Core Real Estate: What It Is, and How to Explain It in Real Estate Interviews

It’s one of several strategies that real estate private equity firms (and other types of investment firms) follow to acquire, operate, and sell properties.

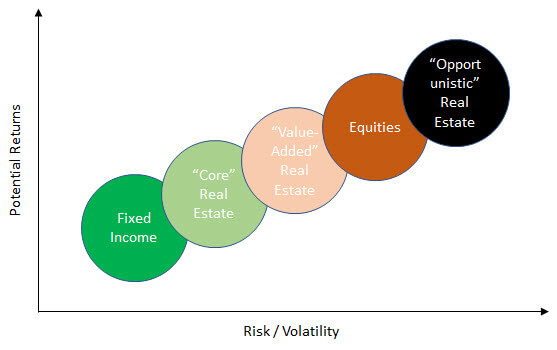

“Core” is considered the safest strategy and the one that’s closest to fixed income (bonds) in terms of risk and potential returns.

It tends to use less leverage than other strategies, very little about the property changes, and cash flows are stable and predictable.

So, what could go wrong?

If you go by most online descriptions and explanations of this category, you might say, “Nothing – it sounds pretty simple.”

But as you’ll see, there are some subtleties that most sources gloss over:

The Main Real Estate Investment Categories

The four main ways to invest in individual properties in commercial real estate are:

- Core: Acquire stabilized, mature assets, keep them nearly the same, and sell them in the future.

- Core Plus: Do something similar, but make more changes, such as light improvements to the units or the furnishings.

- Value-Added: Acquire a property, complete a major renovation that takes months or years to complete, and then sell it in the future.

- Opportunistic: Develop a new property from the ground up, or acquire an existing one and “redevelop” it into a different type (e.g., shopping center to industrial complex), and sell it in the future.

You can see the risk and potential returns of these strategies here (“Core Plus” would be just to the right of “Core Real Estate”):

The likely IRR of many Core deals is in the high-single-digit range, while PE firms often aim for 15-20%+ returns.

So, even if a PE firm claims to do Core deals, most likely, it is also pursuing Core-Plus deals – or it is acquiring properties at a low point in the market cycle.

True Core deals tend to attract more conservative investors, such as pensions and endowments, that target lower annualized returns.

What Makes These Categories Different?

Many articles highlight the following points as differences between Core, Core-Plus, Value-Added, and Opportunistic deals:

- Tenants: Core properties tend to have blue-chip, high-quality tenants on long-term leases; this is less true for the other categories.

- Locations: Core properties tend to be in major urban centers with plenty of demand.

- Capital Spending: Core owners/investors spend little on capital improvements because nothing major changes; it’s the opposite for Value-Added and Opportunistic deals.

- Stability: Core properties tend to have stabilized occupancy rates and rents with predictable cash flow each year; the other categories fluctuate more.

- Holding Period: The holding period for Core deals is often longer than it is for the others (e.g., 10 years rather than 3-5 years).

- Leverage: Core deals tend to use less leverage (40% or less) than those in the other categories, which can often go up to 60-70% (or more).

- Sources of Returns: Core properties generate most of their returns via income in the current period, but the other deal types generate most of their returns via capital appreciation.

I’ve done a fair amount of real estate investing via crowdfunding sites, the public markets, and real estate investment funds, and I’ve also seen many investment memos for property deals.

And I’ve created multiple versions of our Real Estate Financial Modeling course based on case studies and modeling tests given in real interviews.

Based on that, I do not agree with all these points.

For example, I’ve seen plenty of “Core” and “Core-Plus” deals that use higher leverage, such as 50-70%, as long as the credit stats and ratios remain healthy at those levels.

This higher leverage is partially because interest rates have been very low in the decade or so following the 2008-2009 financial crisis (see: more on commercial real estate lending and real estate debt funds).

The holding period also varies quite a bit, and in real life, it often comes down to “We’ll sell as soon as we get a good price.”

Many Core properties are in major urban centers, but the location alone isn’t the best way to differentiate these categories.

Finally, Core properties do generate more stable cash flow than the others, but it’s not necessarily the case that most of the returns come from cash flows in the holding period.

For example, when the real estate market is at a cyclical low, many investment firms will acquire underpriced, stable properties.

Then they’ll wait for prices to increase and sell the properties later in the cycle so that a majority of their returns comes from capital appreciation.

This strategy becomes less feasible as the cycle progresses, so many investors switch to Value-Added and Opportunistic deals instead.

The bottom line is that you should distinguish strategies according to what the investor/owner DOES during the holding period: if the property barely changes, it’s a Core deal.

Why Are Core Real Estate Returns “Limited”?

It’s more accurate to say that the market environment and timing play a bigger role in returns for Core deals than they do for deals in the other categories.

This makes the Core category great for passive investors who don’t want to be involved in day-to-day management, but not so great for anyone buying at the top of the cycle, or anyone who wants more control.

To illustrate, we’ll look at example returns from a Core deal for a multifamily property (apartment building) in several different market environments.

These examples are based on a modified version of one of the samples in the real estate pro-forma article.

In all cases, we acquire the property for $9.5 million at a 50% LTV, which implies a Going-In Cap Rate of 6.0%.

The Debt Service and Capital Costs stay the same in all cases, but the Net Operating Income (NOI) growth and Exit Cap Rate change based on the market.

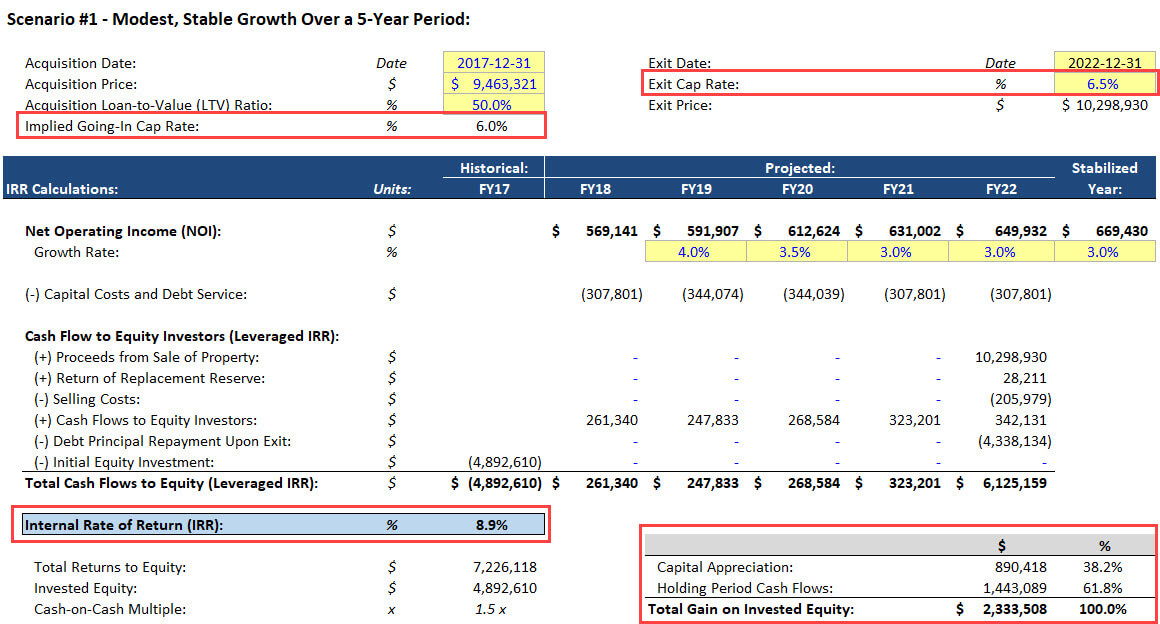

Scenario #1 – Modest, Stable Growth Over a 5-Year Period

In this case, the property’s NOI grows at 3-4% per year, and the Exit Cap Rate rises modestly to 6.5% because the property ages and does not undergo major improvements:

Most online descriptions of Core real estate stop here, but it’s more complicated than this because the market could also change during the holding period.

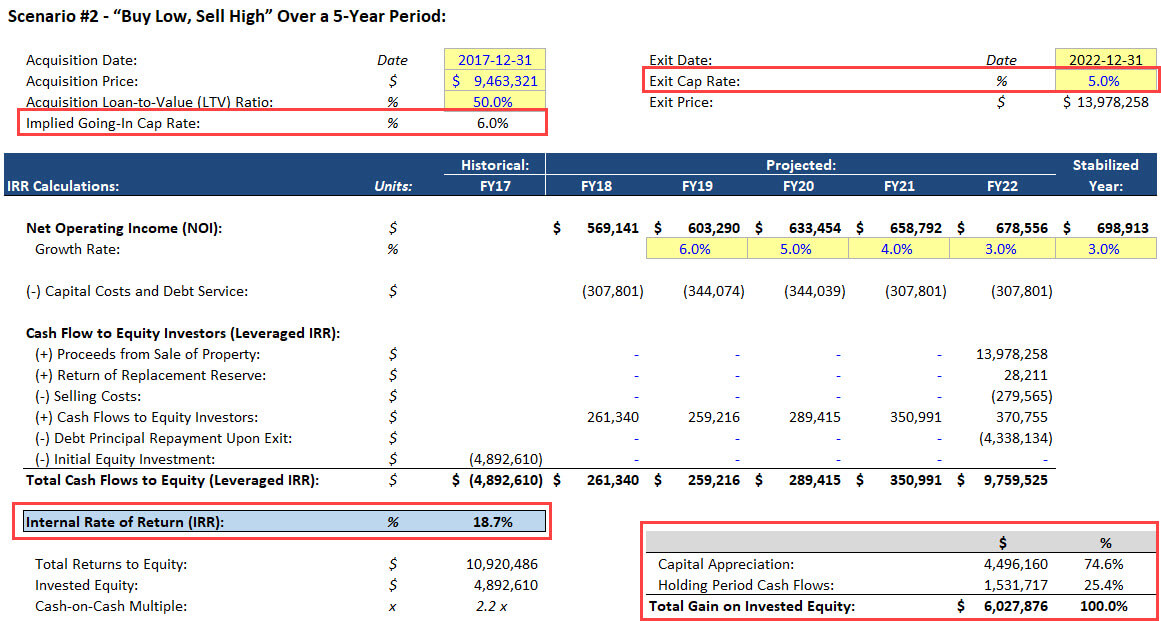

Scenario #2 – “Buy Low, Sell High” Over a 5-Year Period

In this scenario, we assume that we acquire the property toward the bottom of the market cycle, and then we sell it after prices have risen for several years (i.e., falling Cap Rates).

NOI growth is also higher than normal in the first few years as the market recovers:

It’s not implausible to acquire a property at a 6.0% Cap Rate, make no major changes, and sell it at 5.0%, but usually it only happens in a high-growth market with a supply/demand mismatch.

If you present an analysis like this for a Core real estate deal, people will naturally be skeptical unless you have a lot of data to support your argument.

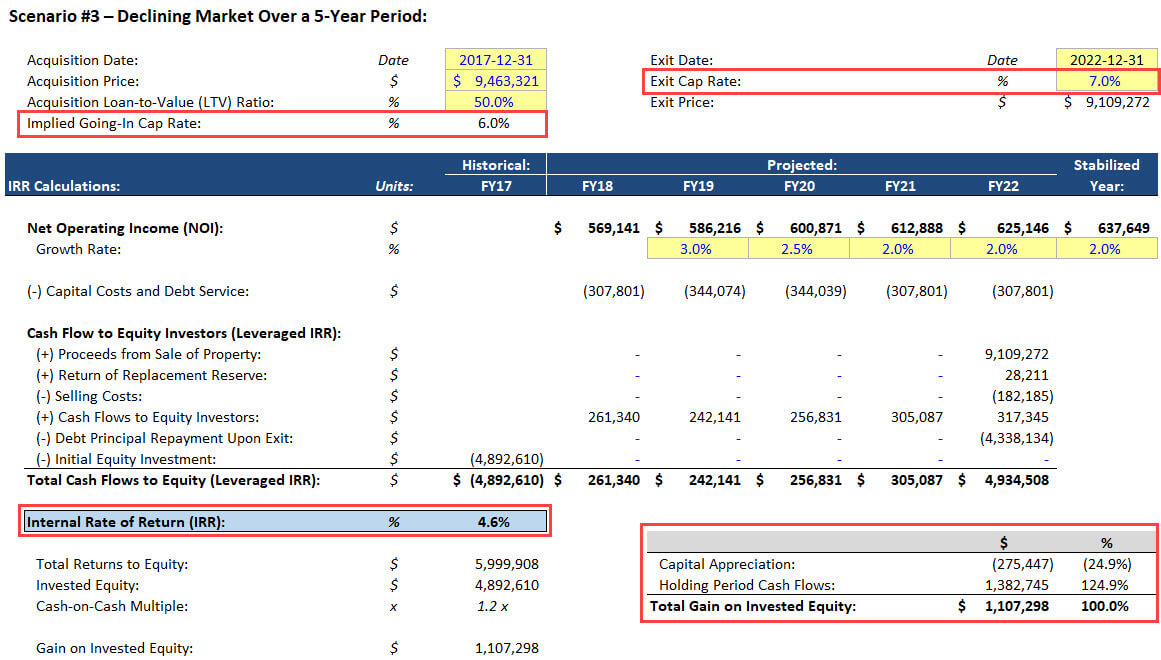

Scenario #3 – Declining Market Over a 5-Year Period

In the final scenario, we’ll assume that we get unlucky and happen to acquire the property right as the market is starting to decline.

As a result, the Cap Rate rises by the end, and NOI grows more slowly:

That said, it’s still not a “disaster” – we still avoid losing money because of the stable cash flows in the holding period.

Even if NOI declined modestly for 1-2 years and then began to grow once again, the IRR would still be positive.

The point of these examples is to illustrate that Core deals are far more dependent on the market environment and timing than the other categories.

Yes, if everything is stable, a high-single-digit return is a likely outcome, and most of the gains will come from the property’s cash flows.

But if not, the range of outcomes is quite wide, and the owner or investor has limited control over the results.

Core Real Estate Careers: Why Work in the Field?

As mentioned above, this is not a true “choice” because many real estate investment firms use different strategies.

However, it’s fair to say that groups or firms focusing on Core strategies are best if you enjoy market analysis and finding properties and regions that might be underpriced.

You won’t necessarily be building the most complex models since the acquired properties largely stay the same.

But you will need to understand market cycles, demographics, and supply/demand to make the right decisions.

Many conservative investors such as pensions and endowments also like Core real estate because of the perception that it’s a “safer” asset class that still offers higher annualized returns than most fixed-income securities.

So, if you do end up focusing on Core real estate, it might be at one of these of firms – which means lower pay, but also reduced hours and stress.

Why Invest in Core Real Estate?

For individual investors, Core real estate is appealing for all the reasons mentioned above: the potential for high-single-digit returns, the ability to be relatively passive, and relatively low risk even if the market declines.

There’s another key benefit as well: stability.

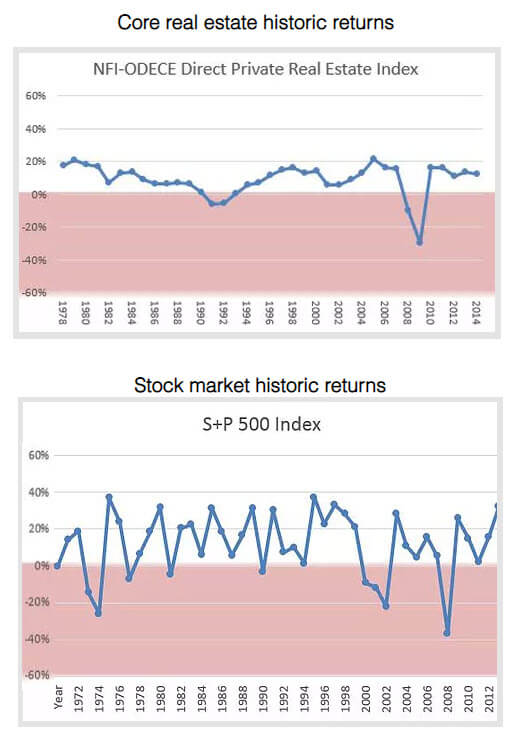

The S&P 500 has a higher average annualized return if you invest in an S&P index fund and hold it for decades, but it also fluctuates significantly from year to year.

By contrast, Core real estate returns tend to be much smoother, and they often stay positive even when equity returns fall off a cliff (as in the 2000 – 2002 period).

This graph from Real Estate Crowdfunding Review sums it up pretty well:

Core real estate has deep drawdowns as well (see the 2008-2009 numbers above), but they tend to be less frequent and severe than the ones in equities.

Skin in the Game: Why I Invest in Core Real Estate

In the interest of full disclosure, I like Core real estate as a category and have invested in it via sites such as Fundrise.

Around 5-10% of my total assets are in real estate equity funds or individual properties, and a good portion of that is in the “Core” category.

I do it for the reasons described above: stability, the passive nature, and fairly good risk-adjusted returns.

The downside is that liquidity is limited because selling a property or redeeming shares in a fund are much harder than selling publicly traded shares or bonds.

But I’m willing to accept that if it means positive returns in a year when most other markets are down.

Anything Else?

That’s about it for the Core real estate category.

Coming up next, we’ll move into the Value-Added and Opportunistic categories and (maybe) look at Core-Plus as well.

Additional Reading

You might be interested in Value-Add Real Estate: What Makes It Different, and Why You Should Invest – Maybe.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

I am interested in pursuing a career in real estate private equity or private debt, would you advise someone like me to work at a regional RE debt advisory firm that advises client on the whole capital stack or a global insurer firm that invests in mortgage loans only?

A regional RE debt advisory firm is better because you work across the entire capital structure.

Hi Brian,

Thanks for the reply.

Just one more question, the typical size of the transactions that the firm advises are around $20-$50m range, with occasional $200m deal. Would the small deal size affect the exit opportunities in the future?

Yes, somewhat, but on balance, it’s still better to gain exposure to more types of deals and more parts of the capital structure.

Hi Bryan !

Thank you for this interesting article!

Quick question not related. Have you ever written an article dealing with CLO (career, evolution & exit especially in IB, LevFin & PE)?

Looking forward to hear your point of view.

Thanks. We have not yet covered CLO funds. There were 1 or 2 prospective CLO fund interviews over the years, but they never happened for various reasons. We hope to cover it in the future, and if we don’t find a willing volunteer, I might just research the topic and write something on my own.

If it could help for your article I’m working as Buy Side Investment Analyst in Asset Management (it’s an IBAB in NYC).

We cover multiple CLOs and LBOs funds for our clients and our coverage is mainly focused on US & Europeans names.

I guess my experience can help you aside from the exits opportunities.

Let me know if it can interested you.

Sure, thanks, feel free to reply to the newsletter or write to editor@mergersandinquisitions.com if you want to contribute. We could do it either via the phone or email.