Will Credit Suisse, Deutsche Bank, or UBS Become Lehman Brothers 2.0?

Over the past week, there has been a ton of speculation on social media that Credit Suisse – and possibly also Deutsche Bank or UBS – is about to have its “Lehman Brothers” moment.

If you’re reading this right now, you’re probably too young to remember what happened, but the Wikipedia article about the 2008 financial crisis has a good summary.

In short, a gigantic housing bubble in the U.S. burst, banks that bet heavily on “subprime mortgages” to support this bubble started collapsing, and in September 2008, Lehman Brothers – formerly one of the biggest investment banks – went bankrupt.

Everyone knew the bank was troubled throughout 2007 and 2008, but most people assumed the government would bail it out, as it had already done for Bear Stearns.

Instead, the Federal Reserve shocked everyone by allowing a bankruptcy, which soon turned into the largest in U.S. history (involving over $600 billion in assets).

Meanwhile, Barclays and Nomura acquired Lehman Brothers’ investment bank in different regions, and Barclays turned itself into a bulge bracket bank like that.

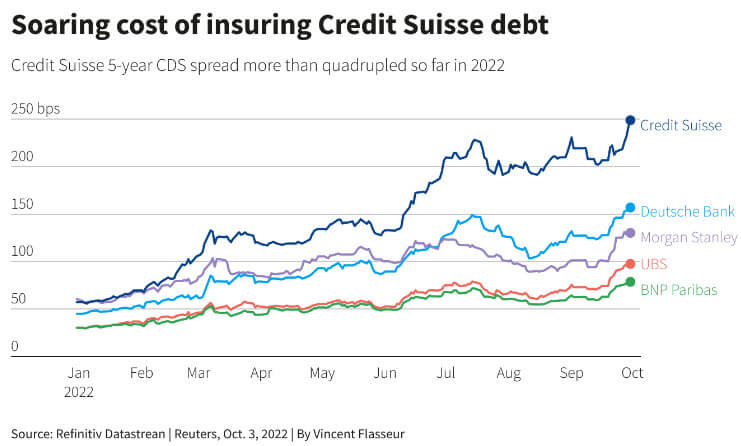

Many of the same things that happened to Lehman in 2008 have been happening to Credit Suisse and Deutsche Bank in 2022:

- The stock price is down by 30-50%+ year-to-date.

- Credit default spreads have hit record highs.

- There have been scandals, and investments have gone horribly wrong.

- And there are doubts about the bank’s loan quality and funding sources.

The short answer is that it’s very unlikely that any of these firms will go bankrupt .

But a spin-off, divestiture, restructuring, or another major event is likely:

The European Investment Banks: How Did We Get Here?

Credit Suisse, Deutsche Bank, and UBS have all underperformed the U.S. banks since 2008, to the point where they’re now considered “lower-tier” bulge brackets.

Several factors have contributed:

- Some of these firms now focus on wealth management and other non-IB activities.

- Some of these banks are stronger in specific regions, such as Asia, and are happy to pursue growth in these regions at the expense of the U.S.

- The macro and regulatory environment in Europe is quite different, and banks have been hurt by higher compliance costs, negative interest rates, and poor economic growth and demographics.

There are also bank-specific factors. I’ll focus on CS here to make this a shorter list:

- They made bad bets on Archegos and Greensill and are likely exposed to other investments about to go bust.

- They’ve had various scandals over the past few years (corporate espionage in 2019, issues with the private banking division, fraudulent bonds in Mozambique, the CEO resigning in 2020…).

- And their recent performance has been quite bad (losses of 1.65 billion CHF in 2021 and 1.9 billion so far in 2022).

The bank plans to reveal a turnaround plan on October 27th, which might include job cuts, asset sales, spin-offs, and maybe a fresh capital raise.

The CEO also sent out a letter this past weekend pointing to the bank’s “strong capital base and liquidity,” which completely backfired and made more people doubt the firm.

“All rumors are false until officially denied.”

Why Credit Suisse is in a Much “Less Bad” Situation Than Lehman Brothers

When analyzing these situations, I prefer to focus on the numbers rather than rumors and fearmongering on social media.

But we need to cover some quick FIG accounting to explain the comparison between Lehman and CS first.

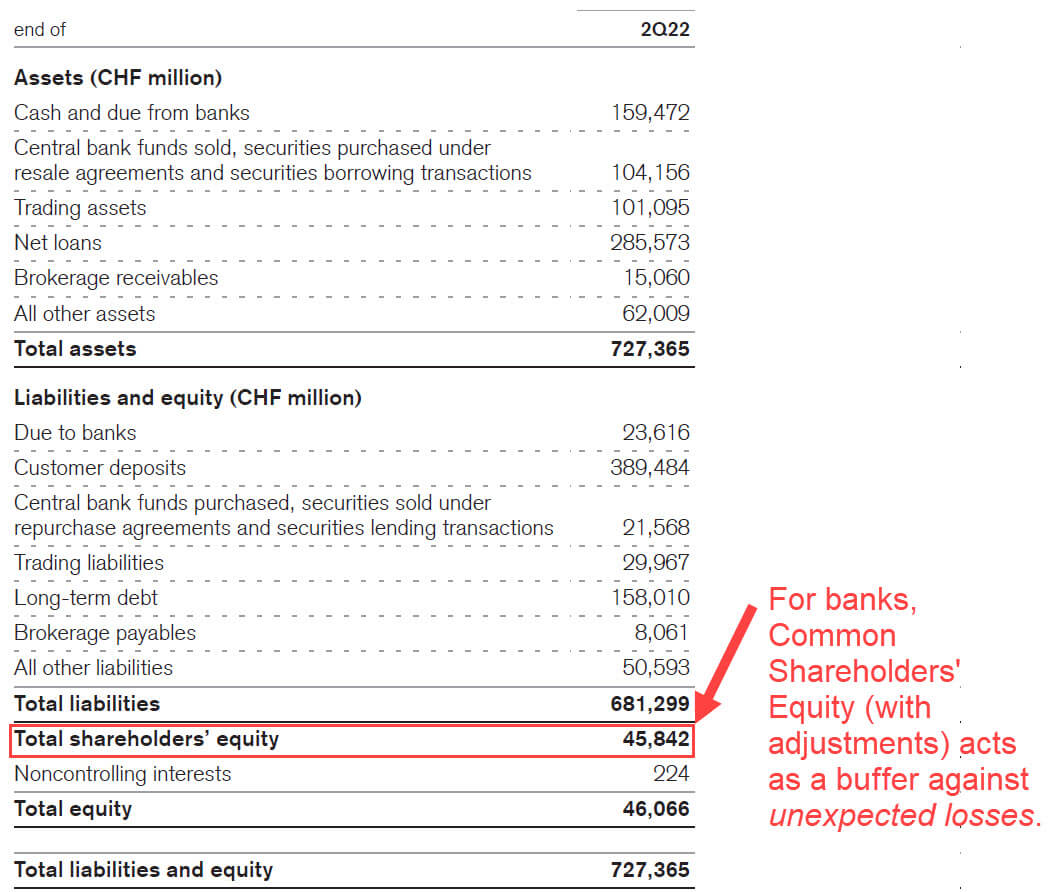

All banks must maintain a minimum amount of Common Shareholders’ Equity (CSE) relative to their Total Assets or “Risk-Weighted Assets.”

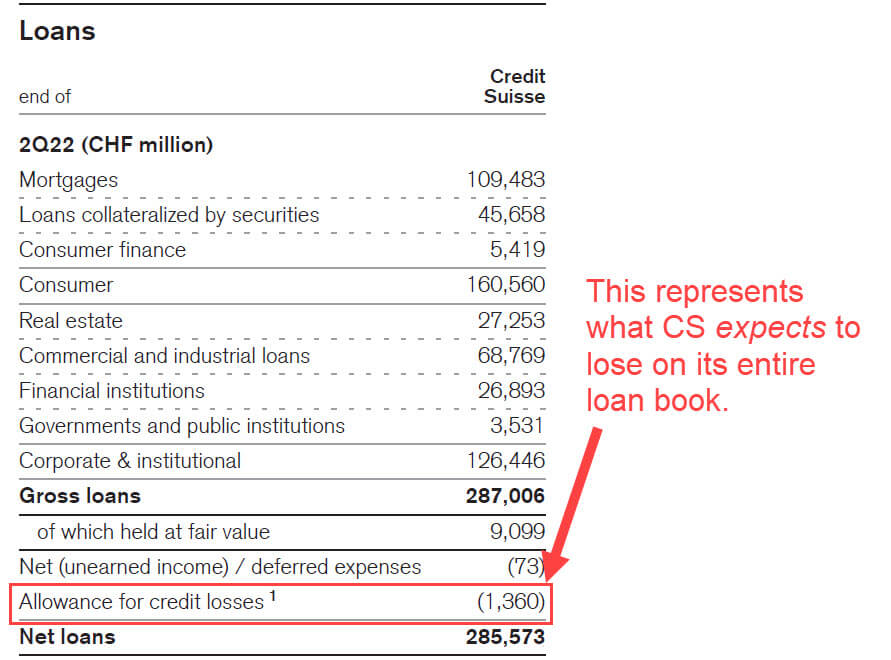

In addition, all banks have a contra-asset called the “Allowance for Loan Losses” that represents the losses the bank expects to incur on its loan book.

This Allowance is for expected losses, and the bank’s CSE is for unexpected losses:

Since unexpected losses affect the Income Statement, they reduce the bank’s Net Income and, therefore, its Common Shareholders’ Equity (CSE).

The problem is that if this CSE reaches $0, other parts of the Liabilities & Equity side of the Balance Sheet must “absorb the losses” as the Assets side keeps decreasing.

“Other parts” means “Debt and other funding sources, AKA the creditors” (bad) or “Deposits, AKA the bank’s customers” (really bad).

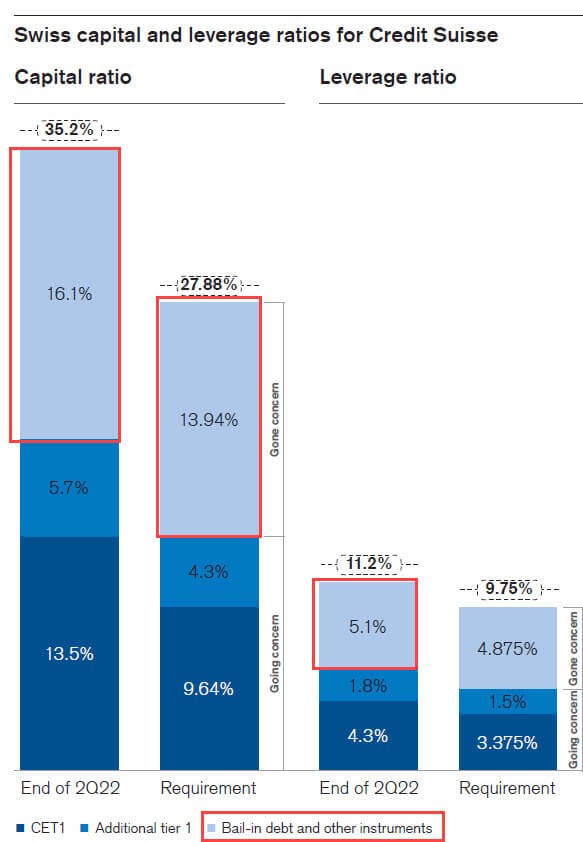

To avoid this scenario, banks must maintain their CSE – and variations like Common Equity Tier 1 (CET 1) and Tangible Common Equity (TCE) – at or above certain levels.

After the 2008 crisis, regulators also added rules about the bank’s “stable funding” sources (the Net Stable Funding Ratio) and the bank’s liquidity (the Liquidity Coverage Ratio).

For more on these metrics and ratios, please see our Bank Regulatory Capital tutorial.

Assuming a bank reports its results honestly, we can use these ratios to assess its risk.

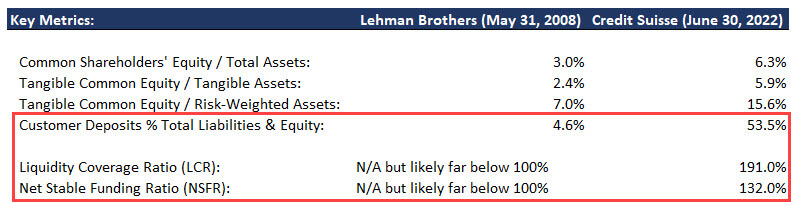

I’ll compare CS, based on its Q2 results as of June 30, 2022, and Lehman as of its last full 10-Q on May 31, 2008 here:

Many of these ratios did not exist when Lehman went bankrupt, but if the LCR or NSFR had existed, Lehman’s would have been dangerously low (far below the 100% minimum).

That’s why Lehman failed: its short-term funding sources dried up as counter-parties lost faith in the bank, and it had minimal customer deposits for long-term funding.

By contrast, CS relies far more heavily on deposits than Lehman, and it uses ~2x less leverage (as measured by CSE / Total Assets and the related ratios).

Many of CS’ debt instruments can also be converted into equity if things get dire enough; they’re even labeled “Bail-in debt and other instruments”:

They did this with Monte dei Paschi in Italy in 2016, although some argued it was more of a bail-out than a bail-in.

But What About the Credit Default Swaps?!! This Guy on Reddit Said…

Yes, I agree, the spreads on 5-year CS credit default swaps – which measure credit risk – have surged by 4-5x since January:

Also, note that plenty of banks have had their CDS spreads blow up, and nothing has necessarily happened. One example was Morgan Stanley back in 2011.

Rising spreads can indicate troubled companies, but they tend to overestimate default probabilities because speculators often get overzealous when rumors spread.

Why I’m Skeptical of a Collapse But Not Other Events

Besides the quantitative differences above, there are some other important differences.

First, in 2008, the large banks were at the center of the subprime mortgage crisis.

This time around, some banks have made bad decisions, but they’re caught in the crosshairs of various other crises (inflation, energy, Ukraine, supply chain, currencies, etc.).

So, I’m not sure the general public would “blame” a failing bank for its failures quite as much as it did in 2008.

And after seeing the aftermath of Lehman, I doubt any regulators want to repeat the incident.

For CS or DB or any other large bank to outright fail, there would have to be something like major fraudulent activity at the highest levels… and incompetence does not equal fraud.

With all that said, these European banks will likely experience one or more major “events” very soon.

These might consist of:

- Divestitures of their non-performing loans (NPLs) or other assets.

- Spin-offs or divestitures of certain divisions, such as IB, wealth management, or private banking.

- Across-the-board cost cuts (AKA layoffs).

- And one of them might even be acquired (but it might be tricky because of rules around deposit concentrations).

What If You’re About to Start Working at CS or DB or Another “Troubled Bank”?

I can’t say much here because the job situation depends completely on the outcome of whatever happens to these firms.

There is precedent for banks rescinding summer internship and full-time offers in crisis years, but it didn’t happen in 2020 – contrary to my expectations.

If there is a divestiture of the IB group at one of these firms, you’ll probably be fine in the short term, even if they move to “cut costs” in the longer term.

If there is an actual liquidation or government-forced wind-down, you will not be fine (but, again, this seems incredibly unlikely).

So, should you start looking for other internships or full-time jobs to hedge yourself?

Unfortunately, it’s a bad time to look for other jobs because banks, tech firms, and other desirable workplaces have been announcing job cuts and hiring freezes.

Also, “full-time hiring” for banks doesn’t exist much outside of bringing back summer interns who performed well.

So, you could certainly reach out to your network and ask about other openings, but your time might be better spent looking at non-IB roles, such as ones at normal companies or even in corporate/commercial banking.

If you’re already working full-time at one of these firms, it’s a decent idea to reach out and start asking about other opportunities, but I don’t think you need to enter “panic mode” yet.

The biggest risk isn’t that one of these firms will collapse, but that in the long-term, it de-emphasizes groups such as IB even more.

So, from a long-term career perspective, you might be better off elsewhere, even if it makes sense to stay there in the short term.

Disclaimer

I’ll close with a disclaimer: I have a mixed track record with major predictions.

For example, in the middle of 2008 – when this site was less than a year old – I thought the U.S. government would not let Lehman Brothers fail.

I even mentioned this in a few reader emails, including in one message to a person with an offer there (oops).

In 2020, I thought banks would rescind internship offers due to COVID, but they kept the internships and made them all “virtual.”

I was closer to the mark on other predictions (Brexit, Trump, etc.), but I’ve certainly been wrong on some major issues before.

All that said, I think that social media has been overreacting to this one… and most bankers seem to agree.

—

If you liked this article, you might be interested in reading my analysis of UBS and Credit Suisse: The Next Shoe to Drop in the Financial Crisis of 2023? or Negative Interest Rates, Negative Yields, and the Next Financial Crisis.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

My sense is this moves very fast. CS is in a death spiral this morning following comments from Saudi Arabia. I would not be surprised if Swiss officials intervene, and force a ‘sale’ to UBS

Yes, things do move quickly. When I wrote this article ~5 months ago, CS collapsing did not seem likely. Now it is more likely, given that we have a crisis in the U.S. banking system due to SVB and idiots there not understanding how to hedge duration risk (see the latest article) and the fact that fears stemming from this have now spread to many other banks.

All that said, I still think it is highly unlikely that they will let CS go bankrupt. Someone else will acquire it or buy its assets. And they were already in the process of spinning off their IB division to form a new elite firm with Michael Klein, so I don’t think the investment bankers there will be affected much.

Hey Brian well its 2023 and the Credit Swiss situation it’s as bad as it can be

What is nowadays and facing the info available your thoughts about the credit Swiss ?

Maybe bankruptcy’s it’s nos yet on the event horizon but something is going to happen

Let’s

Wait for the “delay “ results of them

Keep the good work

Cheers from Lisbon Portugal

Yeah, so it’s not surprising that CS is spinning out the IB division. With the rest of the bank, I can’t really say what will happen because I haven’t followed it closely since this article (just too busy with other projects, and there’s so much in the news each day that it’s impossible to keep up). I still do not think CS will “fail,” but more divestitures/spin-offs or asset deals are possible.

Hey Brian,

I think there’s a need to compare some more stats as what’s more important here is the availability of liquid money.

Did you read/see the parts above about the Liquidity Coverage Ratio? It has its problems, but it’s the best/most standardized measure of a bank’s liquidity. And no large bank is going to have an LCR of 1000% or anything much higher than CS. And the requirement is only 100%.

It was a much needed post,wanted to hear on this topic from you. Could please make a post on the on going crisis in the UK economy.

Thanks. I don’t think there is really much to say about the various crises. “Governments/leaders are stupid and do not understand how money, energy, or the economy work, and they repeatedly do silly things to virtue signal that ultimately hurt everyone, including themselves.” That’s it!