2022 Investment and Market Updates: Just How “Transitory” is Jerome Powell’s Brain?

I’ll be completely honest with you: I did not pay much attention to the financial markets or my portfolio in 2021.

But that’s not because they were “boring.”

The year started with the GameStop short squeeze (I deleted the article, sorry – blame the trolls in the comments) and continued with more meme stocks and a crypto melt-up, crash, and recovery (??).

Next, the SPAC craze began, and just as I predicted, most performed poorly by the end of the year.

Then, Xi Jinping decided to assert his rights as Eternal Emperor of China by cracking down on private companies, ranging from tech to finance to education and entertainment, and Chinese stocks entered a death spiral.

Supply chains worldwide broke down, people finally realized that inflation was real, and the political situation was so depressing that I began hoping for an alien invasion.

Meanwhile, indices like the S&P and Nasdaq shrugged off everything and posted annual returns between 20% and 30%.

So, many things happened, but I didn’t change my portfolio much because real life kept interfering.

Several major medical issues came up, I moved to the Free State of Florida, I made major changes to the BIWS courses, and we’re in the middle of switching to a new platform and shopping cart (about as fun as a trip to the proctologist).

So, I’m going to approach this annual update a bit differently and cover my rationale, goals, and performance data before getting into the minor tweaks I made:

My Current Portfolio

Here’s what it looks like as of yesterday, with differences vs. the start of 2021 in brackets:

- Equities: 38% [Up 8%]

- Crypto (Bitcoin and Ethereum): 16% [Up 1%]

- Cash & Savings: 14% [Down 8%]

- Gold: 10% [Down 1%]

- Real Estate – Equity Funds: 6% [Up 1%]

- Real Estate – Owned Properties: 4% [Up 4%]

- Angel Investments: 4% [Down 1% – recording these at historical cost]

- Real Estate – Senior Secured Loans: 3% [Down 1%]

- Silver: 3% [Down 1%]

- Municipal Bonds: 1% [Down 1%]

- Uranium: 1% [Up 1%]

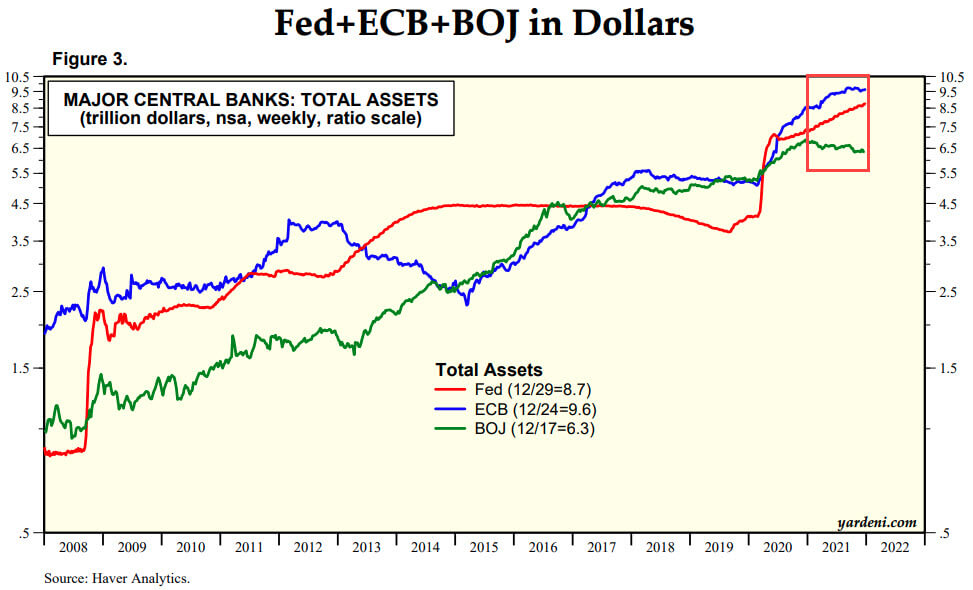

If you look at central bank asset growth, this overall allocation is not surprising:

Crypto went on a wild ride this year, and even though I sold a large portion of my position, the percentage allocated to it increased because prices went up so much.

There were some minor changes with everything else, but nothing too earth-shattering.

Rationale and Goals

I approach my investing differently from most people because:

- I don’t aim to match or beat specific indices.

- Since I’m self-employed, I have a lot of control over my income. So if the market is doing poorly, I can focus more on business (or vice versa!).

- I rarely invest in individual companies because I don’t have the time to follow them 24/7 and watch all developments. So, I stick to automated solutions (Wealthfront), index funds, and ETFs.

My general goals are:

- Downside Case: Increase my investable assets by a minimum of 10% per year.

- Base Case: Increase investable assets by 20% per year.

- Upside Case: Increase investable assets by 30% per year.

I use these numbers because I believe that the true inflation rate in the broader economy is closer to 10%, not whatever garbage output the CPI indicates, so I want to meet or exceed it.

Since my goals are based on “investable assets,” not “return on financial assets,” I can get there in different ways.

A long time ago, my investable assets grew much more quickly.

For example, in 2010, they increased by ~200% because the business was growing quickly, and I was starting from a low base.

But it’s impossible to grow at that rate forever, and in 2015, I realized that business growth opportunities were limited.

Therefore, I started taking my investing activities more seriously rather than funneling all excess profits into business growth.

Recent Performance Data

If you’re curious about recent performance data, here it is:

- 2019: 36% increase in investable assets

- 2020: 38% increase in investable assets

- 2021: 25% increase in investable assets

It’s difficult to separate the contribution from business income vs. market returns because I allocate each month and rebalance frequently.

But if I had to make a rough estimate, it’s probably a 20-30% contribution from business income over these past few years.

I performed well in 2019 and 2020 but less well in 2021 because:

- The price of gold increased by 18% in 2019 and 24% in 2020 but fell by ~5% in 2021.

- I kept too much in cash because I wanted a reserve for a post-March 2020 crash, which never came.

- Even though my highest allocation is to equities, I’ve under-weighted large-cap tech stocks and have allocated more to small-cap, value, and non-U.S. markets, which underperformed in 2021.

Major Changes Since Last Year

When 2021 started, it became clear that I needed to change my state residency ASAP.

Washington State imposed a 7% capital gains tax, and while it’s still being challenged in court, I wasn’t going to risk it by staying there.

Also, Seattle had become a dystopian hellhole between 2010 and 2020, and being there for even a few months each year was depressing.

The natural choice was Florida: no income taxes, great weather, normal people rather than anti-social weirdos, easier travel options to Europe, and barely any covid restrictions.

I had spare cash that I didn’t want to put into equities, precious metals, or crypto, so I bought a condo there via a 100% cash deal.

I expect to rent it out occasionally and spend a few months there each year.

With other real estate, I let most of my secured loans mature and sold others early.

In the current environment – rising inflation and rising rates – fixed income anywhere seems like a bad bet, and my returns here were “OK” (high single digits) but not great.

On the other hand, I increased my allocation to real estate equity funds on Fundrise because they target smaller/overlooked properties outside of major urban centers.

Valuations aren’t necessarily cheap, but the migration out of large cities will continue to drive demand in these areas, and I like the high cash flow yields these properties generate.

The Crypto Conundrum and My Profitable Fat Finger

My views on crypto haven’t changed much since last year: it is not an “inflation hedge” or a “store of value.”

It’s a speculative asset, closer to an early-stage startup than anything else, and I would not be surprised if Bitcoin rose to $500K or fell to $1K.

I initially bought some Bitcoin for under $1,000 back in 2013, sold a portion in 2017 when the price hit $20K, and then started buying more in late 2020 as the price started climbing.

Throughout 2021, I sold Bitcoin at prices ranging from $50K to $60K, but I also sold some between $30K and $40K, missing the highs.

Also, I accidentally bought more Ethereum in January 2021 (I was heavily drugged due to a major injury), which resulted in a 3-4x gain by the end of the year.

The nice thing about investing is that you don’t need talent or skills if you get lucky and accidentally press “Buy” instead of “Sell.”

With central banks now tightening (see below), I’m skeptical that crypto will continue to perform well in 2022.

I still have a 50/50 mix of BTC and ETH, but I’m considering selling more and dropping my allocation from 16% to 10%.

Uranium and the ESG Hype Train

Finally, I bought a small position in uranium [URA], which started the year around $16, rose to $30, and finished at $23.

Yes, Fukushima 2.0 is a risk factor, but I think nuclear is the energy of the future.

My prediction is that The Powers That Be will rebrand it as “green nuclear” or some other nonsense to appeal to the ESG crowd, and next-generation nuclear reactors will take off over the next few decades.

Solar and wind have their place and can be useful supplemental sources, but they’re never going to “replace” oil, gas, and coal; historically, new energy sources have been additive.

On the other hand, nuclear could be a plausible substitute for most coal and natural gas.

With that out of the way, let’s take a quick look at inflation and emerging markets, both of which delivered some surprises in 2021:

Inflation, Gold, and the Tragedy of Jerome Powell

In the first half of 2021, the Fed kept stating that inflation was “transitory.”

As it turns out, the only thing transitory was Jerome Powell’s brain, which seemed to expire right around the time he was appointed Fed Chair.

Even the mainstream media concedes that inflation is at its highest level since 1982.

If you look at online commentary, people like Peter Schiff and sites like Wolf Street repeatedly claim that it’s all because of QE and interest-rate suppression:

“The Fed and other central banks printed so much money over so many years that we’re finally seeing consumer-price inflation!”

I agree that a vastly increased money supply makes inflation more likely, but I don’t agree with this view 100%.

After all, there was massive money printing following the 2008 financial crisis, but most of that showed up in asset-price inflation. Consumer prices rose, but not to the extent they’re increasing now.

Inflation is not purely a monetary phenomenon; it’s also determined based on factors such as:

- Industry Concentration/Competition – If an industry is highly concentrated (e.g., 2-3 dominant firms), companies can get away with charging higher prices because there’s less competition.

- Production and Supply Chains – Is the country of origin (i.e., China) disrupted or locked down? Is there a transportation shortage? How vulnerable is the entire supply chain?

- Employee Power – How much negotiating power do employees have? Are they unionized? Could they easily find better job offers if companies don’t raise wages?

For more on everything above, check out Matt Stoller’s article about how corporate profits drove ~60% of inflation increases.

So, the punchline here is that even if the Fed “tightens” by halting QE and eventually raising interest rates, that might not halt or reverse inflation to the extent that people expect.

We could easily have a scenario where interest rates and inflation both increase, and real bond yields turn even more negative.

In such a scenario, I would expect equities, real estate, and crypto to fall substantially, but value stocks might hold up better than growth.

I have no idea how precious metals would perform.

In theory, rising inflation helps gold and silver, but rising interest rates and bond yields also hurt precious metals, so prices might stay about the same.

Also, much of this expected inflation may have been priced into gold in 2019 and 2020, which explains its strong gains in those years.

With all that said, I’m still thinking about putting a bit more money into gold and silver because I don’t see how they could be worse than cash when inflation and rates are both rising.

Emerging Markets

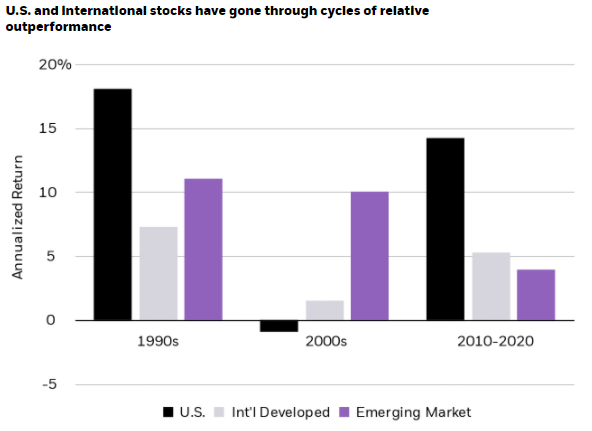

In my equities allocations, I maintain a 1/3 split between the U.S. market, non-U.S. developed markets, and emerging markets.

Over the past few decades, this split has produced good results because different parts of the world perform well in different periods:

Many EM indices have huge weightings for companies like Alibaba, Tencent, Meituan, etc., so this trend could easily continue over the next few years.

That said, I have a multi-decade holding period, and I expect that emerging markets will outperform developed markets a good percentage of time over the next few decades.

So, I ignored the noise and rebalanced a few times, buying more emerging market equities as prices fell.

So, What Happens Next?

To figure out what might happen next, you have to think about two main questions:

- What will the Fed and ECB do? Will they follow or ignore the many other central banks worldwide that have already begun to tighten?

- Will the U.S. government attempt to break up Big Tech or other concentrated industries? What about price controls or restrictions on supplier sourcing to encourage domestic production?

Here are my predictions.

The Fed will make some noise about tightening and announce a few rate hikes, but as soon as the S&P 500 falls by more than 10%, it will back off and cut rates or re-start QE since the primary objective of the Fed is to prop up the stock market.

Then, inflation will pick up, the Fed will panic and think about tightening again, and then reverse itself when markets fall.

In other words, expect a repeat of the events from December 2018 to January 2019, but they’ll be on loop this time.

This cycle will end when the Fed governors morph into a black hole that consumes 100% of life in the universe, doubling Thanos’ performance.

On point #2, Lina Khan at the FTC has already blocked some mega-mergers and is making it more difficult to execute large deals, but I’m not sure how far the government will go to break up large companies.

That’s a tricky process that would require competent, economically literate staff and a popular administration, so I doubt anything big will happen unless there’s another crisis.

In the meantime, though, I would not be surprised if they go back to Nixon’s playbook from the 1970s and introduce price and wage controls or other silliness that fails to address the root causes of inflation.

After all, these measures will be “transitory” – just like Jerome Powell’s frontal lobe.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

Hi Brian,

Can you share how you invest in Uranium please? thanks

There are many ETFs, mutual funds, etc., that hold uranium and/or uranium-related companies.

https://sprott.com/investment-strategies/physical-commodity-funds/uranium/

Also URA, URNM, and NLR

“Also, I accidentally bought more Ethereum in January 2021 (I was heavily drugged due to a major injury), which resulted in a 3-4x gain by the end of the year.

The nice thing about investing is that you don’t need talent or skills if you get lucky and accidentally press “Buy” instead of “Sell.”

That’s an honest view – hope you recovered well, and glad you were lucky in your mistake !

Hi Brian,

Can you share what international ETFs that you specifically are invested in?

Thanks!

Emerging Markets:

FPADX

IEMG

VEMAX

Developed/All:

VFSAX

VEA

IDEV

VTMGX

Some are index funds or admiral shares (Vanguard) but there are usually corresponding ETF versions.

Thanks! by your wording in the article I thought you were investing in specific country ETFs- so you just focus on these ones you have lisetd?

I don’t do country-specific funds because I don’t have time to reallocate and constantly check conditions in each country. I prefer to divide the world into U.S., non-U.S. developed, and emerging markets and leave it at that.

What do you think of the idea that the ’08 printing went to banks in the form of low velocity money and therefore was less inflationary, while the recent printing was high velocity in the form of checks directly to consumers and therefore more inflationary?

Yes, that is part of it as well. Distributing all the new money to people in the form of stimulus checks tends to create more consumer price inflation than sending the money to banks. But the supply chain issues and the greater consolidation / pricing power since 2008 also play a big role.

I’ve been waiting for this! Thank you, Brian!

P.S. You deleted the Gamestop short squeeze article? Don’t let the bastards (or trolls) grind you down!

Thanks. It was more that I got tired of responding comments and requests to “update” my views on GameStop (and other people disagreeing and saying it had nothing to do with money printing/stimulus distribution/lockdowns). It was interesting to look at once, but I have no desire to keep following the company and every single movement in its stock price over time.