AngelList Review: Should You Add Angel Investments to Your Portfolio?

Crowdfunding across various asset classes – real estate, peer-to-peer lending, and tech startups – has exploded over the past decade.

But is it worthwhile?

Should you allocate a percentage of your investments to this new asset class, or is it a waste of time and money?

My short answer would be: “Angel investments can be worthwhile in specific situations, but only once you have a substantial, traditional portfolio first. Also, the quality of the crowdfunding platform often matters more than the underlying asset.”

And here’s the longer version, with my experience on AngelList since 2014:

What is Angel Investing, and How Does AngelList Work?

Traditionally, “angel investors” were wealthy individuals who invested in early-stage startups with a high risk of failure, in exchange for equity or convertible debt.

As an asset class, angel investments have an even more skewed risk/return profile than venture capital: the vast majority of companies will fail, but if you invest in one that becomes 100x or 1000x more valuable, you could still earn a high overall return.

The average amount invested by individual angels spans a wide range, from $5K to $100K, but the median is $25K.

At those levels, angel investing was previously only viable for the wealthy.

AngelList launched in 2011 as a platform that allowed “normal people” to invest directly in startups, but you still had to be an accredited investor (AKA: well-off, but not necessarily “wealthy”).

And it allowed startups to raise money via crowdfunding instead of the traditional route (friends and family, wealthy individuals, and VCs).

Since that time, the site has expanded to offer job boards, social networking, recruiting, and even promotions for new products and services.

I’ve never used any of those features, so this review will be about investing.

How and Why I Used AngelList

In early 2014, I was sitting on a lot of cash and wasn’t sure what to do with it.

I had several crises in the early years that made me paranoid about the survival of this business, so I was extremely conservative and didn’t put much in the markets.

But I couldn’t keep doing that forever.

Even back in 2014, the S&P 500 seemed expensive, so I looked at alternatives, and angel investing came up as one option.

I liked the idea of helping companies grow and potentially earning well above what the public markets could offer.

So, I started investing in both individual companies and funds, such as the Consumer Fund I and Enterprise Fund I.

I also joined a few syndicates, which are groups created by individuals who invest in many startups each year.

They invite you to invest in individual deals, and you can join or pass on each one.

As of 2020, it looks like almost everything on the platform has moved to syndicates or funds, with few opportunities to invest in one-off deals – which is probably a good thing.

AngelList Fund Performance

I’m not supposed to disclose detailed performance data, but at a high level, I’ve earned a ~15% IRR and 2.1x multiple according to the platform.

However, those numbers include unrealized gains, so take them with a grain of salt.

Some early-stage startups need 10-15 years to exit, so it will be tough to judge real performance until 2025 or 2030.

AngelList now has an “Access Fund” that lets you invest in a broad startup portfolio that they select.

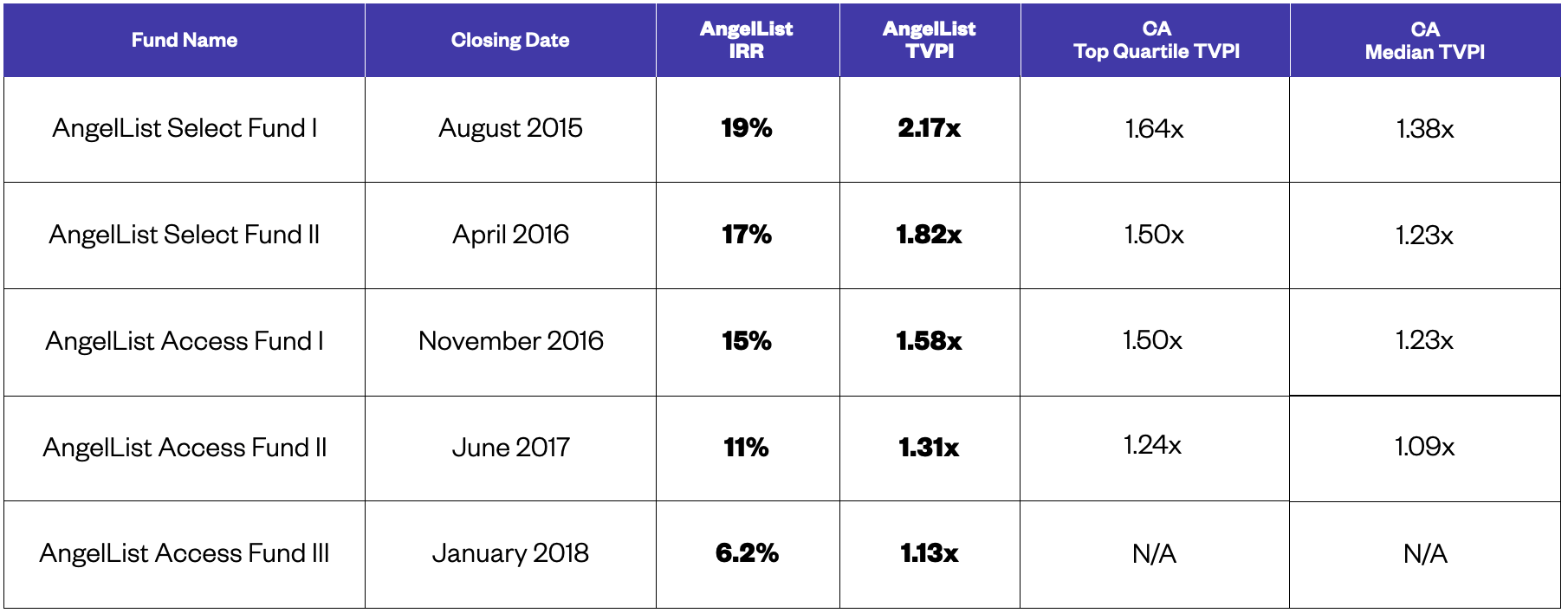

They report the following performance data for their past Access and Select funds:

- TVPI and IRR include unrealized gains. In the “Total Value to Paid-in-Capital” (TVPI) metric, Total Value includes cumulative distributions and the “residual value” of the fund, and estimates for this “residual value” vary widely.

- This is fund-wide data for a huge portfolio. You are unlikely to see similar numbers if you put smaller amounts of money into individual companies. And the minimum investment for these funds is quite high (usually over $100K).

AngelList Review: The Good

I’m not too active on the platform anymore, but when I used it more often in 2014 – 2018, I liked the following points:

- Opportunities – You will find some companies here that would be impossible to back outside the platform. Individuals still can’t gain access to the top VC funds, but they can access some of the best companies via AngelList.

- Your Capital Stays Locked Up for Years – Yes, I view this as a positive. The #1 mistake retail investors make is too much buying and selling, often at the wrong times, so anything that forces you to stick to a plan is worthwhile.

- You Can Legitimately Help Portfolio Companies – Especially if you participate in follow-on rounds, they might reach out and ask for help with hiring, business development, marketing, and more.

- Relatively Low Minimum Investment for Individual Deals – When I started, it was around $1,000. It’s now between $1K and $10K per deal, depending on the syndicate. The minimum amount is much higher for funds, and some syndicates and funds also require a “quarterly subscription.”

- The Companies Are Generally Well-Vetted – Yes, they are early-stage startups, so many will fail. But AngelList does a much better job vetting deals than many other crowdfunding platforms, such as RealtyShares, which went out of business.

Recently, AngelList also added an “Investor Dashboard” that displays your overall portfolio value, multiple, and IRR.

It’s not perfect because the valuation estimates are so subjective, but it does make it easier to see everything in one spot.

AngelList Review: The Bad

I’m no longer so active on AngelList because of issues with angel investing and the platform:

- Investing in Individual Companies is Accessible, But Not a Good Long-Term Strategy – Even if you’re plugged into the startup community, you will have almost no informational advantage in any of these deals. Sure, you could put $100K into 100 different companies, but you could easily lose money if you miss that one company that produces a 50x return.

- Investing in Funds is a Much Better Idea, But Minimum Investments Have Risen Greatly – Originally, you could invest $10K to $25K in funds set up by individuals or platform funds like the Enterprise and Consumer ones. But the minimums are now much higher – above $100K in most cases, and the “Access Fund” appears to require a minimum of $200K per year.

- You Can and Will Get Diluted Very Easily – Let’s say you invest $10K into a company raising money at a $1 million valuation. Then, the company exits for $10 million… so, you’ve turned $10K into $100K, right? Wrong! If the company raised additional money in between, you’d own far less by the exit. On average, expect 20-30% dilution in each subsequent round of funding. And if there’s a 2x or 3x liquidation preference, good luck getting anything at all.

- Reporting and Updates Are “Infrequent” – I receive quarterly updates on exactly one company in my portfolio, and it’s only because I invested in the company off-platform in a follow-on round. Funds on AngelList issue periodic updates, but they usually only give high-level stats.

To be clear: most of these are issues with angel investing itself, not the AngelList platform.

If you invest $1,000 in a company that’s worth $10 million and has institutional money behind it, you have no right to expect detailed quarterly updates.

And dilution is always an issue, even for the best investors in the business.

But the point about the minimum investment size in funds is specific to AngelList, and they could broaden the platform’s appeal by making the funds more accessible to normal people.

AngelList Review: The Ugly

And now to the main reason why I became less active on the platform: K-1 forms.

If you’re not familiar with them, K-1 forms under U.S. tax law are used to report distributions from partnerships and LLCs, such as the entities that invest in startups on AngelList.

In theory, if you’re a U.S. citizen or permanent resident, you should receive a form each year for every company you’ve invested in.

In reality, some companies never issue them, other companies may issue them late, and only funds seem to issue them reliably each year.

But even the funds often issue “corrected” versions afterward, and they’re often late as well.

So, you’ll almost always have to file for a tax extension each year but still pay estimated taxes in April.

The K-1 issue turned into a giant headache for me because I made the mistake of investing small amounts in individual companies rather than going with funds 100%.

It also makes tax preparation more expensive, but the main problems are the delays and waiting around for paperwork.

AngelList Review: Final Thoughts

I would recommend investing via AngelList if specific conditions are true:

- You have been working full-time for at least 5-10 years in a relatively high-paying job, and therefore qualify to use the platform.

- You already have a substantial portfolio in traditional asset classes.

- You allocate a small amount (5-10%) to funds on the platform rather than individual companies (or maybe to a syndicate that does many deals each year).

- You do not need to access this money for at least 10-15 years.

Unfortunately, AngelList has made it more difficult to follow this strategy because minimum investments in funds have risen substantially.

So, it’s probably best to find a few active syndicates and allocate small amounts to their deals consistently, so that you end up with dozens or hundreds of companies in your portfolio.

I don’t regret using AngelList.

It is a good platform, especially next to many of the less-than-reputable crowdfunding sites out there.

But I’m not going to put in additional money unless they make some of the funds more accessible or make it easier to invest in an “index” of startups.

For Further Reading and Listening

- “Why I Stopped Angel Investing (And You Should Never Start)” by Tucker Max

- Recent Discussion with Me on the Strategy Chain Podcast [Comments on angel investing and startups start at 1:30:32]

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

Hey Brian, great post as usual.

Have you come across any individuals tat pivoted from a finance career into product management/digital space? Would love to read an interview on such topics

Thanks. Yes, we’ve published stories on this one before:

https://mergersandinquisitions.com/finance-product-management/

https://mergersandinquisitions.com/bitcoin-startup/

https://mergersandinquisitions.com/investment-banking-to-sales-tech-start-up/