The Complete Guide to Technology Private Equity

Ever since the 2008 financial crisis, there has been massive hype about both private equity and technology.

Seemingly every MBA student wants to get into one of these industries, and when you combine them, the hype tends to multiply.

Over the past few decades, technology private equity has gone from “barely existing” to representing the largest single sector in PE by both deal value and deal count.

And just as tech and TMT investment banking have become the most desirable groups on the sell-side, tech private equity has reached a simlar status on the buy-side.

Some tech specialist firms have delivered an incredible performance, often with annualized returns (IRRs) of 30-40%, while others “followed the herd” and didn’t do quite so well.

I’ll cover the top firms, deals, recruiting, and career differences here, but as with any superhero saga, I’ll start with the origin story:

Definitions: What is a Technology Private Equity Firm?

Technology Private Equity Definition: A tech private equity firm raises capital from outside investors (Limited Partners), acquires minority or majority stakes in software, internet, hardware, and IT services companies, and grows and sell these stakes within 3 – 7 years to realize a return on their investment.

This definition includes both traditional private equity (buyouts and control stakes) and growth equity (minority stakes) because many “tech PE firms” do both.

The lines between different strategies have blurred over time, and many firms have multiple funds that target companies at different stages.

Why Did PE Firms Start Buying Tech Companies?

When private equity was relatively new in the 1970s, 1980s, and 1990s, most firms stayed far away from technology.

If they did invest at all, they stuck to areas like hardware/semiconductors and services since they were seen as “less risky” than software.

Hardware companies had significant assets that could be used as collateral, pleasing the lenders, and services companies often had large corporate contracts that represented predictable revenue streams.

But all that started to change during the dot-com boom of the late 1990s.

Two of the biggest tech PE firms, Silver Lake and Vista, were founded in 1999 – 2000, partially as contrarian bets on the sector.

At the time, most people assumed that the only way to “invest in technology” was for venture capitalists to pay computer science majors to drop out, strap themselves to Red Bull IVs and espresso machines, start coding 24/7, and launch new websites that might become worth billions overnight.

But Vista and Silver Lake (and eventually Thoma Bravo) saw an opportunity to acquire and grow mature firms, and as the tech industry developed, that opportunity expanded.

Four major trends caused PE interest in tech to skyrocket:

- The Shift to Subscription-Based Software (SaaS) – Software companies always had some recurring revenue from maintenance & support fees, but the switch to 100% subscriptions made revenue and cash flows far more predictable.

- Industry Maturation – By the 2000s, many technology companies had matured and fallen into the “low-to-moderate growth, with too much corporate bloat” category.

- Software Took a Few Bites of the World, But Didn’t Finish Eating – As Marc Andreessen wrote in his famous editorial, software became integral to so many industries that PE investors could no longer ignore it. But some areas proved much harder to “disrupt” than expected, so there remained a perception of untapped opportunity.

- Loose Monetary and Fiscal Policy – Zero and negative interest rates and massive money printing tend to inflate valuations the most for high-risk, high-growth companies. So, as central banks kept printing, PE firms, VCs, and other investors kept benefiting as they could buy companies at nosebleed multiples and sell them at even higher multiples.

Tech represents the best of both worlds for PE firms: it offers high growth potential with light capital requirements, but also some downside protection because of most companies’ recurring revenue.

There is some risk that customers could switch to other vendors, but if the software is truly “mission-critical,” it’s likely to be deeply entangled with companies’ operations.

That makes switching or canceling long and very expensive processes, further reducing the risk.

Because of these factors, PE firms have been able to pay high multiples for software and other tech companies and still earn high returns.

The Top Technology Private Equity Firms

I would put tech PE firms and PE firms that “do many tech deals” into 6 main categories:

#1: Large, Pure-Play Tech Private Equity Firms

There are three main firms here: Vista, Thoma Bravo, and Silver Lake.

Vista and Thoma Bravo have accounted for around half of all software buyouts over the past few years, and they use a similar playbook: cut costs, increase efficiency, and raise prices when possible.

They also use “buy and build” strategies, such as bolt-on acquisitions, but most large deals are motivated by efficiency gains.

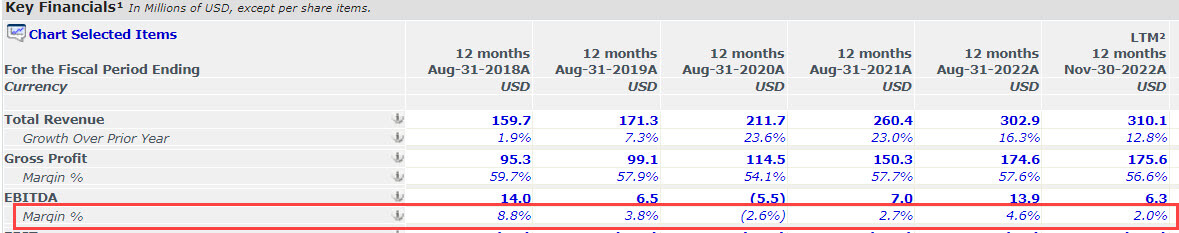

A great example of this is Vista’s $2.6 billion buyout of Duck Creek Technologies (insurance SaaS) in early 2023 for a seemingly nonsensical 234x EBITDA multiple and 7.6x revenue multiple:

And this was not a high-growth business: historical growth rates were in the 15 – 25% range (solid but unremarkable for tech).

But Duck Creek also had low margins, which PE firms likely viewed as an opportunity to cut costs:

A standard LBO model where you assume similar growth rates and margins into the future wouldn’t support this deal.

But if you assume the company can reach 20% or 30% margins, the IRR math might become much more plausible.

Silver Lake, in contrast to these two firms, is less of a software specialist because it also does plenty of hardware, communications, services, and even media deals.

It also does plenty of non-buyout deals, including minority stakes and occasional “rescue” deals for troubled companies, such as for Airbnb when COVID first struck in 2020.

#2: Mid-Sized and Smaller Tech-Focused Private Equity Firms

In this category are firms like Francisco Partners, Vector Capital, Accel-KKR, Marlin, Siris, Hg, Clearlake (more than tech), Symphony Technology Group, and GI Partners (more than tech).

You could also add names like Ardan, Luminate, Fulcrum, and Hermitage (Asia tech) to this list.

Some of these firms, like Francisco Partners, were founded around the same time as Silver Lake and Vista but did not grow to the same extent, with about half as much in AUM currently.

They still execute large deals but do fewer transactions in the $1+ billion range.

If you go even smaller, you’ll find names like Sumeru (Silver Lake’s middle-market firm), Banneker (founded by ex-Vista employees), Riverwood, and Leeds (with a “knowledge industries” focus).

Smaller firms in this category often focus on organic growth and bolt-on acquisitions to scale their portfolio companies.

You will still see traditional buyouts and some efficiency focus, but this group is closer to the “growth equity” side.

#3: Tech-Focused Growth Equity Firms

This list includes firms like Summit, General Atlantic, TA Associates, Insight, PSG, Susquehanna Growth Equity (not structured as a traditional PE/VC firm), and Vitruvian in Europe.

Many large PE firms and mega-funds also have smaller, growth-oriented funds (ex: “Tech Growth” at KKR and similar names at Blackstone, Providence, TPG, Bain, Advent, Permira, etc.).

The business model here is simple: find high-growth tech companies that need more capital to reach the next level, typically to pay for sales & marketing, and invest in minority stakes.

These stakes often have structure attached, such as liquidation preferences, which reduce the downside risk if growth slows or multiples compress.

Many of these deals also include both secondary purchases (existing shares) and primary purchases (new shares issued, which boost the cash balance).

Growth equity firms can often buy existing shares from employees at lower valuations, giving them more potential upside – while they can attach terms like liquidation preferences to primary shares for more downside protection.

#4: Private Equity Mega-Funds and Other “Large Funds” with a Tech Focus

All the PE mega-funds do tech deals, as do other “large PE firms,” such as Hellman & Friedman, Advent, Warburg Pincus, Permira, Bain, EQT, and Apax.

Some of these firms compete with Vista and Thoma Bravo to win deals, so you’ll see many of them in the same sell-side M&A auction processes.

In some cases, they might even team up to acquire companies together – one example was Blackstone and Vista partnering to acquire Ellucian in 2021.

I would also put many sovereign wealth funds and pension funds in this category – especially ones that are more active in deals, such as GIC in Singapore and CPPIB in Canada.

In some cases, they can be even more aggressive bidders because they’re funded by the government, not traditional Limited Partners.

#5: Middle-Market Private Equity Firms with a Tech Focus

You could add many of the firms in the middle-market private equity article to this list, but a few worth noting are Welsh Carson, Veritas, Genstar, New Mountain, and Audax (some of these do more than tech, but they all have a solid presence in the industry).

These firms usually do not compete with Vista or Thoma Bravo to win deals – the key competitors include smaller tech-focused PE firms and other MM PE firms.

Sometimes, these firms will put together custom deals outside bank-run auction processes, often via “sourcing” (cold outreach) and existing relationships.

#6: Tech Venture Capital Firms

Venture capital is a whole separate topic, but I list it here because many traditional, early-stage firms have moved up-market over time and now have separate funds that do growth deals for later-stage companies.

Also, you’ll occasionally see Vista, Thoma Bravo, or Silver Lake go “down market” and invest in earlier-stage companies alongside VC firms.

One example was MedTrainer’s $43 million Series B round in 2022, led by VC firm Telescope Partners and Vista.

On the Job in Technology Private Equity

You might look at these lists and think, “OK, there’s a metric ton of PE firms operating in tech. But how is the day-to-day experience different? And how is tech PE different from any other vertical within PE?”

Unfortunately, the answer here is boring: “It’s not that much different.”

The differences relate mostly to your firm’s strategy and size, not whether you work in tech vs. industrials vs. consumer/retail.

So, at a middle-market tech PE firm, expect the usual MM PE differences: smaller companies, less bureaucracy, more focus on operations and less on financial engineering, and more accessible recruiting.

Compensation has more to do with your firm’s size and performance than its industry focus, and the hours and lifestyle are similar.

The main difference is that you’re more likely to specialize in a vertical, such as insurance software, at the pure-play tech PE firms, while you’re more likely to be a generalist at a tech team within a larger PE firm.

Also, working at one of the “Big 3” tech PE firms might seem more like working at a mega-fund than working in tech at an actual mega-fund.

Since the entire firm does tech, it feels like “the team” is massive.

By contrast, tech is only a small part of what the PE mega-funds and other large firms do, and the day-to-day teams are smaller.

Recruiting at Tech PE Firms

Again, most of the differences here relate to the firm’s size and strategy, not its industry focus.

Recruiting differs far more between private equity vs. growth equity vs. venture capital firms than it does between industrial vs. tech PE firms.

That said, the “Top 3” tech PE firms have a reputation for starting very early, often launching the entire on-cycle private equity recruiting process each year.

So, you can expect fierce competition to win a role at one of these firms, as you’ll be up against all the other 1st Year Analysts in the best groups.

Having tech or TMT experience in investment banking helps, but it’s not essential if you have good technical skills and can confidently explain your deals.

At the smaller tech PE firms, you can expect the off-cycle recruiting process (lots of networking, outreach, and following up) and open-ended private equity case studies.

Growth equity firms tend to use a mix of the on-cycle and off-cycle processes, depending on their size, but they test slightly different topics (see below).

And most VC firms are in the “off-cycle” category, as they’re not necessarily competing for the same types of candidates.

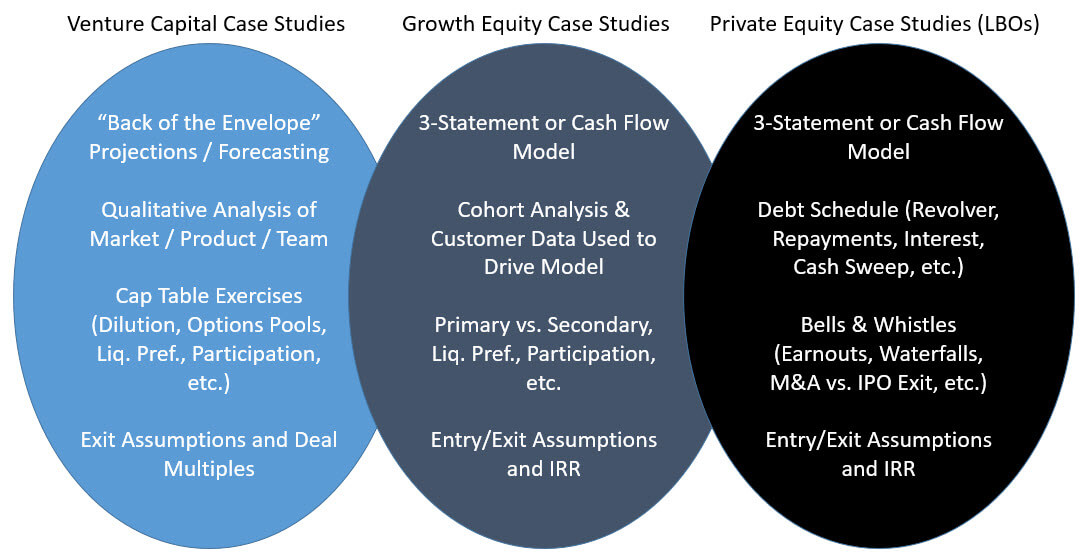

If you ignore firm size and the on-cycle vs. off-cycle distinction, the biggest recruiting difference is that different types of firms test different skills in case studies and modeling tests.

Here’s a summary from our Venture Capital & Growth Equity Modeling course:

Expect more qualitative case studies in VC and possibly a few cap table exercises; growth equity tends to focus on “customer analysis” and 3-statement models; and LBO modeling tests in private equity are more about the formulas and calculations.

Final Thoughts on Technology Private Equity

Technology private equity has had a great run, but I’m skeptical that it will continue at the same pace.

We’re now in a very different macro environment than the 2008 – 2021 period, enterprise software is increasingly difficult to sell, and tech valuations have fallen across the board.

Some of these points could change over time, but I doubt that we’ll return to QE Infinity anytime soon.

Tech and software will continue to be growth industries, but I don’t think pure growth will be valued as highly going forward.

And I expect that many of the funds raised and deployed toward the end of this cycle will deliver underwhelming returns (see: PE funds raised in 2007).

I’m not predicting the apocalypse; just that overall tech performance will move closer to the industry median over time.

That means the tech/PE hype train will probably decelerate – even though it will never go off the rails completely.

For Further Reading

I recommend these two articles/interviews if you want to learn even more about tech PE firms and one of the most prominent people in the industry:

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

Great read and very insightful! Would be nice if there would be a follow up on Venture Capital and key players in this area.

Thanks. We have covered venture capital in several articles here:

https://mergersandinquisitions.com/venture-capital/

Nice article. Any thoughts on software / tech conglomerates? (e.g., Constellation Software)

Thanks. I haven’t done much research on conglomerates like Constellation Software, but the stock price increase looks insane (literally too good to be true). But I will see if we can cover this topic in a future article or find someone who has worked at one of these companies for an interview.