Investment Banking in Dubai: The New York of the Middle East?

Investment banking in Dubai stands out for attracting remarkable hype on social media.

You’ll find influencers on Instagram, TikTok, LinkedIn, and other sites constantly praising Dubai and claiming it’s the best place to work or start a business.

It’s almost like the city has its own PR department and never-ending marketing campaign.

If you’re interested in the Middle East or have connections to the region, all this hype has probably made you wonder about finance careers there.

Specifically, should you aim for entry-level investment banking roles in Dubai rather than London, New York, or other financial centers?

Are the tax benefits, safety, and diversification worth the drawbacks of less deal activity, smaller intern classes, and somewhat “random” work?

The short answer is that, like other smaller regions, Dubai is best in very specific cases; the average student would still be better off starting in NY or London.

And if you want all the details and some sports analogies to sum up everything, read on:

Investment Banking in Dubai: Hub of the Middle East

Dubai acts as a hub for transactions in the Middle East and North Africa (MENA) region, which includes ~20 countries.

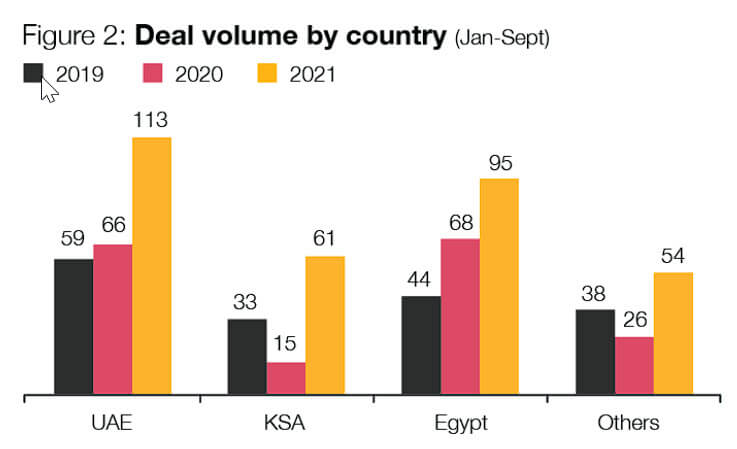

The most prominent three countries by deal activity are the United Arab Emirates (UAE) itself, Saudi Arabia (KSA), and Egypt:

The “Others” category includes countries like Algeria, Jordan, Lebanon, Qatar, Morocco, and Oman.

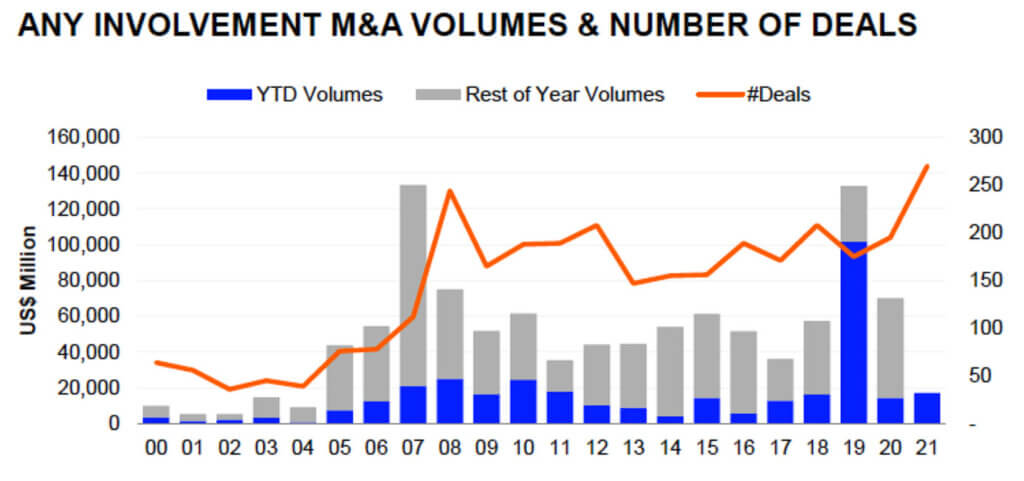

And while Dubai may be a hub for this region, deal activity across MENA is fairly low.

There are usually a few hundred M&A deals per year for $50 – $100 billion of total volume:

For context, that’s less activity than Canada in an average year, and it’s about 5-10% of the deal volume of the Asia-Pacific (APAC) region.

That doesn’t make Dubai “bad” – it just means it’s smaller than many think.

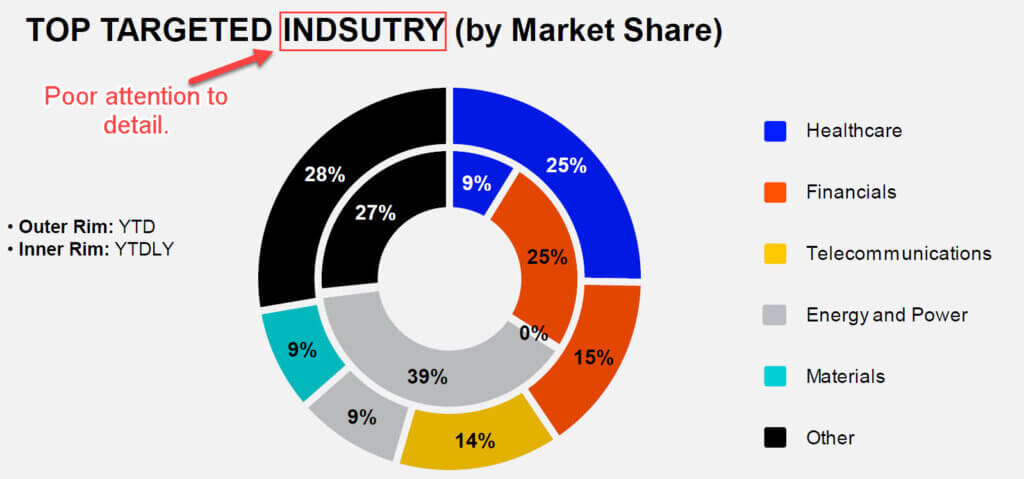

Industry-wise, oil & gas and power & utilities are huge, but sectors like healthcare, financials, and telecom are quite significant as well:

Technology has been growing, but it’s still less developed than in regions like London or NY.

You’ll also see a fair number of deals in the financial sponsors group due to the many sovereign wealth funds in the region.

The bottom line is that while there is a lot of energy-related deal activity, Dubai is more diversified than you might expect, and many bankers work as generalists.

Another selling point is that when other regions are doing poorly, Dubai often performs well and acts as a “counter-cyclical” finance center.

This happened back in 2008 and, more recently, in 2022, when deal activity fell almost everywhere except for the Middle East.

But I would be careful about reading too much into this because Dubai doesn’t necessarily defy long-term trends for long.

For example, total deal activity held up better than in other places in 2008, but it fell substantially in 2009, following the rest of the world.

Investment Banking in Dubai: The Top Banks

The usual U.S. bulge-bracket banks, such as JPM, GS, MS, and Citi, always rank well in the league tables.

The other bulge brackets (BofA, Barclays, UBS, and DB) tend to rank lower, but this varies each year.

Many people would say that the elite boutiques – specifically, Moelis and Rothschild – are the top banks in the region based on deal activity, business model, and overall experience.

Among the other banks, HSBC usually makes a strong showing, most middle-market banks are barely present, and the other elite boutiques (Evercore, Lazard, etc.) are much less active.

The most important point is that many bulge-bracket banks do “coverage work” in Dubai, which means more “process management” and less technical analysis.

This has changed over time and varies based on the industry, but in many cases, teams based in London do much of the heavy lifting in deals.

Moelis and Rothschild are unique because they do everything out of their Dubai offices, which means a better experience for Analysts and Associates in most cases.

It also means larger Analyst classes than at some of the other banks.

Some MENA-based banks also do a lot of deals in the region, but as in Hong Kong and Canada, they tend to focus on corporate bonds for domestic companies (DCM).

Example firms here include Riyadh Bank Ltd, Saudi National Bank SJSC, Abu Dhabi Commercial Bank, First Abu Dhabi Bank, and the Arab Banking Corporation.

As you can tell by the names, many are based in Saudi Arabia or other Middle Eastern countries and also operate in Dubai.

Finally, there are MENA-based boutique investment banks, such as Alpen, Arqaam, Awad, deNovo, EFG Hermes, SHUAA, and Swicorp.

Some of these firms offer internships or off-cycle roles, but there’s not much information about most of them.

Investment Banking in Dubai: Recruiting and Interviews

The biggest differences in recruiting and interviews are as follows:

- Entry-Level vs. Lateral Roles – Dubai tends to be very skewed toward lateral hires, such as Analysts who spent 1-2 years working in Europe. Internships and off-cycle roles for fresh graduates pop up, but the “class sizes” are small (see below).

- Technical Skill Required – Partially due to this emphasis on lateral recruits, the technical rigor seems to be higher than in London. Most of our students and coaching clients in the Middle East have had to complete modeling tests or case studies, even for entry-level roles, and something like the 90-minute 3-statement modeling test or DCF model on this site could easily come up.

- Smaller Class Sizes – The numbers change yearly, but many banks in Dubai have “Analyst classes” of only 5 – 15 per year. There are probably a few dozen new Analyst hires per year in the city, making it comparable to Australia in terms of headcount.

- Drawn-Out Process – Due to the emphasis on lateral hires, recruiting processes in Dubai are mostly “off-cycle” (i.e., network yourself, follow up repeatedly, and interview over several months to win the job).

- Ideal Candidate Profiles – For the best chance of working in Dubai, you should attend a top-ranked university or Master’s program in the U.S. or U.K., gain 1-2 years of deal experience first, and have a strong connection to the Middle East.

Technically, Arabic is not required to win IB roles in Dubai, and banks hire non-Arabic speakers since English is the standard business language.

But native-level Arabic skills will give you an advantage and compensate for other weaknesses in your profile.

It’s just that language skills are not a “requirement” like they are in Hong Kong, nor do they give you quite the same boost as European languages in London.

Target School and Degrees

The investment banking target schools for Dubai combine the U.S. and European lists, but you can also add a few of the top schools in the Middle East, such as the American University of Beirut (perhaps more for consulting).

There is no preferred degree or major, as your university, work experience, interview prep, and networking matter the most.

Investment Banking in Dubai: Salaries, Bonuses, and Taxes

In most cases, IB salaries and bonuses in Dubai match New York compensation, with some banks paying slightly less – but there are no personal income taxes.

For reference, you can view our NY-based IB salary and bonus report here.

If you’re a U.S. citizen, you still need to report and pay taxes on your worldwide income, but you get an exemption on the first ~$120K per year, which means you save a good amount.

The Dubai influencer team likes to highlight this lack of personal income taxes as one of the top selling points of the region.

They’re correct that it is a significant benefit, but they also miss some important points.

First, the tax savings are much more impactful when you earn, say, $500K+ at the senior levels and your home country has a high tax rate.

If you’re earning $150K per year, the lack of taxes helps, but you don’t necessarily want to change your life and career to save $30K.

Second, working in Dubai makes it more difficult to transfer to other regions if you change your mind and want to return to the U.S. or Europe.

Finally, although I don’t have hard data to back this up, I assume that most Managing Directors in Dubai earn less than in NY because of the reduced deal flow and smaller deal sizes.

They might still come out ahead post-tax, but the lower pre-tax pay may translate into a smaller-than-expected difference.

With all that said, the tax benefits are great, and if your main goal is to save as much money as possible over a few years in investment banking, nothing beats Dubai.

Pretty much any other city with real IB roles has income taxes or pays less than NY – or both.

And while Dubai is an expensive city, it’s also cheaper than NY and London in rent, food, and transportation, so your savings can be substantial.

IB Lifestyle, Culture, and Hours in Dubai

Banks in Dubai have a reputation for maintaining a “sweaty” culture (i.e., you will work even longer hours than usual).

Clients tend to be demanding and unsophisticated, which often translates into a lot of last-minute work (especially when you factor in the smaller team sizes).

So, expect the usual 70-80-hour workweeks with spikes to higher levels when deals heat up, or when there’s an emergency.

People often say that the work culture is “no-nonsense,” meaning that bankers are direct about the quality of your work and your overall performance.

That could be a positive if you like transparency but a negative if you don’t respond well to criticism.

Getting promoted can be very political because banks tend to favor certain nationalities and offices within the broader MENA region.

Like the issues with sovereign wealth funds there, you’ll face a much tougher path if you’re not from the right country or you don’t have the right connections.

I hesitate to say much about Dubai as a “place to live” because it’s subjective and depends on how you want to spend your free time.

But even the biggest Dubai influencers would admit that there are fewer cultural hotspots and activities than in cities like London, New York, or Tokyo.

There are sports, outdoor activities, and shopping, but the city’s main draw is that it’s great for weekend trips due to the cheap flights to other parts of the Middle East.

Of course, this assumes that you’ll have the occasional free weekend, which is a bit of a gamble as a junior banker.

Investment Banking in Dubai: Exit Opportunities

The standard exits – private equity, hedge funds, corporate development, family offices, and sovereign wealth funds – exist, but they’re all smaller than in other regions, except for SWFs.

I’ll back this up by citing Capital IQ data about the number of firms in different regions:

- Private Equity Firms:S.: ~7,200 | U.K.: ~1,000 | Dubai: ~150

- Hedge Funds:S.: ~3,200 | U.K.: ~500 | Dubai: ~15

Admittedly, the real numbers are slightly higher, as these lists include only firms headquartered in Dubai.

The Dubai PR team even claims that 60 hedge funds are setting up base there.

But even if you add up all the PE firms and hedge funds in the entire Middle East and Africa region, it’s still less than the total number in just the U.K.

All the private equity mega-funds have offices in Dubai or Abu Dhabi, and the big SWFs all do PE-style deals as well.

The 2018 collapse of Abraaj, one of the most prominent domestic PE firms, hurt Dubai’s local private equity scene, and it still hasn’t fully recovered.

There are a few MENA-specific PE firms that have done well, such as Gulf Capital, Waha Capital, and NBK, but they would all be considered “lower-middle-market” by U.S. standards (i.e., low billions up to $10 billion in AUM across all funds).

But the biggest issue with the exit opportunities is that it is much harder to go from Dubai to NY/London than to do the reverse.

So, if you spend a few years there, build up your stacks of cash, and decide you want to leave, it might not be the easiest transition.

Recruiters and bankers still tend to “discount” experience gained outside the major financial centers, and that’s unlikely to change anytime soon.

Is Investment Banking in Dubai an Oasis or a Mirage?

If you consider the advantages of Dubai:

- After-tax savings potential.

- Deal/market diversification.

And the disadvantages:

- More difficult recruiting.

- Questionable deal experience, depending on the bank.

- More limited exit opportunities (except for SWFs)

It makes the most sense to work there in three scenarios:

- You’re a High Earner Who Wants to Save More and Leave – If you’re already at the senior level in finance and want to boost your savings for a few more years before you leave the industry, Dubai is great (ideally, you’ll also be a non-U.S. citizen).

- You’ve Already Worked in London or NY and Want Something Different – You might be able to enhance your profile with this experience, especially if you stay for 1-2 years and then move on.

- You Have a Strong Connection to the Middle East – In some cases, a strong enough connection might make you competitive for Dubai roles even if your profile is not quite good enough for London or NY roles.

Online detractors sometimes say that working in Dubai is like joining “the minor leagues” in U.S. baseball.

But I think another sports analogy is more apt: a banker moving to Dubai is like Lionel Messi leaving Paris Saint-Germain to join Inter Miami.

Messi has already established himself as one of the best football/soccer players of all time, he’s earned over $1 billion, and he just won the World Cup.

But at 35 years old, he doesn’t have that much time left in his sports career, and he’s unlikely to win another World Cup.

So, he’s joining a weaker, U.S.-based team to downshift and get a huge pay package for his last few years.

If you move to Dubai toward the end of your finance career, you’ll get similar benefits.

Just don’t expect to win the World Cup again.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

Hey brian, What do you think about Indians trying to recruit for IB in Dubai, Heard they really prefer US/UK Candidates and there is a lot of racism

I hesitate to say that an entire city, region, or country is “racist,” as that is a big claim to make and must be backed up by data and objective evidence (not just thoughts/feelings).

However, yes, bankers and recruiters in Dubai tend to prefer candidates from the U.S. and Europe over ones from Asia. But this is likely due to the perception (not necessarily reality) that they have better training and stronger technical skills.

If you’re in India, your best move is usually to leave and attend a top MSF program in Europe. The Indian IB market is terrible given the size of the country and the number of candidates trying to get in.