2021 Investment Updates: Where to Put Your Money in a Dystopia… and Some Thoughts on Crypto

Multiple European countries have re-imposed lockdowns, central banks are still printing money non-stop, and this “vaccine rollout” doesn’t seem to be going so well.

Meanwhile, the financial markets have become an even bigger casino, with stocks like Tesla up almost 700% in the past year and Bitcoin up around 350%.

How long will the insanity last?

Will life ever return to normal?

And how should you react to this giant bubble?

I’m not sure I have answers to these questions, but I’ll discuss how I changed my portfolio in 2020 and one specific, controversial topic: cryptocurrencies.

What Changed in 2020?

My current allocation looks like this (changes vs. mid-year 2020 allocation):

- Equities: 30% [Down 1%]

- Cash & Savings: 22% [Unchanged]

- Crypto (Bitcoin and Ethereum): 15% [Up 10%]

- Gold: 11% [Up 1%]

- Angel Investments: 5% [Down 1% – recording these at historical cost]

- Real Estate – Equity in Individual Properties: 5% [Down 2%]

- Real Estate – Senior Secured Loans: 4% [Down 3%]

- Silver: 4% [Up 1%]

- Municipal Bonds: 2% [Down 4%]

- Miscellaneous (Risk Parity Fund): 1% [Down 3%]

The biggest change in this list is the crypto category – for obvious reasons.

I discussed a few changes in my mid-year 2020 update, such as:

- Selling all my U.S. Treasuries and moving the proceeds into gold and silver.

- Underweighting U.S. equities and moving into non-U.S. developed markets and emerging markets.

- Purchasing S&P 500 put options (Dec 2022 expiration with strike prices of 1500, 2000, and 2500) as “disaster insurance.”

- Wanting to renounce U.S. citizenship because it’s pointless to keep paying taxes there when I’m only in the country for 1-2 months per year (it’s the only country besides Eritrea that taxes based on citizenship rather than residency).

In addition to those, I made a few other changes in the second half of 2020:

- Wealthfront – I sold about 2/3 of my position here because I didn’t like their limited portfolio options. Setting a single “risk score” isn’t enough – I want to allocate percentages into specific categories. And the site offers nothing except traditional stocks and bonds (and Ray Dalio’s questionable “risk parity” idea).

- Crypto – Yes, there was a huge crypto rally heading into the end of the year and continuing into 2021. I bought some on the way up, but I’ve also sold a good chunk in the past week. More on this one below.

- Real Estate Shifts – As loans on Peer Street have matured, I’ve been reallocating the proceeds into the other categories above. I don’t like fixed income in the current environment, even when the interest rates are higher.

- EUR-Denominated Account – Since Interactive Brokers allows for accounts in almost any currency, I decided to switch to euros there. I don’t think the EUR is “better” than the USD, necessarily, but I don’t want to be tied 100% to one currency.

I’ll comment on some of these and the main categories above, but I’ll start with a quick market summary:

My Market View Going into 2021

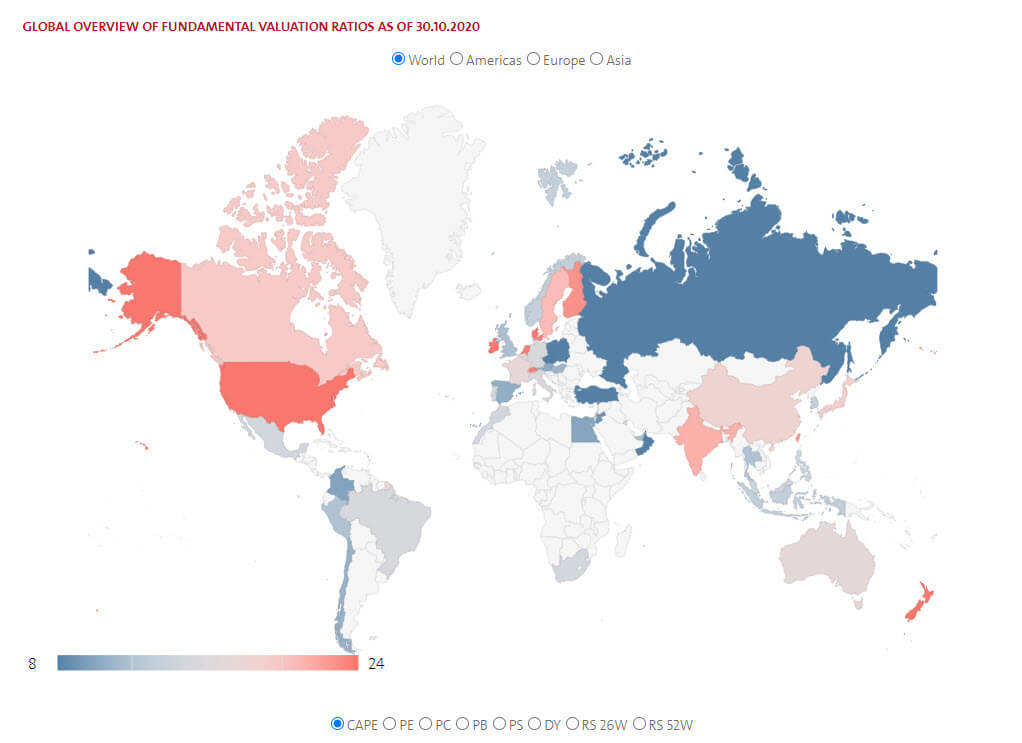

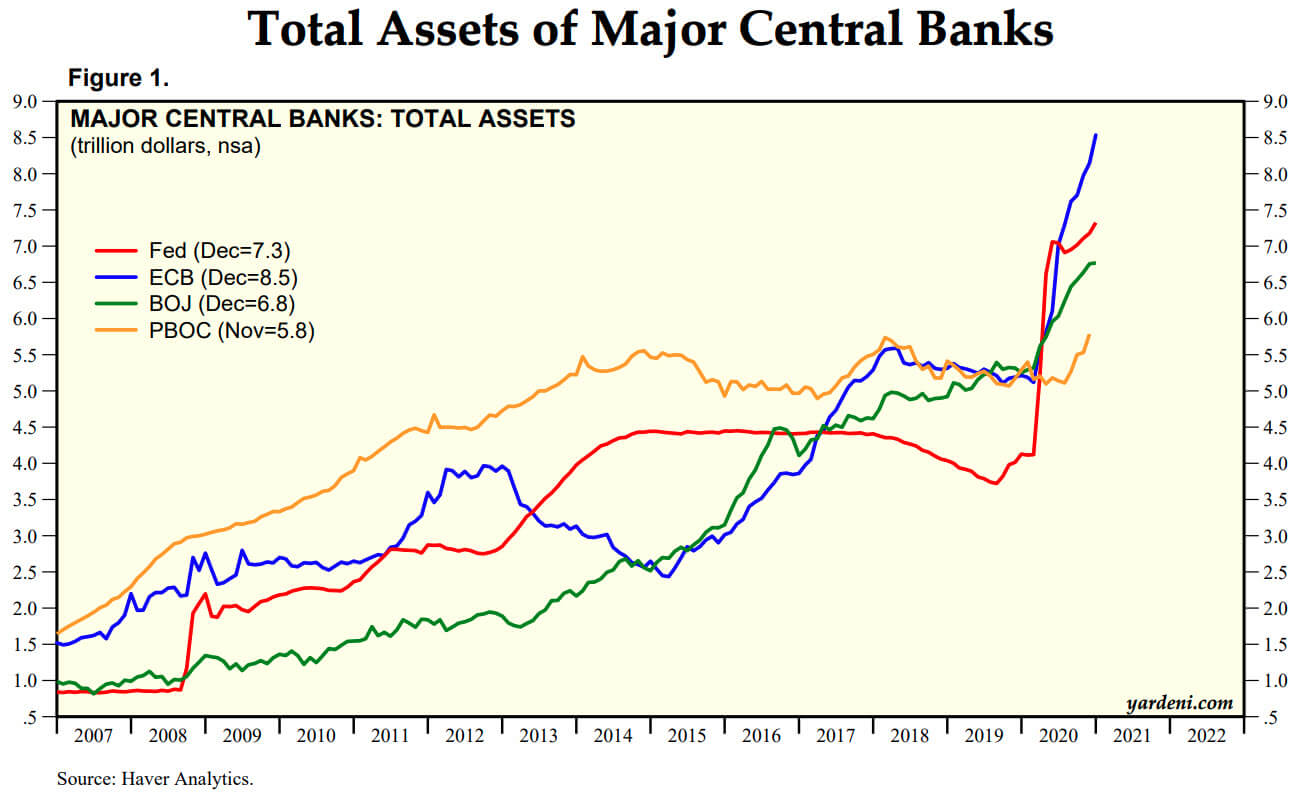

These two charts from Star Capital and Yardeni Research sum up 2020 in the markets quite well:

While other central banks printed trillions, the Chinese government decided to “print” the virus and share it with the entire world.

Markets that were cheap in 2020, such as Russia and many emerging markets, have remained cheap, while the U.S. has remained at nosebleed valuation levels after a drop in March and swift recovery.

By virtually any metric – P / E, Shiller P / E, Market Cap / GDP, etc. – the S&P 500, Wilshire 5000, and Dow Jones are at ridiculously high valuations.

The only exception is the equity risk premium (i.e., the additional percentage that stocks are expected to return above the risk-free rate, which is normally the 10-year government bond yield).

Since the risk-free rate is so low, stocks aren’t that expensive! Really!

The surreal thing about this current bubble is that the real economy is in terrible shape, with hundreds of thousands of small businesses dead and the unemployment rate at its highest level in years.

Normal people are so desperate for money that they’re vandalizing politicians’ homes.

In past bubbles, such as the 1920s and late 1990s, the normal economy at least “appeared” to be doing well by conventional metrics.

This time around, there’s a massive disconnect because governments and central banks are handing money to the wealthy and telling everyone else to commit suicide.

I expect financial assets to keep inflating in the short term because there will be no end to the money printing unless something forces central banks to stop.

But I also expect inflation in the real economy to pick up, and there are already signs that that’s happening.

Given all of that – rising inflation, money supply expansion, and bond yields at all-time lows – it seems incredibly silly to put much in cash or fixed income.

And while the FAANG stocks, Tesla, etc., are all in bubble territory, not all equities worldwide are.

That’s why I’ve heavily under-weighted large-cap U.S. stocks and over-weighted small-cap value and international stocks.

Wait, Why Do You Have Such a High Cash Balance?

“But wait!” you say, “If all fiat currencies are being devalued and inflation is picking up, why do you have 22% in cash currently?”

The short answer is:

- This percentage was more like 10% until the past 1-2 weeks, but I sold a large amount of crypto after the prices ran up, and I haven’t yet reallocated the proceeds.

- I have to pay higher-than-expected taxes this quarter, and the U.S. government requires payment in USD, not gold or Bitcoin or Tesla stock.

- And I’m considering buying a property in Florida and moving my “U.S. address” there. Florida is a bit like Zion in The Matrix movies: the last free place for humans, without lockdowns, mask mandates, or other absurdities.

I don’t want over 20% in cash (my target is more like 5-10%), but in the short term, sometimes it’s necessary.

Crypto Bubbles Rallies?

Yes, you read that correctly: I currently have 15% of my investable assets in crypto – mostly Bitcoin and Ethereum.

This category’s interesting because crypto was underpriced earlier in 2020 (especially when everything crashed in March) but then rallied and became frothy by the end.

I started buying more in October and November, based purely on momentum… but in the past week, I’ve sold around 40%.

Crypto prices might keep rising – in fact, Bitcoin is up over 10% in the past 24 hours.

However, unlike most of the crypto fanatics, I manage an actual portfolio with many different assets.

If the price of one asset skyrockets, I need to sell some of it to maintain my targeted percentages.

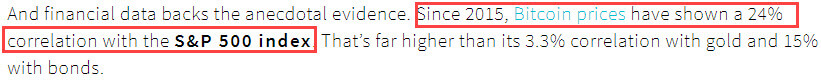

I did not feel comfortable with almost 30% in crypto, given that it’s effectively a levered stock index with a bit of gold.

Also, my cost basis on most of the Bitcoin I sold was just under $1,000, and I was more than happy to sell at nearly $30K to record a 25-30x gain.

Real Estate Shifts

I experimented with investing in individual property deals and loans on platforms like Peer Street and Realty Shares (now shut down), but I’ve concluded that they’re not worthwhile.

It’s too difficult and time-consuming to do due diligence – especially in the middle of a pandemic when travel is restricted – and these platforms don’t vet deals that well.

I’ve seen better results with platforms like Fundrise that accept investments in entire funds rather than individual properties.

As a bonus, the Fundrise minimum investment is $500, so almost anyone can use it.

People often say that real estate is an “inflation hedge,” and sometimes it is – but I’m not sure how true it is in the current environment.

The issue is that rents are dropping off a cliff in places like NYC and SF, while they’re rising in the South, Midwest, and other regions as people migrate away from the coastal cities.

If rents in big cities are down 20% in one year, real estate is not much of a “hedge” against an M2 money supply that increased nearly 25% in the past year.

I still think it’s worthwhile to put some percentage in real estate, but I’m less bullish than in previous years.

Renouncing Citizenship and Other Delayed Plans

In previous posts, I mentioned that I had planned to renounce U.S. citizenship and relocate to Singapore, New Zealand, or Australia through an investor visa.

Nothing has happened on that front because travel is still shut down, and most countries have completely closed their borders.

I expect that these countries might remain shut down to outside visitors and immigrants for 20-30 years – so moving there doesn’t seem like an option.

But I also don’t want to apply for EU citizenship, so I’m in limbo at the moment.

Crypto: A Giant Scam, or Great Disruptor of the Financial System?

I’ve received many requests for a discussion of cryptocurrencies.

On one end of the spectrum are people like Peter Schiff, who argue that crypto is a scam and that Bitcoin’s price will eventually collapse to $0.

On the other side are people like Anthony Pompliano, who think that Bitcoin will hit $100K by the end of 2021 (or is that $1 million now?).

I’m somewhere in between these views, which is why I have 15% in crypto rather than 50% or 100% like the most hardcore supporters.

Overall, I believe there’s far more regulatory and legal risk associated with crypto than most of its supporters believe.

I have yet to read a solid rebuttal to many of the questions a skeptic might ask, such as:

- If crypto truly becomes a threat to fiat currencies, won’t governments seize it and shut down the exchanges? As we’ve all seen over the past year, governments worldwide have no problem acting together for stupid, nonsensical reasons. Oh, and most people are dumb enough to listen to whatever the government says.

- If it’s a “safe haven” and a way to protect yourself from monetary inflation, why is the price so volatile? Which other “safe haven” assets increase by 350% or fall by 80% in a single year?

- Even if governments don’t shut down crypto, what happens if they choose to regulate it as a security rather than a commodity? Take a look at the SEC’s case against Ripple for more on that one.

The hardcore HODLers justify their beliefs with multiple contradictory arguments:

- Crypto represents the end of fiat currencies! Bitcoin will surpass the USD, EUR, JPY, and RMB and become the ultimate store of value! It’s even better than gold!

- Oh, and Bitcoin is also going up to $100K, $1 million, or $10 million. But it might experience a few 80% drawdowns before then. I mentioned it’s a safe haven, right?

- But the price doesn’t even matter because fiat currencies won’t be worth anything! All transactions, including coffee shop purchases, will be conducted in Bitcoin!

- In conclusion, buy Bitcoin because the price is going up AND because it doesn’t matter that the price is going up!

If Bitcoin is a “safe haven” asset that protects against inflation and central bank shenanigans, then its price should increase proportionally with the money supply.

And if it’s a risk asset that might increase by 1,000% or fall by 80%, fine – but in that case, it’s not a safe haven.

Bitcoin is currently most similar to a levered stock index if you look at its market performance:

The Bottom Line on Bitcoin (and Crypto)

While I don’t think crypto is a “scam,” I do think that the hardcore bulls are seriously underestimating the regulatory and legal risks.

Blockchain technology has a lot of potential, but anything could happen to specific currencies.

It’s worth putting a small percentage into crypto, but you’d be insane to go far beyond that.

Even my current level of 15% is too much, and I wouldn’t even blink if there were an 80% drawdown (I’ve weathered more than that before).

The current fiat monetary system will be forced to change eventually, but the timing is highly uncertain, and it’s far from clear that crypto is “the answer.”

If you believe with 100% certainty that crypto will displace all fiat currencies and become the ultimate store of value and keep increasing by 10x per year, you don’t have an investment thesis.

You have a religion – even if you call yourself an atheist.

So, When Does This Bubble Burst?

I don’t think another pandemic, continued lockdowns, or even a disaster with the vaccine would be enough to burst this bubble.

Instead, either:

- Something would have to force central banks to lose control of rates (e.g., China invading Taiwan or declaring war on India); or

- As Jeremy Grantham has predicted, maybe it will just be a gradual deflation as the pandemic ends and people realize that the economy is still terrible, the stimulus is ending, and valuations are absurd.

But the good news is that, as you know, these types of market surprises never happen.

Stocks only go up in a straight line forever, and it’s physically impossible for interest rates to increase.

Forget about $100K for Bitcoin because it’s going to $100 million.

Tesla will soon be worth $500 trillion (more than 6x global GDP).

And if you think either one of those is impressive, don’t forget about Dogecoin.

It was up 125% after both Elon Musk and an adult film star tweeted about it.

What else do you need to know?

Risk on!

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Comments

Read below or Add a comment

Hi Brian, great article. I also commented on your 2020-mid year outlook. I was wondering your thoughts on on real-estate. I’m currently getting to the point of having some saved up money that I would like to put to work. A friend and I are thinking about getting into the real estate market and buying an investment property (residential real estate). This way we get some skin in the real estate game, and possibly some passive income.

My question is around where you see the real estate market going. I know its geographic dependent. But my main concern is the 5+ years timeline for the general market. I think asset prices will continue to grow over next 1-3 years, due to stimulus from both fed and the government and interest rates will remain low. However, what I am concerned about is mid-long term. What happens when that low 5-year fixed rate I am approved for now becomes variable when interest rates are higher. What happens to the asset price I am sitting on when interest rates increase. Do you think its a likely possibility that 5+ years from now I’ll be stuck paying a higher interest rate on a house that I essentially have a capital loss on due to asset prices correcting from interest rate increases? And a side question any tips you would have for someone in their mid 20’s with $50-$100k ready to invest if you don’t agree with real estate (aside from portfolio allocation)?

Yes, it’s very possible that interest rates will be higher or the USD will be lower, and so you’ll be sitting on either a nominal loss or a real loss. I would not necessarily recommend buying individual rental properties unless you have A LOT of time and willingness to manage them and deal with crazy tenants, emergencies, etc. I do not.

Other than real estate and a generally diversified portfolio, think about using the $50-$100K to start some type of side business that generates cash flow… in the long term that will pay off more than financial assets.

I’ve been reading through “Extraordinary Popular Delusions and the Madness of Crowds,” and it seems like we’re living in a super bubble.

Curious, why don’t you want to apply for EU citizenship? Mine was just approved through the Czech Republic…

What makes you say FAANG is in bubble territory? Owning Google with a P/E of 35 and revenue growing at 20% sounds infinitely better than owning a 10 year t-bill yielding 1% with no chance of growth.

A 20-30 YEAR shutdown for New Zealand and Australia? That’s a bit excessive no? Care to place a long bet on that time horizon? :)

EU citizenship would create tax issues because I am also a resident, which means my effective tax rate would be something like ~80% (the exemption from U.S. taxes on income earned while abroad is such a small percentage for me that it’s basically meaningless). And I don’t have the documentation to apply for citizenship through family descent in other countries in which I am not currently a resident.

I don’t think anyone is comparing Google, or any stock, to a 10-year T-bill. The proper comparison is to other stocks that are growing at moderate rates. And while Google is less bubbly than the other big tech companies, a 35x P/E multiple is still very high for 20% growth, by historical standards (oh, and not to nitpick, but the projected growth rate is more like 10-15%). It’s currently trading at its highest EBITDA and revenue multiples over the past decade, according to Capital IQ. So, maybe not a “bubble,” but definitely the most expensive it has ever been. And the company is about to be broken up or heavily regulated.

I don’t place bets online with readers, but I would not be surprised if both countries remain highly restricted for decades. Yes, maybe they’ll eventually let in some people, but they’ll probably raise the bar for residency and citizenship so high that effectively no one can apply except for the ultra-high net worth. And you know that as soon as there’s one COVID case in some small town in the middle of nowhere, they’ll instantly shut down the whole country again.

Brian- Happy New Year! Not to press on the EU part further, but sincerely curious because it’s a thought I had myself for some time now. If you became an EU citizen and renounced your US citizenship like you mentioned, wouldn’t that eliminate your tax concerns?

Yes, but there would still be some overlap period where I’d end up owing taxes in both countries, which is annoying. This is less of an issue in a place like Singapore because the tax rate is so much lower to begin with.

Also, I’m not sure I could actually get EU citizenship because I would have to pass some type of language/history test (most countries require this, unless you want to pay millions in Cyprus or something)… and I’m probably not at the level required to pass, given that I spend almost 0 time talking to people in real life (and it’s gotten worse since the pandemic started). Oh, and you need 8-10 years of residency in most countries, which I don’t have.

First time commenter (really appreciate your takes)! Curious how your portfolio positioning has worked against a buy and hold benchmark or what you would use a your benchmark? How do you evaulaute your performance and what is your investment time horizon? I suspect based on previous articles you have a bit more defensive approach than someone building up a retirement account/dollar cost averaging for a 50 year period (though definitely correct me if I’m wrong).

Thanks. Good questions. I don’t benchmark against public indices, but my goal is to grow my total assets by 25% per year, under the assumption that the actual rate of inflation is ~10% (based on the Chapwood index).

In the past two years, I am up 90%, so roughly 45% per year. But that also includes contributions from business income and rent, so it’s not purely from investing. Investing contributed maybe 50% of that gain. And I’ll admit that a large portion of it came from the run-up in gold and crypto prices, so it will be more difficult to replicate in future years.

If I were actually “retired” (i.e., no business or self-employment income), I would have to be more conservative and focus more on income generation.

You know what they say, invest on Crypto when no one’s talking about it anymore but only God knows when its gonna be though

Yeah…

Hi Brian- what are your thoughts about investing in Dogecoin?

Well, porn stars support Dogecoin, so it must be a great investment. However, all investments must also be judged by the number of tweets backing them. If Dogecoin can generate more activity on Twitter, I’ll go all in and put my entire net worth into it.

(This was all sarcasm in case someone is reading this and cannot discern sarcasm online.)

Hi Brian –

Always enjoy your investment updates. I appreciate hearing you throw cold water on the Bitcoin mania as I found myself getting a bit sucked in by the HODLers recently. Question on your Wealthfront move as I founds similar distaste for their limited portfolio options. Did you move those funds to another robo advisor or to a brokerage where you could be more hands on? Also, have you looked into other alternative platforms that allow you to invest Art, wine, sports cats, etc. as a means of diversification? Appreciate hearing your thoughts on these if you have any.

Thanks. No, I just moved Wealthfront funds to sites like Vanguard that require manual rebalancing for now. I haven’t really found a robo adviser that does what I want.

I’m staying away from art, wine, etc., for now because I don’t want to get even more sucked into “alternative investments.” Most of those are being driven by the same forces as Bitcoin, so the risks are highly correlated. I want something that is extremely uncorrelated with equities, which currently means gold and silver.