Private Equity Strategies: Growth, Buyouts, Credit, Turnarounds, and Toll Roads to Nowhere

The answer to the first one is: “In the short term, the large, traditional firms that execute leveraged buyouts of companies still tend to pay the most. But in the long term, it gets more complicated.”

And the answer to the second one is: “Read all about private equity recruitment and interviews on this site.”

But there are also more interesting questions here: Which strategies will be the best going forward? Will private equity continue to attract trillions of dollars?

And will students with no clear goals or ambitions other than “make a lot of money” continue to be obsessed with the industry?

We’ll return to all of those at the end, but let’s start with a quick tour:

Private Equity Strategies

I would summarize the industry like this:

How to Classify Private Equity Firms

It’s tricky to classify many private equity firms because the largest firms have been diversifying and moving into many areas beyond traditional “company investing” (i.e., equity strategies).

But the main classification criteria are size (in assets under management (AUM) or average fund size), stage of investment, geography, industry, and investment strategy.

Size

Size matters because the more in assets under management (AUM) a firm has, the more likely it is to be diversified.

For example, smaller firms with $100 – $500 million in AUM tend to be quite specialized, but firms with $50 or $100 billion do a bit of everything.

The biggest PE firms are known as “mega-funds,” and they tend to have over $50 billion in AUM, with some, like Blackstone and Apollo, at over $300 billion.

Below that are middle-market funds (split into “upper” and “lower”) and then boutique funds.

Stage of Investment

There are four main investment stages for equity strategies:

- Early Stage – This one is for pre-revenue companies, such as tech and biotech startups, as well as companies that have product/market fit and some revenue but no substantial growth. Venture capitalists and angel investors operate here.

- Growth Stage – This one is for later-stage companies with proven business models and products, but which still need capital to grow and diversify their operations. Many startups move into this category before they eventually go public. Growth equity firms and groups invest here.

- Mature – These companies are “larger” (tens of millions, hundreds of millions, or billions in revenue) and are no longer growing quickly, but they have higher margins and more substantial cash flows. Traditional leveraged buyouts take place here.

- Declining – After a company matures, it may run into trouble because of changing market dynamics, new competition, technological changes, or over-expansion. If the company’s troubles are serious enough, a firm that does distressed investing may come in and attempt a turnaround (note that this is often more of a “credit strategy”).

Credit and asset-level investing (real estate and infrastructure) are less about “stage” and more about “How risky is this part of the capital structure?” or “Are we acquiring an existing asset or building a new one?”

Geography

A firm can focus on a single country, a few countries, an entire region (e.g., North America or Europe), or even something as broad as developed markets or emerging markets.

In practice, a single-country focus is rare unless the country’s domestic economy is large (e.g., the U.S. or China).

Most of the mega-funds operate worldwide, but they may devote more time and resources to specific geographies.

Industry

A firm could be diversified and invest in all industries: technology, consumer/retail, healthcare, manufacturing, financial services, media, energy, and more.

Or, it could specialize in a specific sector.

While size plays a role here, there are some large, sector-specific firms as well.

For example, Silver Lake, Vista Equity, and Thoma Bravo all specialize in technology, but they’re all in the top ~20 PE firms worldwide according to 5-year fundraising totals.

Investment Strategy

Does the firm focus on “financial engineering,” AKA using leverage to do the initial deal and continually adding more leverage with dividend recaps?

Or does it focus on “operational improvements,” such as cutting costs and improving sales-rep productivity?

Some firms also use “roll-up” strategies where they acquire one firm and then use it to consolidate smaller competitors via bolt-on acquisitions.

In earlier investment stages, the strategy boils down to “accelerate growth at all costs.”

The exit strategy also plays a role here: if the firm buys companies or assets but cannot sell them, it can’t make money.

The main options are IPOs and M&A deals (sales to normal companies or other PE firms), but in emerging markets, many firms rely on strategies like dividend recapitalizations if there are no obvious buyers.

Private Equity Strategies: Putting Together the Pieces

You can use these criteria to distinguish the three main “equity” strategies: venture capital, growth equity, and leveraged buyouts.

Private Equity Strategy #1: Venture Capital

Venture capital firms raise money from Limited Partners, such as pension funds, endowments, and family offices, and then invest in early-stage, high-growth-potential companies in exchange for ownership in those companies.

VCs expect 50%+ of their portfolio companies to fail, but if they find the next Google or Facebook, they could still earn high returns (see: venture capital careers).

Venture capital tends to attract a different group of professionals than other categories within private equity: former CEOs, entrepreneurs, product managers, and engineers are more likely to end up here.

You still need to know accounting and finance, but product/market knowledge is far more important.

And in life science venture capital, scientific knowledge is critical, so many Ph.D.’s and M.D.’s end up in the field.

You could further sub-divide venture capital into seed stage, early stage, late stage, and pre-IPO stage investing, with the latter two being more like growth equity.

Size: The largest VC firms have $10 – $20 billion in AUM across all funds; mid-sized firms have in the single-digit billions, and smaller ones are in the tens to hundreds of millions.

Stage of Investment: Early stage to growth stage.

Geography: Diversified, but most investing takes place in North America and Asia.

Industry: Heavy focus on technology and healthcare (biotech), but some also invest in cleantech, retail, education, and other sectors.

Investment Strategy: Minority-stake deals; growth at all costs!

Representative Large Firms: Accel, Andreesen Horowitz (a16z), Benchmark, IDG Capital, Index Ventures, Kleiner Perkins, New Enterprise Associates, and Sequoia.

Private Equity Strategy #2: Growth Equity

In growth equity, also known as “growth capital” or “expansion capital,” firms invest minority stakes in companies with proven markets and business models that need the capital to fund a specific expansion strategy.

Unlike venture capital, there’s minimal risk that a company will outright “fail” in growth equity; the worst-case scenario is that it grows less than expected.

The “classic” growth equity firms often acquire secondary stakes in companies by buying shares from employees or other investors.

The company receives no cash, or minimal cash, in this case, so it’s more about picking winners and finding ways to boost growth outside of additional capital.

On the other hand, newer firms that operate more like late-stage VCs do invest new capital to support growth.

But many firms use both strategies, and some of the larger growth equity firms also execute leveraged buyouts of mature companies.

Some VC firms, such as Sequoia, have also moved up into growth equity, and various mega-funds now have growth equity groups as well.

Size: Tens of billions in AUM, with the top few firms at over $30 billion. Smaller firms could be in the billions or hundreds of millions.

Stage of Investment: Growth stage, but that could be anywhere from “just achieved product/market fit” to “ready for an IPO.”

Geography: Diversified, but a focus on North America and emerging markets.

Industry: Still a lot of tech and healthcare, but also consumer/retail, services, media/telecom, and financial services.

Investment Strategy: Minority-stake deals; anything to accelerate growth.

Representative Large Firms: TA Associates, General Atlantic, Summit Partners, Insight Partners, JMI, Providence Strategic Growth, Accel-KKR, TPG Growth, Sequoia Growth, Warburg Growth, Spectrum, and Great Hill.

Private Equity Strategy #3: Leveraged Buyouts

Unlike VC or growth equity, which both involve minority-stake investments in early-stage or growing companies, leveraged buyout firms acquire majority control – usually 100% ownership – of mature companies.

Firms invest using a combination of debt and equity to improve the potential IRR; more debt means that they contribute less of their own capital (see: the LBO model concept).

The debt/equity split varies based on the geography and industry, and the amount of debt is usually based on a multiple of EBITDA rather than a percentage of the total purchase price.

Returns from traditional LBOs are mostly linked to financial leverage because the companies are already mature, so growth opportunities are more limited (see: quick IRR calculations for LBO models).

Of course, this works both ways: leverage amplifies returns, so a highly leveraged deal can also turn into a disaster if the company performs poorly.

Some firms also “improve company operations” via restructuring, cost-cutting, or price increases, but these strategies have become less effective as the market has become more saturated.

Also, the targeted internal rate of return (IRR) on leveraged buyouts has fallen over time; the goal used to be 30%+, but now it’s more like 20-25%, especially on larger deals.

Size: The biggest private equity firms have hundreds of billions in AUM, but only a small percentage of those are devoted to LBOs; the biggest individual funds might be in the $10 – $30 billion range, with smaller ones in the hundreds of millions.

Stage of Investment: Mature.

Geography: Diversified, but there’s less activity in emerging and frontier markets since fewer companies have stable cash flows.

Industry: Diversified, but firms often avoid certain industries that are too speculative (e.g., biotech).

Investment Strategy: Financial engineering, operational improvements, and roll-ups and industry consolidations.

Representative Large Firms: Blackstone, Brookfield, Apollo, Carlyle, KKR, Ares, TPG, CVC, Apax Partners, Warburg Pincus, EQT Partners, Silver Lake, Advent, Bain Capital, and Onex.

Credit Strategies or “Private Debt”

These strategies are not exactly “private equity strategies” because firms using them invest in debt, not equity, but many PE firms also operate in this space.

The main difference is that the upside is capped, so professionals focus on assessing the downside risk in deals.

For example, what happens if a company loses customers in one geography? What if its market declines? What if there’s a pandemic? What happens in a recession?

Could a company survive and still repay its lenders even if it faces a small disaster?

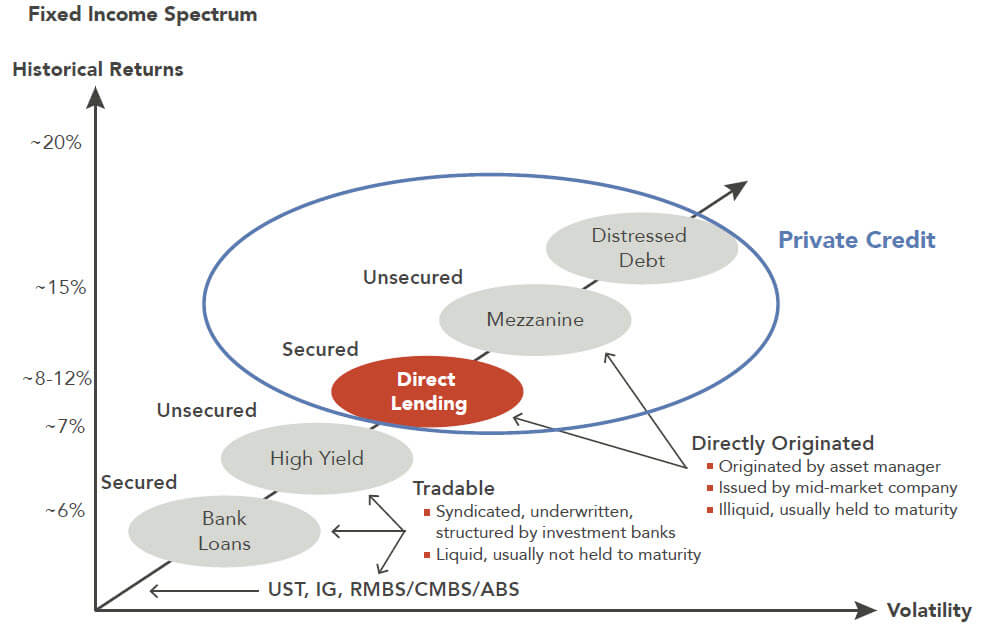

There’s a good summary of the three main credit strategies that PE firms pursue in this graph from Marquette Associates:

Direct Lending

Unlike mezzanine and other, riskier forms of debt, the loans here are secured by the company’s assets.

It’s similar to the difference between Term Loans issued by banks and High-Yield Bonds, but “direct loans” are not liquid instruments that trade on the markets.

Since the 2008 financial crisis, direct lending has soared, with total assets rising into the hundreds of billions.

Part of that is because of regulatory changes: due to the Dodd-Frank legislation in the U.S. and Basel III worldwide, large banks retreated from traditional lending activities as the number of banks plummeted.

That made room for “non-bank lenders,” such as private equity firms.

Yields on direct loans are often in the high single digits to low double digits (e.g., 7% to 12%), so the targeted IRRs are in that range as well.

Representative Large Firms: Ares, Oaktree, Blackstone (GSO), Goldman Sachs Merchant Banking, Lone Star Funds, AXA, M&G Investments, HPS, Intermediate Capital Group, Apollo, Centerbridge, Cerberus, and Fortress.

Mezzanine

We covered mezzanine funds in a detailed article, but the short version is that it sits between Senior Debt and Common Equity in a company’s capital structure.

Mezzanine funds invest in these loans and aim to earn IRRs in between the ones targeted by Senior Debt and Common Equity Investors.

Mezzanine debt tends to have a relatively high, fixed coupon rate (e.g., 10-15%), incurrence covenants, bullet maturity, call protection, commitment fees, an original issue discount (OID), and an “equity kicker,” such as warrants or options.

Most of the job is creating “downside” scenarios for companies and seeing which ones could survive long enough to repay their loans.

The modeling and deal analysis are similar to what you do at an LBO-focused private equity firm, but there are a few key differences:

- More deals and less detail on each one – Since firms assume lower risk and target lower returns, they don’t spend nearly as much time doing due diligence on each deal.

- No operational details – Even if there’s an “equity kicker,” mezzanine funds rarely have enough ownership to enact operational changes. So, more financing and less operating.

- Somewhat better lifestyle – The hours can be more reasonable than those in PE (more like 50-60 per week rather than 60-70 or 70-80), but they’re also highly variable and linked to firm size and culture.

Representative Large Firms: Crescent, Blackstone (GSO), Bain Capital Credit (fka: Sankaty), Oaktree, Carlyle, Kayne Anderson Mezzanine Partners (KAMP), Ares, BlackRock Capital (fka: BlackRock Kelso), Morgan Stanley Credit Partners (MSCP), HPS Partners (fka: Highbridge), and Apollo Credit Funds.

Distressed Private Equity

Again, we have a comprehensive article on distressed private equity, so you can refer to that.

Distressed PE firms invest in troubled companies’ debt or equity to take control of the companies during bankruptcy or restructuring processes, turn the companies around, and eventually sell them or take them public.

They use a variety of strategies, ranging from distressed debt trading to buying and holding debt to gain influence or control to turnarounds following full acquisitions.

In most cases, though, distressed PE firms end up investing in troubled companies’ debt, so this one is usually seen as a “credit strategy.”

Since the risk and potential returns are much higher in distressed PE, the range of potential outcomes for individual deals is much wider as well.

You’re not going to see a narrow band of IRRs between 8% and 15%; one deal might produce a 50% IRR, and another one might produce 1%, or even a negative IRR.

This field is relatively small and specialized, and to get in, you need a good credit background (e.g., restructuring investment banking, leveraged finance, mezzanine, or distressed debt trading).

Representative Large Firms: Oaktree, Cerberus, TPG, Centerbridge, Fortress, PIMCO, Apollo, Ares, Brookfield, Bain Capital, and Blackstone (GSO).

Industry-Specific and Asset-Level Strategies

The main difference here is that these firms invest in specific assets, not entire companies.

There are also “industry-specific” firms that focus on healthcare or technology or media/telecom, but they almost always buy companies or divisions of companies.

The main two sectors in this category are real estate and infrastructure, and firms invest in them using one of three strategies:

- Acquire Existing, Stabilized Assets – This one is also known as “core real estate” (or “core-plus”), and in infrastructure, it could use the same name or “brownfield.”

- Acquire Existing Assets and Renovate or Improve Them – This one is called “value-add” in both fields.

- Develop New Assets – This is called “opportunistic” in real estate or “greenfield” in infrastructure.

Real Estate Private Equity

Once again, we have a detailed article on real estate private equity, but here’s the short version:

Unlike traditional PE firms, REPE firms invest in properties – to operate them as-is, to improve them, or to develop new ones.

If you’re on the Acquisitions side, much of the work involves deals: analyzing new properties, building real estate financial models, setting up the financing, and buying and selling properties.

The Asset Management side is related to the ongoing operations of a property once the firm has acquired it, and the job involves both maintenance and operational improvements.

Some REPE firms focus on specific segments within commercial real estate, such as multifamily, industrial, office, retail, or hotel properties; other firms are diversified.

There may also be a geographic focus or preferred strategy, and some REPE firms may also invest in real estate debt.

The targeted IRRs on these deals tend to be lower than those in traditional leveraged buyouts because there’s less room for growth, and properties change less than companies over time.

No matter what the REPE firm does, it can’t just “raise” the average rent by 10% per year; rents follow average incomes and demographic trends.

Targeted annualized returns might range from the high single digits for “core” deals up to the mid-teens for value-added deals up to 20%+ for opportunistic deals.

Top Firms: Blackstone, Brookfield, Starwood Capital, GLP, Lone Star Funds, AEW, Carlyle, Rockpoint, and BentallGreenOak.

Infrastructure Private Equity

Once again, we have an article on infrastructure private equity, so please refer to that for the details.

At a high level, it’s similar to real estate in that firms acquire stabilized assets (“brownfield”) or pay to develop new ones (“greenfield”).

The difference is that the assets are different: toll roads, bridges, power plants, oil and gas pipelines, wind farms, and airports rather than apartments or office buildings.

The financial modeling and deal analysis are often incredibly granular, to the point where you’ll see hundreds or thousands of rows in Excel for all the individual customer contracts.

A few other differences include:

- Relatively Low Volatility and Stable Cash Flows – A power plant can’t just “stop working” unless human civilization collapses.

- Strong Cash Yields – Unlike traditional LBOs, where all the returns might come upon exit, infrastructure assets usually yield high cash flows during the holding period.

- Links to Macro Environment and Inflation – Investors often view infrastructure assets as “inflation hedges” because they’re linked to population growth, GDP, and other macro factors that change the demand for infrastructure.

As in real estate, the targeted IRRs here are lower, with anything from 5-10% up to 10-15% depending on the asset type and strategy.

Due to the stability of the assets, the “worst-case” scenario often yields something like a 2-3% IRR.

Holding periods are also longer, compensation is lower due to lower management fees (1.0% – 1.5% rather than 2.0%), and a huge variety of firms invest in the sector.

Representative Large Firms: Macquarie, Brookfield, Global Infrastructure Partners, EIG, ArcLight, Energy Capital Partners, Goldman Sachs Infrastructure Investment Group, and Morgan Stanley Infrastructure.

If you include pensions, sovereign wealth funds, and life insurance firms, the names include CPP (Canada), the Abu Dhabi Investment Authority, the National Pension Service of Korea, Allianz Capital Partners (Germany), CDPQ (Canada), and China Investment Corporation (more here).

Funds of Funds

Once again, we have an article on this one (private equity funds of funds).

With this strategy, firms do not invest directly in companies’ equity or debt, or even in assets.

Instead, they invest in other private equity firms who then invest in companies or assets.

This role is quite different because professionals at funds of funds conduct due diligence on other PE firms by investigating their teams, track records, portfolio companies, and more.

A lot of time is spent digging into the historical results and determining if they represent repeatable processes, and these firms also run “valuation checks” on portfolio companies.

Some funds also co-invest with their PE firms, and in those cases, you get more exposure to deals.

This field is more relationship-driven and less analytical at the junior levels, which could be positive or negative depending on what you’re looking for.

Representative Large Firms: ATP Private Equity Partners, HarbourVest Partners, Horsley Bridge Partners, LGT Capital Partners, Portfolio Advisors, Horsley Bridge Partners, Axiom Asia Private Capital, SwanCap Partners, Access Capital Partners, Oriza Holdings, and Adams Street Partners.

Do Private Equity Returns Match the Hype?

The WSJ and FT have both covered the topic of private equity returns before; see this example from the FT and this one from the WSJ.

On the surface level, yes, private equity returns appear to be higher than the returns of major indices like the S&P 500 and FTSE All-Share Index over the past few decades.

However, the IRR metric is deceptive because it assumes reinvestment of all interim cash flows at the same rate that the fund itself is earning.

If you adjust for that, the picture looks worse:

- 1984 to 2006: Around ~800 U.S. buyout funds generated an excess return of 3% over the S&P.

- 2006 Onward: There was almost no excess return (similar results for European funds).

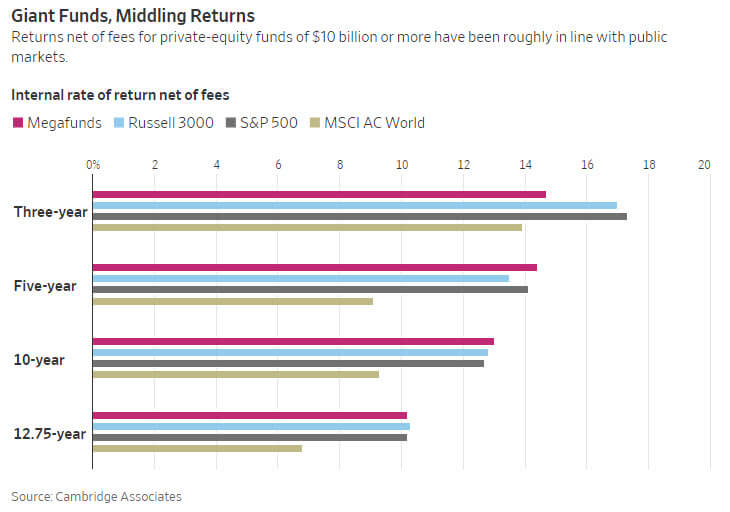

And even if you do not adjust for that, mega-funds with $10 billion or more have only performed in-line with public-market benchmarks:

For more on this one, take a look at the CFA Institute’s coverage of private equity and how you could replicate its performance with public stocks.

And if you want to reconsider your life plans, check out this feature on Coin-Flip Capitalism.

Private Equity Strategies: My Unpopular Predictions

So, which strategy or firm type is “the best?”

First, you should note that private equity grew into a huge asset class because of specific monetary, fiscal, and regulatory conditions:

- Monetary – Interest rates have been falling since the early 1980s, which boosted all equity assets. The Fed and other central banks have suppressed interest rates and are now monetizing the debt, which mostly benefits the wealthy.

- Fiscal – Tax policy has favored the wealthy, the U.S. started running massive deficits, and income and wealth have increasingly shifted to the top 1%.

- Regulatory – The government has been “deregulating” and has barely enforced anti-trust law for the past few decades. That favors private equity because it enables industry consolidations and easier exits while hurting normal employees.

These conditions will not persist forever.

Just look at the past century: from the 1930s through the 1970s, the middle class grew, corporate power was restrained, and the compensation premium for finance jobs was much lower.

I don’t think the entire industry will disappear overnight, but I expect that we’ll return to a similar environment within the next few decades, especially as political pressure grows.

Currently, the private equity mega-funds get a lot of hype because they offer the highest pay to incoming Associates.

But they could easily be regulated out of existence, and I don’t think they have a particularly bright future (how much bigger could Blackstone get, and how could it hope to realize solid returns at that scale?).

So, if you’re looking to the future and you still want a career in private equity, I would say:

- Your long-term prospects may be better at smaller/startup firms that focus on growth capital since there’s an easier path to promotion, and since some of these firms can add real value to companies (so, reduced chances of regulation and anti-trust).

- Asset-level firms, especially in infrastructure, are more likely to be sustainable in the long term because returns, fees, and compensation are already lower, and they’re perceived to be doing some social good.

- The outlook for credit strategies, except for maybe distressed/turnaround, isn’t great because companies and governments are already over-leveraged (how much higher can debt levels go?).

It’s not so much that you’ll “earn more” with these specific strategies – it’s that they’re less likely to be affected by a changing macro environment.

So, you can continue to be obsessed with the industry, but you might want to change the exact target of your obsessions.

Want More?

You might be interested in reading The Complete Guide to Technology Private Equity.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

Great article.

If PE’s will decline, as well HF- if that’s so, what careers are best to start to pursue in finance? I am interested in hearing your thoughts about the future of finance careers. If you could hit the restart button on your career, would you do anything differently? Is the IB -> PE route something you’d still recommend to a college grad in 2021?

This isn’t a great question for me because I only worked in the industry for a few years, left to start this business, and am now “semi-retired” (i.e., I am still running this site, but more out of boredom than extreme passion or financial need). I think it’s still reasonable to start out in IB/PE, but I think the long-term prospects are worse than they were in 1990, 2000, or 2010. My top recommendation is to pick a job where you work and earn a lot and also develop skills you can use to start a side business.

Thanks for reply

So, what are the highest paying jobs with good work life balance and you can develop a broad skill set? What skills should I develop to start a side business? Thanks in advance

Way too broad a question to answer in a comment response. See:

https://mergersandinquisitions.com/finance-investment-banking-jobs-tradeoffs/

https://mergersandinquisitions.com/is-finance-a-good-career/#:~:text=%E2%80%9CYes%2C%20the%20overall%20industry%20will,companies%20in%20the%20long%20term.

Excellent article!!

Interesting. Along with this topic on headwind to private equity industry, what’s your view on private equity careers in Asia (Hong Kong, Singapore)? Given the current standstill between the US and China, do you think money flowing into Asian market from LPs in the US will dry out at some point? I know you talked about the end of globalism in other posts in post-COVID world. Will it have a far reaching consequence on flow of money into other markets as well?

Or do you think Asian PE market still offer attractive alpha given the inefficiency that still exists in market. Curious to hear your thoughts.

Yes, the flow of funds from LPs in the West into Asian markets will probably slow down at some point. There is more growth potential in Asia, but I’m still skeptical that PE really “adds value” in most cases. Oh, and leverage levels in China are already very high, with no sign of a reduction in place, so it’s not clear how that ends. So, I don’t know, maybe the industry is better off in Asia, but I still don’t think the prospects are great over the next 20-30 years.

I think there will be some opportunities in corporate carvouts and asset spinoffs in emerging markets like China and India. Private equity firms are selective in this approach. Banks in India are already in dire stress and they shut down the whole credit especially to already indebted companies and corporate bonds market is still in nascent stage in India with very few companies are raising capital via foreign currency bonds which are long term debt . Other companies access capital which are short term loans. commercial papers and debentures. With banks went into the back seat now, companies right now look forward for outside capital to sustain their business and pE INVESTORS are selective in this approach. We saw some buyouts from private equity players like KKR and Advent and some cases they take a minority stake and partner with businesses on a strategic basis. Moreover, companies in India hardly reliquinsh their control since many are family oriented businesses. Many conglomerates are doing asset spinoffs , raising capital from private equity investors to retire bank debt and middle range companies are in the need of capital in which banks are hard to lend due to their own aversion of risk and legacy loans already weighing their balance sheet. Apart from that, refinancing debt and restructuring companies are cumbersome since India’s Insovency and bankruptcy court is in early stage as well as lack of deep corporate bond market both very smal primary issuers and very very few secondary market ,only mutual funds are buying and selling the papers of some companies. We see there will be lot of Pe investors wanted to invest in businesses ,but not in Debt side but in equity side ,buyouts, carvouts etc. Blackstone and Brookfield are having some great success in REITs space . But the main issue is access to capital is very much low for middle range companies, private equity investors are selective due to restructuring issues and regulatory barriers, so we can able see very few deals in Mezzanine debt or long dated bond financing due to lack of deep bond market. Many companies today are raising money via preferred shares or from rights issue in India, the whole debt side financing is absent when the other part of the world are raising billions of dollars via bond financing especially British petroleum where you shave shared the post. The largest company in India called Reliance was selling equity stake to Pe players and retire their legacy debt ..private debt markets or public debt markets are opportunities but regulatory barriers, proper financial reporting standards and rule of law must be intact which will allow PE investors to allow capital flow freely to companies in need of capital. Again I would say, PE investors are very selective and that’s correct.

Really interesting article. I did not know about how removing the IRR reinvestment assumption alters returns so drastically. A couple thoughts on your macro trends arguments:

“Monetary – Interest rates have been falling since the early 1980s, which boosted all equity assets. The Fed and other central banks have suppressed interest rates and are now monetizing the debt, which mostly benefits the wealthy.”

Agreed.

“Fiscal – Tax policy has favored the wealthy, the U.S. started running massive deficits, and income and wealth have increasingly shifted to the top 1%.”

There’s more nuance to this. Many studies have shown that after taxes and transfers the United States has one of the most progressive tax regimes in the world. That said, the preferred long term capital gains rate makes a big difference in specific fields where that applies. So the end result is “wealthy” doctors and lawyers that draw a salary pay a fortune in taxes, while private equity partners with carried interest pay a much lower rate. I don’t see the macro shift being raising taxes on the wealthy per se, but a rethinking of preferred capital gains rates as some on the left have advocated could definitely make private equity less lucrative.

“Regulatory – The government has been “deregulating” and has barely enforced anti-trust law for the past few decades. That favors private equity because it enables industry consolidations and easier exits while hurting normal employees.”

I don’t think this is true. I can think of very few PE portfolio companies that would rise anywhere near the level of a monopoly even when combined with a big strategic player. The US anti trust system has actually not been dormant, just since the 70s it has used a “consumer harm” criterion to assess anti-competitiveness. This is why the FANG companies get away with being as big as they do; they can easily argue that they offer regular people lots and lots of free, innovative services that would disappear if these companies ceased to exist, thus harming consumers. More aggressive anti trust enforcement a la Europe would make life harder for massive strategics, but I am not sure that they would impact PE firms. (As an aside, in some ways increased regulation benefits large companies which can hire armies of lawyers and accountants to navigate the regulatory morass – this disadvantages smaller players). Also to your employee harm comment, that may have been true of KKR’s 1980s slash and burn cost cutting tactics but the industry has moved beyond that so I think this is less of a negative than it’s often portrayed.

Overall really liked the piece.

Thanks.

Yes, I agree that there is more nuance to the income/wealth gap, and that if you include transfer payments, it doesn’t look quite as bad. That said, the carried interest loophole is a huge point that favors the wealthy, and, frankly, it shouldn’t even exist. If anything, taxes should be higher on carried interest.

Regarding regulatory changes and antitrust, there are plenty of industries where private equity effectively has monopoly power or something close to it. Take a look at Matt Stoller’s coverage of this topic to see many examples in industries you’ve probably never even heard of:

https://mattstoller.substack.com/p/weird-monopolies-and-roll-ups-horse

“Consumer harm” is a very narrow criterion for antitrust, and I don’t think it’s appropriate. Yes, I understand that this is how the law is CURRENTLY applied, but it hasn’t always been that way, and it may not stay that way indefinitely. Laws and their interpretation change over time.

Look at Amazon: yes, consumers get lower prices, but at what cost? Hundreds of thousands of small businesses have died, counterfeit products flood the market for many items, and the company provides no support.

The point is, you need to look at the entire ecosystem around the company/platform, not just whether or not customers get lower prices. Again, yes, I understand that’s not how the law is applied currently, but that could easily change, given that it has changed before.

Yes, regulation often benefits large companies, but there are ways around that. For example, just include a carve-out saying that rules only apply above revenue level x.

Small companies in fragmented, competitive markets should not be regulated much at all. But when a company amasses as much as power as the FAANG ones, regulations and break-ups are appropriate.