The Off-Cycle Investment Banking Internship: The Best Side Door into the Industry?

As investment banking recruitment has moved up earlier – especially in the U.S. – many students “miss” the process or start too late to have a good chance.

And in other regions, timing differences for degrees and gap years mean that not everyone can complete internships in the traditional time frame.

Finally, work experience expectations have risen over time, and you may not even be competitive in IB summer internship recruiting without other finance internships first.

These factors have made the off-cycle investment banking internship a popular strategy for many students.

In other words, rather than completing an internship during the normal period (the summer in the northern hemisphere), you do it during the fall, winter, or spring – or even after graduation.

Unfortunately, this topic is tricky to discuss because “off-cycle” means something different in Europe vs. the U.S. vs. elsewhere, and it also differs at different types of banks.

I’ve seen some people suggest that off-cycle investment banking internships are better than the traditional summer ones, but I don’t think this is correct.

Instead, off-cycle internships are useful under specific conditions, but you shouldn’t view them as an alternative to normal internships – they’re more like a supplement, pre-requisite, or backup plan.

But let’s start with the definitions, key differences, and different variations:

What is an Off-Cycle Investment Banking Internship?

Off-Cycle Investment Banking Internship Definition: In an off-cycle IB internship, you work at a bank for 3-6 months outside the traditional summer period, and you typically win the internship via networking or a less-structured recruiting process.

This definition is intentionally vague because people use the term “off-cycle” to refer to all of the following:

- A traditional IB internship that leads to a potential full-time offer, but with different timing due to a university’s trimester system or other non-standard enrollment dates.

- An informal and unadvertised internship at a boutique bank (or PE/VC firm) that you complete part-time during the school year in Year 1 or 2 of university.

- A standard 6-month internship in a continental European country where everyone has to do several 6-month internships to have a chance of winning full-time offers in the country (e.g., France or Germany).

- A 3-6-month internship at a large bank that starts in a non-summer month, such as January, and which may or may not result in a full-time return offer (common in Europe but rare in the U.S.; they’re sometimes labeled “Winter” or “Spring” internships).

There isn’t much to say about variations #1 and #3: you pretty much have to do off-cycle internships, at least if you want to work in a country where they’re required.

Variations #2 and #4 are more interesting because these types are “potentially useful but not required.”

If you already have one solid summer internship, high grades, and a brand-name university, an off-cycle internship at a boutique bank may not add much.

But if you don’t have all three of those, an off-cycle internship could make you more competitive for future internships and full-time roles.

The case for an off-cycle internship at a large bank (variation #4) is much weaker, in my opinion.

If you have to do it because of timing issues or because you started recruiting very late, fine, go ahead.

But there’s rarely a reason to do this type of internship instead of a traditional summer one (see below).

Why Do an Off-Cycle Investment Banking Internship?

People sometimes argue that off-cycle internships are “better” than traditional summer ones because of:

- Ease of Recruiting – The claim here is that interviews will be less intense, the questions will be easier, and the process will be less structured. Also, fewer candidates might apply, which improves your odds.

- Reduced Intensity – Some also argue that the internship itself might be easier, with reduced hours and expectations, since it’s not part of the bank’s normal, structured process.

With the first claim about easier recruiting, interviews are often less rigorous if you network with boutique firms and get a bank to create an internship for you.

However, you’ll also spend more time emailing people and setting up calls, so I’m not sure I’d say that recruiting is “easier” overall.

You’ll still spend a good chunk of time on the process, but you will not need to know technical topics in the same depth.

And with off-cycle internships at large banks in Europe, you’ll still go through the same process of online applications/assessments, assessment centers, standard interviews, and so on.

Yes, fewer people apply, but fewer spots are also available – maybe ~15-20% of the summer internship openings.

And most of the students applying to these roles have already interned at other banks, so it’s not as if you’ll suddenly go from “low chance” to “competitive” (unless your profile has changed significantly).

The second claim above about the reduced intensity might be true for informal internships at boutique firms, especially if you’re working there part-time.

But it’s not true at all for off-cycle roles at the large banks – in fact, you might end up working even longer hours because:

- There are fewer other interns, so the work per intern is higher.

- There’s usually more deal activity outside the summer months, especially in Europe, since everyone goes on vacation in August.

Why NOT Do an Off-Cycle Investment Banking Internship?

Besides the issues above, there are some other potential downsides:

- Compensation – These internships at boutiques and smaller firms are often unpaid or offer significantly lower pay than the large banks.

- Full-Time Return Offers – These are off the table if you’re interning at a boutique. But even if you’re at a large bank, your chances of getting a return offer are arguably a bit lower because you’re outside the normal intern pipeline.

Examples of Banks That Offer Off-Cycle Investment Banking Internships

If you’re aiming for boutique firms, you should be able to find firms in your area via simple Google searches.

The larger banks often post these openings on job boards and their internal sites.

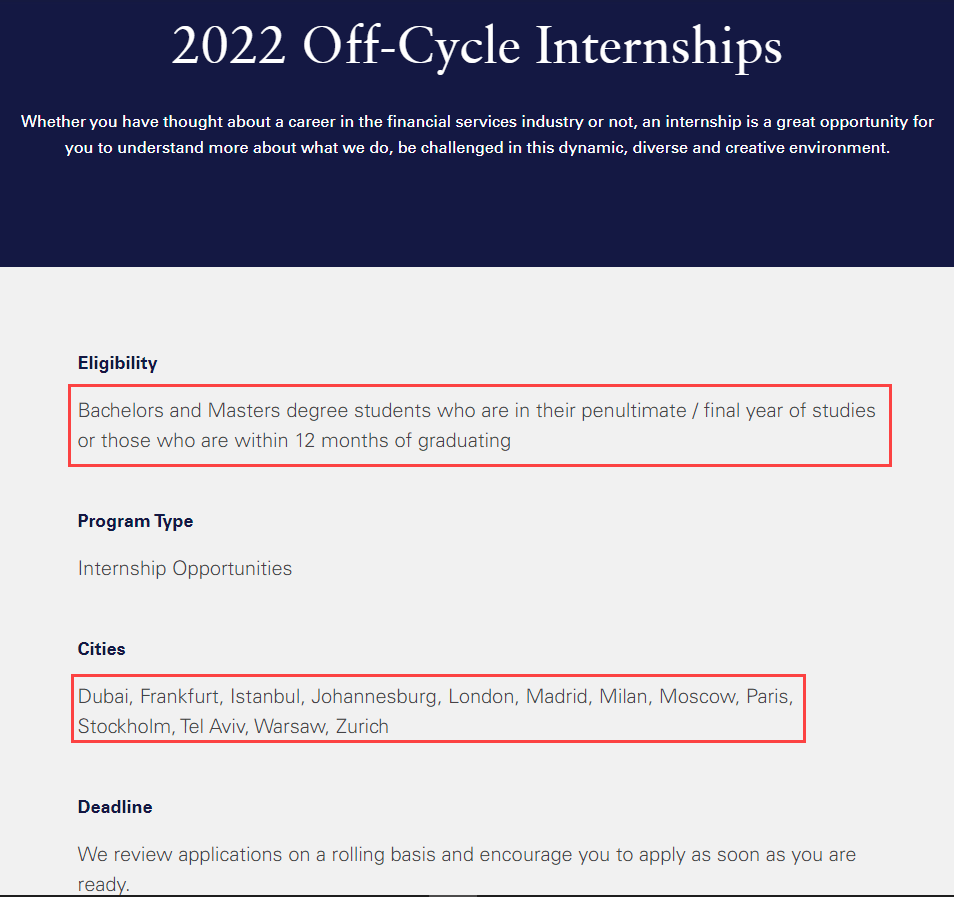

Here’s an example from Goldman Sachs that sums up off-cycle internships in Europe quite well:

Credit Suisse also has a section about off-cycle internships on its site, as do many other large banks.

You can easily find specific job postings from the large banks on all the usual job boards, LinkedIn, etc., by searching keywords like “off-cycle internship” or “fall/spring/winter internship.”

Since I have a lot of LinkedIn connections from running this site, I decided to do a quick search to see which specific banks have offered off-cycle internships.

I counted in this list any bank that appeared in at least one person’s profile with “off-cycle intern” as the person’s title at that bank:

Larger Banks That Have Offered Off-Cycle Internships: JPM, UBS, Lazard, Rothschild, Moelis, DB, William Blair, PJT, Jefferies, BBVA, SocGen, MS, BNP Paribas, GS, CS, Barclays, Nomura, HSBC, Evercore, ING, Citi, and Houlihan Lokey.

Other Banks That Have Offered Off-Cycle Internships: Goetzpartners, Yorkdale Partners, Berenberg, Intesa Sanpaolo, Atlas Advisors, Configure Partners, Torreya, JD Merit, Banca Akros, Berkery Noyes & Co., Clairfield International, Arctic Securities, Brocade River Merchants Capital, Stamford Partners, DNB Markets, Antarctica Advisors, Frontier Investment Banking, and AZ Capital.

I stopped reviewing the results after ~10 pages, but you could find dozens (hundreds?) of other names if you keep going.

How to Find an Off-Cycle Investment Banking Internship

If you’re aiming for boutiques, start by searching for local firms and looking on job boards and LinkedIn, as in the examples above.

To contact these firms and get responses, take a look at our guide on how to cold email for internships and follow the steps and templates there.

Winning an unstructured/unadvertised internship comes down to:

- Do they need help?

- Can you add value?

- Are they feeling nice today?

- Are you persistent about following up without crossing into “stalker” territory?

For off-cycle roles at large banks, you almost always need previous internships to be competitive, and it’s the same recruiting process as always.

The deadlines vary, but you might apply 4-6 months before the internship begins.

For example, if you’re targeting a London-based internship with a January start date, you might apply in August and go through interviews and the assessment center in September.

At boutique firms, the start date is “whenever you finish speaking with people there and convincing them you can do something useful.”

Interviews for Off-Cycle Internships

At the large banks, expect the usual set of investment banking interview questions and be prepared for all the common fit/behavioral and technical categories.

At boutique firms, interviews tend to be more qualitative.

They might still ask you general questions about topics like the DCF model, valuation, or the LBO model, but they’re not going to probe you on obscure details.

Common questions might include:

- Why are you interested in our firm? / Why investment banking?

- How much do you know about our clients?

- How can you save us time or contribute to deals?

- How can you help us if you have no previous work experience?

- How much do you know about what you do in an M&A deal?

It’s nothing difficult if you’ve read this site, but you do need to have some decent responses prepared.

I recommend downplaying your technical knowledge/skills here and focusing on how you can help them with administrative tasks.

They’ll be more likely to believe you, and there’s plenty of work in that area that full-time bankers never want to do.

What Happens During After an Off-Cycle Investment Banking Internship?

Please see the investment banking internship guide for tips about how to perform well in the internship itself.

You’re extremely unlikely to receive a full-time offer at a smaller bank, especially if you’re doing this off-cycle internship in Year 1 or 2 of university.

You’re there to get the name and work experience on your resume/CV and get a potential recommendation from the people at the firm.

If you’re doing this internship at a large bank, you’ve performed well, and the bank needs help, you should have at least a decent shot of converting it into a full-time offer.

But be careful because firms in certain countries are notorious for making interns go through endless off-cycle internships with no long-term hiring plans.

I’m not sure what you can do to avoid this other than research the firm and office and speak with others who interned there.

The Bottom Line: Are Off-Cycle Investment Banking Internships Worth It?

This question is a bit like asking whether a certain nutritional supplement, such as Vitamin D, is “worth it.”

If you already have healthy Vitamin D levels from sunlight and food, you don’t need supplements.

If not, or if you’re in a region where it’s very difficult to get enough, then supplements could be quite useful.

With off-cycle investment banking internships, you’re not going to benefit too much if you already have a highly relevant summer internship, good grades, and a top university, and you’ve started recruiting early.

But those are quite a few requirements, and most people will not have everything on the list.

Therefore, the off-cycle internship could be very useful in these situations:

- You Don’t Have a Year 1 Summer Internship or Your Internship Isn’t Relevant: Maybe you changed your mind about careers or didn’t know what you wanted to do initially in university.

- You Graduated Without Much/Any Relevant Work Experience: Doing these informal internships at small firms could be your best shot at breaking into finance.

- You Have Low(ish) Grades or Go to a Non-Target University: More internship experience helps offset these issues.

- You’re Taking a Gap Year or Have Other Unusual Timing: Summer internships might not be an option, but off-cycle ones certainly are.

I don’t think the other supposed benefits, such as “easier” recruiting or “reduced” hours, are the real benefits of most off-cycle investment banking internships.

Instead, off-cycle internships are useful mostly because they provide other paths into the industry and may improve your chances via the traditional summer internship route.

For Further Learning

If you want to learn more about off-cycle internships, take a look at these articles/interviews:

- Investment Banking in Europe (some discussion of off-cycle internships in various countries there)

- The IB Recruiting Timeline (some examples of off-cycle internships at boutique firms in the U.S.)

- From Private Equity Internship to Bulge Bracket Investment Banking (leveraging off-cycle internship into full-time roles in the U.K.)

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

Hi Brian,

Thanks for the article. I’m currently a master’s student at a Southeast Asian university (in the Philippines). I wanted to ask for some advice regarding my approach into getting into large banks like JP Morgan, Morgan Stanley, and Goldman Sachs in Hong Kong or Singapore. I’m currently interning at a large investment bank in my country (the largest in fixed income deals by far, together with some equity deals). Because of your article, I now intend to apply for summer analyst positions instead of off-cycle positions in the future. However, being that I graduate at 2024 with my master’s (I’m currently 21), I was hoping to ask would working for a full-time position in a large investment bank in my country be an experience that large banks in Hong Kong and Singapore would consider? Together with this, I’m worried that prejudice might arise from my school. I come from a reputable school in the Philippines, however, I’m doubting whether they’re expecting people from Harvard or Wharton.

Lastly, is experience in Hong Kong and Singapore enough to break into Goldman Sachs (specifically in New York)? That’s actually my main goal, honestly.

Thank you.

We’ve covered both these regions recently, and the short answer is that HK and Singapore are not ideal places to work unless you have exactly the right profile (native Chinese speaker for HK or strong SEA connections and language skills for Singapore):

https://mergersandinquisitions.com/investment-banking-in-hong-kong/

https://mergersandinquisitions.com/investment-banking-in-singapore/

If your goal is to work in NY, and you graduate next year, your best option is probably to find a role at a large bank with a presence in NY and then push for a transfer to NY after 1-2 years.

I can’t say whether you should stay in the Philippines or move to Singapore or somewhere else because I don’t know what kind of connections you have to the regions. If you’re a native speaker of Tagalog (for example), you should have a pretty decent chance at winning SG-based roles because the language skills will help quite a bit there.

You can’t do much about your school unless you do another degree (not recommended). In short: if you have the right skills/background, consider Singapore-based roles and then push for a transfer to NY. If not, stay where you are, see if you can find a role at U.S.-based bank there (no idea if they even exist in the Philippines), and then transfer from there.

Hi Brian,

Thanks for the article. I have a full-time offer for a one of / similar level to the “other banks” mentioned would you recommend taking this offer or gaining an off-cycle internship at one of the larger banks?

I am unsure whether it is easier to start at the lower-tier bank and then after 6 months to a year try and get into a larger bank, or to convert an off-cycle into full time.

Any advice would be great!

In general, if you already have a full-time offer at any bank, it’s almost always best to accept that offer rather than turning it down or delaying and looking for an off-cycle internship at a larger bank.

If you already *had* an off-cycle internship at one of the larger banks, it might be better to accept that and try to turn it into a full-time offer there. But if you’d have to spend time searching once again, it’s better to take the full-time offer, get some experience, and make yourself more marketable to the large banks from that experience.

Hi Brian,

Thanks for the helpful article. I am a rising senior (class of 2023) at a target in the US studying Mathematical Economics and I wanted to ask your opinion on my situation and if it is still realistic for me to break into the industry, especially given the current macroeconomic situation. I just accepted a fall internship offer at a reputable MM bank and I plan on graduating on time in the spring. This summer I interned remotely with a less well-known LMM boutique as I was not able to secure a more reputable summer analyst role. I think it’s worth recruiting full-time as a return offer from this fall internship is not guaranteed, however, I am worried about the fact that my previous work experience won’t be seen as “legitimate” in the eyes of more established banks. Do you think this fall internship makes sense given my current situation?

If you think you have a > 50% chance of getting a full-time return offer from this fall internship, yes, I think it’s worth it. I don’t think it will help a huge amount if you’re trying to leverage it to interview around for roles at other, larger banks, especially since banks are unlikely to award many full-time offers outside their intern classes this year. So I would not bet too heavily on that unless you have some very good connections at these banks already.

Hi Brian,

Thank you for writing another great article. I wanted to ask for some guidance on my approach to breaking into investment banking. I am in the UK and I graduated in January with a master’s degree in finance & economics (distinction/4.0 GPA) from a semi-target university. I have internship experience in big 4 audit, private wealth management, and I have some sales experience + good extra-curriculars.

I have been applying for positions in London since Novemeber but I haven’t had much luck with online applications (off-cycle internships, graduate jobs). A lot of the time I haven’t heard back or they keep me waiting before telling me the role has been filled. I have applied for various roles within investment banking, S&T, equity research, M&A and some consulting roles. I have only had one interview for a boutique IB firm however I was not successful (they wanted specific industry knowledge).

I am unsure what is the best approach to take next. I am continuing to apply for jobs as they appear on jobs sites. I haven’t done much cold emailing/networking as I started slightly late. Do you have a recommendation on how to approach my job search going forwards? If IB/S&T etc aren’t an option, what is the next best sector/group within finance to apply for (middle office/asset mgmt/big4/mgmt consulting)? I am open to different career opportunities.

Any advice would be really helpful, thank you.

Thanks. It’s probably some combination of your university (semi-target makes it harder) and lack of direct IB/S&T experience. If you’re not getting good responses from online applications for off-cycle roles, I would recommend one of the following:

1) Forget about IB/S&T/ER for now and instead apply for something like corporate banking, Big 4, or independent valuation firms so you can gain more relevant experience.

2) Or start cold emailing boutique PE firms (and maybe banks) to ask about off-cycle roles, even if they haven’t advertised them formally or opened up online applications.

I would not recommend consulting, middle office roles, or asset management if your goal is IB/S&T. Of that list, Big 4 makes the most sense, but only in specific areas (valuation/due diligence/transaction services).