Power & Utilities Investment Banking: How to Turn Yourself into an Electrified ESG Warrior

The power & utilities investment banking team has a reputation for being “boring.”

Traditionally, the sector was viewed as a defensive play for investors who wanted stable dividends and no drama.

That is still true for the average company in the industry: it is more defensive than something like technology or financial institutions.

But over time, trends like market liberalization, deregulation, the shift to renewables, and the ESG religion “movement” have shaken up a sleepy sector.

We’ll get into these fun developments, but I want to start with the basic definitions:

Power & Utilities Investment Banking Defined

Power and Utilities Investment Banking Definition: In power/utilities IB, bankers advise companies that produce, transmit, and distribute electricity, natural gas, and water on raising debt and equity and completing mergers and acquisitions.

If you’re wondering about “transmission” vs. “distribution,” transmission is the part of the process where electricity is sent from power generation sites over long distances at high voltage levels to substations that are closer to people and businesses.

In the distribution process, the voltage is “stepped down” by transformers and sent to homes and businesses.

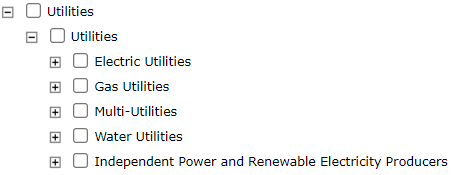

The “classification tree” is simple because this sector is quite narrow:

Of these verticals, electricity is easily the most important one; ~90% of publicly traded utility companies are involved in electricity in some way.

Power companies generate power (from fossil fuels, renewables, and nuclear) and sell it wholesale to utilities companies and other customers. They are often unregulated and do not focus on the transmission or distribution aspects.

Utility companies might generate their own power, but they could also buy some from power companies, and they focus on the transmission and distribution steps. They are also highly regulated and tend to be vertically integrated.

The power & utilities sector has lower volatility than others because electricity, gas, and water are necessities for modern life.

Companies tend to offer high, stable dividend yields, and they finance their massive capital expenditures primarily with debt, with the highest leverage ratios of any industry outside of financial institutions.

It’s also a highly localized industry, with many companies serving specific countries, states/provinces, and cities, and many operating “local monopolies.”

Different banks classify their power & utilities groups differently.

For example, Goldman Sachs puts it in “Natural Resources” or “Public Sector and Infrastructure,” JP Morgan puts it in “Energy,” it’s a separate group at Morgan Stanley, and there’s a “Power, Utilities & Renewables” group at Bank of America.

While there is overlap between power & utilities, infrastructure, oil & gas, and renewables, the industry structure and drivers are quite different, so we’re treating it as a separate group.

Recruiting into Power & Utilities Investment Banking

There’s nothing special to note here because power & utilities investment banking is a moderately specialized group (at best).

You have a small advantage if you have a relevant background, such as experience at a power or infrastructure company or in the public sector, but it won’t make a night-and-day difference.

Most large banks have strong power & utilities groups, so you can’t go wrong with any of them.

If you’re recruiting outside the large banks, there are many boutiques in this sector, but they tend to focus on high-growth renewables companies, so it’s not quite the same industry.

Overall, though, there are fewer industry-focused independent/boutique firms than in sectors like technology or healthcare.

That means that power & utilities is not the best sector to target if you’re trying to get into IB from “off the beaten path.”

What Does an Analyst or Associate in Power & Utilities Investment Banking Do?

The most common deal types in this group are debt issuances and asset acquisitions/divestitures.

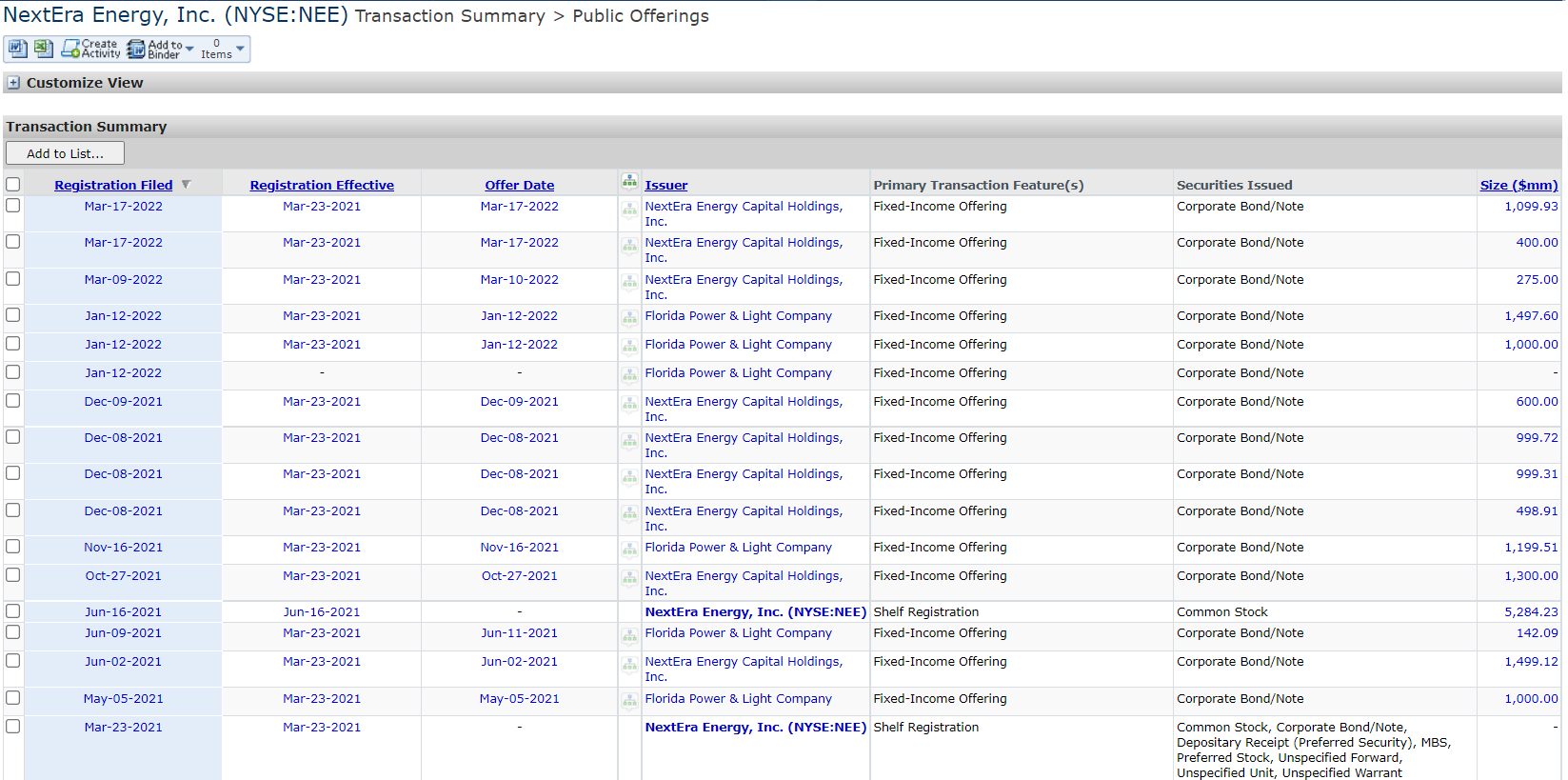

To get a sense of this, take a look at the number of debt issuances by NextEra Energy (Florida Power & Electric) in less than one year (click the image to view a larger version):

Investors do not view most power/utility firms as “growth companies,” so initial public offerings (IPOs) are fairly rare.

Follow-on equity offerings occur, but they’re usually motivated by concerns such as complying with a debt / total capital ratio set by the government.

Larger M&A deals also happen, but they’re less common than in other sectors because of factors like regulation, which may limit companies’ expansion into new regions.

Asset acquisitions are very common because they’re one of the few growth strategies available to these companies.

Regulators might block large corporate-to-corporate M&A deals and might not allow a company to raise its rates, but they’re less likely to block the acquisition of a single power plant or a smaller transmission network.

Also, the push for renewables has led to many firms divesting oil/gas/coal assets and acquiring ones with less of a carbon footprint.

Leveraged buyouts of entire power & utility companies are not common for similar reasons (regulations, infamous failure stories like TXU, etc.); asset-level deals are more frequent.

Finally, except for one-off scenarios like the Pacific Gas & Electric bankruptcy, restructuring deals are not common in this sector.

If they were, lenders wouldn’t accept 50% debt / total capital ratios.

Power & Utilities Trends and Drivers

Some of the most important drivers include:

- Economic Growth – Strong economic growth tends to result in higher electricity usage, but people don’t necessarily use more water or gas when growth is higher. Utilities often benefit when economic growth weakens because a recession hurts them less than other industries.

- Demographics – Population growth and demographics are the most important long-term drivers that affect utility demand. For example, is the birth rate rising or falling? What about the new household formation rate? Are people moving to areas where more or less electricity, gas, and water will be required?

- Interest Rates and Monetary Policy – Loose monetary policy, such as lower interest rates and expansion of the money supply, tends to benefit utility companies because they can finance their capital expenditures at lower rates. However, when interest rates rise, this financing becomes more expensive, and utilities’ dividend yields become less attractive relative to higher-yielding bonds.

- Inflation – Inflation makes fuel and other operating costs more expensive, but regulatory mechanisms sometimes allow utilities to pass on rising costs to customers. Sometimes their “authorized revenue” is even linked to the inflation rate. So, the impact of inflation depends on the regulatory scheme and whether it is expected or unexpected. Unregulated power companies often benefit from inflation because they can react and increase their prices more quickly.

- Technological Change (Shift from Oil/Gas/Coal to Nuclear and Renewables) – Government mandates, tax credits, and subsidies have shifted the typical fuel sources for both power and utility companies, and the effects vary widely based on investor sentiment and the policies supporting these changes. It’s safe to say that they have encouraged more deal activity.

- Regulation – This affects everything from firms’ capital structures to their revenue, margins, and favored fuel sources, so the impact could be minimal or very large in either direction, depending on what the government changes.

Power & Utilities Overview by Vertical

Electric utilities are the biggest segment, so we’ll focus on them here.

Water is the smallest, so we’ll group water and gas utilities and discuss multi-utilities and power firms separately.

There are very few “pure-play” firms in any of these categories because most firms do a bit of everything.

Electric Utilities

Representative Large-Cap Public Companies: Fortum (Finland/Europe), Enel (Italy), Electricité de France, Korea Electric Power Corporation, Iberdrola (Spain), Tokyo Electric Power Company, EnBW Energie Baden-Württemberg (Germany), Exelon, NRG Energy, Endesa (Spain/Portugal), and Duke Energy.

The biggest electric utility companies tend to have unregulated power generation assets that span multiple states/provinces or even countries (ex: Duke Energy in the U.S. or Fortum/Uniper in Europe).

The smaller players usually operate as vertically integrated “local monopolies” and more closely resemble the traditional view of the utilities sector.

Since electricity cannot be stored or controlled easily but can travel great distances almost instantly, electric utility companies need delivery systems with significant spare capacity to deal with rapid demand fluctuations.

They divide demand into the “base load,” “intermediate load,” and “peak load,” and they manage their networks based on the load factor (peak load minus average load) and the load composition (the weights of different customers, such as residential vs. industry).

These load metrics matter because companies tend to use different fuel sources to meet each type of demand.

The ideal “base load” fuel sources include those with high fixed costs and low variable costs, such as coal, nuclear, and hydroelectric power.

For intermediate and peak loads, companies prefer sources such as oil and natural gas, with lower fixed costs and higher variable costs (since these loads comprise much less time).

Wind and solar might also be used in the intermediate range if they’re available.

Regulated utilities follow the cost of service rules, in which the government sets allowable electricity rates so that utilities can cover their expenses and offer a “reasonable” return for investors.

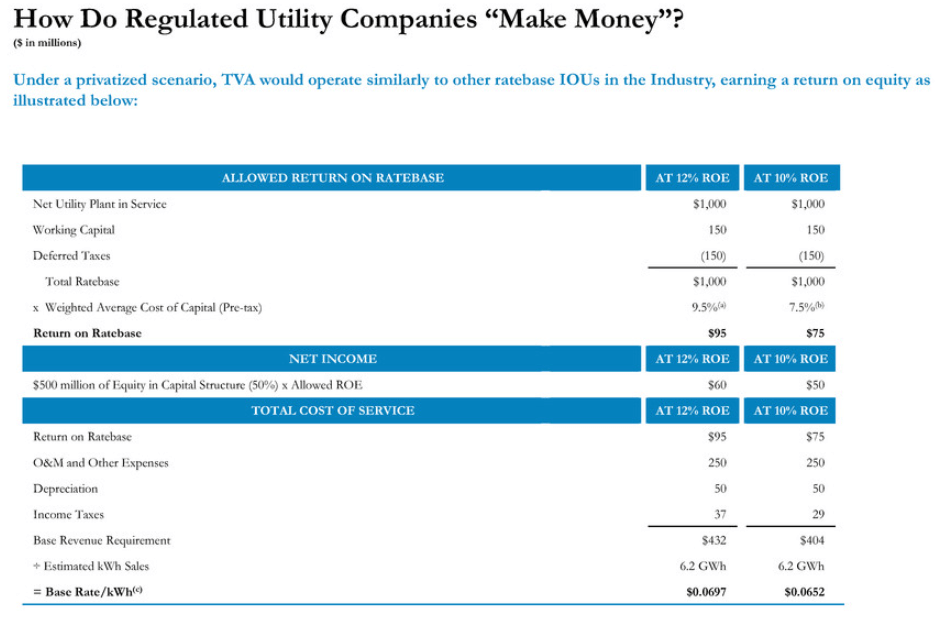

Lazard’s presentation to the Tennessee Valley Authority on its possible privatization sums up the mechanics quite well on slide 118 (click the image to view a larger version):

All regulated utilities have a “Rate Base,” which represents the total value of their power plants, transmission lines, distributions, and other infrastructure (Net PP&E on the Balance Sheet with some adjustments, such as deductions for unregulated power assets in regulated regions).

Regulators then set the allowed Debt / Total Capital ratio that can fund these assets and the authorized Return on Equity (ROE).

For example, let’s say the company’s Rate Base is $1,000, as in the Lazard example above.

The allowed Debt / Total Capital Ratio is 50%, so the company has $500 of Equity and $500 of Debt to fund its assets (ignoring non-PP&E assets for simplicity).

The Authorized ROE is 10%, so the allowable Net Income is $500 * 10% = $50.

At a 25% corporate tax rate, its Pre-Tax Income is $50 / (1 – 25%) = ~$67.

Regulators then work backward and add the standard Income Statement expenses to determine the Base Revenue Requirement.

Maybe the company’s Pre-Tax Cost of Debt is 5%, so the lenders earn $500 * 5% = $25 in interest.

The company also has $200 in Operating & Maintenance Expenses and $40 in Depreciation.

Adding those up, $67 in Pre-Tax Income + $25 in Interest + $200 in O&M + $40 in Depreciation = $332 for the Base Revenue Requirement.

If the company sells 4 GWh of energy, its “allowable rate” is $0.083 per kWh.

You can already see one major problem with this method: what if the company’s costs suddenly change due to inflation, a fuel shortage, or high demand?

To deal with this issue, some regulators allow “enhanced cost recovery mechanisms” that allow utilities to increase their rates without formally requesting a rate increase.

Another issue is regulatory lag, as power plants and infrastructure can take years or decades to develop – and while that is happening, utility firms may not be allowed to earn more.

Some regulators allow “Construction Work in Progress” to be counted in a firm’s Rate Base to deal with that.

Because of cost-of-service rules, regulated utilities have 3 main growth options:

- Cut expenses and boost the actual ROE as close to the Authorized ROE as possible.

- Ask the regulators to increase their Authorized ROE, reduce regulatory lag, or permit a different capital structure.

- Develop or acquire more power plants and transmission/distribution infrastructure, i.e., increase the Rate Base.

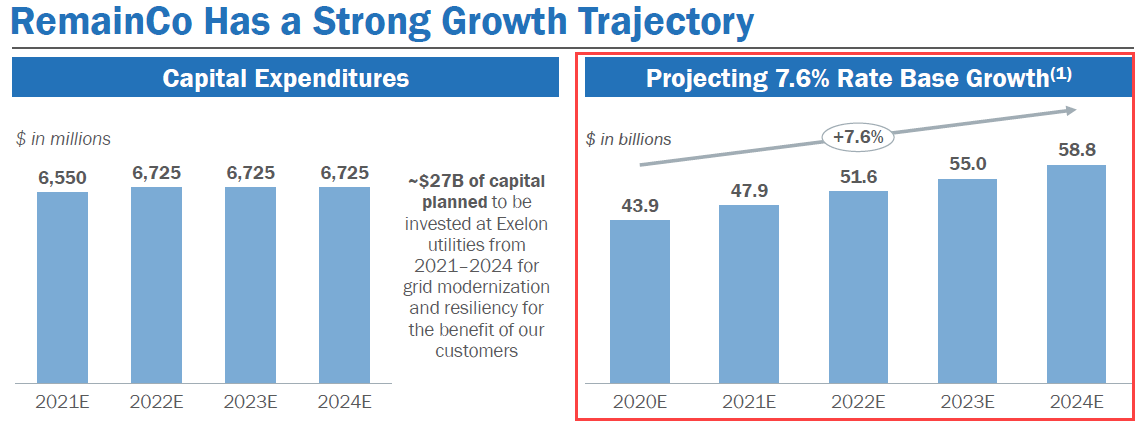

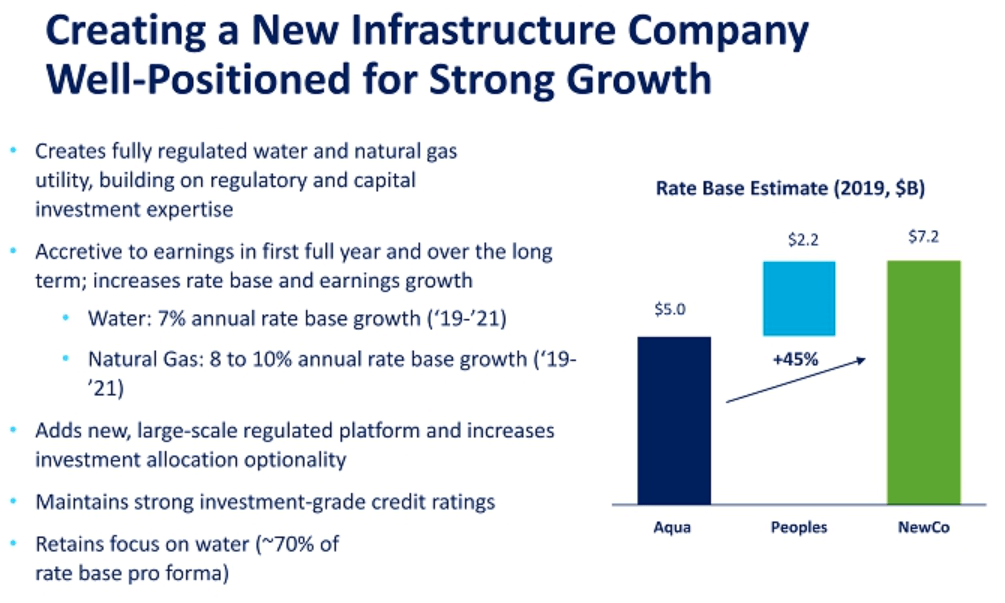

These factors explain why all power & utilities investor presentations have references to the company’s “strong projected Rate Base growth”:

One Final Note: The terminology and calculations differ by region, but the principles are always the same.

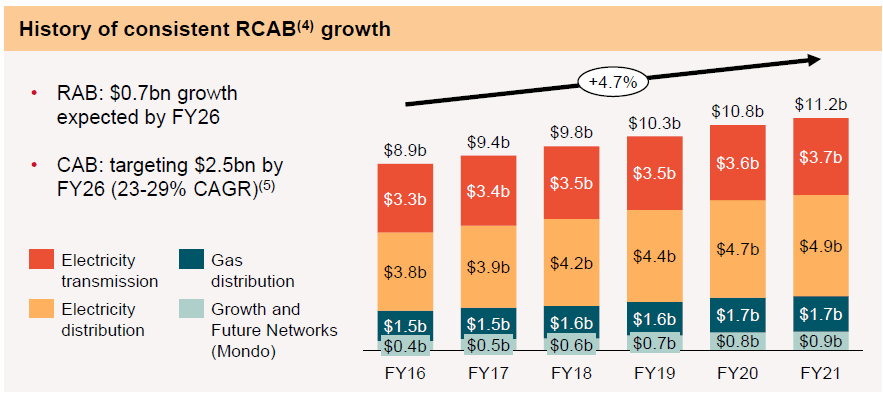

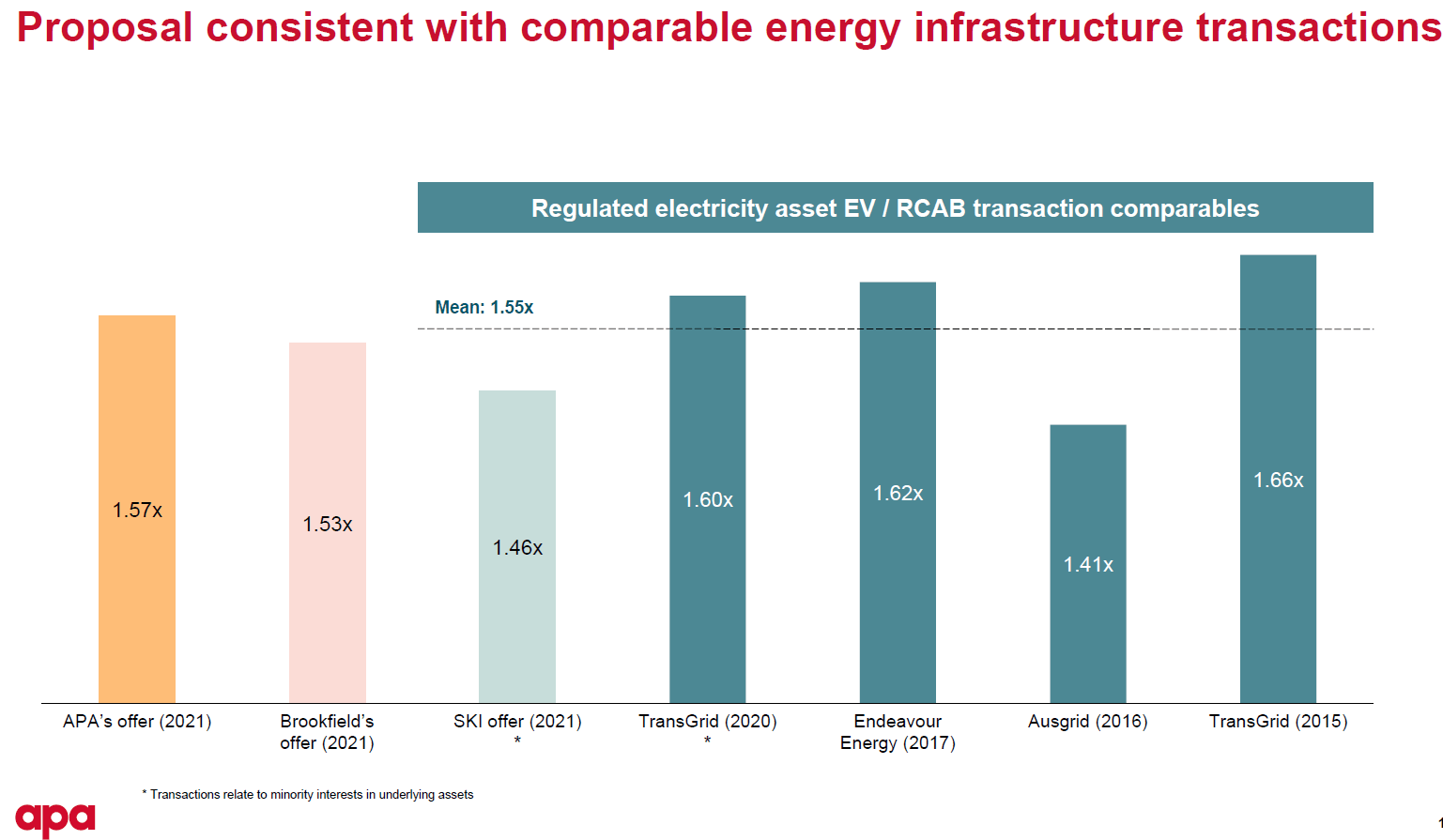

For example, in Australia, the Rate Base is called the “Regulated and Contracted Asset Base” (RCAB), but it’s the same idea:

Independent Power Producers (IPPs) or Non-Utility Generators (NUGs)

Representative Large-Cap Public Companies: Uniper (Germany/Europe), Huaneng Power International, RWE Aktiengesellschaft (Germany/Europe), GD Power Development (China), Edison (Italy), NTPC (India), Datang International Power Generation (China), Huadian Power (China), Vistra (U.S.), AES (U.S.), Drax (U.K.), Enel Generación Chile, and Meridian Energy (New Zealand).

Many of these companies are subsidiaries of larger utility/power companies, and most of the biggest ones operate in China.

Power generation is the most complex and expensive part of the electricity delivery system, which explains why many companies doing it operate as unregulated entities (higher prices).

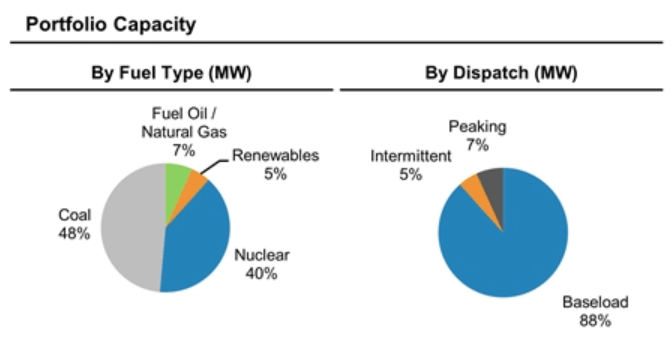

When analyzing these companies, the split of fuel sources and the availability of each one matter a lot:

And apologies to the faithful ESG warriors out there, but each fuel source, including renewables, has its advantages and disadvantages.

For example, coal power plants are expensive, emit the most carbon, and require high upfront spending for their infrastructure, but their variable costs are low since coal is cheap.

Gas plants are smaller and cheaper to build, and they emit less carbon, but their variable costs are higher – so gas tends to be used for intermediate and peak demand.

Renewables like solar and wind also have higher upfront capital costs because the power generation sites are far from populated areas, which means more infrastructure.

And yes, they do not emit carbon once operational, but they’re also less dependable until storage technology gets much better.

Since fuel is the biggest expense for power companies, one of the most important metrics is the gross utility margin, or the revenue generated by the sale of electricity minus the fuel costs.

This margin goes by different names based on the fuel source as well (“spark spread” in natural gas, “dark spread” in coal, and “quark spread” for nuclear).

Other important metrics include the dispatch curve (power supplied vs. the variable costs of power generation), the capacity and utilization of individual plants, and the reserve margin (total generation capacity minus peak demand).

Finally, you need to understand the basic units that allow you to calculate revenue.

For example, if a solar installation has a 20 MW capacity, a 15% utilization rate, and power prices are currently $50 per MWh:

- Annual Capacity = 20 MW * 24 hours * 365 days = 175,200 MWh or 175.2 GWh

- Annual Energy Production = 175,200 MWh * 15% = 26,280 MWh

- Annual Revenue = 26,280 MWh * $50 per MWh = $1.3 million

In the projections, you’d apply an escalation factor to the power prices and operating expenses and a “degradation factor” to the capacity because of wear and tear.

Gas & Water Utilities

Representative Large-Cap Public Companies: Naturgy Energy (Spain/Latin America), Korea Gas, ENN Natural (China), Tokyo Gas, AltaGas (Canada), Sabesp (Brazil), American Water Works, Southwest Gas Holdings, Beijing Enterprises Water Group, and Rubis (France/Europe).

Some of the key drivers and metrics for electric utilities are also important here.

For example, regulated water and gas companies focus heavily on their Rate Base, capital structures, and CapEx, often using these factors to justify deals:

The key differences are as follows:

- There are very few publicly traded water companies because in many countries, such as the U.S., 90% of water and waste management is managed by municipal governments. Most of the biggest water companies are part of the larger, diversified companies in the Multi-Utilities segment (see below).

- In the U.S., many gas utilities operate as regional monopolies called “Local Distribution Companies” (LDCs) that serve specific geographies. Multi-state and multi-country companies with some unregulated assets are less common than in electric utilities.

Gas and water can be stored more easily than electricity, so the distribution networks don’t need as many special features.

That makes the companies operationally simpler, at least if you focus on pure-play firms.

Multi-Utilities

Representative Large-Cap Public Companies: E.ON (Europe), ENGIE (France), Veolia Environnement (France), National Grid (U.K.), Centrica (U.K.), A2A (Italy), DTE Energy (U.S.), Hera (Italy), Dominion Energy (U.S.), Consolidated Edison (U.S.), Sempra (U.S.), Abu Dhabi National Energy Company, and AGL Energy (Australia).

Many companies in this sector do a bit of everything because there’s significant overlap between different types of utilities or, in banker speak, “synergy opportunities.”

For example, gas and electric utilities both need to install meters to measure customers’ usage and bill them, so why not combine the functions into a single device that one technician can install?

Also, since rising fuel prices represent a major risk factor for both, an electric company that relies on natural gas might be able to hedge some of the risk by acquiring a gas utility and selling gas when prices rise.

When analyzing these companies, you need to divide them into their respective segments and consider which ones are regulated vs. unregulated.

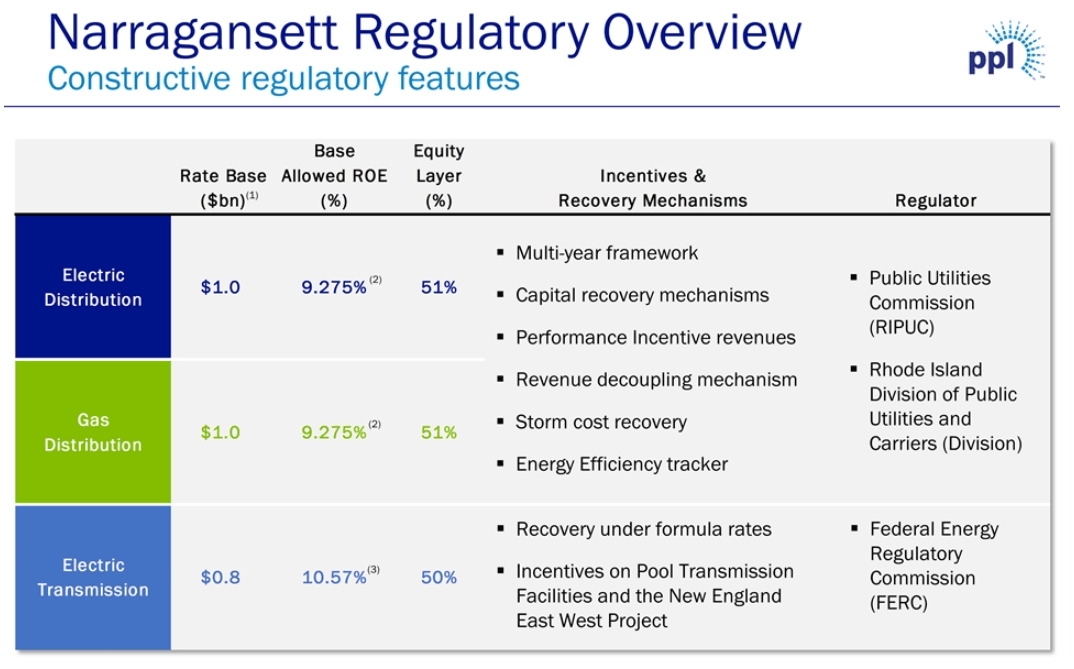

The Cost of Capital, Rate Base, Authorized ROE, and even the Debt and Equity percentages may differ for different segments:

Power & Utilities Accounting, Valuation, and Financial Modeling

There are some differences on the technical side, but this group is not nearly as specialized as real estate, FIG, or oil & gas.

Most operational/projection differences relate to the concepts already discussed above, such as the Rate Base, Authorized ROE, and Capacity/Production calculations.

As a result of these points, you often make CapEx and the Rate Base the key drivers and then “back into” revenue based on allowed price increases.

It is 100% possible to use standard valuation multiples, such as P / E and TEV / EBITDA, to value power/utility companies, and you’ll see many examples in the Fairness Opinions below.

However, there are a few industry-specific or specialized multiples as well:

- Enterprise Value / Rate Base (TEV / RB): The Rate Base represents all investors in the company and determines its allowable revenue and earnings, so it’s perfectly valid to turn it into a valuation multiple.

- Equity Value / Book Value (P / BV) or Equity Value / Tangible Book Value (P / TBV): Since Book Value, or Common Shareholders’ Equity, is a percentage of the Rate Base for regulated utilities, you can also split off this equity portion and turn it into a valuation multiple. As with banks, utilities with higher ROEs tend to trade at higher P / BV multiples.

- Enterprise Value / Capacity ($ per MW): Finally, for power generation companies, capacity is the key top-line driver that determines revenue. It affects all investors, so TEV / Capacity multiples are sometimes used.

You can see an example of an industry-specific multiple (EV / RCAB in Australia) if you look at APA’s presentation used in an attempt to outbid Brookfield for AusNet:

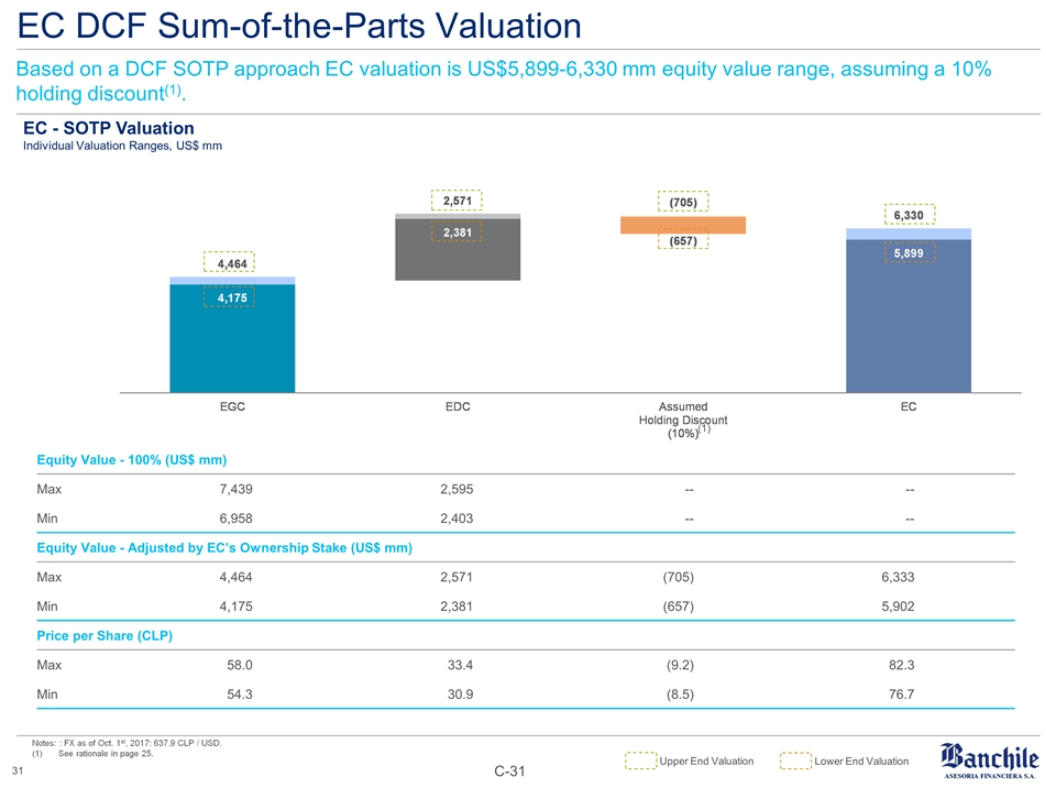

The Sum of the Parts Valuation is a very important methodology in this sector, and you see it in all types of valuations and Fairness Opinions because so many companies operate across multiple segments.

For example, take a look at these valuations for a complex reorganization of Enel Group in Chile:

Example Valuations, Pitch Books, Fairness Opinions, and Investor Presentations

Since many of these companies and deals involve multiple verticals, I’m not splitting up this list like that.

Instead, I’ll make a short note of the deal type and banks involved:

- Tennessee Valley Authority (TVA) – Potential Privatization or Spinoff (Lazard)

- Strategic Assessment Presentation – This is the most detailed presentation you will find in this sector (139 slides!).

- Article with Background Information

- Exelon / Constellation Energy – Spinoff (MS and Centerview)

- National Grid / PPL – Divestiture of U.K. Utility Business (Barclays, GS, and JPM)

- Brookfield and Other Investors / AusNet (Adara Partners, Citi, and BAML) – Heavily contested utilities deal in Australia

- JPM Infrastructure Investments / South Jersey Industries (Centerview and BAML) – Primarily a natural gas utility

- Aqua America (nka: Essential Utilities) / PNG Companies (GS, Moelis, RBC, and MS) – A water utility acquiring a gas utility to diversify

- Algonquin Power & Utilities (BAML and Wells Fargo as joint bookrunners) – $750 million in Subordinated Notes

- Veolia Environnement / Suez (BAML, Credit Agricole, HSBC, Messier Maris, MS, Perella Weinerg, and FINEXSI) – Huge merger in France in the waster/wastewater management space

- Pacific Gas & Electric (PG&E) (JPM, BAML, Barclays, and Citi) – Bankruptcy and Debtor-in-Possession Financing

- Enel Chile / Enel Generación (Banchile, Econsult, LarrainVial, and Asset Chile) – This was a complicated reorganization deal with a combined merger and public tender offer

- Avangrid / PNM Resources (BNP, MS, and Evercore) – Power generation and electric utility merger

Power & Utilities Investment Banking League Tables: The Top Firms

It’s tricky to determine the “top banks” in this sector because many deals are asset acquisitions that do not show up in the league tables since the deal sizes are undisclosed.

Also, there are classification issues because power & utilities investment banking overlaps with other groups such as renewables and natural resources.

However, if you ignore all that and focus on the league tables by deal value, you’ll see names like Bank of America, JP Morgan, RBC, Goldman Sachs, Morgan Stanley, and Barclays as leaders.

Some of these focus on larger corporate-level deals (GS), others are stronger in conventional energy (Barclays), and others are stronger in renewables (BAML).

Citi is also quite active in the sector but tends to work on asset-level deals more than corporate ones.

Among the elite boutique banks, Evercore and Lazard are quite active, as are Moelis, Centerview, Guggenheim, and Robey Warshaw (more of an “up and coming” elite boutique?).

Some of the Big 5 Canadian banks are also well-represented on these deals, and “good but not quite elite boutique firms” such as PJ Solomon also show up.

There’s also Nomura Greentech, which is very active but only on renewable deals.

Similarly, most boutique banks in the space focus on renewables: Marathon, CohnReznick, Onpeak, and Green Giraffe are some examples.

Power & Utilities Investment Banking Exit Opportunities

Contrary to what you might think by reading this article, the exit opportunities out of power & utilities investment banking are quite broad.

Yes, you have an advantage if you aim for something highly relevant, such as an infrastructure private equity firm or corporate development at a power company, but you’re not precluded from more generalist opportunities.

You’re probably not a great candidate for venture capital and growth equity roles except for those focusing on the renewables sector, but the other standard opportunities are all feasible (hedge funds, private equity, corporate development, etc.).

On the other extreme, you probably wouldn’t be a great candidate for distressed investing roles because most debt issuances in this sector are investment-grade.

For Further Reading

Some good information sources include:

- News: Utility Dive, S&P Energy News and Research, Power Mag, Energy & Utilities, Transmission & Distribution World Magazine, and FT Utilities

- Industry Research: Deloitte, KPMG, PricewaterhouseCoopers, and Ernst & Young

- Books: Fisher Investments on Utilities, Principles of Utility Corporate Finance, and a metric ton of books on renewables

Is the Power & Utilities Investment Banking Group Right for You?

So, you get solid exposure to many debt, M&A, and asset deals, fairly broad exit opportunities, and you can specialize without becoming overly specialized.

What’s the downside of power & utilities investment banking?

Some would say that it’s “boring,” but with all the tech trends, policy changes, and ESG craze, I don’t think that’s necessarily true.

The biggest real downside is that you often work on the same types of deals repeatedly – even in different verticals – so there is less variety than in a healthcare or consumer/retail group.

But if you don’t mind that, or you can find a group with more varied deal types, this might not be a downside at all.

Just remember to reduce your carbon emissions before applying, or your ESG score might stop you from getting a job – even if your GPA is fine.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

Wow. Hands down the best primer on power / utility banking that I have come across. Thank you! Shared with my MBA cohort.

Thanks! Glad to hear it.

this was super helpful, thank you! Have been preparing for an interview and this has been a great resource.

Thanks, glad to hear it!

Since debt issuances are very common, are there any good materials out there on the power credit market? Specifically for someone looking to break into a power-focused credit investing group?

I don’t know of anything, sorry. I doubt there are any books because power-focused credit investing is very specific. But you might able to find some overviews and snapshots from banks and Big 4 firms that address the topic as part of their sector coverage.

do you have any info on Power S&T groups at banks? Or are only hedge funds and utility companies hiring traders.

No, I don’t, sorry. I don’t think there are industry-focused S&T groups at banks in the same way there are for IB – you would probably be looking at something like the commodities desk or an offshoot of that.

I have a question unrelated to this. I am considering a finance job from a natural gas upstream company. The job is interesting (M&A, strategic planning, etc) and the compensation is well above the average I’d find in my area and what I currently make.

My main question – does a finance job in oil and gas kind of pigeon hole you for exit opportunities? Would it be hard to find a job in a different industry down the road?

Energy is a highly specialized field, so yes, you will get pigeonholed to some extent. But it’s probably less of an issue in corporate finance than it would be in investment banking because CF roles tend to perform many of the same functions at different companies across different industries. You might not be the best candidate to move to something like Google or Facebook corporate development or corporate finance afterward, but you could move into something outside of energy, especially at companies that have some relationship to it.