Business Valuation Firms: The Best Backdoor into Investment Banking and Private Equity?

If you’ve read interviews on this site over the years, you’ve seen one name pop up repeatedly: business valuation firms, also known as “independent valuation firms” or just “valuation firms.”

To some, these firms are “Plan B” options if you don’t make it into investment banking right out of undergrad.

To others, they’re a way into investment banking if you changed your career or decided on finance too late to be competitive in recruiting.

And to others, these firms simply offer solid long-term careers.

Business valuation firms are like “choose your own adventure” games, so let’s start with the high-level description before deciding on a specific path:

The Business Valuation Landscape: What Do Firms Do?

Valuation firms, as the name suggests, offer paid valuation services for all types of scenarios: M&A transactions, estate planning, employee stock ownership plans (ESOP), litigation, Fairness Opinions, and more.

The scope of services is much broader than what a typical investment bank offers.

But the work itself tends to be an inch wide and a mile deep.

In other words, you might spend weeks valuing just one asset for just one company, all to support one small aspect of a deal, lawsuit, or inheritance.

By contrast, the work in investment banking is a mile wide but an inch deep: you’re running multiple deal processes, responding to client requests, and dealing with random tasks at the same time, but you don’t go into incredible depth on any one task.

A few examples of common assignments at valuation firms include:

Private Company / ESOP Valuation – All private companies have shares, but their share prices are not easy to determine because they do not trade on the public markets.

So, when private companies award stock options to employees and determine the proper exercise price, they hire valuation firms to perform 409A valuations.

These valuations also come up when there’s a pending lawsuit, or an existing shareholder wants to sell shares.

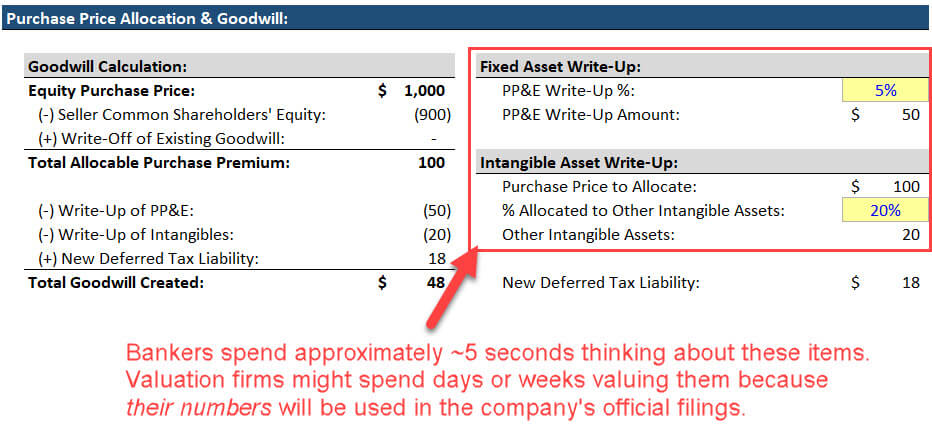

Purchase Price Allocation – When an M&A deal closes, the buyer must “allocate the purchase price” to different items and adjust the seller’s assets and liabilities to fair market value.

It may also create new items, such as Goodwill and Other Intangibles, to “plug the gap” between the Equity Purchase Price and the seller’s Common Shareholders’ Equity, which is written down in the deal (see: how to calculate Goodwill).

Bankers treat this as a simple afterthought in models, but valuation firms spend significant time valuing and re-valuing these assets because companies must record accurate numbers in their filings:

Goodwill Impairment Testing – For example, if Company A acquired Company B for $1 billion, it created $200 million of Goodwill in the process, and then Company B becomes less valuable, Company A needs to “write down” or “impair” that Goodwill to reflect this change.

Companies hire valuation firms to perform these periodic checks and determine the correct impairment.

Private Equity Portfolio Company Valuation – Clients in private equity might hire valuation firms to double-check their portfolio company valuations and ensure accurate reporting.

If they disagree with a PE firm’s assumptions for the discount rate, valuation multiples, growth rates, or liquidity discount, the value of the entire portfolio might change.

Estate and Gift Tax – If a wealthy person dies, their attorney may hire a valuation firm to determine the value of the wealthy person’s net assets.

The government will then collect estate taxes based on this estimate.

So… How Does “Business Valuation” Work?

“Wow, this work sounds quite complex,” you might say, “So, how does valuation work? Are there new methodologies? Hidden tricks? New, complex math?”

Nope!

Valuation is valuation: You still use DCF models based on Unlevered Free Cash Flow, valuation multiples based on comparable companies or transactions, and asset-based approaches such as the liquidation valuation.

The difference lies in the level of detail: schedules and assumptions spanning many spreadsheets rather than much simpler approaches in IB.

The “math” still does not go beyond arithmetic and basic statistics.

(One exception is if your group values complex financial derivatives, in which case the required math level increases.)

Besides the level of detail, another difference is that the purpose of the work varies by firm type and size.

For example, at the Big 4 firms, valuation teams exist mainly to support their audit teams.

Therefore, you spend a lot of time reviewing valuations from other firms so that the audit team can agree on specific line items on the financial statements, such as the stock-based compensation expense recorded on the income statement.

By contrast, you’ll often do more “interesting” work at boutiques and smaller, independent firms: anything from valuing Anthony Bourdain’s estate to a valuation of a near-bankrupt company in a distressed private equity firm’s portfolio.

What this means for you, as an entry-level employee, is that you’ll be spending a lot more time in Excel than you would be in investment banking.

You might spend over 50% of your time in spreadsheets, which would be unusual even in more technical groups in IB; there, PowerPoint, Word, and “fix random problem X” are more common.

The Top Valuation Firms

The Big 4 firms – Deloitte, E&Y, PwC, and KPMG – all do business valuation, but, as mentioned above, much of it supports their audit practice.

Outside of them, the largest independent valuation firm is Duff & Phelps.

It does far more than valuation, as it also offers compliance and regulatory consulting, cyber risk assessments, and restructuring advisory.

Houlihan Lokey is also considered a top business valuation firm, but it acts as a middle market investment bank that advises on deals as well.

Other names include Stout Risius Ross (SRR), BDO, Grant Thornton, Willamette, Alvarez & Marsal, RSM, CBIZ, CohnReznick, MPI, VRC, Withum, Andersen, Baker Tilly, and Mercer Capital.

Similar to Duff & Phelps, most of these firms do more than just valuation, and many specialize in certain areas.

For example, Alvarez & Marsal is best-known for turnaround consulting and restructuring-related services.

Then there are dozens, if not hundreds, of boutique valuation firms that specialize in specific geographies or industries.

Valuation Salaries, Bonuses, and Lifestyle

Total compensation for entry-level roles at these firms ranges from $60K to $80K USD, with a bonus that might represent 0% to 25% of your base salary.

Yes, that is far lower than the compensation in investment banking, but the lifestyle makes up for the lower pay: you’ll usually work 40-50 hours per week.

The hours might be longer at the larger firms, but it’s never going to be a consistent 80-hour-per-week job.

Also, travel is not that frequent if you’re in a pure valuation team, especially compared with the requirements in “financial due diligence” (FDD).

You might go on the occasional trip, but you won’t be out of the office every week.

Non-Big-4 firms tend to pay less than the Big 4 firms, but the differences tend to decrease as you advance up the ladder.

At the highest levels, Partners and MDs at business valuation firms could earn in the low-to-mid-six-figure range (think: $250K to $500K).

I could not find much evidence of the average compensation at this level being in the $1 million range, but it might happen occasionally.

That level is more plausible at the Big 4 firms, but you should note that Big 4 Partners tend to start in the same low-to-mid-six-figure range.

To earn $1 million at a Big 4 firm, you need to generate revenue that is a multiple of your compensation, such as $4-5 million per year, so it might take years to get there.

(NOTE: Compensation figures as of 2020.)

The Long-Term Career Path in Business Valuation: Worthwhile?

The hierarchy in business valuation is quite similar to the one in investment banking: Analyst, Associate, Vice President, Senior Vice President or Director, and Managing Director or Partner.

Sometimes it’s more compressed, with fewer people in the middle; for example, some firms only have Analysts, VPs, and MDs.

That’s possible because they do not work on extended deal processes that require constant client contact.

As you move up, it becomes more of a sales role, where you need to win new clients and bring in additional assignments from existing clients to advance.

Overall, though, there’s less pressure than in IB because the fees are lower, and many of the assignments are “routine” and not dependent on massive deals.

In terms of stability, groups that focus on M&A and litigation assignments tend to have fluctuating deal flow because they’re highly sensitive to the economy.

Estate and gift tax groups are stickier because wealthy people are always dying regardless of economic conditions, and portfolio company valuation is somewhere in between.

The basic trade-offs of this career path are simple: you earn significantly less than in IB/PE, but you also work less and endure less stress.

You also become more of a specialist rather than a generalist who works on different deals types across industries.

Recruiting at Valuation Firms

Overall, recruiting is less competitive than it is in investment banking or private equity.

You don’t need to start years in advance, you can have a slightly lower GPA, and you don’t need to attend one of the top universities.

The list of “target schools” is broader and includes top state schools, a few private business schools, some of the Ivy League, and some Master’s in Finance programs.

For entry-level roles, most firms prefer recent undergrads and pre-work-experience Master’s students; for jobs beyond that, you almost always need valuation work experience.

There is some MBA-level recruiting as well, but it’s less developed than in other industries.

It’s more common to see Associates and Senior Associates attend MBA programs to win promotions or to see professionals in other groups use an MBA to move into valuation.

To win interviews, you don’t necessarily need to do a massive amount of networking – though you can stand out a lot more because it’s far less common.

Another difference is that certifications are arguably more helpful for business valuation roles.

There’s always the CFA, but there’s also the CPA, the ABV (Accredited in Business Valuation), and the ASA (American Society of Appraisers) certifications, such as the CEIV (Certified in Entity and Intangible Valuations).

These all help to some degree, but they’re still less useful than your work experience, school, and even a modest networking effort.

If you pursue any of these, start with the CFA because at least that one is useful in other fields.

Finally, interviews are very similar to investment banking interviews, perhaps with more focus on accounting and valuation and less on M&A and LBO modeling.

Valuation Exit Opportunities: Backdoor Your Way into Banking?

Typical exit opportunities include:

- Other valuation firms or Big 4 firms.

- FP&A and other corporate finance roles at normal companies.

- Middle market or boutique investment banks.

- Corporate development at normal companies.

- Equity research at banks.

- Asset management.

So, business valuation offers some good exit opportunities, but it may be more difficult than expected to move into investment banking (if that is your main goal).

You need to move quickly – ideally, within 1-2 years – and you need to put up with nonsense about “modeling case studies” that are just Excel/PowerPoint formatting tests.

Also, your exit opportunities depend on your team and client base.

For example, the litigation team may offer fewer opportunities than the ESOP team (which can lead to other audit/tax roles).

To move into IB, you ideally want to be working on purchase price allocations, portfolio company valuations, or something else M&A-related.

Your odds of moving directly into private equity or hedge funds are low because you need more than just valuation skills to win those roles.

You also need to understand entire deal processes or, in the case of hedge funds, the full investment process, catalysts, and how to mitigate risk.

Business Valuation Careers: Final Thoughts

Summing up everything above, here’s how you can think about careers at valuation firms:

Pros:

- Business valuation is a great “Plan B” if you got a late start in finance; recruiting is also less competitive than the IB/PE process.

- You’ll learn skills that are directly relevant to other fields in finance, and you’ll master valuation in more depth than you would in IB/PE.

- It’s a fairly stable career path with the opportunity to earn into the mid-six-figure range at the top and still have a good lifestyle.

- And you also gain access to a wide variety of exit opportunities.

Cons:

- The compensation at all levels is significantly lower than it is in IB/PE.

- You will not get much exposure to entire deals, so you’ll need to learn the process and M&A/LBO modeling if you want to move into a deal-based role.

- Advancing up the ladder can be difficult because many other people also plan to “grind it out,” and turnover is often lower than it is at banks.

- Your exit opportunities will be more limited if you’re in the wrong team, or you wait too long to transition out of the industry.

I think business valuation is one of the most overlooked areas in finance.

It may be less “prestigious” than other areas, but it works well as a Plan B, a steppingstone into other industries, and a long-term career plan.

And you can’t say that about too many industries.

For Further Reading

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

Hey Brian ,

Thanks you for an amazing article!

I have a question in regards to the to transferring. I graduated last year from a non-target uni about 1 month ago with a masters in finance, but my GPA is not as great enough to get into IB (I have a 3.4), would it be best for me to join a valuation firm in the hops that at some point down the road i can jump to IB and then eventually PE. Also, what are your thoughts on Kroll would it be prestige enough to get into IB for boutiques (Lazard, Jefferies) if not BB

Thanks. If you can win an offer at a valuation firm, yes, it’s a good idea because you can get into IB/PE later with enough experience (even with a lower GPA). I don’t know much about Kroll specifically, but I would imagine you can get into boutique and middle-market banks from there.

Hey Brian, I graduated last year from a non-target uni with two master’s degrees – with a 4.0 in Economics for the latter and engineering for the former. I’ve done an internship in commercial due diligence at a boutique this year and am looking to go the IB/PE route here in the UK (or maybe even the consulting/PE route because I see that it’s easier to do so in this region). In regard to moving laterally from valuation firms, I have been looking at some opportunities in restructuring advisory at firms such as Kroll/Duff & Phelps and RSM UK/Baker Tilly. Would it be possible to move into RX IB directly from these roles? Also, with regards to RSM, the role seems to focus on insolvency and fraud/asset recovery so would I need to move into the more distressed/turnaround sectors first to be considered for an RX role in IB? Thanks!

It’s possible, but not necessarily the most likely exit (since some groups/firms focus more on operations, and others focus more on finance). But restructuring is very specialized, so you do have an advantage. It’s better to work in the actual distressed/turnaround group rather than insolvency and fraud/asset recovery, yes, but it’s not necessarily “required.” The probability of success is higher in a more relevant group, though.

Hey Brian,

I’ve worked in Big 4 Valuation as an entry level associate for about 8 months, but my ultimate goal is to break into Middle Market IB. I’m debating whether to make the switch after a year here or waiting until I’m promoted to Senior (in a little over a year). Do you think the benefits career/resume wise of being promoted before transfering are worth waiting an extra 6-12 months to do so?

Thanks ahead of time for the response, and appreciate all the work you put into this site.

Thanks. If you have enough client/deal experience to speak to after a year, start networking and plan to make the switch after a year. Your chances actually tend to go down if you wait too long in the same role before aiming for lateral IB roles because they want people who have some experience but who are still “impressionable,” and the perception is that it gets harder to train you the more experience you have elsewhere.

Hi Brian, this is by far the informative article explaining what we do to the outsider.

I am working at one of the largest independent valuation firm now (as a junior). Given the fact that there is not much valuation firms out there and advancing up is difficult, what are your thoughts on lateral jump between valuation firms? Does it help to accelerate the effort? Or do you think there is no need to jump around plan B’s and instead, i should get prepared and aim for IB? In general, I am planning my mid-long career goal in a sense that my skills being most appreciated and got reflected on my compensation.

Thanks. Lateral jumps between valuation firms can help you move up, yes, assuming that they actually bump your title once you move. But if your main goal is to get into IB, you should just do that, start networking, and apply for IB roles directly. There’s no real reason to go from one junior role to another junior role at a different firm if your main plan is getting into IB anyway.

On this topic – I’d suggest folks to steer clear of the public accounting arena (PPA, Goodwill impairment, portfolio valuation). The work itself is necessary, but very dry, demanding, salaries are low, and exit opportunities are decent. Managers and people more senior have no patience for teaching junior staff, there’s an incredibly large amount of turnover, and ultimately your work is anchored towards an auditor’s conclusion. Also – you’re very far removed from the deal process. The work itself is basically verifying that the plug figure (goodwill) is still reasonable, the GPs or LPs investment is properly valued (hint: it always is), or deriving the plug figure yourself (goodwill). If the choice is between BV at a public accounting firm and other opportunities, choose the other opportunities. Hope this helps people.

Thanks for adding that. I agree with your comments, but in the context of other jobs that provide possible transitions into investment banking, business valuation is a decent choice. No, it’s not that interesting, but it beats roles that have absolutely nothing to do with M&A or deal work.

Hey Brian, I’ve been in CRE valuation at a large national company for around 4 months. I like what I do but I am more interested in business valuation the more I learn about it. Do these two every transfer to each other? I have just a business administration degree, would it be beneficial going back to school if needed?

Some of the skill sets are similar, but real estate is a lot more specialized. You can potentially get into business valuation from CRE valuation, but it might not be the easiest transition. I don’t think you need another degree to do something like this. That seems like overkill and is more appropriate for making a bigger change, such as getting into investment banking or management consulting or something similar. This one probably comes down more to networking and learning the required accounting/valuation/other skills for non-real estate companies.

Hey Brian,

Thanks for such an amazing article! I just have a small question, is 409a valuation useful to add to resume for lateralling into investment banking? Thank you!

Thanks. Yes, it is useful for an IB resume.

Thanks for your reply, I just want to follow up on the previous question. How useful is the 409a valuation and could 409a valuation be considered as one example of Capital Market Advisory?

Thank you!

It is more useful than unrelated work experience but less useful than actual IB/PE-style deals executed from start to finish. I don’t think it really counts as capital markets advisory.

Hey,

I am currently working at a major valuation firm as a Valuation Analyst and I am interested in breaking into IB in the next 1-2 years. I expect to be working on purchase price allocations and portfolio valuations in the coming weeks. Are fairness opinions a good experience to have for breaking into IB and what other valuation related jobs are good?

Thank you.

Fairness Opinions are decent experience and slightly more relevant than PPA and portfolio valuations, but the actual work is extremely tedious and repetitive, so I’m not sure I would recommend focusing on FOs. Almost any valuation-related job could work as long as you project cash flows of assets or companies and use comparable assets or deals to value them.

Hi Brian, I have been at a small investment bank for four months and its my first job out of college. I am considering moving to a valuation role because the job I am doing isn’t what was advertised (sales, nonexistent modeling work, no involvement in deal processes). Would this transition be possible? How would I initiate recruiting for valuation? Any thoughts would be appreciated

Yes, it should be possible. Start by finding people working at valuation firms on LinkedIn and reaching out to introduce yourself and start the networking process. You can look for open positions on job sites as well, but you’ll usually get better results by networking. The most important point here is to be very careful with your story because you don’t want to go in and say, “My current job is bad and not real IB work, so I want to switch” – you have to act like you do some valuation/modeling work but far too much sales and cold outreach, and you want to focus on the technical side instead.

Hey Brian,

I have been out of school for 2 years and working as a wealth management analyst at a top firm (MS/ML/UBS) for 1.5 years. What do my chances look like for lateraling into valuation? I am pretty well prepared for the interviews.

Any other tips or areas you might recommend would be great. I’m considering FP&A, IB or MBA as the next step. I had an offer to join a mm firm as an IB analyst earlier this year but the offer was rescinded due to COVID and now the competition is pretty intense.

Thanks

I think you should narrow your options a bit because FP&A and IB and valuation firms and the MBA are all quite different. As far as lateraling into valuation, if you’re well-prepared for interviews and have other good academic stats, you should have a good shot.

Hi,

This is a really great overview. One comment I’d say on the cons is that you can actually learn LBO modeling on the job in some valuation firms, depending on what their focus is (ie ESOPs which are primarily levaraged financed deals). There could be some good opportunities in that space for people that want to sharpen their LBO skillsets.

Thanks for adding that, that is a good point. You can learn the modeling on the job, depending on your group. Though I would say that the “you haven’t worked on an entire deal process” objection is still likely to come up, even if you know the modeling.

Hey Brian,

Thanks for an amazing piece of article!

If you don’t mind, I would like to ask a question that isn’t related to the article.

I have two internship offers, one from a small consumer sector-focused PE firm (mostly F&B companies with AUM of $400m) and another from medium sized infra-focused asset management firm(mostly energy related assets with AUM of $1 billion). My ultimate goal is to break into investment banking and I have an ECM team internship so far. Considering this, which one do you think is better option for IBD?

Thank you so much for your understanding.

Thanks. I would pick the consumer-focused PE firm because infrastructure is more specialized and may not be as useful for generalist IB roles.