UBS and Credit Suisse: The Next Shoe to Drop in the Financial Crisis of 2023?

With the number of emergency / news-related articles on this site lately – two in a row! – it’s starting to feel a lot like 2008.

Before delving in, though, I want to start with the elephant in the room: I was partially wrong ~5 months ago when I wrote about Credit Suisse, UBS, and Deutsche Bank, and whether they would become Lehman Brothers 2.0.

Technically, my assessment in that article was correct:

“The short answer is that it’s very unlikely that any of these firms will go bankrupt.

But a spin-off, divestiture, restructuring, or another major event is likely.”

However, the tone of the article was too optimistic, and I should have recommended looking for “Plan B” options more forcefully.

I made the same mistake the regulators did: ignoring shifts in the Credit Suisse deposit and cash base because its regulatory capital ratios looked “fine.”

So, what happened?

Why did UBS just acquire CS for less than $1.00 per share when it was trading above $8.00 a year ago?

Is the financial system going bust?

And what should you do if you have an internship or full-time offer at CS or UBS?

UBS and Credit Suisse: What Happened?

In case you somehow missed the news, UBS on Sunday (March 19th) announced plans to acquire Credit Suisse for ~$3.2 billion at a P / BV multiple of 0.1x – exceptionally low for a commercial bank.

It’s so low that UBS is, effectively, paying a negative amount for CS because $17 billion of the bank’s bonds are also being written down.

The deal is backstopped by the Swiss government, which committed ~$10 billion to absorb potential losses (UBS will absorb the first ~$5 billion). If the losses are even higher, UBS and the Swiss government will split them above this $15 billion level.

UBS did not want to acquire Credit Suisse, but the Swiss government made the deal happen via the “offer you can’t refuse” methodology.

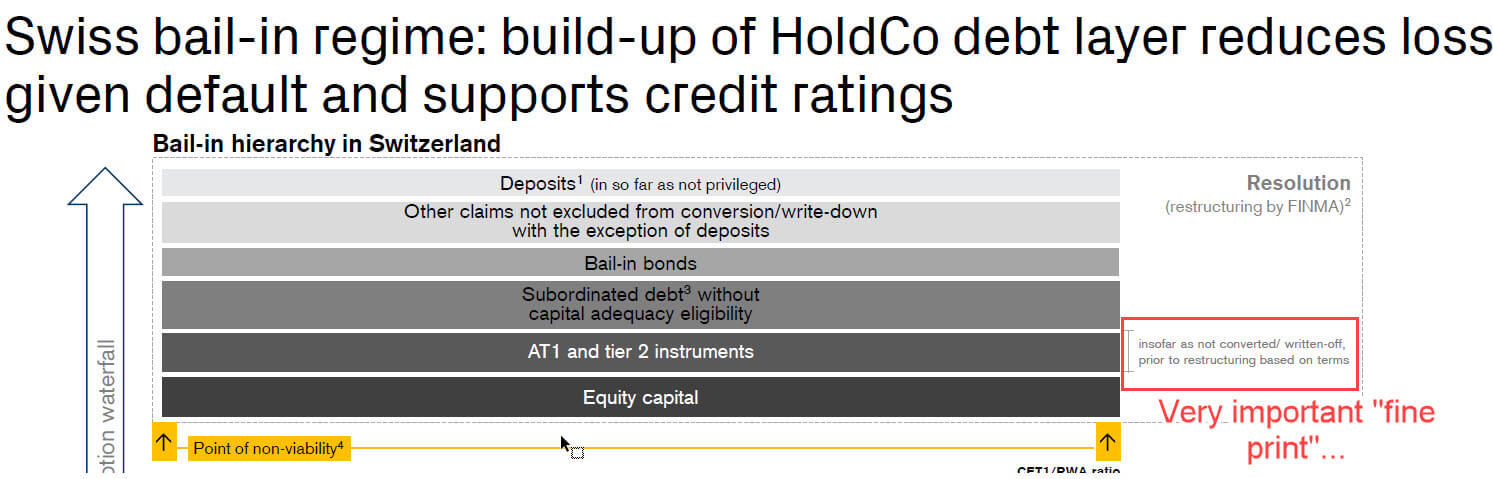

One strange aspect of the deal is that about $17 billion of Credit Suisse bonds will be written down, making them junior to the common shareholders.

These are known as “Additional Tier 1 (AT1) Bonds” or “contingent convertible” (CoCo) bonds, and they allow a bank to boost its capital ratios without diluting shareholders via an equity issuance.

Investors panicked and bid down the prices of other AT1 bonds in Europe, which prompted EU regulators to step in and state that this “would not happen to other banks.”

The AT1 bondholders are now banding together to file a lawsuit.

But it seems that the Swiss government designed the AT1 bonds to work this way, at least if you read the fine print for their “bail-in regime” (click the image to view a larger version with legible text):

In another twist, this entire deal took place without shareholder approval from either side – because everyone would have rejected it.

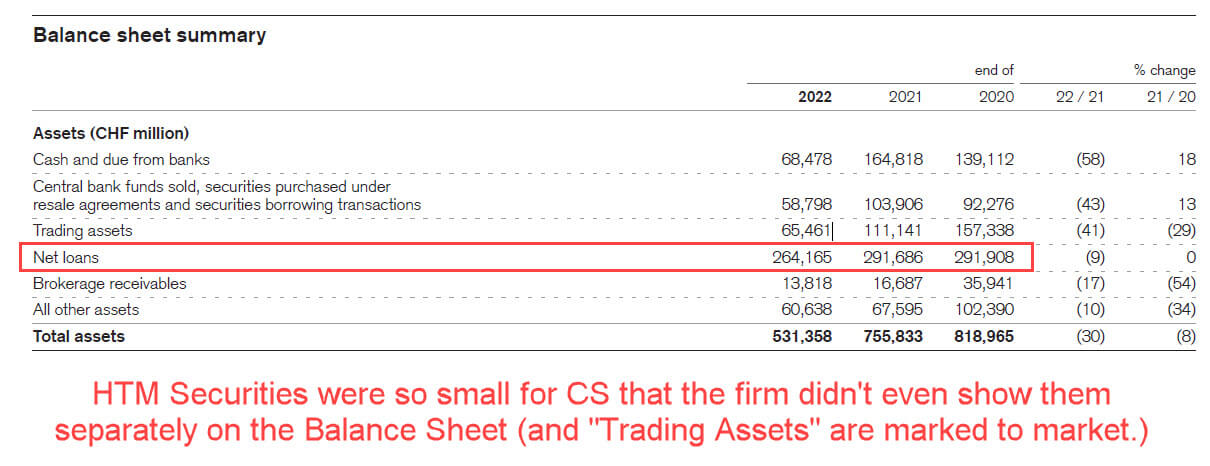

I explained the reasons for Silicon Valley Bank’s failure in last week’s article: incompetent risk management, massive losses on HTM securities, and a run on the bank that created the need to sell securities at a loss and get cash to cover the withdrawals.

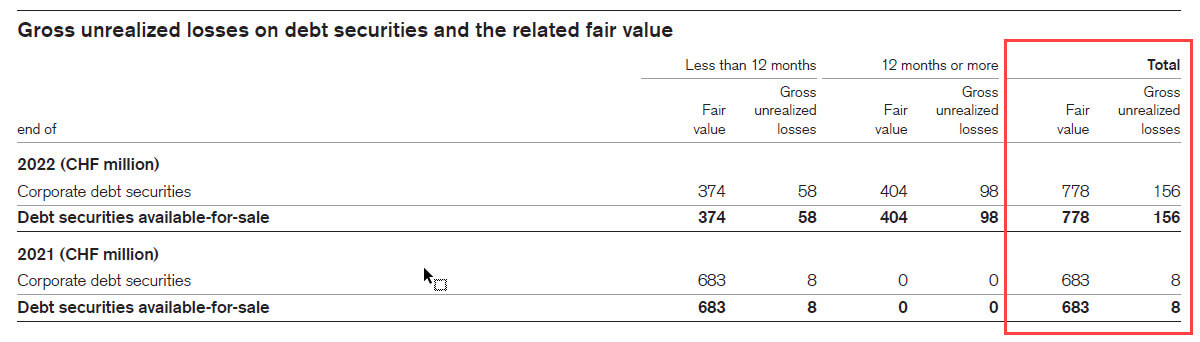

By contrast, Credit Suisse barely had any HTM securities.

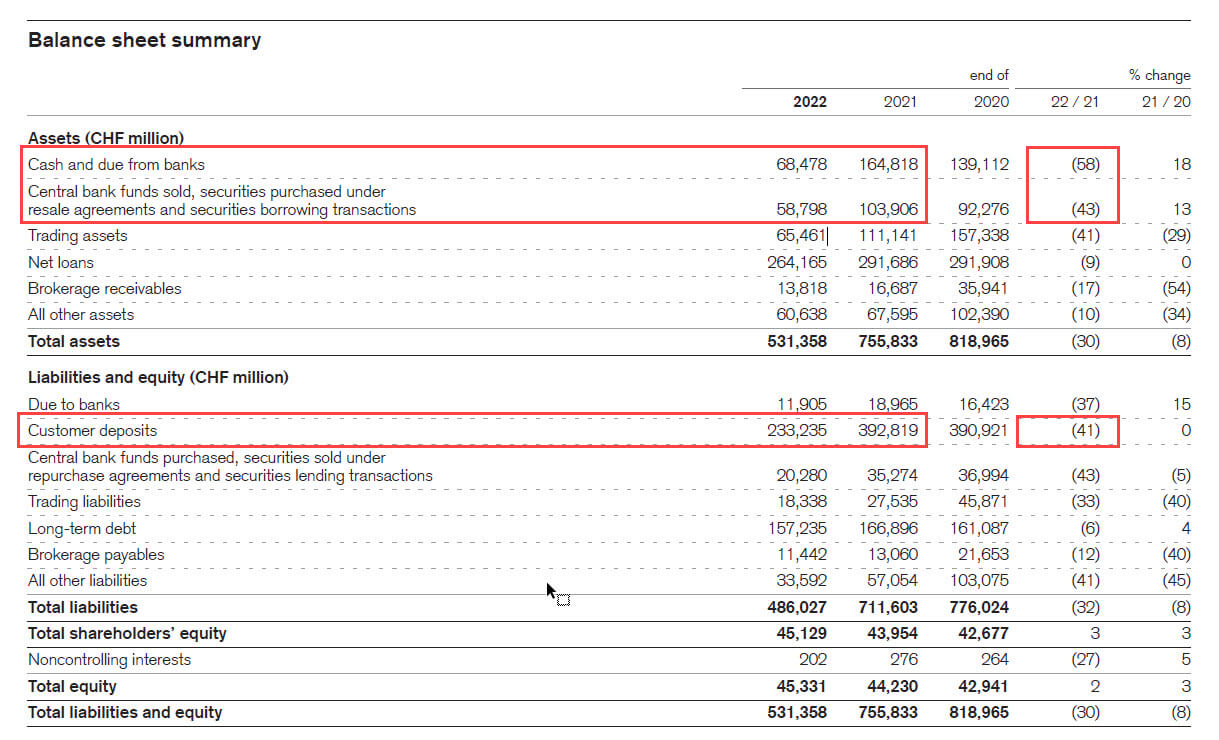

And while it did have a decent amount of unrealized losses, they were tiny next to its Net Loans balance of nearly $300 billion:

As I pointed out in the previous article

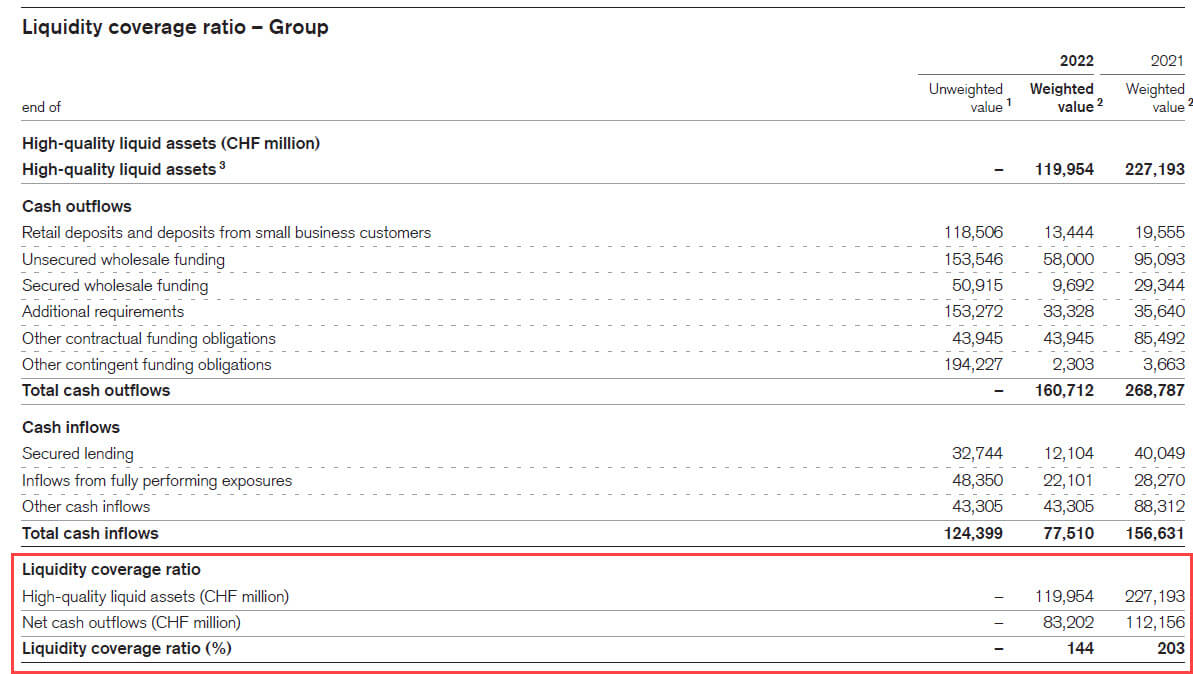

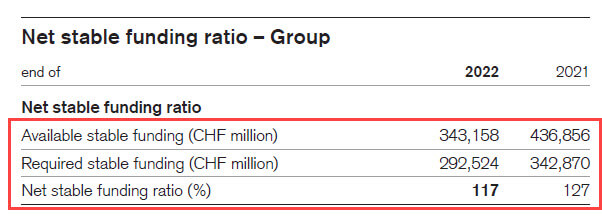

, its capital ratios were fine, and its Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) were both above 100% (for more, see our full tutorial on Bank Regulatory Capital):

It even passed the Federal Reserve’s “stress tests” in the U.S. with flying colors!

The short answer is that none that mattered because depositors didn’t care and began withdrawing all their cash anyway.

Ratios like the LCR are designed for “moderate stress” scenarios, such as a bank losing 20% of its deposits over 30 days.

CS was facing $10 billion in customer deposit withdrawals per day against a cash balance of only ~$130 billion, so it was not going to last long:

Only a few strategies can prevent or mitigate a bank run, and most of these need to be set up far in advance:

- Limit the Allowed Withdrawal Rate – Besides being legally dubious, this one might also make the eventual problem worse by drawing attention to it.

- Insure the Deposits – But this is expensive and is available only up to a certain per-account limit in most countries, such as CHF 100,000 in Switzerland and $250,000 in the U.S.

- Get an Emergency Loan from the Central Bank – The central bank is supposed to be “the lender of last resort,” so this strategy can work – but only up to a certain withdrawal percentage.

- Do Not Use Customer Deposits for Funding – Some financial institutions operate like this, but it’s much more expensive, so they need to make riskier loans and investments to profit (think: mortgage REITs and business development companies).

OK, But What Was the Catalyst for the Run on Credit Suisse?

The “run” on CS started last year if you look at the Balance Sheet above, but it accelerated with the Silicon Valley Bank failure the week before.

Investors and large depositors looked at the market and said, “OK, banks are in trouble. What’s the weakest link now that Silvergate, Signature, and SVB are down?”

And the answer was “U.S. regional banks with high percentages of uninsured deposits and scandal-plagued European banks like Credit Suisse.”

As with SVB, Credit Suisse did not “fail” in a few days.

It had been making horrible moves for years/decades, its risk management was non-existent, and it accrued one of the longest Wikipedia sections I’ve ever seen for “controversies.”

Everyone knew it was in trouble; the main question was whether it would be sold whole or in pieces.

What Happens Next with UBS and Credit Suisse?

First, Credit Suisse is obviously no longer a bulge bracket bank, so I’ll have to update that article.

But that would have happened anyway because of the firm’s plans to spin off its IB group into Michael Klein’s advisory firm, M. Klein & Co.

Before this deal, I had expected that “CS First Boston” would become another elite boutique and a strong competitor to the likes of Evercore, Lazard, and Moelis.

But this spin-off might not even happen now; UBS has said that it plans to continue moving away from investment banking in favor of wealth management (it’s currently ~54% of revenue).

They may keep some CS investment bankers in the U.S. and Asia, especially in sectors like tech and TMT investment banking, but Europe is much more uncertain.

The biggest beneficiaries here are, as usual, the large U.S. banks (GS, MS, JPM, BofA, and Citi).

With the retreat of both CS and UBS, these firms’ market shares in Europe and Asia will continue to grow.

Also, many of the elite boutiques will benefit because they’ll be perceived as “lower risk” after this crisis due to their lack of large Balance Sheets.

What If You Have an Internship or Job Offer at Credit Suisse?

Unfortunately, as of Wednesday (March 22nd), neither CS nor UBS has said anything about what will happen to incoming interns or those with full-time offers.

In 2008, some banks rescinded internships and full-time jobs, so it’s safest to assume that will happen again.

Even if internships somehow proceed this summer, the chances of getting a full-time offer at these firms are very low (and even if you got one, would you want to accept it?).

Unfortunately, because of the accelerated timing for internship recruiting, you’re probably not going to find another IB internship that starts in a few months.

So, if you’ve accepted an offer at CS, all you can do at this point is network around and look at fields outside of IB (Big 4, corporate banking, valuation, corporate finance, etc.), and see if anything is available at the last minute.

In terms of full-time jobs these firms, the target company’s employees are usually at greater risk than the acquirer’s, and middle and back-office functions are at higher risk than front-office jobs.

But this is an odd scenario because UBS has explicitly stated that it wants to reduce its investment banking footprint.

My guess is that most wealth management jobs will be preserved, IB/markets job cuts will vary by division and region, and there will be painful cuts in various MO and BO roles.

If you’re at UBS or you’ll begin working there soon, you’re probably OK for now, but I wouldn’t recommend staying for long.

They’ll always maintain some presence in investment banking, but you don’t want to spend years and years at a firm that has already shifted away from that market.

The Macro Impact of UBS and Credit Suisse (and SVB)

I expect more bank failures, hurried/forced acquisitions, and “emergency backstops” before this crisis is over.

In a standard bank failure, a larger, healthier bank acquires the troubled bank’s assets and liabilities, and the lenders and common shareholders lose all/most of their money while the depositors preserve theirs.

But with these recent deals involving SVB, CS, and others, the regulators and government officials seem to be making up rules on the spot:

- SVB and Signature Bank got “exceptions” that allowed the government to treat them as systemically important banks (they aren’t).

- UBS and CS got a backstop from the Swiss government and special treatment that allowed the CS AT1 bonds to be wiped out (“legal,” but it will be challenged in court).

- Midsize banks are now lobbying for “exceptions” that allow the government to guarantee all deposits in the U.S.

I would argue that these exceptions and special rules are making these problems worse by drawing so much attention to banks’ problems and implying that any bank without special treatment is at risk.

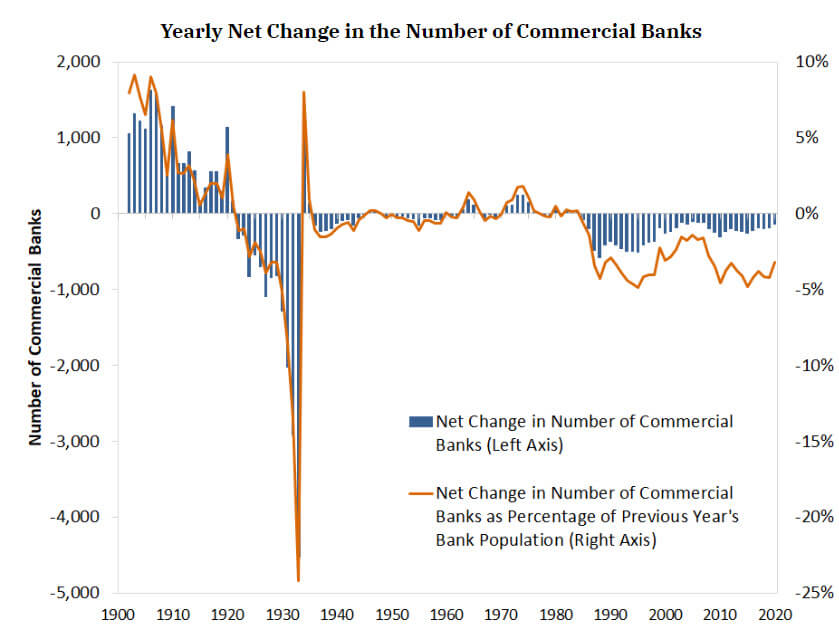

In the long term, these policies will lead to more centralization and a flight to the larger, “too big to fail” banks (~30 banks worldwide are considered “systemically important”).

This is negative for the financial system because the rescue costs will be even higher in the future if when one of these “systemically important” banks does something stupid.

Effectively, these large banks are becoming quasi-governmental entities, which is the opposite of how a healthy economy should function.

Central banks could also use these events to push even more dystopian ideas, such as central bank digital currencies (CBDCs) and social credit scores.

It will be a repeat of what happened during COVID: the Chinese Communist Party introduces dystopian ideas and promotes them with propaganda, and NPCs in Western countries believe everything and try to copy them.

What Should Banks and Regulators Do?

I’ve seen many proposals about how to “prevent” SVB and CS-style bank failures:

- Remove the deposit insurance limit or increase it from $250K to $10 million in the U.S.

- Impose stricter regulations and requirements, even on smaller banks below $250 billion in assets.

- Don’t create new regulations; just force regulators to do their jobs and take action to wind down or sell a bank when it is approaching insolvency.

- Create a “free” national bank that offers checking/saving accounts for everyone.

- Bitcoin! Crypto solves everything.

Insuring all deposits or deposits up to $10 million is a bad idea because it will encourage bank executives to be even more reckless.

Why not gamble everything on subprime mortgages or CDOs if the government will save your customers? You might even get a higher bonus!

Enhancing existing regulations or enforcing them correctly might help to some extent, so suggestions #2 and #3 could be starting points.

But the cold, hard truth is that nothing can “prevent” bank failures unless the government simply takes control of all banks.

Even if banks had to maintain 100% reserve ratios – enough cash to cover all potential deposit withdrawals – they could still fail if everyone withdrew 100% of their deposits simultaneously.

The “answer” is to accept that banks will fail and make sure that their wind-downs and takeovers by healthier banks are as orderly as possible.

This means that in some cases, companies and individuals will not be able to access all their cash immediately – but percentages matter.

If a company with $100 million in the bank fails because it can access only $50 million next week, this company should not exist in the first place.

On the other hand, if it can access only $1 – 2 million of its cash for a week, the bank takeover process needs to be revamped.

Regulators should not cave into threatening tweets from VCs who claim the world is going to end because their portfolio companies cannot “make payroll.”

And there should be no backstops because banks should not be allowed to grow to their current sizes in the first place.

The idea that some banks can be “too big to fail” is ridiculous, which is why there’s a strong case for breaking up these firms into smaller entities.

A healthy economy should have dozens/hundreds of mid-sized and smaller firms competing, and the failure of a single firm should never create systemic risk.

Of course, implementing these policies would represent a complete reversal of the consolidation in the U.S. banking system since ~1930, so don’t hold your breath:

But maybe there is some cause for optimism.

Once ChatGPT-7 is released and your social credit score is linked to your checking account, your deposits might finally be safe – as long as you haven’t offended anyone on Twitter.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

Hi Brian! Do you think that next decade wealth management will expanding its participation in banks revenue following BB reduce their IB divisions? So it’s might be reasonable try to begin a career in private banking/wealth management. The things I completely worry are zero exit opportunities and stupid cold-calling in the beginning of the career which doesn’t give any useful and relevant skills for future career path. I’m 24 years old now, going to be graduated Master of Finance in Moscow and don’t have any relevant internships is IB/Corporate Finance, just trading on my own funds but I want to move from it because it’s very emotionally stressful and risky to bet on this as the profession of life. I have now Private Banking offer and consider to work couple of months and prepare for IB with your Financial Modeling Course to take corporate finance/valuation skills for potential internship or junior analyst position because I’m a real looser in these areas now :) So what do you think will be safer and more reasonable in my case?

P.S. Thank for your efforts, I really appreciate it, this is the best financial resource with Zerohedge:)

Thanks! Yes, I expect more banks to become dependent on wealth management revenue. But I’m still not sure I would recommend it as an “alternative career” to IB because of the issues you cited (bad exit opportunities, lots of stupid cold outreach early on, etc.). It’s the type of field where it’s really good if you’re at the top, but it’s not fun or interesting to advance to that level at all.

If you have a private banking offer and no other relevant internships, I would take it and see if you can leverage the internship into something else. It may not be ideal for the long term, but you need some type of finance-related experience if you want to go for IB roles in the future. And it’s not worth delaying this offer or turning it down just to spend months looking for something slightly better.

Yeah, I agree with you. I’m graduating this year, private banking offer is not an internship, it’s full-time job. Only thing I’m afraid that IB guys are not so happy about experience in private banking in CV. Maybe, the best way I should consider is to work in PB 3-6 months, gain skills in corporate finance/modelling and then move into IB. Moreover, who knows, maybe PB is my real career path where I would want to work long time and during the work I’ll be realising it is mine or not:) What do you think about it?)

I think you should spend a few months there and then see what you want to do. Yes, some bankers don’t like to see PB experience, but the reality is tons of people do PWM/PB internships before IB, so it can’t be that bad. If you don’t like it, you could also think about other areas at the bank, like equity research, that have somewhat better exit opportunities than PB (and yes, I realize ER is worse than it once was, but it’s still a good starting point for careers).

Yes. I agree with you. You know, I am extremely extraverted and love interaction with people. And my hobby is psychology and influencing on people. This is a reason why I potentially can have a great career in PB. Moreover, Head of PB at the bank told me that it’s achievable in next 1-2 years for me to earn bonuses and fees which are 400/500% to base salary by selling investment products to clients and managing their portfolio. I don’t know it’s truth or lie but anyway:) But I realise that experience, salary and exit opportunities which are offered by IB are so tempting that it’s hard to choose. Age is 24, despite I look like 20, so time has come to form career path in the horizon of 10-15 years. I think research is not for me because this work requires perseverance and thoughtfulness. Considering I’m fit for more fast and unpredictable atmosphere like IB and PB- these are my two favourite choices but what I will choose next 3-6 months- it is very tough question)

That sounds like a very aggressive compensation target. Maybe at the senior-most levels, you can earn 400-500% of your base salary in bonuses, but it sounds implausible within 1-2 years. But who knows, maybe you’ll enjoy it and advance quickly anyway. Good luck!

Hey Brian – In an older post, you said there was an article online which details the *actual* real world use cases for blockchain tech.

Would you happen to remember which article?

I know what you’re referring to, but I can’t find that specific article at the moment. You can find plenty of results from a Google search, but most seem like thinly veiled ads for various crypto services. The main use cases probably relate to emerging and frontier markets where people have no legitimate places to store their money, invest, or transfer their money out of the country.

Hi Brian, just wanted to generally comment that I’ve been a long time reader of your website and despite not being in the IB industry myself, I think your opinionated takes on current news, often filled with light-hearted, humorous language and pop-culture references, are always appreciated. Always keen to consume your evidence-backed content (and I can appreciate that these types of articles aren’t exactly revenue-generating). Keep up the great work!

Thanks! Glad to hear it.

Hi Brian

Thanks for writing this.

I recently did a 10-week IB internship at Credit Suisse, London. (Sep 2022-Nov 2022). The UK job market for entry level IB roles is not very favourable right now. It seems that I’d have to wait and apply only when the recruitment cycle begins again in Sep 2023. Do you have any advice on the best roles to target for the time being? I am worried about explaining the CV gap. I have been browsing LinkedIn, speaking to headhunters and sending applications but nothing seems to work for now. I am an MSc Finance grad from a top tier target in London.

I think your main options are to apply to smaller PE firms/banks without formal recruiting processes or to go outside of IB roles and think about the other options mentioned here (valuation, Big 4, corporate finance, corporate banking, etc.). If they ask “why” you went from an IB internship at a large bank to one of these, just say the hiring market was quite bad but you wanted to gain experience while waiting for the next recruiting cycle, even if it meant doing something slightly different.

As for which role to focus on, it really depends on your previous experience and what you’re most comfortable with (cold emailing/calling vs. sending out lots of applications to larger firms). If you haven’t already done an internship at a smaller PE/VC firm, though, that might be a better option because it is somewhat closer to IB, and if you’re persistent enough, you can usually find a firm willing to hire you for an internship (especially since you’ve had a previous IB internship). This hiring market might also be bad at the moment, but the difference is these firms always have work to do even if deal activity is low (due to their portfolio companies, fundraising efforts, etc.).

So is there a risk to DB in the short or medium term?

There is still risk with DB, but it’s different from the risk faced by SVB and CS. The issue with DB relates more to its huge derivatives book and a possible blow-up there. But people have been arguing that it’s a huge risk for years (maybe a decade?) and nothing has happened.

Unfortunately, DB really is a black box because it doesn’t disclose much about its derivatives. But if I had to guess, I would say the near-term risks are fairly low. It doesn’t have the same visible issues that SVB and CS did with unrealized losses, rapidly declining deposits/cash, etc.

UPDATE: OK, I don’t know, apparently the CDS market is now skeptical of DB. I’m honestly not sure because I have not done a deep dive into their financials. They seemed to be in better shape than they were years ago, but who knows. But many European banks are also down significantly over the past month, so…

Fine article. One thing I missed here is some comments on the root cause of this crisis which is unequivocally the last few unnecessary stimuluses when Covid was winding down. Sudden and huge money supply in the tune of multiple Trillions in the system is guaranteed to cause inflation. Economics 101. Lot of people are blaming the Fed for tanking the economy and the market. They are right up to the extent that the Fed delayed the QT. They should have acted early and should not have towed the state line “inflation is transitory” which essentially gave the green signal to the administration to splurge on their socialist entitlement programs in the disguise of fighting Covid. That sowed the seeds of this crisis. And now that the Fed has been tightening, an argument can be made that they are overdoing it and will cause a hard landing if not a series of bank runs and extremely hard landing. That argument is not devoid of merit, Fed may be wrong but they are just reacting to runaway inflation, to the best of their abilities with the toolset they have at hand. That unfortunately still doesn’t change the root cause of this mess. A mean culpa from the ruling party would be an honest and right start but the chances of that happening is zilch, so God help us.

Thanks. I agree with you that the Fed and other central banks created much of this mess, but individual banks have to accept some of the blame. There’s a reason why CS failed and had to be rescued, while Barclays and HSBC are fine (same with SVB vs. regional banks that actually had risk management in the U.S.).

No one in the current government or political structure will ever apologize for any of this or admit wrongdoing. At this point, I would sooner bet on aliens invading or ChatGPT being elected the next president.

Thanks Brian. Agree 100%. I did not mean to let banks go scott free. The ones that failed definitely lacked risk management and the “professionals” managing portfolios there lacked the foresight to see what’s coming with ever increasing rates.

Aliens vs ChatGPT: based upon known facts, I lean towards former ?. Fingers crossed that it changes in the future, hopefully.

Your site is incredibly insightful and helped/helps me learn a lot.

Thanks!