Event-Driven Hedge Funds: The Best Home for Bankers Turned Investors?

“Event-driven hedge funds” is one of the more confusing labels in finance.

Part of the issue is that many different strategies fall within the “event-driven” category: merger arbitrage, activist investing, distressed investing, special situations, and more.

But the other problem is that all hedge funds are “event-driven” because they invest based on catalysts, or specific events that could change a security’s price.

You could even say that a long-only fund that invests in undervalued companies based on their earnings announcements is “event-driven.”

They have their investment thesis and valuation, and the earnings announcement is the event that unlocks value…

…but this is not what “event-driven” means in most cases.

I’ll do a deep dive into the entire space in this article, including the top funds, example trades, recruiting, exit opportunities, and more.

But, as usual, I want to start with the definitions and fund types:

What is an “Event-Driven Hedge Fund”?

Event-Driven Hedge Funds Definition: Event-driven hedge funds bet on specific corporate actions, such as M&A deals, divestitures, spin-offs, bankruptcies, and business reorganizations, and they profit based on changes in the value of a company’s debt or equity after the action.

Event-driven hedge funds differ from other funds because they rely on specific “hard catalysts,” such as acquisitions and divestitures.

A long/short equity fund could find an undervalued company, like it for reasons A, B, and C, and argue that its price will increase by 50%.

It doesn’t necessarily need “hard catalysts”; they could be softer or more speculative, such as the expectation that the company will announce higher growth for the year.

If this fund is right, the company’s price may increase by 50%.

But even if the specific catalysts never materialize, the stock price might still increase by 20% or 30%.

By contrast, an event-driven fund would never bet on such a situation.

Instead, the fund would look for a company that has announced plans for a specific action, such as a spin-off of one division, and use this logic to invest:

- “If this spin-off happens and we’re right about the new company’s value, we could potentially earn 50% by buying the parent company’s shares.”

- “But if we’re wrong, and the spin-off doesn’t happen or gets done at a lower valuation, the parent company’s share price would fall by only 10%.”

It’s 50% upside and 10% downside, so a fund specializing in this strategy might invest.

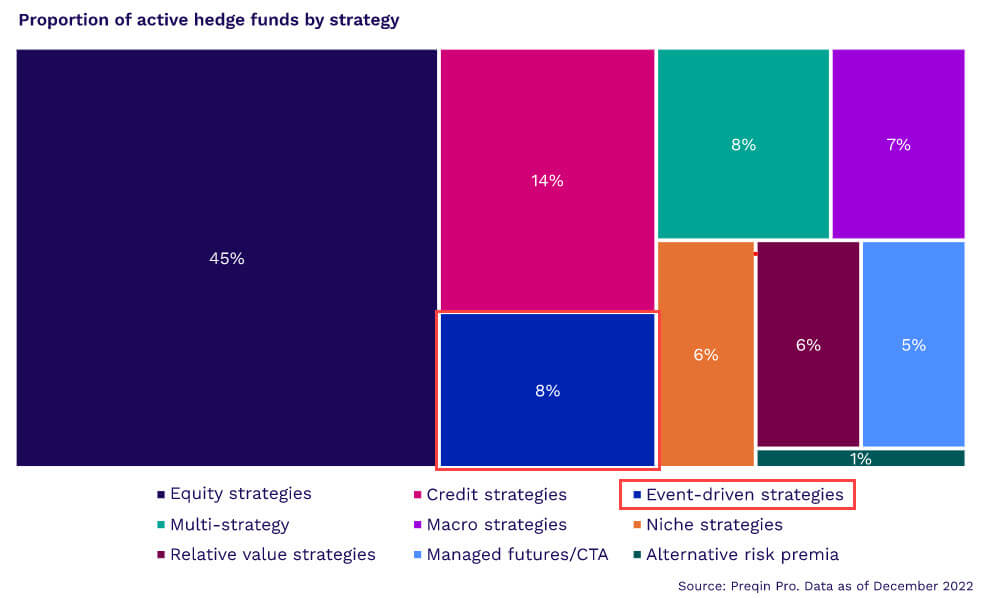

According to Preqin data, event-driven funds represent 8% of all hedge fund strategies, roughly the 3rd largest category:

Types of Event-Driven Hedge Funds

Opinions vary on the exact categories, but in this article, I’ll assume there are 4 main types of event-driven hedge funds:

- Merger Arbitrage – These funds bet on mergers and acquisitions closing; most focus on making lots of small, modestly profitable bets while avoiding blowups.

- Special Situations – These funds focus on companies that are spinning off or divesting divisions, reorganizing, or otherwise going through more unusual changes (not just simple acquisitions or capital raises).

- Distressed / Restructuring – These funds invest in the debt or equity of distressed companies or ones entering the bankruptcy process.

- Activist – These funds attempt to create their own catalysts by forcing specific changes at companies and then profiting when the share price increases.

We’ve covered merger arbitrage and activist hedge funds in separate articles, and distressed hedge funds will get their own future article, so I’ll focus on special situations here.

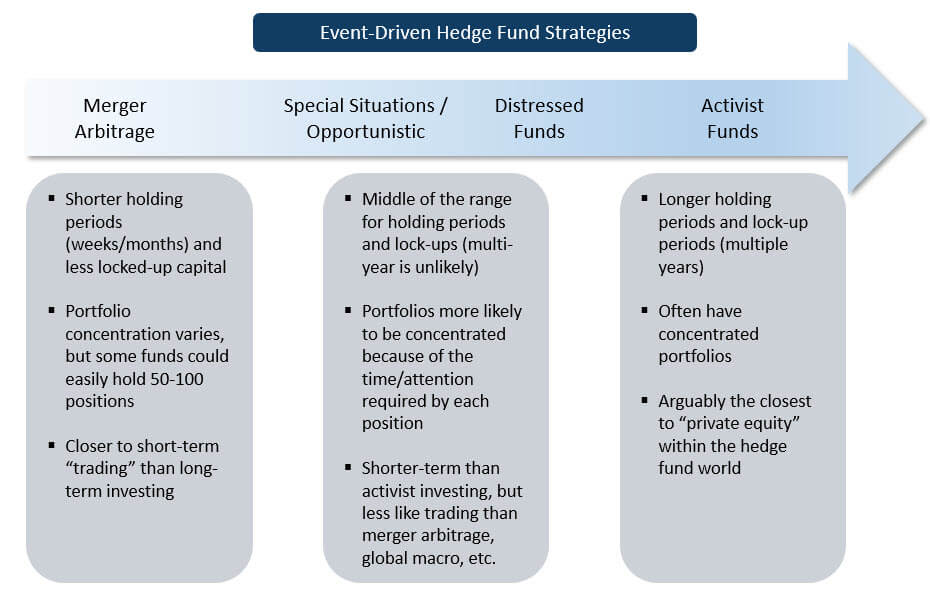

Here’s how these strategies compare on the “trading vs. private equity” spectrum:

The big selling point of the “middle” strategies – special situations and distressed – is that their returns are relatively uncorrelated with the overall market, and they have greater potential upside than something like merger arbitrage.

And unlike activist hedge funds, they don’t have to force the company to do something – instead, they bet on a specific event that has already been announced.

It’s the best of both worlds because they can analyze deals and put money behind their views without grinding through deal processes or forcing changes.

A Sample Event-Driven Hedge Fund Trade

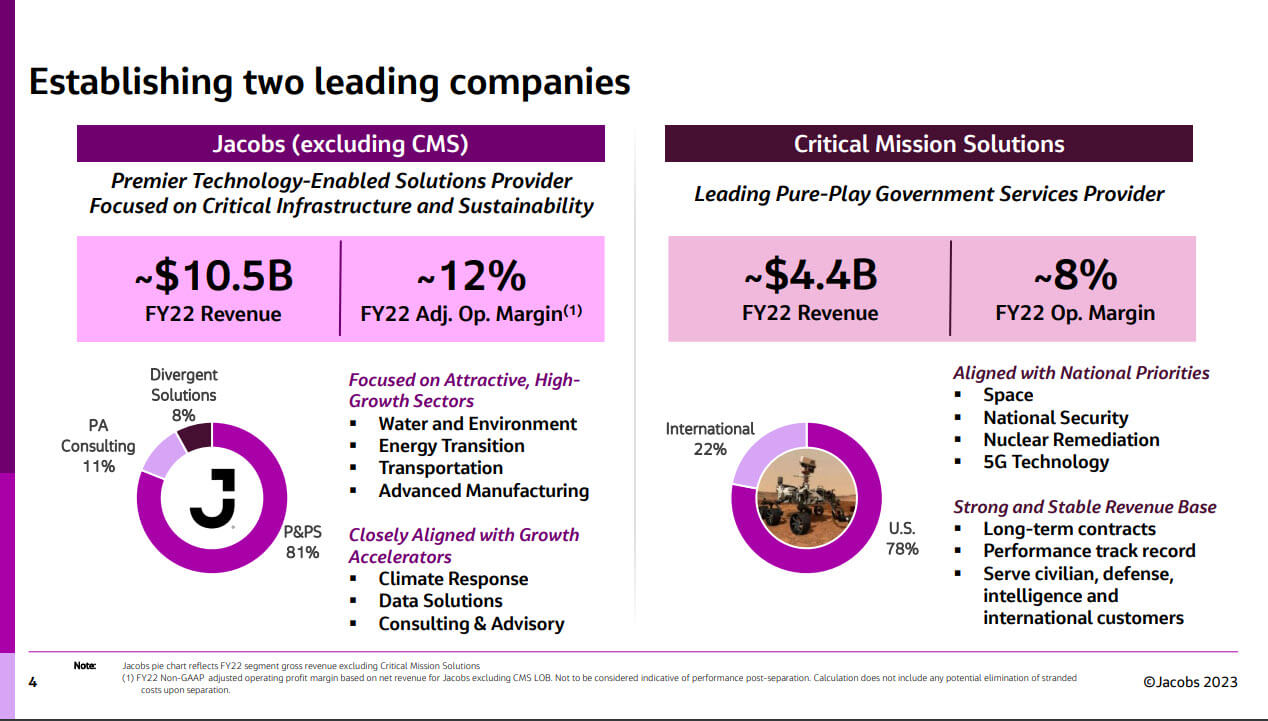

To illustrate how these hedge funds work, I’ll walk through an announced spin-off here – Jacobs Solutions’ plan to divest its Critical Mission Solutions (CMS) division.

Jacobs is a moderate-growth, moderate-margin company in the professional services space, currently trading at 1.2x revenue and 11.5x EBITDA.

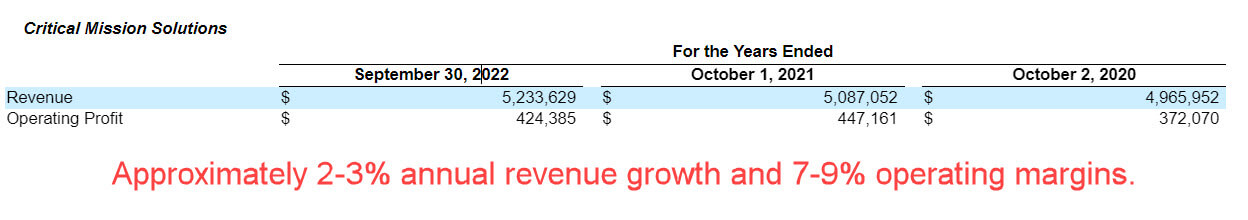

CMS contributes about 1/3 of its revenue and operating income, but it has lower revenue growth, with margins in about the same range as Jacobs:

The company uses this corporate-speak to justify the deal:

“By separating CMS, we will streamline our business portfolio and transform Jacobs into a higher-growth, higher-margin company more closely aligned with key global mega trends and growth sectors.”

Translating that to English: “We can grow more quickly and get higher margins without CMS, so our multiples will increase, and our share price will go up.”

Here it is in the investor presentation:

We don’t know the planned valuation for CMS in this spin-off, but let’s assume that Jacobs plans to spin it off at an IPO offering price that implies an 11.5x EBITDA multiple, matching its own.

If you’re working at a special situations fund, you could trade this deal in many ways:

- Long Jacobs and Short CMS – You believe the company is correct about the deal’s benefits, but you think CMS is overvalued at 11.5x EBITDA since it’s only growing at 2-3% per year vs. 5-10% per year for Jacobs.

- Long Jacobs and Long CMS – You think Jacobs’ share price will increase, but you also think CMS will grow at higher-than-expected rates as a separate entity, so it might trade up to a 14-15x multiple.

- Short Jacobs and Short CMS – You think this deal is a terrible idea that will result in “dis-synergies” and cause both companies’ growth rates and margins to fall, resulting in multiple compression and lower share prices.

- Short Jacobs and Long CMS – You think Jacobs’ growth rate will slow down without CMS, but CMS’ prospects will increase since it can win more government clients as a separate company.

- Capital Structure Trades – Or you could focus on Jacobs’ ~$4 billion in debt and long or short some of their bonds (or use credit default swaps) if you believe its credit rating will change once the deal takes place. You could do the same with CMS if any debt is transferred here.

You could also use call or put options to hedge the risk in all these trades, especially if you’re longing or shorting both companies.

Since this deal will take at least one year to close, and possibly more than that, you also need to think about time frames and annualized returns.

For example, if Jacobs trades up from an 11.5x multiple to 14.0x, that’s a 22% increase – but if it takes 2 years to reach that level, it’s only ~11% per year.

This is a good return, but it may be below what your fund is seeking.

What Makes Event-Driven Hedge Funds Different?

With this one, you need to look at the entire category, which means merger arbitrage on one end and activist on the other.

But if we do that and take special situations and distressed as the “mid-points”:

1) Liquidity – Overall liquidity is higher than it is for activist hedge funds, and lock-up periods are shorter for obvious reasons: these funds need less time to execute their trades. But lock-up periods are longer than most long/short equity funds.

2) Time Horizon – Activist hedge fund trades could take years (or even longer), merger arbitrage trades could take months, and special situations and distressed are somewhere in between.

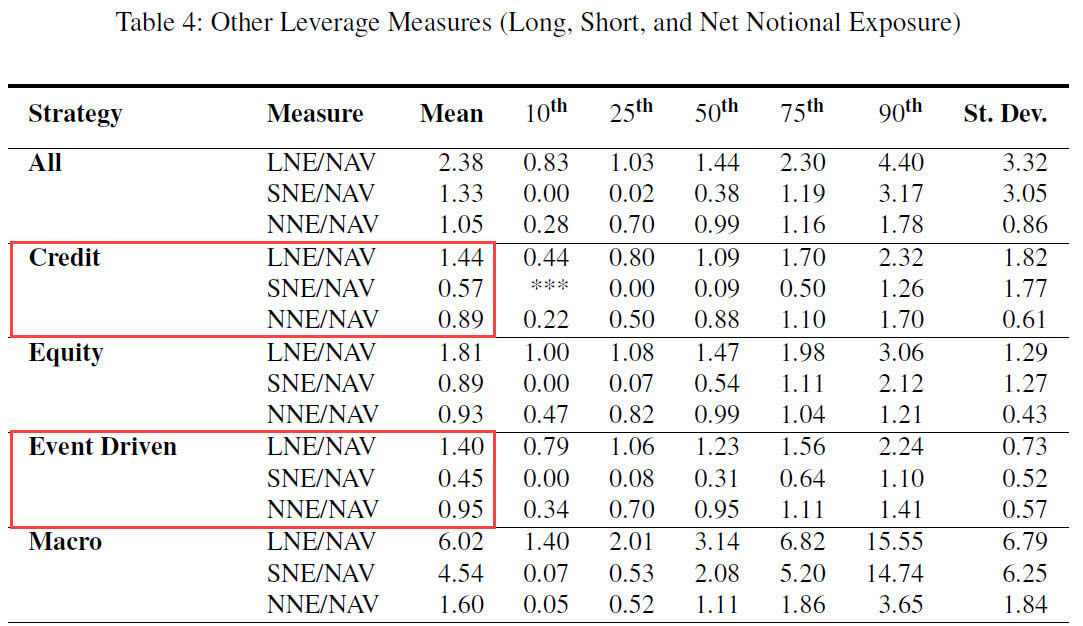

3) Low/Moderate Leverage – On average, event-driven hedge funds use about the same leverage as credit hedge funds: less than equity strategies and far less than global macro.

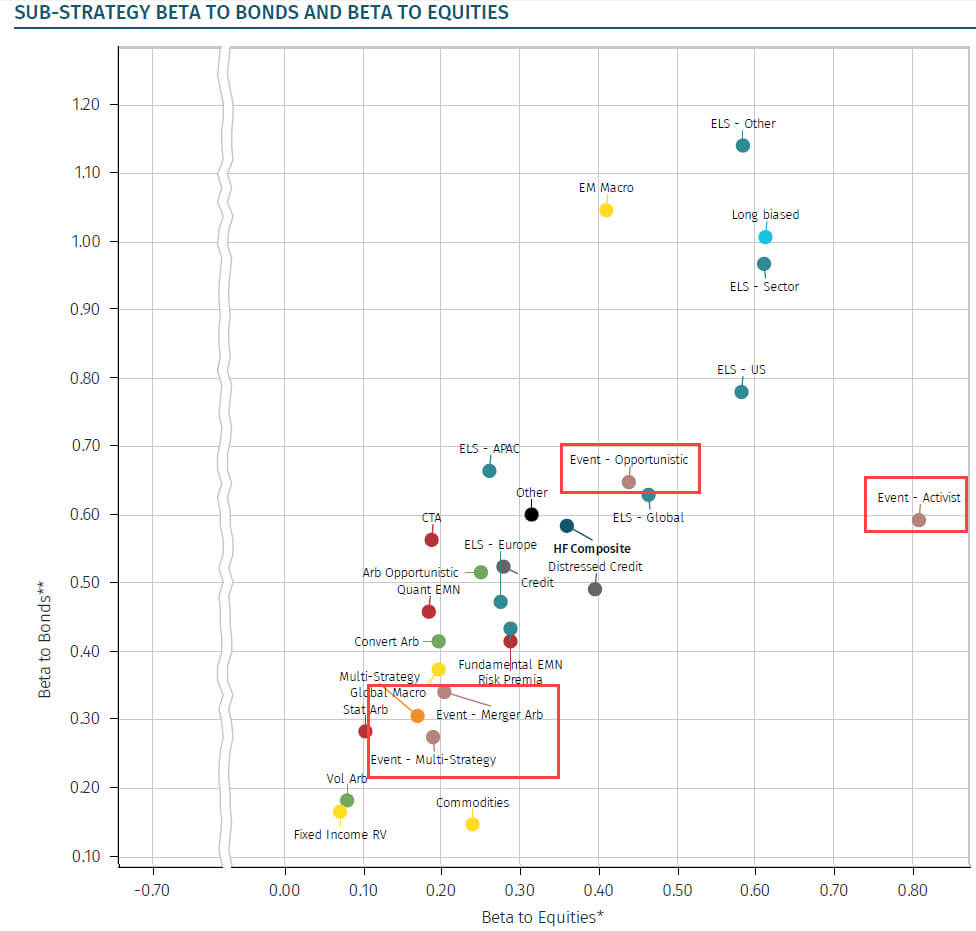

4) Moderate Net Exposure and Beta to Bonds and Equities – The image below shows the full spread of these variables: activist funds are highly correlated with equities, merger arbitrage is much less so, and everything else is in the middle.

5) Portfolio Concentration – Many special situations and distressed funds run concentrated portfolios (e.g., 10-15 positions) because each trade takes a lot of time and effort to analyze and follow, and the potential upside and downside vary greatly.

Deal and Valuation Analysis

The analytical side depends heavily on the specific strategy your firm uses.

Merger arbitrage is closer to plain-vanilla valuation with a bit of merger model and accretion/dilution analysis, while activist investing is closer to private equity due to the longer holding periods.

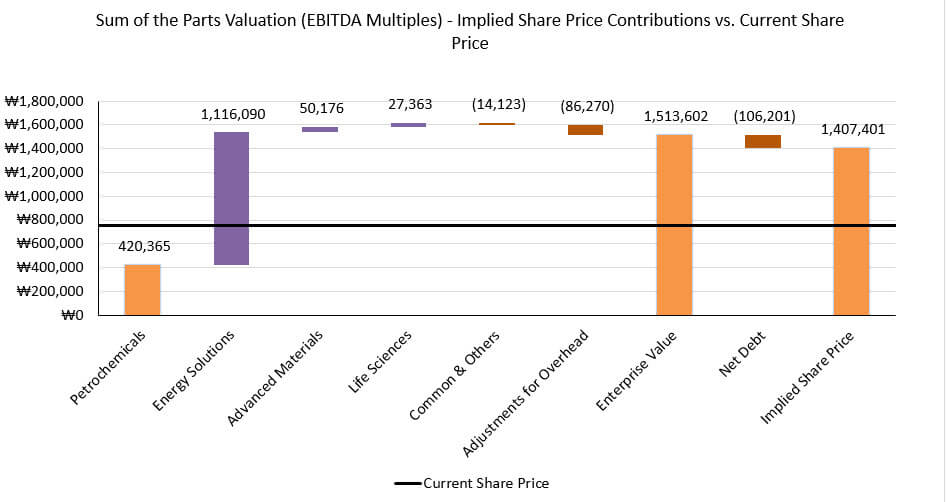

Special situations funds are in between these, but one key difference is that methodologies like Sum of the Parts (SOTP) are especially useful here.

Companies are usually motivated to spin off divisions because they believe their valuations will increase afterward.

And the only way to test this claim is to value each division separately and add them up:

The example here is for LG Chem, a conglomerate in South Korea.

If you want more, there are Sum of the Parts examples in both the Core Financial Modeling and Advanced Financial Modeling BIWS courses.

The Advanced ones go into more depth, but the Core ones are fine for a quick introduction or review.

Core Financial Modeling

Learn accounting, 3-statement modeling, valuation/DCF analysis, M&A and merger models, and LBOs and leveraged buyout models with 10+ global case studies.

learn moreNot all event-driven trades require a Sum of the Parts analysis, but you’ll usually have to factor in a significant business change to value the company’s debt or equity properly.

The Top Event-Driven Hedge Funds

There are full lists of the top funds in the merger arbitrage and activist hedge fund articles, so you can refer to those for all the details.

Some of the best-known activist hedge funds in the U.S. include Elliott Management, Third Point Partners, ValueAct Capital, Trian Partners, JANA Partners, and Starboard Value.

Dedicated merger arbitrage funds are more niche and lesser-known, but a few names include Lyxor/Tiedemann Arbitrage Strategy, Man GLG Event-Driven Alternative, GAMCO Merger Arbitrage, Alpine Merger Arbitrage Fund, and the Franklin K2 Bardin Hill Arbitrage UCITS Fund.

All the large multi-manager funds, such as Millennium, also use event-driven strategies to some extent.

Other well-known funds with a broad event-driven focus include Davidson Kempner, Farallon, HG Vora, Luxor, Canyon, P. Schoenfeld Asset Management (PSAM), Pentwater, Silver Point, Anchorage, and King Street.

Some of these, such as PSAM, use only event-driven strategies, while others, like Farallon, are highly diversified but have specific funds for strategies like merger arbitrage.

Recruiting: Who Wins Offers at Event-Driven Hedge Funds?

I did my usual LinkedIn survey of professionals at event-driven hedge funds and got the following results for the most common backgrounds:

- Other Hedge Funds: 37%

- Investment Banking: 26%

- Sales & Trading: 26%

- Other (Credit, Equity Research, Corp Dev, Consulting, etc.): 11%

I was surprised at the high percentage from sales & trading, but that’s mostly due to classification issues (e.g., should convertible arbitrage be in this category?) and the fact that I did not filter out execution traders.

If you do not start working at a hedge fund out of undergrad, you are best off working in investment banking if you want to join an event-driven fund.

This is true for pretty much anything in the category because all these strategies require you to analyze major transactions.

Restructuring groups lend themselves to distressed strategies, and M&A and strong industry groups are good for special situations, activist, and merger arbitrage funds.

In the hedge fund recruiting process, you can expect more of an “off-cycle” approach, especially at smaller funds, with the usual questions about the market, your deal experience, and your ideas for potential trades.

Interviews and Case Studies

There’s a lot of overlap between case studies and stock pitches for long/short equity and activist hedge funds, but also some key differences.

The biggest difference is that you need a “hard” catalyst, such as a specific action or transaction the company has announced.

You can create your own catalysts on the activist side, and for L/S equity, you don’t necessarily need highly specific catalysts – but for special situations, you do.

If you’re preparing for interviews at different funds, I recommend searching for recently announced spin-offs and divestitures on Bloomberg or Capital IQ to get ideas.

You can then run a simple Sum-of-the-Parts valuation to get ideas for potential trades.

If you then interview for a long/short equity or activist fund, you can re-use this idea but tweak it a bit.

For example, at an activist fund, you could acknowledge that this spin-off or divestiture will take place but say that the company needs to go even further and spin off another division – and recommend winning a Board seat to force that change.

The “special situations” and “event-driven” categories include more than spin-offs and divestitures, but I recommend sticking to these because it’s easier to generate ideas.

Careers, Hours, Lifestyle, and Compensation

If you look up people who have worked at event-driven hedge funds on LinkedIn, you’ll find that many of them leave for other types of hedge funds, such as long/short equity.

The reason is simple: it’s a stressful job with somewhat longer hours than many other hedge fund roles since you’re analyzing and following deals (or even making them happen sometimes).

Many event-driven strategies are also quite cyclical because, depending on market conditions, there are tons of opportunities or very few.

For example, in periods of loose monetary policy, large M&A deals become more common, which benefits merger arbitrage.

But spin-offs and divestitures become less common since companies do not feel they “need” to shore up their cash balances – which is bad news for special situations.

So, as with other cyclical strategies, it may be a bit of a twisted path to advance to the senior ranks.

Compensation is like any other hedge fund strategy: you’ll start in the low six figures and advance to the low seven figures at the Portfolio Manager level or above.

Payouts are tied to fund size and overall performance, but they tend to be very discretionary at single-manager funds and more systematic at multi-managers.

You can read “discretionary” as “a higher chance of a surprise in either direction, depending on the PM’s mood.”

Exit Opportunities

The good news is that event-driven hedge funds span a wide range of strategies, so you have some flexibility.

You could go to one of the more specialized sub-strategies, such as distressed or merger arbitrage, or become more of a generalist with something like long/short equity.

You could even return to investment banking since you’ll have a decent amount of “deal experience” (and you probably had IB experience before joining).

Even corporate development or private equity might be possible, depending on what you did before joining your current fund.

If you have enough credit experience, you could even go in that direction and think about direct lending, mezzanine, or distressed PE funds.

You would not be a good candidate for more “trading-oriented” opportunities, such as global macro funds.

Finally, fields like venture capital and growth equity might also be out of reach, as the skill sets are quite different.

Additional Resources

The merger arbitrage and activist hedge fund articles both have suggested books and articles, so I’ll refer you to those.

Unfortunately, I’ve never been able to find much specifically about special situations investing.

The best source seems to be this classic book by Maurice Schiller about “Special Situations in the Stock Market,” but I’m not sure if there’s anything better or more recent.

Feel free to leave any tips or recommendations in the comments.

Final Thoughts on Event-Driven Hedge Funds

Since this category of hedge funds spans a wide range of strategies, there’s something for almost everyone here.

But the main benefit of the “middle” strategies, such as special situations, is that they’re a bit like “investment banking / private equity lite.”

You need to understand deals and take a strong view of them to succeed, but you don’t grind through all the documents and process work yourself.

Also, you can find event-driven strategies at nearly all large hedge funds and many mid-sized and smaller ones, so you don’t necessarily need to be in the “top” group or bank to recruit for these roles.

The biggest issue is that these strategies tend to be either “simple but boring” (merger arbitrage) or “more interesting but also more stressful” (distressed, special situations, and activist).

But if you’re fine with that trade-off, joining an event-driven hedge fund might just be your best “career event.”

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

I found You Can Be A Stock Market Genius by Joel Greenblatt to be one of the few good books out there on non-distressed/merger arb special sits.

Thanks for adding that. I saw that one recommended by a few sources, but it didn’t seem relevant at first glance. But looking at the table of contents, it probably has the best coverage of special situations analysis I’ve seen. I’ll update the article with this tip.