Join 307,012+ Monthly Readers

Join 307,012+ Monthly Readers

Free Banker BlueprintCommercial Real Estate (CRE)

An Overview of Commercial Real Estate, Including Development, Acquisitions, Lending, Real Estate Investment Trusts (REITs), Real Estate Investment Banking, and Real Estate Private Equity

What Is Commercial Real Estate (CRE)?

Commercial Real Estate Definition: Commercial real estate refers to non-residential property (land and buildings) used by companies to support business activities; the owners of these properties generate income by charging the companies rent to use this space.

The main categories include office buildings, retail properties such as shopping malls, industrial complexes such as warehouses, hotels, and apartment complexes or “multifamily” properties.

Commercial real estate does NOT include single-family owned homes or condominiums (condos) because those properties are used for residential (living) purposes rather than business purposes.

Apartment complexes (“multifamily properties”) are an exception to this rule; they are considered “commercial” because they are owned by investors and rented out to individuals (rather than being owned by individuals).

Commercial Real Estate Roles

The commercial real estate employment landscape is extremely diverse. Jobs are divided into several major categories that include acquisitions, development, lending, brokerage and other areas such as appraisal.

Many companies offer real estate positions including brokerage firms, real estate investment firms, investment banks, private equity firms, and specialized firms such as Real Estate Investment Trusts (REITs).

Real Estate Acquisitions

Real Estate Acquisitions refers to purchasing existing properties, operating them, and then reselling them to others; there may also be elements of renovations/improvements.

Acquisitions roles tend to be deal/office-based that don’t require a heavy on-the-ground presence. They also tend to pay well due to the reliability of income streams from existing properties.

Real Estate Development

Development refers to construction and brick-and-mortar jobs, which have much more variable outcomes and tend to pay less; more of a physical job and less of a desk job / knowledge worker activity.

Real Estate Brokerage

Real estate brokerage is a job where agents connect buyers and sellers and earn a commission on the sale of properties. In that sense, it’s very similar to investment banking, but on a much smaller scale for properties rather than entire companies.

Top Commercial Real Estate Companies

- Brookfield Asset Management (CAN)

- American Tower (USA)

- Simon Property Group (USA)

- Prologis (USA)

- Link REIT (HKG)

- Weyerhaeuser (USA)

- AvalonBay Communities (USA)

- Public Storage (USA)

- Gecina (FRA)

- Klepierre (FRA)

How to Get Into Commercial Real Estate

There are many paths that real estate professionals follow in order to break in, but there are a few common threads:

- It’s often said that in real estate, “it’s not what you know, it’s who you know”. For this reason, coming from a school with a reputation for real estate and a large alumni network is an advantage (In the USA, schools such as Wharton, UC Berkeley, USC, Wisconsin, etc.).

- Another typical path is to first get into real estate investment banking. Many of the top people at the biggest real estate firms and REITs started out this way.

- If your school doesn’t have a strong presence in real estate, another option is to get an MBA at a school with a strong real estate program.

- It’s also possible to start out in a “non-investing” real estate role, such as property management or land surveying, and use that to move into a brokerage or investing role that is linked to deal activity.

- Much more so than other fields within finance, real estate is more about your results than your pedigree.

- Whatever you do, networking is even more important in real estate than other industries, so start pounding the pavement as soon as possible. For advanced methods, get your hands on the BIWS Networking Toolkit.

Commercial Real Estate Lending

Almost all property acquisitions and developments are funded with a combination of debt and equity, so lending is extremely important; done by a combination of traditional large banks, government entities, dedicated lenders and debt funds, and alternative investment managers.

Real Estate Investment Trusts (REITs) and Real Estate Operating Companies (REOCs)

Real estate investment trusts (REITs) raise debt and equity continuously in the public markets and then acquire, develop, operate, and sell properties.

REITs must comply with strict requirements about the percentage of real estate-related assets they own, the percentage of net income they distribute in the form of dividends, and the percentage of their revenue that comes from real estate sources.

In exchange for that, they receive favorable tax treatment, such as no corporate income taxes in many countries.

Real estate operating companies (REOCs) are similar, but they do not face the same restrictions and requirements and do not receive the same tax benefits.

Real Estate Investment Banking (REIB)

Real Estate Investment Banking refers to the groups at investment banks that advise real estate, gaming, and lodging companies on M&A deals and capital markets activities.

This is different from brokerage and development/acquisitions groups because REIB focuses on entire companies, not individual properties.

Bankers in these groups do need to know something about individual properties, but the financial modeling and technical analysis differ substantially because most of it is done at the corporate level, not the asset level.

Real Estate Private Equity (REPE)

Real estate private equity (REPE) firms raise capital from outside investors, called Limited Partners (LPs), and then use this capital to acquire and develop properties, operate and improve them, and then sell them to realize a return on their investment.

REPE firms differ from REITs in that they are not raising equity and debt constantly and distributing dividends to their investors. Instead, they raise capital once, deploy it over time, and then eventually return it to their investors and then raise a new fund.

Top Real Estate Private Equity Firms and Groups

- Blackstone Group

- Starwood Capital Group

- Lone Star Funds

- Brookfield Asset Management

- Tishman Speyer

- Colony Capital

- Carlyle Group

- Fortress Investment

- Oaktree Capital

- Ares Management

Real Estate Analysis and On-The-Job Deliverables

Real estate professionals are responsible for a host of analytical tasks, including technical and market analysis, as well as preparation of investment documentation and memos. There may also be a hands-on element to the role (e.g. inspecting properties and building sites).

Commercial Real Estate Market Analysis

Commercial real estate market analysis is the process of generating reasonable assumptions for use in financial models and to ensure that the qualitative aspects of the market and property meet your requirements as an investor.

Techniques used in market analysis include:

- Reviews of comparable properties and sales

- Historical rent, expenses and other trends

- Lease terms and renewal probabilities

- Absorption data

- Demographic trends

- In-person assessment of the property and neighbourhood

Real Estate Financial Modeling

With real estate financial modeling (REFM), you analyze a property from the perspective of an Equity Investor (owner) or Debt Investor (lender) in the property and determine whether or not the Equity or Debt Investor should invest, based on the risks and potential returns.

There are three major categories of real estate financial models:

- Real Estate Acquisition Modeling: Acquire an Existing Property, Change Little to Nothing, and Sell It.

- Real Estate Renovation Modeling: Acquire an Existing Property, Change It Significantly, and Sell It.

- Real Estate Development Modeling: Buy Land, Pay to Build a New Property, Find Tenants, and Sell It Upon Stabilization.

Real Estate Pro-Forma

The real estate pro-forma is a key part of any real estate analyst’s toolkit. You can think of the pro-forma as a combined and simplified Income Statement and Cash Flow Statement – for a property rather than a company.

Real Estate Investing Strategies

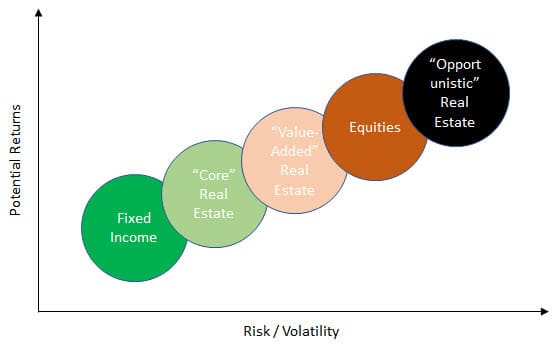

Real estate investment strategies for individual properties are organized into several broad categories, which include:

- Core: buy an existing, stabilized property, change very little, and sell it again

- Core-Plus: similar, but make minor upgrades

- Value-Added: acquire an existing property, renovate or greatly improve it, and then sell it again

- Opportunistic: develop or redevelop a property and then sell it

You can see the risk and potential returns of these strategies below (“Core Plus” would be just to the right of “Core Real Estate”):

Real Estate Financial Modeling Courses & Interview Preparation

As with most other finance sub-industries, real estate is a competitive field where companies expect new hires to be able to hit the ground running and add value immediately.

But the difference is that unlike in investment banking and private equity, where your pedigree (university or business school, GPA, brand-name internships, etc.) counts for a lot, real estate is mostly about your hustle and your results.

If you can network aggressively and prove yourself capable, you don’t need to go to Harvard or Oxford to win internships or job offers.

But this also means that it’s critical to learn the skills independently so you can get noticed, get hired, and get promoted.

Real estate-specific knowledge is important, of course, but as in any other finance role, you also need to know Excel, accounting, and valuation fundamentals (e.g., how to build a simple DCF).

For commercial real estate (CRE) roles, we recommend the following courses offered by Breaking Into Wall Street (BIWS):

- Excel & VBA – Get up to speed quickly on the most important shortcuts, commands, and formulas

- Core Financial Modeling – Provides an overview of financial modeling in different industries via the 10+ global case studies

- Real Estate & REIT Modeling – Comprehensive training for individual properties and real estate investment trusts (REITs)

- BIWS Platinum – Our entire collection of courses, all for a deep discount off the regular price