The Twitter Buyout: Is Elon Musk a Madman or a Genius?

As is usually the case, everyone wants to talk about Elon Musk and his latest antics – and this time, the antics consist of his Twitter buyout for a cool ~$44 billion.

This specific deal generates endless discussion topics:

- “Free speech” vs. “content moderation,” AKA censorship.

- Possible legal/regulatory hurdles.

- How will Elon change Twitter’s business? Subscriptions? Extra fees for privacy/security? More/fewer ads?

- Will the employees leave because they think Elon is more like Thanos than Tony Stark?

- Is it a good thing if many employees quit since Twitter is bloated and poorly managed?

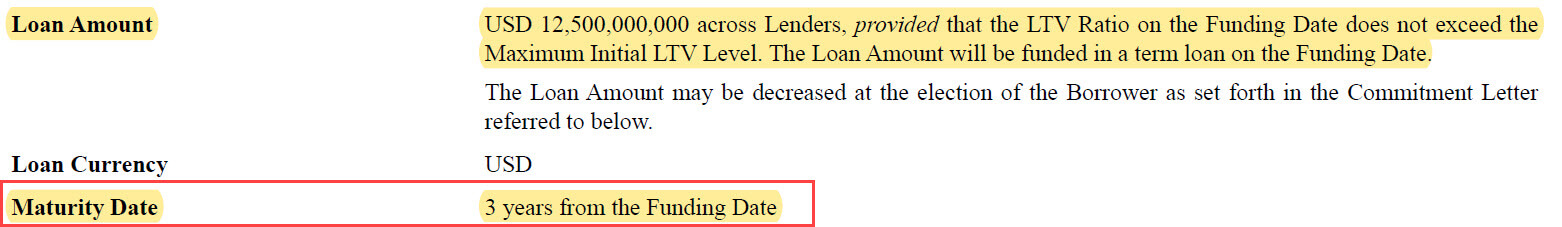

- What about the $12.5 billion Margin Loan secured against a good chunk of Elon’s Tesla shares? These two companies are now linked financially.

These are all interesting topics, but since I am a depressing person, I will ignore them and focus on the numbers.

Put simply, does the math work?

Could Elon Musk achieve the standard 20% internal rate of return (IRR) usually targeted in leveraged buyouts?

The Short, Quick Answer About the Twitter Buyout

I don’t think this deal is completely crazy, but I would say it is moderately crazy.

A 20% IRR over a 5-7-year holding period will be possible but challenging.

For that to happen, many things need to go right.

I expect the following potential outcomes:

- Best Case: A 20-25% IRR if all the stars align.

- Most Likely Outcome: A 10-15% IRR if parts of the deal go well and others do not.

- Worst Case Outcome: Elon loses ~90%+ of his invested equity and gets a very negative IRR. Total wipeout.

The key problems are:

- Very High Purchase Multiple: The historical (FY 21) EBITDA multiple here is 52x, and the FY 22 multiple based on consensus estimates is 28x. These are ridiculously high multiples for any company, let alone a company like Twitter.

- Spotty Cash Flows: Twitter’s margins and cash flows have been highly inconsistent, and in the next two projected years, they do not cover the interest expense on the $25 billion in Transaction Debt (16x projected EBITDA!). And forget about the principal repayments (there’s 5% amortization on the Margin Loan and 1% on the Term Loan).

- Significant Revenue Growth and/or Margin Expansion Required: The numbers work only if Twitter’s margins grow significantly (e.g., 15% to 30%) or it starts growing revenue more quickly (20-30% rather than 10-20%) or, better yet, both.

- An IPO Exit Will Be Required: Twitter cannot be sold to another company for $50-100 billion, and an IPO exit means that the exit multiple and timing are more uncertain. Also, in an IPO, Elon will have to sell his stake over several years, further reducing the IRR.

That’s the short version.

If you want the full tutorial, Excel model, highlighted documents, and more about the most important technical points, keep reading:

The Video Tutorial, Excel File, Documents, and More

Table of Contents:

- 2:13: The Short Answer

- 8:12: Part 1: Information Sources and Model Approach

- 10:31: Part 2: Purchase Assumptions and Leverage

- 14:46: Part 3: Operating Cases/Scenarios

- 17:36: Part 4: Cash Flows and Debt Repayment

- 23:51: Part 5: Exit Assumptions

- 30:08: Recap and Summary

Excel Files and Data Sources:

- Twitter – LBO Model (XL)

- Twitter – Slide Presentation on the Deal (PDF)

- Twitter – 10-K (PDF)

- Twitter – Q1 Earnings Report (PDF)

- Twitter – Financing/Loan Document for LBO (PDF)

- Twitter – Merger Agreement (PDF)

I’ve highlighted the key parts of each document so you can jump around more easily.

And here’s each section in a bit more detail:

Twitter Buyout, Part 1: Information Sources and Model Approach

The main information sources are the Twitter 10-K, its 2022 Q1 Earnings report, the merger agreement, and the loan/financing document.

The 10-K and loan/financing document are the most important parts because you need the company’s annual statements to build a model, and you need the debt tranches, interest rates, etc., to build in the LBO functionality.

As I mentioned in previous articles on the private equity case study and the timed LBO modeling test, we recommend a simple, “cash flow only” LBO model unless they specifically ask you to project all 3 statements:

This way saves time and lets you focus on the most important parts, such as the revenue and expense drivers, rather than minutiae.

You do need a Debt Schedule, and a Net Operating Loss Schedule is relevant here, but I wouldn’t build in more than that.

If you follow these steps and start from a reasonable template, it might take you anywhere from a few hours up to a few days to build this type of model.

It depends on how closely you read the deal documents, how much outside research you do, and how quick you are with Excel.

Twitter Buyout, Part 2: Purchase Assumptions and Leverage

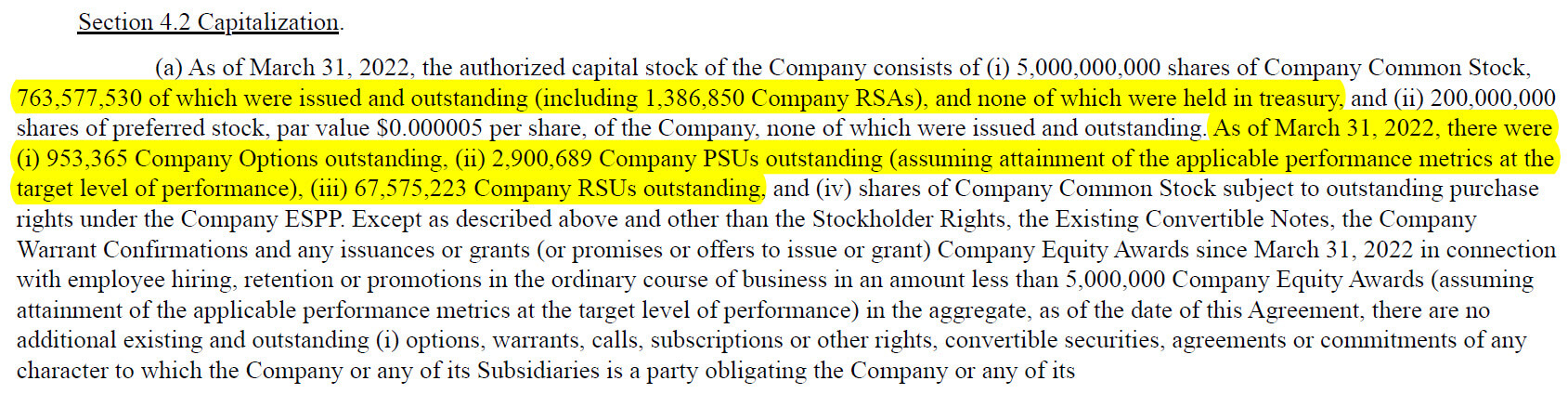

For the share count and option information, I used the merger agreement to get the counts as of the announcement date (the exercise prices come from the 10-K):

Everyone knows the offer price of $54.20, and the Equity Value / Enterprise Value bridge is straightforward based on Twitter’s Q1 Balance Sheet.

Everyone knows the offer price of $54.20, and the Equity Value / Enterprise Value bridge is straightforward based on Twitter’s Q1 Balance Sheet.

There are a few deviations from standard LBO deals:

- Elon’s Rollover Stake: Since he started purchasing Twitter shares in January, several months before the $54.20-per-share offer, he had accumulated a ~9% stake at the company’s “undisturbed” share price. We don’t know his exact cost basis, but I’ve used an average share price of $35.00 as an estimate.

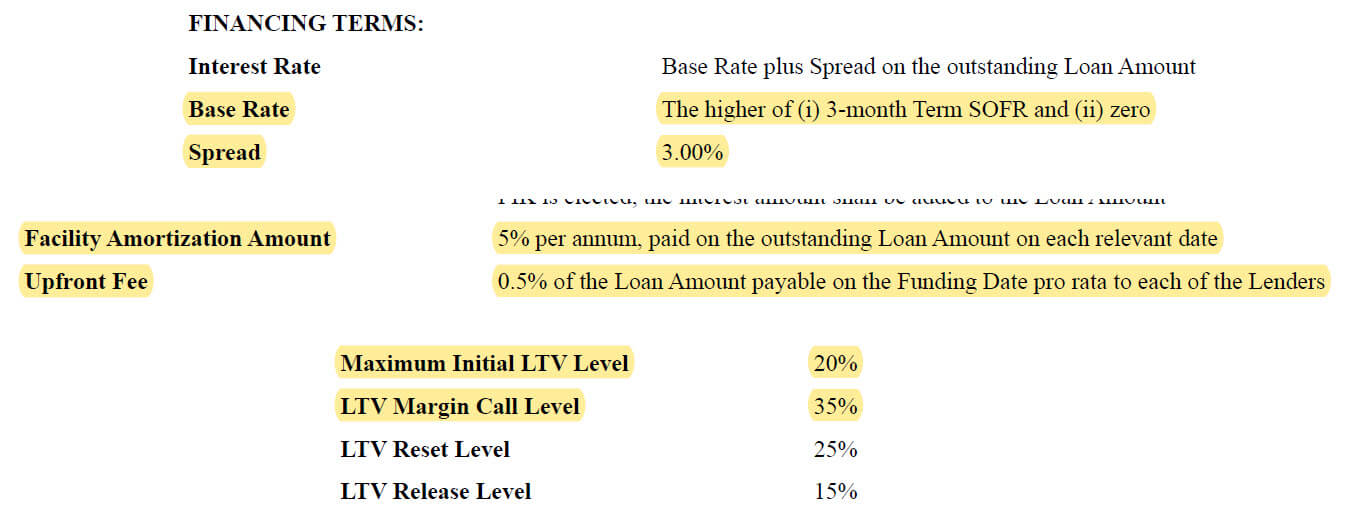

- Leverage and Debt Terms: The leverage here is exceptionally high compared with any normal leveraged buyout. For the interest rates and amortization figures, we are following the descriptions in the financing document:

In a few cases, I had to make guesstimates, such as with the 1.0% overdraw fee on the Revolver.

In a few cases, I had to make guesstimates, such as with the 1.0% overdraw fee on the Revolver.

- Excess Cash: In the Sources & Uses Schedule of many LBO models, you’ll see a line for “Excess Cash.” If a company’s Cash balance is very high, it can use some of it to repurchase shares, reducing the required Investor Equity and Debt.

Twitter clearly has excess cash & investments here: a $6.4 billion balance vs. total operating expenses and COGS of $4.8 billion in FY 21.

But I don’t think the company can use much of this balance to fund the deal.

For example, if they use $4-5 billion to fund the deal, the company runs into trouble with debt service and draws on the Revolver for billions of dollars vs. the theoretical “maximum” of $500 million.

The company cannot even cover the interest expense on the transaction debt initially, so this excess cash is needed to pay for some of the early Margin Loan amortization.

We can debate the exact deal funding, transaction fees, and excess cash, but the bottom line is that it looks like $19 – $21 billion of Investor Equity will be required no matter what happens.

You can translate that into: “Elon’s selling more Tesla shares or finding some partners.”

Twitter Buyout, Part 3: Operating Cases/Scenarios

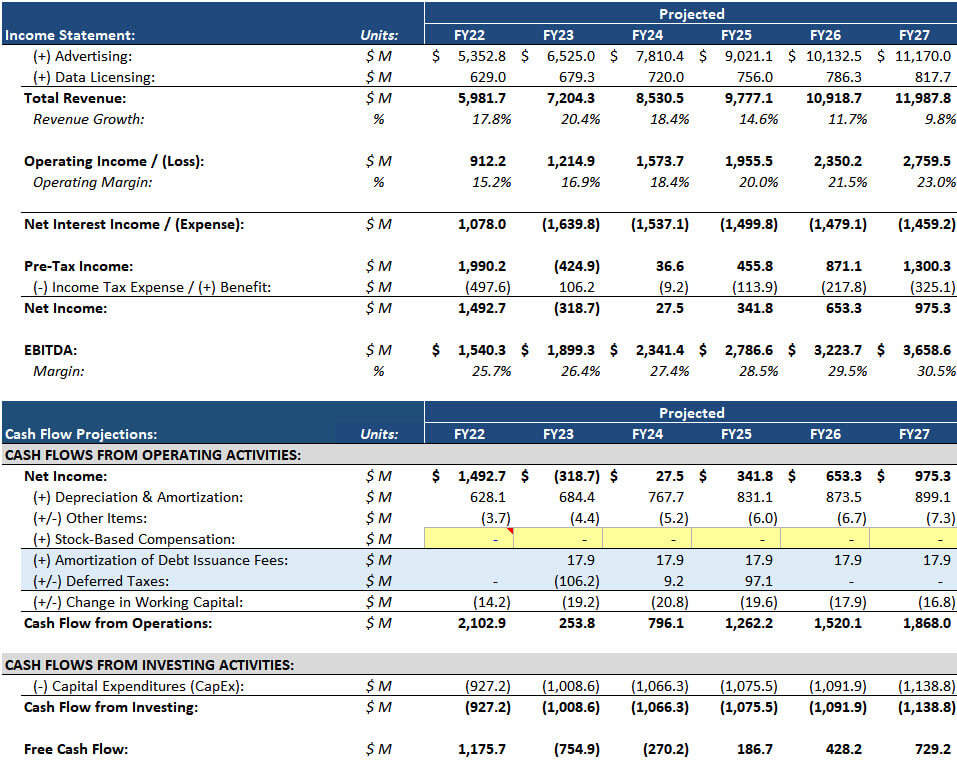

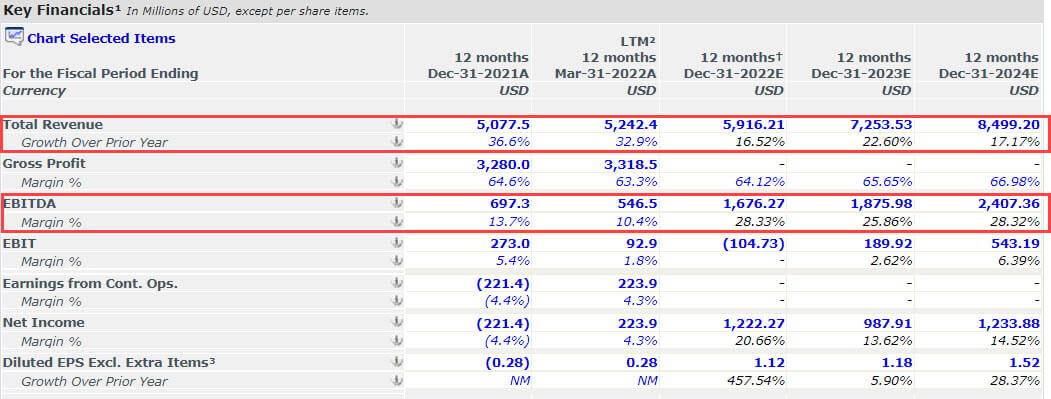

Our usual approach is to start with the consensus numbers for Twitter based on equity research forecasts and move up or down to examine other outcomes:

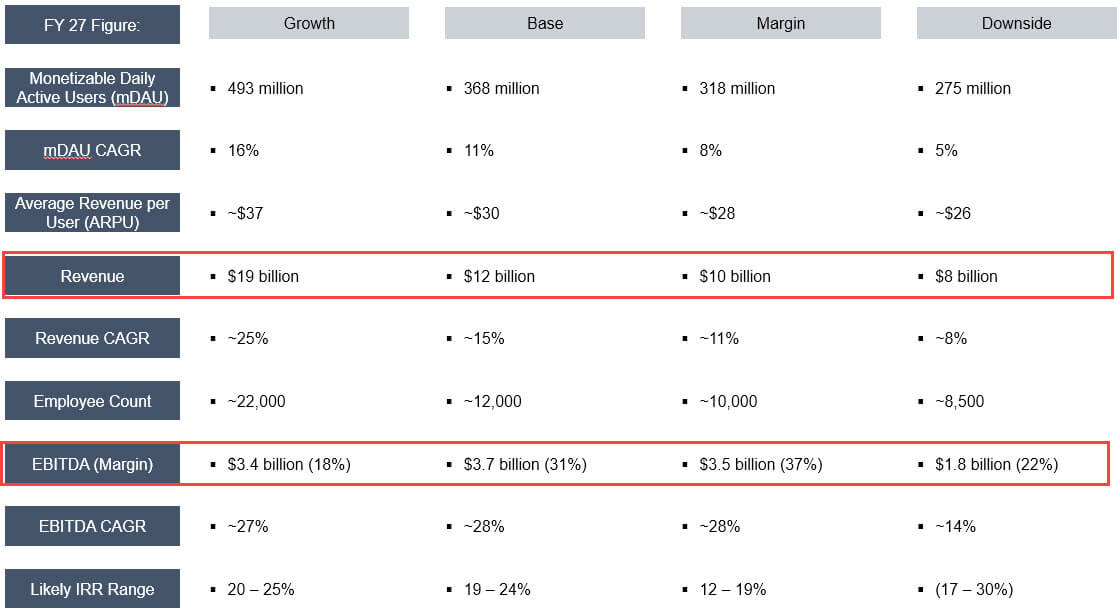

In this case, we also created “Margin,” “Growth,” and “Downside” scenarios, each based on different assumptions for the revenue and expense drivers.

The key revenue drivers are monetizable Daily Active Users (mDAU) and average revenue per user (ARPU), so they’re the highest in the “Growth” case, followed by the Base case, the Margin case, and the Downside case at the bottom.

The margins are based on the Employee Count, linked to a Revenue per Employee assumption, and the Operating Expenses per employee.

The OpEx per Employee figure grows at different rates in these scenarios, and the Employee count is the highest in the Growth case, followed by the Base, Margin, and Downside cases.

In terms of benchmarking these numbers, the overall idea is that Facebook, AKA “Meta Platforms,” is the top company on most of these metrics except for growth.

Its ARPU is around $41, it has billions of users, and it has EBITDA margins of 40-45%.

So, the Growth case here assumes the highest mDAU growth and an eventual ARPU figure close to Facebook’s ($37 vs. $41) – but also the lowest margins (18% by the end).

Each case below that discounts the mDAU growth and ARPU but assumes higher margins such that the FY 27 EBITDA figures are fairly similar:

Each case also uses a different exit multiple because higher-growth companies tend to trade at higher multiples, especially in tech.

Twitter Buyout, Part 4: Cash Flows and Debt Repayment

Much of the online commentary has focused on Twitter’s margins – which are important but not the whole picture.

A few other factors weigh heavily on the company’s ability to service and repay the $25 billion of Transaction Debt:

- Stock-Based Compensation: This should not be counted as a “non-cash expense” in a valuation and transaction modeling context because it creates dilution. Once this adjustment is removed, the company’s cash flow looks even worse.

- High CapEx: In almost every historical year, Twitter’s CapEx exceeded its Depreciation & Amortization (~15-25% of revenue vs. ~10-15% of revenue). We assume this differential will continue, reducing its cash flows in the holding period.

- Rising Interest Rates: The benchmark rate used for the debt financing – SOFR, the Secured Overnight Financing Rate – is “low” right now, but interest rates are rising. Projections currently imply a 2.50% – 3.00% SOFR over the next 5-10 years, so we assumed 2.50% in the holding period of this model.

This assumption matters because it pushes Twitter’s interest in the first year from “very high” to “incredibly high”:

- Term Loan + Senior Secured Bridge Loan: ~$752 million (5.42% weighted spread)

- Margin Loan: ~$687 million (3.00% spread)

- Unsecured Bridge Loan: $375 million (10.00% spread)

On top of all that, there’s also 1% amortization on the Term Loan and 5% on the Margin Loan.

5% * $12.5 billion = $625 million per year

1% * $6.5 billion = $65 million per year (we assumed $95 million because we grouped the Term Loan and Bridge Loan)

In total, that’s $2.5 billion of Debt Service vs. FY 23 EBITDA of $1.9 billion in the Base Case.

This situation creates some odd consequences, especially in the Growth and Downside cases:

- Revolver Draws: In some cases, Twitter may end up having to draw on over $6 billion of its Revolver, over 10x the “limit” of $500 million:

- Net Operating Losses: The Interest Expense is so high that the company’s Pre-Tax Income turns negative repeatedly, and the company builds up a $4-6 billion NOL balance in some cases.

- Credit Stats & Ratios: Metrics like the Return on Invested Capital (ROIC) stay low in the “extreme” cases (e.g., 1-3% historically and the same going forward).

The bottom line is that all these issues make the deal very dependent on the exit multiple and time frame.

And they’re both problematic as well (see below).

Twitter Buyout, Part 5: Exit Assumptions

Regardless of whether Twitter is worth $20 billion, $50 billion, or $100 billion by FY 27, no other company will “buy it.”

Regulators would stop Facebook from doing it, and companies like Pinterest and Snap couldn’t afford it or wouldn’t be interested.

So, an IPO will be required, which raises the questions of the exit multiples range and the time frame.

We’ve assumed a gradual sale of Elon’s stake over 3 years here, but that might be optimistic.

If it takes longer, the IRR will drop even more.

For the range of exit multiples, it’s useful to look at:

- The current multiples of comparable companies.

- Twitter’s historical multiples.

- How Twitter’s growth rates, margins, and ROIC change over time.

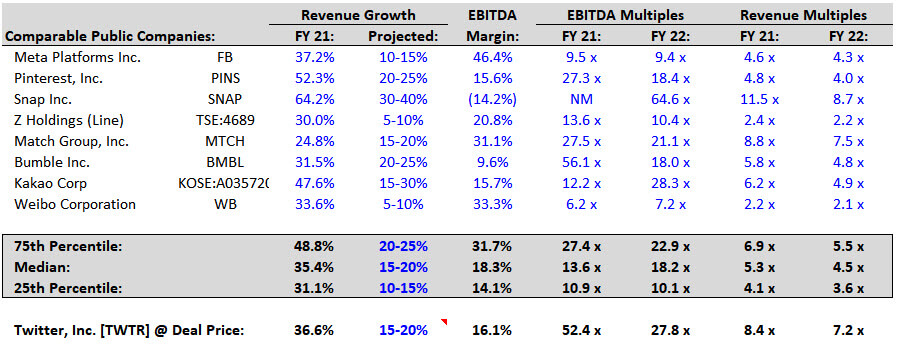

We selected 8 comparable social media, social networking, and “chat” companies and ran the numbers:

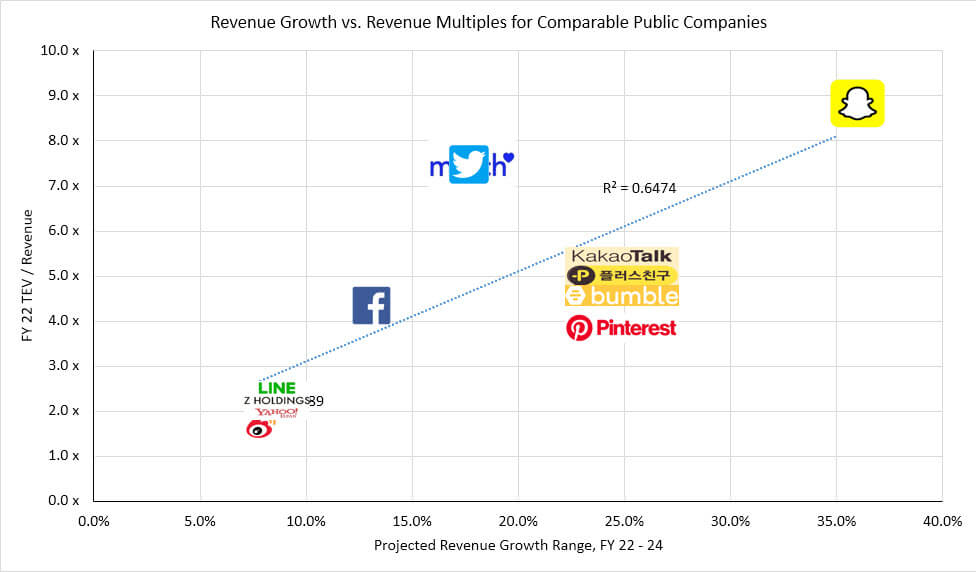

But it’s easier to understand this set when it’s plotted on a graph, with Revenue Growth vs. Revenue Multiples shown here:

At the purchase price, Twitter is far above the trendline and definitely looks overvalued (but even without the purchase premium, it would still be modestly overvalued).

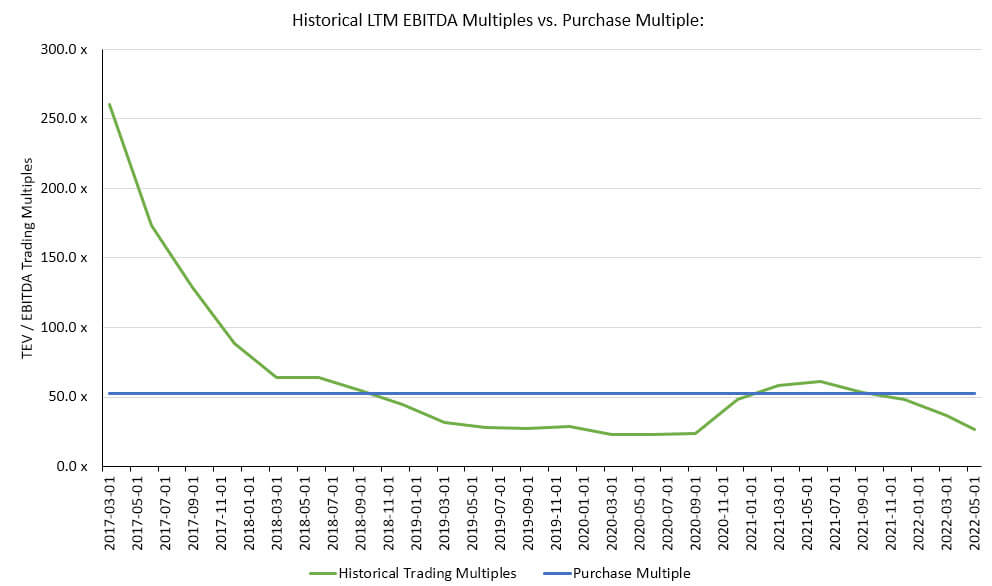

And over the past few years, the company has rarely traded above 50x EBITDA once it achieved substantial positive EBITDA:

In short, we think an exit multiple of 50x+ is implausible, as Twitter is a worse business and has far more issues than Snap, Pinterest, and the other names here.

That said, its financial profile does improve over the holding period in some cases, so a “Median to 75th Percentile” range of multiples may be justified.

Based on that, we selected a range of 15x to 30x in the Downside through Growth cases.

Potential IRR Ranges in the Twitter Buyout

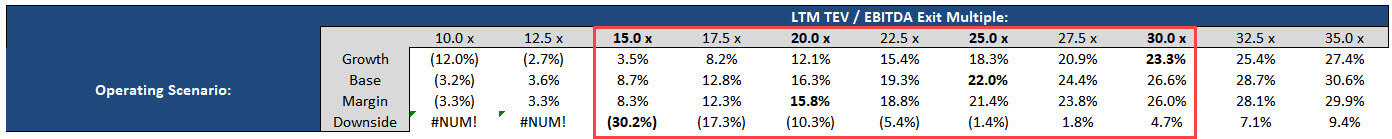

We could sensitize many variables in this deal, but the exit multiple and operational scenarios are the most important ones.

The purchase premium and leverage are both significant, but since this deal has already been announced, they’re not subject to (much) change.

Here’s the damage (click the image to see a larger version):

At first glance, the results might seem pretty good.

But the Downside case numbers are really, really bad, and the assumptions used in the other cases are “generous,” to put it mildly.

It’s certainly possible for Elon to achieve a 20-25% IRR, but a sub-20% IRR seems more likely.

And if you account for some of the other factors, such as more than 3 years required to sell his entire stake following the IPO, the numbers get even worse.

The Twitter Buyout: Final Thoughts

Given that he’s worth ~$250 billion, Elon Musk surely knows that this deal is “financially questionable.”

But as he has previously stated, he seems to be doing this for non-financial reasons.

And that’s fine – if I had even 1 / 100th of his net worth, I might also play around with marginal/controversial companies.

But the financial firms that are backing this deal might not stay along for the ride.

For example, note the very short 3-year maturity on the Margin Loan (vs. the 7-year maturity on the rest of the non-bridge-loan debt):

And it might be difficult to find other backers if Musk decides against contributing another $19 – $21 billion of his net worth to fund this deal.

The Twitter Buyout: Over to You

I normally close comments on technical articles, but I’m leaving them open because this is also a “current events” topic (similar to the Uber valuation).

So, do you think this deal is completely ridiculous? Will Elon save or destroy the world?

And will Tesla start trading based on Twitter’s performance rather than the Zodiac signs?

Bonus points if you can correlate the deal pricing to Elon’s tweets…

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

I’m a little late to this article now that it is Nov 2022 but great analysis! Looks like Elon is doing whatever he can to find ways to generate additional revenue but there has been a lot of backlash and lots of advertisers pausing. We will see how it shakes out.

Thanks. Yes, we’ll see what happens. I wouldn’t trust anything until the company releases actual user and revenue numbers.

A very insightful perspective that contrasts with the mainstream’s treatment of the subject. I am impressed with how you are able to come up with this depth of analysis in just a few days!

Of course it does not look like Elon will look to exit in a few years for a traditional IRR target. If the company IPOs again, it will likely go back to woke censorship in a matter of years. It seems like Elon is more motivated by his societal goal, which explains and for him justifies how unorthodox the underwriting looks.

To me, this looks like a huge gamble that may not be worth its very commendable objective. With Tesla as collateral, the downside seems huge for Elon. But as Kanye put it, name one genius that ain’t crazy.

Thanks. Yeah, I’m a little skeptical of what Twitter will look like as a public company once again unless Elon continues to own a large stake in it (and it seems like he’s doing this for his own amusement).

On the other hand, I’ve been wrong about Tesla repeatedly and missed out on the huge gains there, so maybe he defies all logic and analysis.