The Private Equity Case Study: The Ultimate Guide

The private equity case study is an especially intimidating part of the private equity recruitment process.

You’ll get a “case study” in virtually any private equity interview process, whether you’re interviewing at the mega-funds (Blackstone, KKR, Apollo, etc.), middle-market funds, or smaller, startup funds.

The difference is that each one gives you a different type of case study, which means you need to prepare differently:

What Should You Expect in a Private Equity Case Study?

There are three different types of “case studies”:

- Type #1: A “paper LBO,” calculated with pen-and-paper or in your head, in which you build a simple leveraged buyout model and use round numbers to guesstimate the IRR.

- Type #2: A 1-3-hour timed LBO modeling test, either on-site or via Zoom and email. This is a pure speed test, so proficiency in the key Excel shortcuts and practice with many modeling tests are essential.

- Type #3: A “take-home” LBO model and presentation, in which you might have a few days up to a week to pick a company, research it, build a model, and make a recommendation for or against an acquisition of the company.

We will focus on the “take-home” private equity case study here because the other types already have their own articles/tutorials or will have them soon.

If you’re interviewing within the fast-paced, on-cycle recruiting process with large funds in the U.S., you should expect timed LBO modeling tests (type #2).

If the firm interviews dozens of candidates in a single weekend, there’s no time to give everyone open-ended case studies and assess them.

You might also get time-pressured LBO modeling tests in early rounds in other financial centers, such as London.

The open-ended case studies – type #3 – are more common at smaller funds, in off-cycle recruiting, and outside the U.S.

Although you have more time to complete them, they’re significantly more difficult because they require critical thinking skills and outside research.

One common misconception is that you “need” to build a complex model for these case studies.

But that is not true at all because they’re judging you mostly on your investment thesis, your presentation, and your ability to answer questions afterward.

No one cares if your LBO model has 200 rows, 500 rows, or 5,000 rows – they care about how well you make the case for or against the company.

This open-ended private equity case study is often the final step between the interview and the job offer, so it is critically important.

The Private Equity Case Study, in Parts

This is another technical tutorial, so I’ve embedded the corresponding YouTube video below:

Table of Contents:

- 4:32: Part 1: Typical Case Study Prompt

- 6:07: Part 2: Suggested Time Split for a 1-Week Case Study

- 8:01: Part 3: Screening and Selecting a Company

- 14:16: Part 4: Gathering Data and Doing Industry Research

- 22:51: Part 5: Building a Simple But Effective Model

- 26:32: Part 6: Drafting an Investment Recommendation

Files & Resources:

- Case Study Prompt (PDF)

- Private Equity Case Study Slides (PDF)

- Cars.com – Highlighted 10-K (PDF)

- Cars.com – Investor Presentation (PDF)

- Cars.com – Excel Model (XL)

- Cars.com – Investment Recommendation Presentation (PDF)

We’re going to use Cars.com in this example, which is one of the many case studies in our Advanced Financial Modeling course:

Advanced Financial Modeling

Learn more complex "on the job" investment banking models and complete private equity, hedge fund, and credit case studies to win buy-side job offers.

learn moreThe full course includes a detailed, step-by-step walkthrough rather than this summary, an additional advanced LBO model, and other complex case studies for investment banking, hedge funds, and credit.

Part 1: Typical Private Equity Case Study Prompt

In some cases, they’ll give you a company to analyze, but in others, you’ll have to screen for companies yourself and pick one.

It’s easier if they give you the company and the supporting documents like the Information Memorandum, but you’ll also have less time to complete the case study.

The prompt here is very open-ended: “We like these types of deals and companies, so pick one and present it to us.”

The instructions are helpful in one way: they tell us explicitly not to build a full 3-statement model and to focus on the market and strategy rather than an “extremely complex model.”

They also hint very strongly that the model must include sensitivities and/or scenarios:

Part 2: Suggested Time Split for a 1-Week Private Equity Case Study

You have 7 days to complete this case study, which may seem like a lot of time.

But the problem is that you probably don’t have 8-12 hours per day to work on this.

You’re likely working or studying full-time, which means you might have 2-3 hours per day at most.

So, I would suggest the following schedule:

- Day #1: Read the document, understand the PE firm’s strategy, and pick a company to analyze.

- Days #2 – 3: Gather data on the company’s industry, its financial statements, its revenue/expense drivers, etc.

- Days #4 – 6: Build a simple LBO model (<= 300 rows), ideally using an existing template to save time.

- Day #7: Outline and draft your presentation, let the numbers drive your decisions, and support them with the qualitative factors.

If the presentation is shorter (e.g., 5 slides rather than 15) or longer, you could tweak this schedule as needed.

But regardless of the presentation length, you should spend MORE time on the research, data gathering, and presentation than on the LBO model itself.

Part 3: Screening and Selecting a Company

The criteria are simple and straightforward here: “The firm aims to find undervalued companies with stagnant or declining core businesses that can be acquired at reasonable valuation multiples and then turn them around via restructuring, divestitures, and add-on acquisitions.”

The industry could be consumer, media/telecom, or software, with an ideal Purchase Enterprise Value of $500 million to $1 billion (sometimes up to $2 billion).

Reading between the lines, I would add a few criteria:

- Consistent FCF Generation and 10-20%+ FCF Yields: Strategies such as turnarounds and add-on acquisitions all require cash flow. If the company doesn’t generate much Free Cash Flow, it will have to issue Debt to fund these strategies, which is risky because it makes the deal very dependent on the exit multiple.

- Relatively Lower EBITDA Multiples: If the company has a “stagnant or declining” core business, you don’t want to pay 20x EBITDA for it. An ideal range might be 5-10x, but 10-15x could be OK if there are good growth opportunities. The IRR math also gets tougher at high EBITDA multiples because the maximum Debt in most deals is 5-6x.

- Clean Financial Statements and Enough Detail for Revenue and Expense Projections: You don’t want companies with 2-page-long Cash Flow Statements or Balance Sheets with 100 line items; you can’t spare the time required to simplify and consolidate these statements. And you need some detail on the revenue and expenses because forecasting revenue as a simple percentage growth rate is a bad idea in this context.

We used this process to screen for companies here:

- Step 1: Do a high-level screen of companies in these 3 sectors based on industry, Equity Value or Enterprise Value, and geography.

- Step 2: Quickly review the list of ~200 companies to narrow the sector.

- Step 3: After picking a specific sector, narrow the choices to the top few companies and pick one of them.

In software, many of the companies traded at very high multiples (30x+ EBITDA), and others had negative EBITDA, so we dropped this sector.

In consumer/retail, the companies had more reasonable multiples (5-10x), but most also had low margins and weak FCF generation.

And in media/telecom, quite a few companies had lower multiples, but the FCF math was challenging because many companies had high CapEx requirements (at least on the telecom side).

We eliminated companies with very high multiples, negative EBITDA, and exorbitant CapEx, which left this set:

Within this set, we then eliminated companies with negative FCF, minimal information on revenue/expenses, somewhat-higher multiples, and those whose businesses were declining too much (e.g., 20-30% annual declines).

We settled on Cars.com because it had a 9.4x EBITDA multiple at the time of this screen, a declining business with modest projected growth, 25-30% margins, and reasonable FCF generation with FCF yields between 10% and 15%.

If you don’t have Capital IQ for this exercise, you’ll have to rely on FinViz and use P / E multiples as a proxy for EBITDA multiples.

You can click through to each company to view the P / FCF multiples, which you can flip around to get the FCF yields.

In this case, don’t even bother looking for revenue and expense information until you have your top 2-3 candidates.

Part 4: Gathering Data and Doing Industry Research

Once you have the company, you can spend the next few days skimming through its most recent annual report and investor presentation, focusing on its financial statements and revenue/expense drivers.

With Cars.com, it’s clear that the company’s “Dealer Customers” and Average Revenue per Dealer will be key drivers:

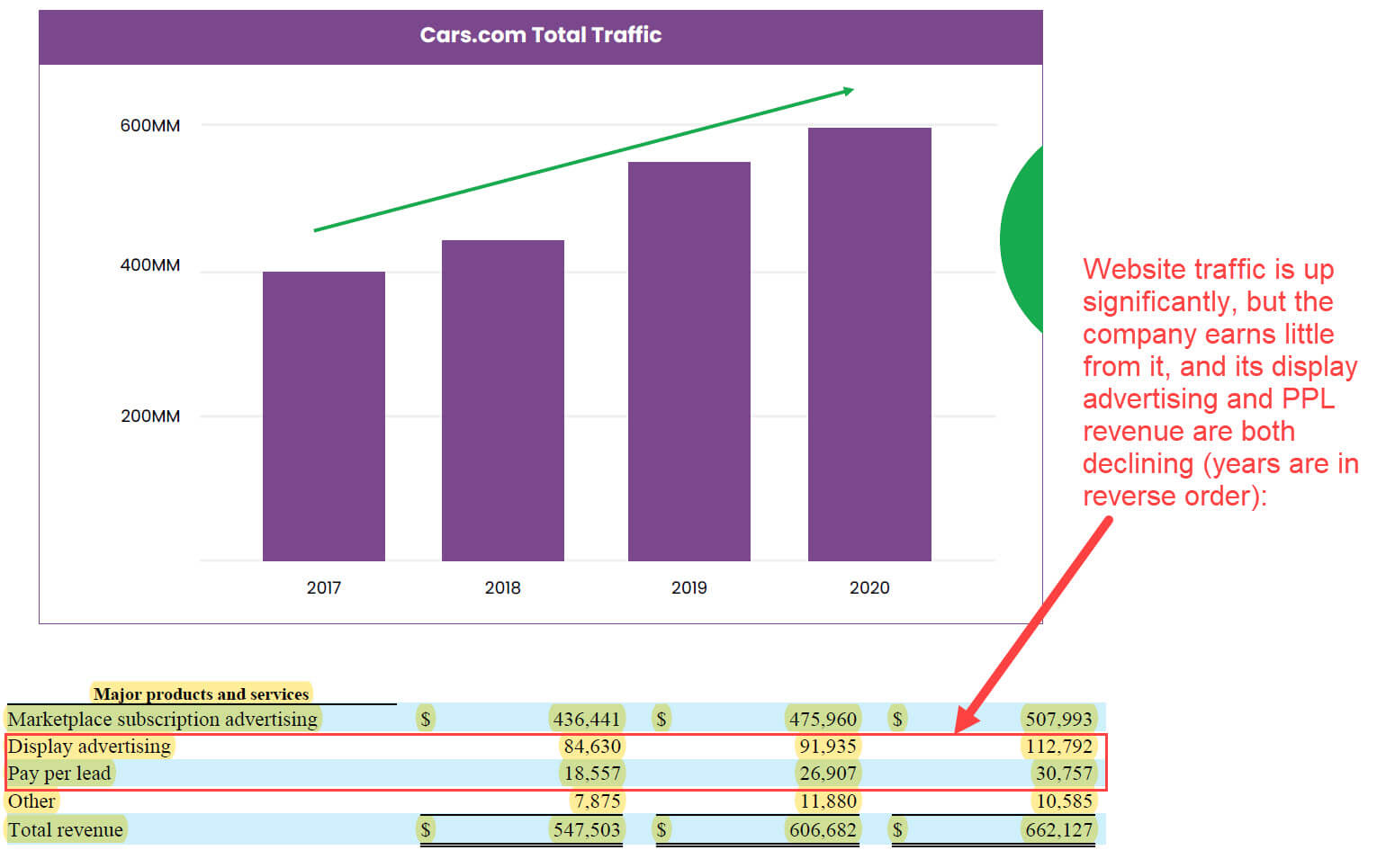

The company also has significant website traffic and earns advertising revenue from that, but it’s small next to the amount it earns from charging car dealers to use its services:

It’s clear from this quick review that we’ll need some outside research to estimate these drivers, as the company’s filings and investor presentation have little.

Fortunately, it’s easy to Google the number of new and used car dealers in the U.S. and estimate the market size and share like that:

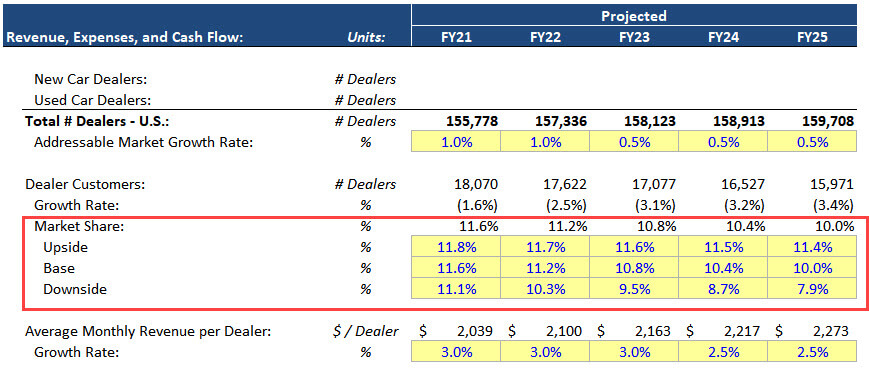

The company’s market share has been declining, and we expect that trend to continue, but it’s not clear how rapid the decline will be.

Consumers are increasingly buying directly from other consumers, and dealers have less reason to use the company’s marketplace services than in past years.

We create an area for these key drivers, with scenarios for the most uncertain one:

You might be wondering why there’s no assumed uptick in market share since this is supposed to be a “turnaround” case study.

The short answer is that we think the company is unlikely to “turn around” its core business in this time frame, so it will have to move into new areas via bolt-on acquisitions.

For example, maybe it could acquire smaller firms that sell software and services to dealers, or it could acquire physical or online car dealerships directly.

Another option is to acquire companies that can better monetize Cars.com’s large and growing web traffic – such as companies that sell auto finance leads.

As part of this process, we also need to research smaller companies to acquire, but there isn’t much to say about this part.

It comes down to running searches on Capital IQ for smaller companies in related industries and entering keywords like “auto” in the business description field.

In terms of the other financial statement drivers, many expenses here are simple percentages of revenue, but we could also link them to the employee count.

We also link the website traffic to the sales & marketing spending to capture the spending required for growth in that area.

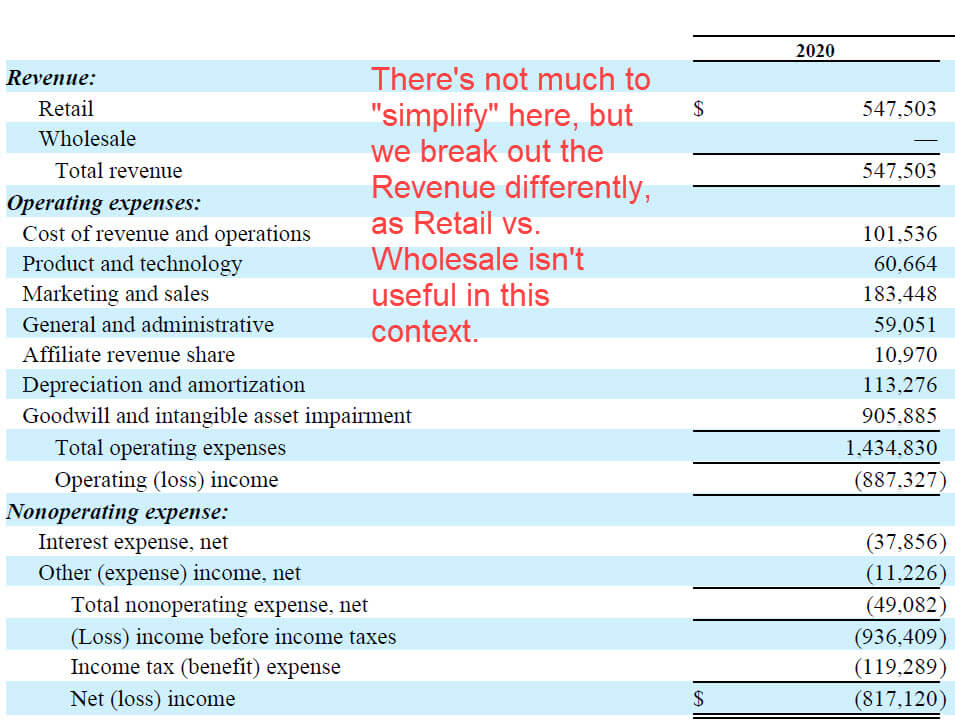

Finally, we need to input the financial statements for the company, which is not that hard since they’re already fairly clean:

It might be worth consolidating a few items here, but the Income Statement and partial Cash Flow Statement are mostly fine, which means the Excel versions are close to the ones in the annual report.

Part 5: Building a Simple But Effective Model

The case study instructions state that a full 3-statement model is not necessary – but even if they had not, such a model would rarely be worthwhile.

Remember that LBO models, just like DCF models, are based on cash flow and EBITDA multiples; the full statements add almost nothing since you can track the Cash and Debt balances separately.

In terms of model complexity, a single-sheet LBO with 200-300 rows in Excel is fine for this exercise.

You’re not going to get “extra credit” for a super-complex LBO model that takes days to understand.

The key schedules here are:

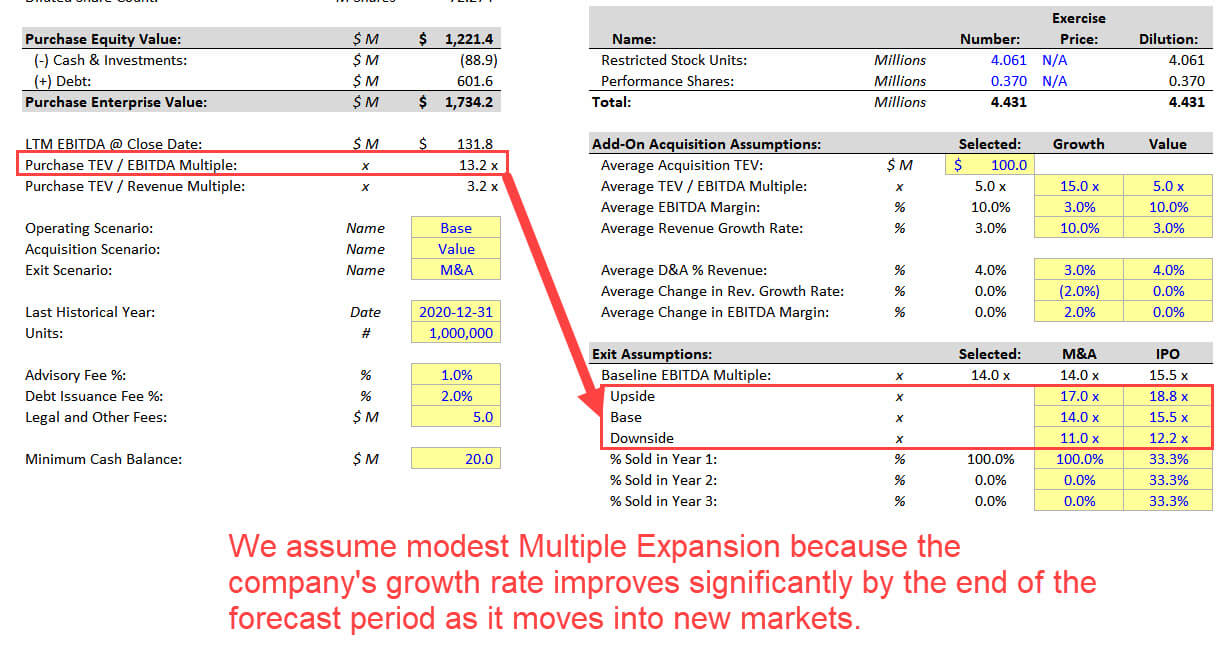

- Transaction Assumptions – Including the purchase price, exit assumptions, scenarios, and tranches of debt.

- Sources & Uses – Short and simple but required to calculate the Investor Equity.

- Revenue, Expense, and Cash Flow Drivers – These don’t need to be super-complex; the goal is to go beyond projecting revenue as a simple percentage growth rate.

- Income Statement and Partial Cash Flow Statement – The goal is to calculate Free Cash Flow because that drives Debt repayment and Cash generation in an LBO.

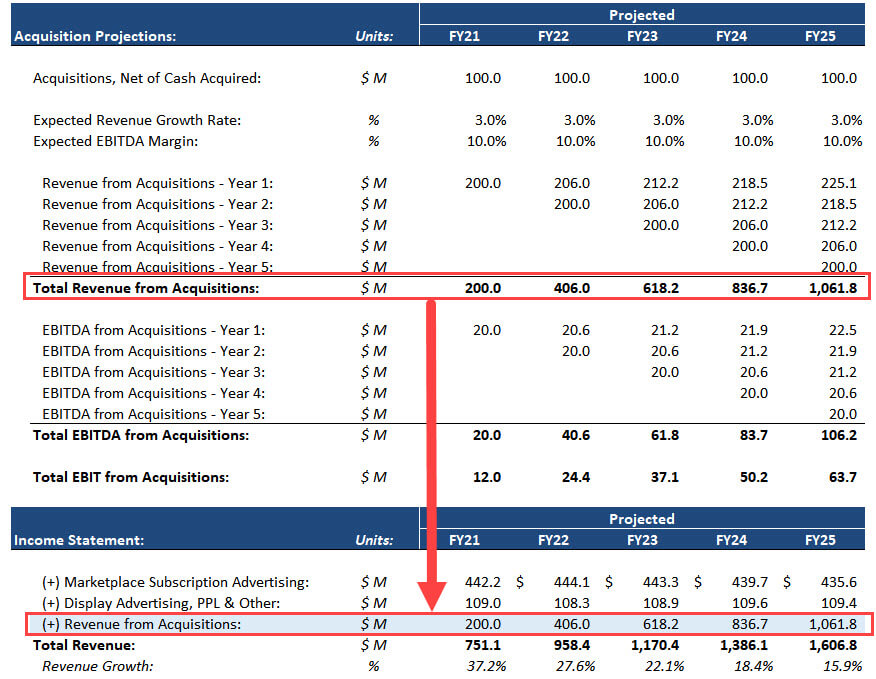

- Add-On Acquisitions – These are part of the “turnaround strategy” in this deal, so they’re quite important.

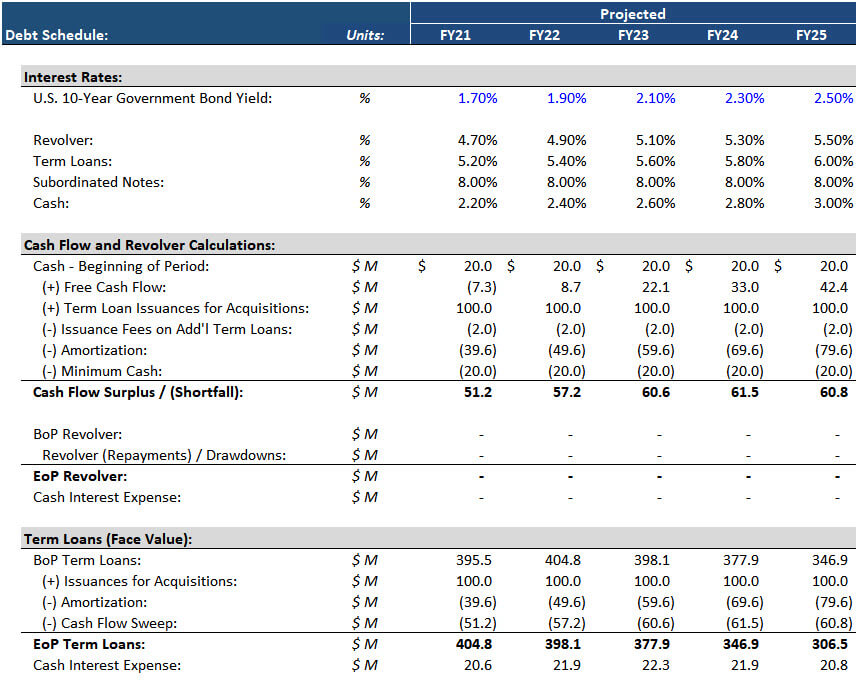

- Debt Schedule – This one is quite simple here because the deal is not dependent on financial engineering.

- Returns Calculations – The IPO vs. M&A exit options add a bit of complexity.

- Sensitivity Tables – It’s difficult to draft the investment recommendation without these.

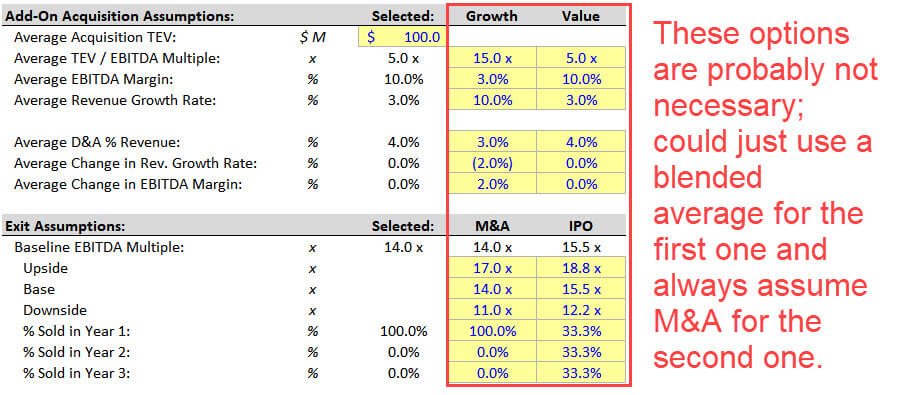

We pay special attention to the add-on acquisitions here, with support for their revenue and EBITDA contributions:

The Debt Schedule features a Revolver, Term Loans, and Subordinated Notes:

The Returns Calculations are also simple; we do assume a bit of Multiple Expansion because of the company’s higher growth rate by the end:

Could we simplify this model even further?

I don’t think the M&A vs. IPO exit options mentioned above are necessary, and we could also drop the “Growth” vs. “Value” options for the add-on acquisitions:

Especially if we recommend against the deal, it’s not that important to analyze which type of add-on acquisition works best.

It would be more difficult to drop the scenarios and sensitivity tables, but we could restructure them a bit and fold the scenario into a sensitivity table.

All investing is probabilistic, and there’s a huge range of potential outcomes – so it’s difficult to make a serious investment recommendation without examining several outcomes.

Even if we think this deal is spectacular, we must consider cases in which it goes poorly and how we might reduce those risks.

Part 6: Drafting an Investment Recommendation

For a 15-slide recommendation, I would recommend this structure:

- Slides 1 – 2: Recommendation for or against the deal, your criteria, and why you selected this company.

- Slides 3 – 7: Qualitative factors that support or refute the deal (market, competition, growth opportunities, etc.). You can also explain your proposed turnaround strategy, such as the add-on acquisitions, here.

- Slides 8 – 13: The numbers, including a summary of the LBO model, multiples vs. comps (not a detailed valuation), etc. Focus on the assumptions and the output from the sensitivity tables.

- Slide 14: Risk factors for a positive recommendation, and the counter-factual (“what would change your mind?”) for a negative one. You can also explain the potential impact of each risk on the returns and how you could mitigate these risks.

- Slide 15: Restate your conclusions from Slide 1 and present your best arguments here. You could also change the slide formatting or visuals to make it seem new.

“OK,” you say, “but how do you actually make an investment decision?”

The easiest method is to set criteria for the IRR or multiple of invested capital in each case and say, “Yes” if the deal achieves those numbers and “No” if it does not.

For example, maybe the targets are a 30% IRR in the Upside case, a 20% IRR in the Base case, and a 1.0x multiple in the Downside case (i.e., avoid losing money).

We do achieve those numbers in this deal, but the decision could go either way because the deal is highly dependent on the add-on acquisitions.

Without these acquisitions, the deal does not work; the IRR falls by 10%+ across all the scenarios and turns negative in the Downside case.

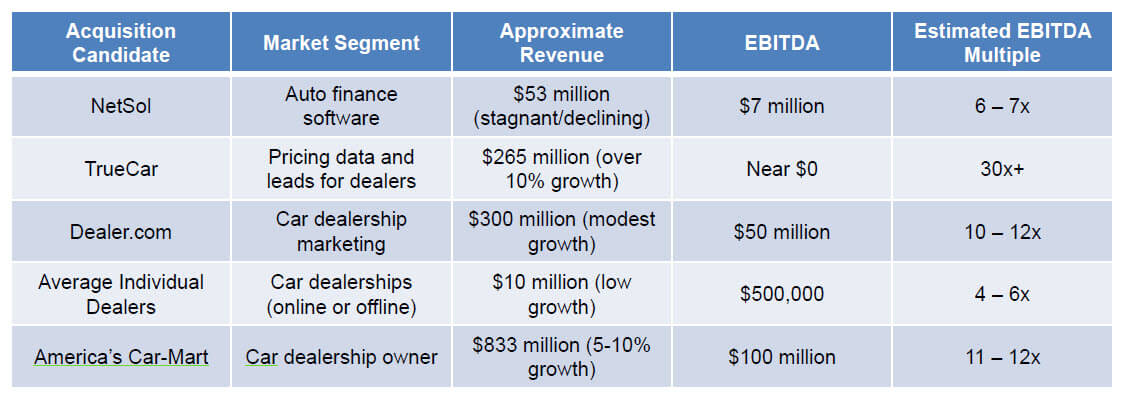

We need at least 5 good acquisition candidates matching very specific financial profiles ($100 million Purchase Enterprise Value and a 15x EBITDA purchase multiple with 10% revenue growth or 5x EBITDA with 3% growth).

The presentation includes some examples of potential matches:

While these examples are better than nothing, the case is not that strong because:

- Most of these companies are too big or too small to fit into the strategy proposed here of ~$100 million in annual acquisitions.

- The acquisition strategy is unclear; acquiring and integrating dealerships (even online ones) would be very, very different from acquiring software/data/media companies.

- And since the auto software market is very niche, there’s probably not a long list of potential acquisition candidates beyond the few we found.

We end up saying, “Yes” in this recommendation, but you could easily reach the opposite conclusion because you believe the supporting data is weak.

In short: For a 1-week open-ended case study, this approach is fine, but this specific deal would probably not stand up to a more detailed on-the-job analysis.

The Private Equity Case Study: Final Thoughts

Similar to time-pressured LBO modeling tests, you can get better at the open-ended private equity case study by “putting in the reps.”

But each rep is more time-consuming, and if you have a demanding full-time job, it may be unrealistic to complete multiple practice case studies before the real thing.

Also, even with significant practice, you can’t necessarily reduce the time required to research an industry and specific companies within it.

So, it’s best to pick companies and industries you already know and have several Excel and PowerPoint templates ready to go.

If you’re targeting smaller funds that use off-cycle recruiting, the first part should be easy because you should be applying to funds that match your industry/deal/client background.

And if not, you can always make a lateral move to a bulge bracket bank and interview at the larger funds if you prefer the private equity case study in “speed test” form.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews