hi, I am starting in Equity Research in a company that overlooks Mining, Construction and Energy sectors. My plan is to move into PE or IB after an MBA and I will like to know which of those three sectors will give me the best background to make the jump.

Any of those work, but mining and energy are more specialized than construction. So construction is probably the safest bet for generalist IB/PE roles.

Love your posts. Thank you so much for the guidance you provide!

Thanks!

I will be starting next summer as a corporate banking analyst for a large US bank, covering Renewable Energy companies. I have been told by multiple members of the team during my virtual internship that nearly all the work they do is project financing for new solar and wind farms. Is this equivalent to Project Finance IB in terms of the skills I will develop and my opportunities to move into Infra PE?

Yes, maybe not “equivalent,” but similar.