The Complete Guide To Commercial Real Estate Market Analysis

I went down the rabbit hole of repeatedly searching for this topic and quickly concluded that peoples’ ideas of “market analysis” are wildly different.

In real life, you could debate the exact meaning, especially if you consider companies and assets across all industries.

But if we limit the industry to commercial real estate and the purpose to financial modeling and valuation, then it’s easier to explain:

The Purpose(s) of Commercial Real Estate Market Analysis

The purpose of commercial real estate market analysis is to generate reasonable assumptions for use in financial models and to ensure that the qualitative aspects of the market and property meet your requirements.

For example, if you are building a real estate pro-forma for a multifamily property acquisition, you’ll have to make assumptions for items such as:

- Average Rents per Unit or Square Foot

- Annual Growth in Rents

- Occupancy Rate

- Expenses and Net Operating Income (NOI) Margins

- Required Capital Expenditures

- The Going-In Cap Rate and Exit Cap Rate

You use market analysis to determine these numbers or to decide if someone else’s numbers are reasonable.

If rents for similar properties in the same area have been growing at 3% per year, on average, then it will be difficult to justify a 10% growth rate in your model.

But a 4-5% growth rate might be easier to justify, especially if something specific explains the difference – such as a renovation, population gains in the area despite a limited housing supply, or a company like Amazon moving in.

Nearly all real estate markets are cyclical, so you pay the most attention to the values of these items in the low points and high points of previous cycles.

This is especially true if you’re doing a credit analysis of a property deal – with limited upside, lenders focus on the numbers in the pessimistic scenarios and the chances of losing money if they transpire.

A few years ago, I helped a client win a job at a real estate credit fund, and then I interviewed him about the experience. Here’s a direct quote from him about market analysis:

“When we see the marketing documents for a new deal, we gloss over most of the ‘Market’ section except for the peak-to-trough rent, which we immediately plug into our models.”

How to Conduct Real Estate Market Analysis

In real life, you’ll do a combination of online research and offline work to analyze the market.

Major components of this analysis might include:

- Comparable Property Sales – What have similar properties in the area sold for on a per-unit and per-square-foot basis in the past few years? What about the Cap Rates?

- Comparable Properties – What are the average rents at similar nearby properties? What about the occupancy rates and concessions given to tenants?

- Historical Rent, Expense, and Other Trends – How have rents changed over the past 5-10 years? What about expenses, such as property taxes and maintenance? How have Cap Rates changed over the past few cycles?

- Lease Terms and Renewal Probabilities – What’s the average term of a lease? How many free months of rent do tenants receive? On average, what percentage of tenants renew their leases upon expiration?

- Absorption Data – What is the total amount of space that becomes occupied in a given period, minus the amount that becomes vacant? How many new units, properties, or square feet are constructed each year, and how many are leased out?

- Demographic Trends – Is the population in the area rising or falling? What’s the average family income, and what is the unemployment rate? Is the population relatively young, or is it aging rapidly?

- In-Person Assessment of Property and Neighborhood – There are some things you can only figure out in-person.

Many online sources recommend using sites like Zillow to look up recent sales and new listings, and trying to find properties with “similar numbers of bedrooms and bathrooms.”

That might work for single-family homes (i.e., places that families purchase, live in, and do not rent out to others), but the process differs quite a bit for commercial real estate.

For example, you might pull information from paid databases like Real Capital Analytics, CoStar, or LoopNet, and you might look at market reports issued by the big commercial real estate brokerage firms, such as JLL and CBRE.

The paid databases help, but the free reports from brokerage firms contain a surprising amount of information.

To see for yourself, try Googling “CBRE market update multifamily [Major City Name]” and you’ll find PDFs with graphs, summaries, and a lot of data.

In-Person Assessments: Say, What?

With real estate market analysis, online research can only take you so far.

If your firm is serious about a deal, and it’s a significant transaction for them, you’ll almost certainly go for an in-person visit at some point.

In-person visits give you information that you’d never be able to find online.

For example, if the area has an epidemic of homeless people and trash on the street, you’ll quickly realize that by using your own eyes.

And if the area is diverse or not diverse in terms of ethnicity, income, and profession, you’ll learn that from an in-person visit.

You’ll also learn a lot about the property itself – everything from the “vibe” to the direction the windows face to the quality of the furnishings.

In-person visits can quickly reveal whether or not the sponsor is spinning a too-good-to-be-true story as well.

For example, many real estate investment groups plan to buy a property, improve it, and then raise rents from, say, $800 per unit to $1,000 per unit, arguing that $800 is well below market rates for the area.

If you look at online reports from the brokerage firms, you might initially agree with them: it seems like $1,000 is closer to the average rate.

But then you go in-person, and you quickly realize that average rents are lower in this one specific 10-block radius of the city because it has a crime problem.

Gang members live there, and local police tell you that this one part of town keeps them busy most of the time.

You wouldn’t necessarily reject the deal based on this finding, but you would become far more skeptical of the sponsor’s plan.

Commercial Real Estate Market Analysis In Practice

Here’s an example of how you can find market information and use it to check your assumptions in a financial model for a real estate deal, taken from the office development case study in our Real Estate Financial Modeling Course.

This deal corresponds to 100 Bishopsgate, a 36-story office development in London.

Many assumptions go into this model, including the land price per square meter, the construction costs, the number of tenants and their lease types, the annual change in office rents in London, the annual rental escalations, and the expense growth rate.

Then there are also “concessions” for the tenants, such as a certain number of free months of rent, and tenant improvements, which give the tenants money to customize their space.

I found all the reports required for this real estate market analysis with simple Google searches for terms like “London office market rent trends” and “London office prime yield.”

You can get two of the reports, with the key sections highlighted, below:

Comparable Property Sales, Comparable Properties, and Rent, Expense, and Other Trends

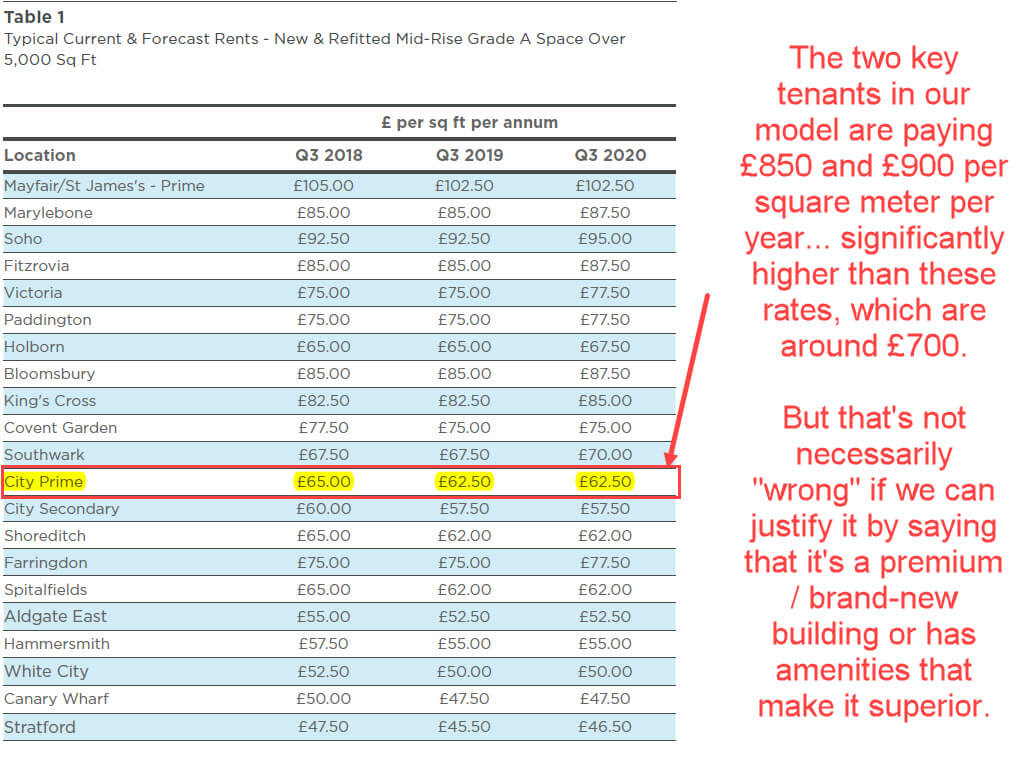

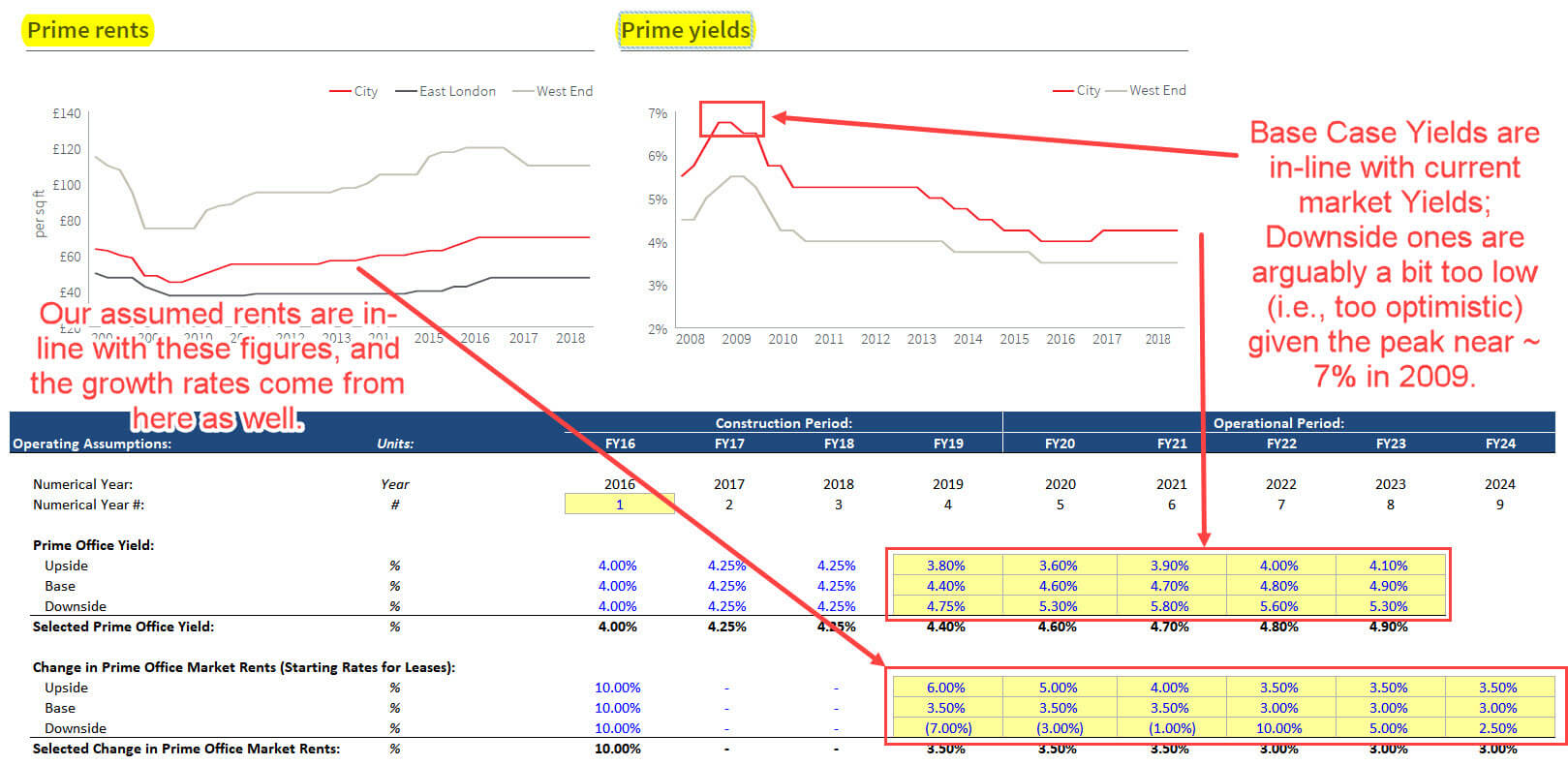

We used the JLL report here to check/confirm potential trends for the change in rent and Cap Rates, called “Yields” here:

(Click to view larger version)

With the “Prime Rents” graph, it’s important to focus on the percentage change and, specifically, how much rents fell in the last recession.

The nominal rent figures have increased since then, so rents would not necessarily decline to £45 or £40 per square foot if another recession struck.

However, they could fall by the same percentage as they did in the last downturn (~25%).

That makes our assumed decline rates of 7%, 3%, and 1% in the Downside Case here a bit too optimistic.

Therefore, we might want to reconsider the Downside Case numbers for both Prime Yields and the Change in Prime Rents if we believe another 2009-style recession is plausible.

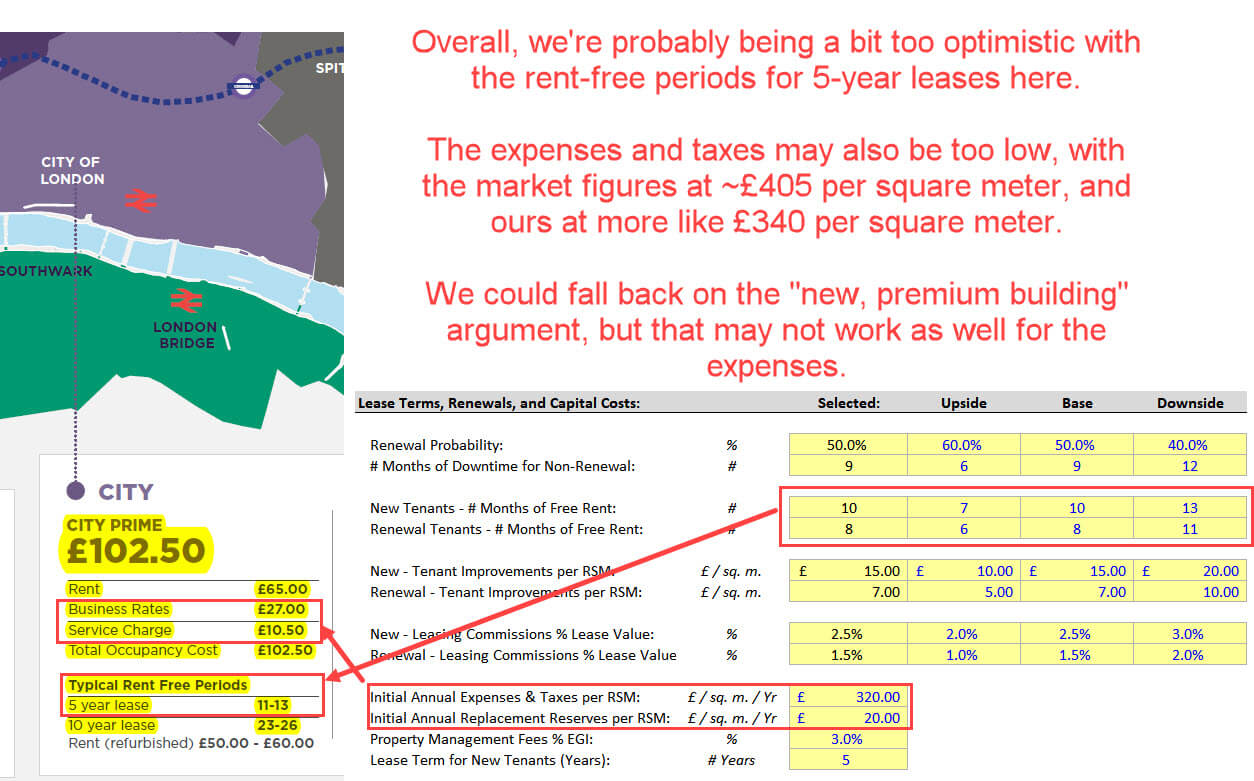

Moving on, we found information on current rents in the City of London from another source (the Carter Jonas report):

And then we found information on current expenses and rent-free periods in the same report:

(Click to view larger version)

There wasn’t much information on expense trends, but looking at past reports, expenses tended to move in the same direction as rents, but by lower percentages.

So, if rents increase by 6%, we might assume only a 3-4% expense increase.

We did not create explicit sections for Comparable Properties or Comparable Property Sales here because we relied on the market-wide data instead.

Also, since this is a new development, lists of individual properties are arguably less relevant than data for the entire region.

Lease Terms and Renewal Probabilities

Renewal probabilities are a big part of any office, industrial, or retail model because these properties tend to have fewer tenants with more customized leases.

It also takes significant time to find a new tenant if an existing one vacates, so lease expiration is a huge risk factor that you try to assess in any real estate market analysis.

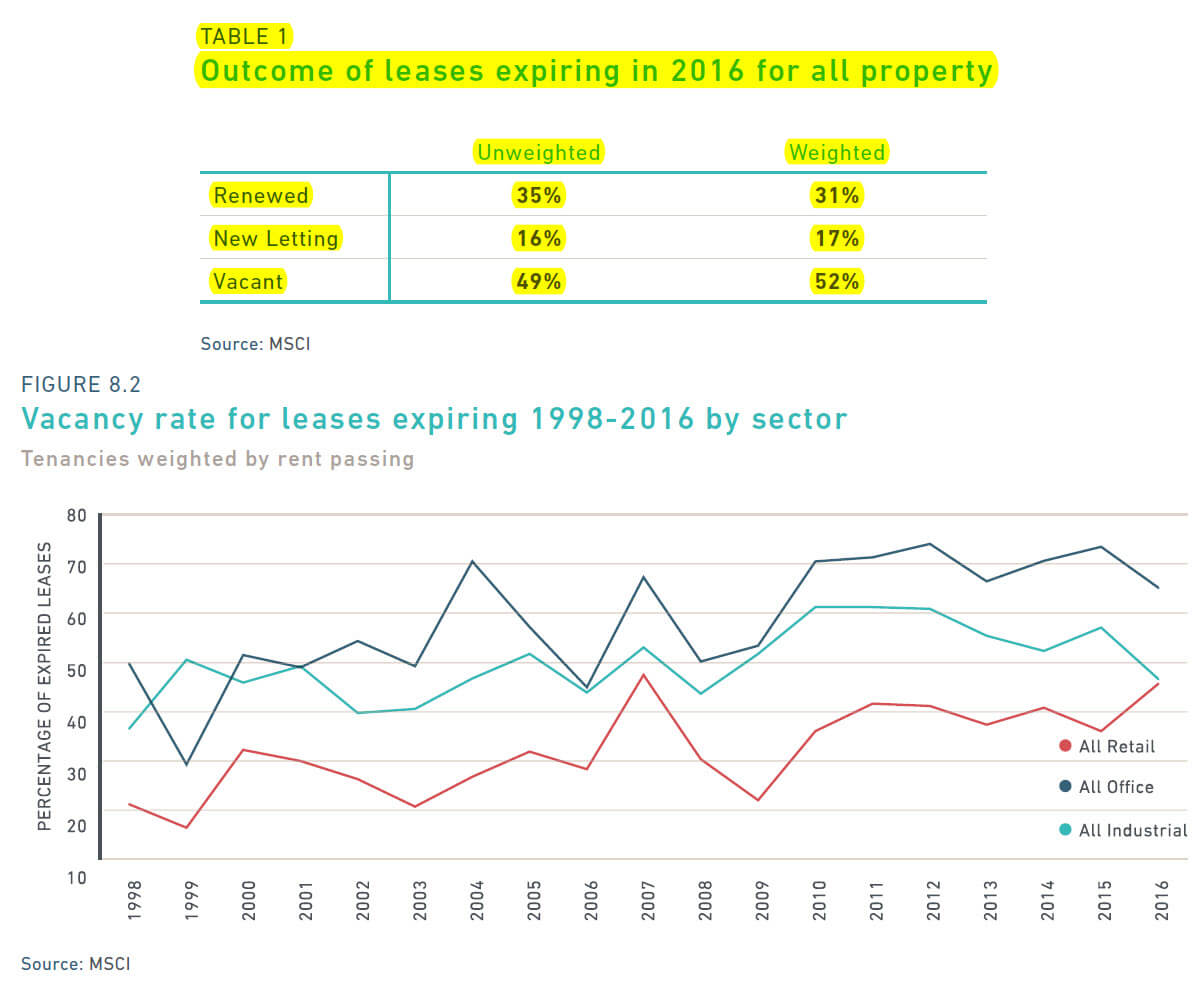

Fortunately, other sources (MSCI) track the percentage of tenants that renew or vacate across these three property types in the U.K. – even going back ~20 years:

We’re assuming renewal probabilities of 40%, 50%, and 60% in the Downside, Base, and Upside cases here, which are probably too optimistic based on this data.

On the other hand, this data is for the U.K. as a whole, not just London – and, presumably, it’s easier to find tenants in the City of London than it is in Random-City-in-the-Middle-of-Nowhere.

This same document has information on the average lease terms and rent-free periods, but they confirm the numbers in the Carter Jonas report, so I’m not pasting them in again.

Absorption Data

A lower absorption rate means more “downtime” spent searching for new tenants, a lower renewal probability, and lower rents.

So, in theory, we should be able to reflect all of those in the assumptions for this model.

But we did not do that here because we could only find partial information on absorption in the JLL report.

They list the “take-up,” or the square feet of space leased out each year in different parts of London, but they don’t have information on the space that becomes vacant each year.

Also, it might be double-counting if we tried to increase or reduce the renewal probabilities and rents based on the absorption data when we’ve already made assumptions based on possible market cycles.

Demographic Trends

We did not look up or use demographic trends at all because this property development is in a prime area of a large financial center.

Information on the population, average income, and the unemployment rate would be more useful in a smaller city or town that’s dependent on a few key employers.

For example, Amazon, Microsoft, and Boeing account for a huge percentage of total employment in the Seattle region in the northwestern U.S.

At one point, Amazon alone occupied ~20% of all prime office space in the city.

If we were looking at a property there, we would pay more attention to these demographic trends and even points like company announcements and news.

In-Person and Qualitative Assessments

Finally, we did not complete any in-person visits or assessments here because this is a case study, and it’s very difficult to “show” that type of assessment in an online course.

For development deals, in-person visits may be a bit less useful unless you’re familiar with the construction process and what to look for.

For example, does construction activity seem lower or higher than expected, given the project’s time frame? Is one part of the building lagging? What are the workers saying?

You might try to answer those types of questions with an in-person visit, but you’d need to bring along someone who has experience with the construction process.

The Truth About Real Estate Market Analysis

In this case, the conclusions are simple: we’re probably too optimistic with most of our assumptions, ranging from rent and expenses to renewal probabilities to likely changes in average rents.

But that’s also because we’re looking at this from an equity perspective (think: real estate private equity), which means that we need some amount of optimism to “sell” the deal and get others to buy into it.

A lender analyzing this deal would use much lower numbers and find ways to justify below-market rates for many of these assumptions.

Market analysis is also one area where the on-the-job requirements differ significantly from the requirements in case studies and modeling tests.

In tests and case studies, you don’t need to do much more than what we did here: review the provided data and make sure your numbers aren’t too far off.

But in real life, you might go far beyond this with on-the-ground research, interviews, and more.

Different firms and groups have different standards for this process, so maybe it’s not so surprising that articles about “real estate market analysis” present wildly different views.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

I’m an “old” reader of your blog (2010 or so) and I’m interviewing for a position in a RE fund (while I was an analyst in IB I never had to work on a RE model, only did pitch books). Thank you! :)

Thanks! Glad to hear it. Check out our other RE articles this year for more examples.